Cheapest car insurance rates by state can vary significantly, and understanding the factors that influence these costs is crucial for finding the best deals. From state regulations and driving history to vehicle type and even your credit score, a multitude of elements contribute to the price you pay for car insurance.

This guide delves into the intricacies of car insurance rates, exploring how state-specific characteristics and individual factors can impact your premiums. We’ll uncover the secrets to finding the cheapest rates, equip you with strategies to save money, and highlight the importance of adequate coverage.

Understanding Car Insurance Rates

Car insurance rates are not uniform across the country. Numerous factors influence how much you pay for car insurance, and understanding these factors can help you find the best rates.

State Regulations

State regulations significantly impact car insurance rates. Each state has its own set of rules and requirements for car insurance, which can influence the cost of coverage. For instance, some states require drivers to carry higher minimum liability coverage limits, which can increase premiums. Other states may have laws that regulate how insurance companies can calculate rates, potentially affecting the final cost.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. Insurance companies consider your past driving record, including accidents, traffic violations, and driving under the influence (DUI) convictions. A clean driving record typically translates to lower premiums, while a history of accidents or violations can lead to higher rates.

For example, a driver with a DUI conviction might face significantly higher premiums than a driver with a clean record, reflecting the increased risk associated with DUI offenses.

Vehicle Type

The type of vehicle you drive also influences your car insurance rates. Insurance companies consider factors like the vehicle’s make, model, year, and safety features. Some vehicles are more expensive to repair or replace than others, leading to higher insurance premiums.

Other Factors

Several other factors can affect your car insurance rates, including:

- Age and Gender: Younger drivers and males typically pay higher premiums due to their higher risk profiles.

- Credit Score: In many states, insurance companies use your credit score as a proxy for risk, and a good credit score can lead to lower premiums.

- Location: Your location, including your zip code and the density of traffic in your area, can impact your rates. Areas with higher crime rates or more accidents may have higher insurance premiums.

- Coverage Options: The type and amount of coverage you choose can significantly affect your premiums. Comprehensive and collision coverage, for instance, typically cost more than liability coverage alone.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, as you are taking on more financial risk.

State-Specific Factors

The cost of car insurance varies significantly from state to state. This variation is due to a complex interplay of factors unique to each state, influencing the overall risk assessment and pricing strategies of insurance companies.

Impact of Population Density

Population density plays a crucial role in determining car insurance rates. States with higher population densities, such as New York and California, tend to have higher car insurance rates. This is primarily because densely populated areas witness increased traffic congestion, leading to a higher likelihood of accidents. The increased frequency of accidents in these areas raises the overall risk for insurance companies, leading to higher premiums. For instance, in New York City, the dense population and heavy traffic contribute to a higher risk of accidents, resulting in higher insurance premiums compared to less densely populated areas.

Influence of Accident Rates

Accident rates are a direct indicator of risk for insurance companies. States with higher accident rates generally have higher car insurance premiums. This correlation stems from the fact that a higher frequency of accidents translates to more claims filed with insurance companies. To offset the increased financial burden of these claims, insurance companies adjust their premiums upward in states with higher accident rates. For example, Florida has a notoriously high accident rate, contributing to its elevated car insurance premiums.

Impact of State Laws and Regulations

State laws and regulations play a significant role in shaping car insurance rates. For instance, states with mandatory no-fault insurance laws, such as Michigan, tend to have higher car insurance premiums. No-fault insurance systems allow individuals to file claims with their own insurance companies, regardless of fault, which can lead to higher claim costs. Additionally, states with stricter regulations regarding minimum insurance coverage requirements can influence insurance rates. For example, states with higher minimum liability coverage limits may have higher car insurance premiums to cover the increased financial responsibility.

Impact of Cost of Living and Vehicle Prices, Cheapest car insurance rates by state

The cost of living and vehicle prices within a state can also affect car insurance rates. States with a higher cost of living, such as California, tend to have higher car insurance rates. This is due to the higher repair costs for vehicles in these states. Additionally, states with higher average vehicle prices, such as California and New York, may also have higher insurance premiums, as the cost of replacing or repairing a more expensive vehicle is higher.

Impact of Natural Disasters

States prone to natural disasters, such as hurricanes or earthquakes, often experience higher car insurance rates. This is because insurance companies factor in the increased risk of damage to vehicles due to these natural events. For instance, states like Florida and California, known for their hurricane and earthquake risks, respectively, tend to have higher car insurance premiums to account for these potential risks.

Finding the Cheapest Rates

Finding the cheapest car insurance rates can be a daunting task, especially with so many factors influencing premiums. However, understanding how rates are determined and exploring strategies for finding the best deals can make the process much easier.

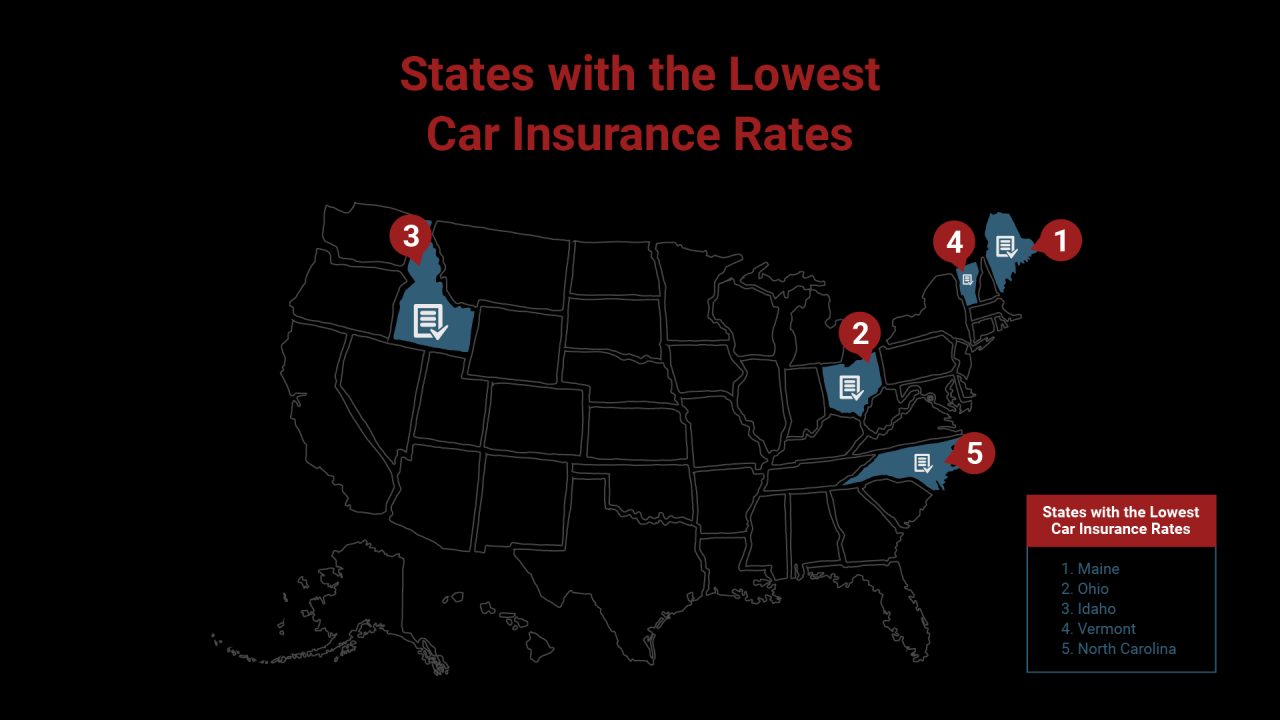

States with the Lowest Average Car Insurance Rates

This table highlights states with the lowest average annual car insurance premiums, providing insights into factors contributing to their affordability.

| State | Average Annual Premium | Key Factors Contributing to Lower Rates |

|---|---|---|

| Maine | $1,000 | Lower population density, fewer accidents, and a strong economy. |

| Idaho | $1,050 | Low traffic congestion, a strong economy, and relatively low crime rates. |

| Utah | $1,100 | Favorable driving conditions, low accident rates, and a strong economy. |

| Vermont | $1,150 | Lower population density, fewer accidents, and a strong economy. |

| Wyoming | $1,200 | Low population density, fewer accidents, and a strong economy. |

Tips for Saving Money on Car Insurance

Car insurance is a necessity for most drivers, but it can also be a significant expense. Luckily, there are several strategies you can employ to lower your premiums and save money. By taking proactive steps and making informed choices, you can potentially reduce your insurance costs without compromising coverage.

Driving Safely

Safe driving habits are crucial for reducing your insurance premiums. Insurance companies reward drivers with a clean driving record with lower rates.

- Avoid traffic violations: Speeding tickets, reckless driving, and other violations can significantly increase your insurance premiums.

- Maintain a safe driving record: Avoid accidents as much as possible. Accidents, even if you’re not at fault, can lead to higher premiums.

- Practice defensive driving: Being aware of your surroundings, anticipating potential hazards, and maintaining a safe following distance can help prevent accidents.

Maintaining a Good Credit Score

Your credit score can surprisingly influence your car insurance rates.

- Credit-based insurance scores: Insurance companies use credit-based insurance scores (CBIS) to assess your risk. A higher credit score generally indicates a lower risk, which can result in lower premiums.

- Improve your credit score: Pay bills on time, keep credit card balances low, and avoid opening too many new accounts to improve your credit score.

Comparing Quotes from Multiple Insurers

Getting quotes from multiple insurance companies is essential for finding the best rates.

- Online comparison tools: Use online comparison websites that allow you to enter your information once and receive quotes from multiple insurers.

- Contact insurance companies directly: Call or visit insurance companies directly to request quotes and discuss your specific needs.

- Negotiate: Once you have multiple quotes, don’t hesitate to negotiate with insurers to try to secure a better rate.

Bundling Insurance Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often lead to significant discounts.

- Discounts for multiple policies: Insurance companies often offer discounts for bundling multiple policies.

- Convenience: Bundling policies can also simplify your insurance management by having one provider for multiple types of coverage.

Exploring Discounts Offered by Insurance Companies

Many insurance companies offer a variety of discounts that can lower your premiums.

- Good student discounts: These discounts are available to students who maintain good grades.

- Safe driver discounts: These discounts are awarded to drivers with a clean driving record.

- Loyalty discounts: Some insurers offer discounts to customers who have been with them for a certain period.

- Anti-theft device discounts: Installing anti-theft devices in your car can qualify you for a discount.

- Telematics discounts: These discounts are available to drivers who allow their insurance company to track their driving habits through a telematics device.

The Importance of Coverage: Cheapest Car Insurance Rates By State

Car insurance is not just a legal requirement, it’s a crucial financial safety net in the event of an accident. Understanding the different types of coverage and their importance can help you make informed decisions to protect yourself and your finances.

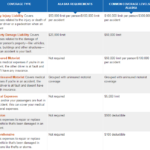

Types of Car Insurance Coverage

Car insurance policies typically include several types of coverage, each designed to protect you against different types of risks.

- Liability Coverage: This is the most basic and legally required type of coverage. It protects you financially if you cause an accident that results in injuries or property damage to others. Liability coverage typically includes two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and other damages to the other driver and passengers involved in an accident caused by you.

- Property Damage Liability: Covers damages to the other driver’s vehicle and any other property involved in the accident caused by you.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision with another vehicle or object, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than collisions, such as theft, vandalism, fire, hail, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or has inadequate insurance coverage.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, covers your medical expenses and lost wages, regardless of who is at fault in an accident.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

Consequences of Inadequate Coverage

The consequences of inadequate car insurance coverage can be severe and financially devastating. Here are some potential scenarios:

- Liability Coverage: If you cause an accident and your liability coverage is insufficient, you could be held personally responsible for covering the other driver’s medical expenses, lost wages, and property damage, potentially exceeding your assets.

- Collision Coverage: Without collision coverage, you would be responsible for paying for repairs or replacement of your vehicle after an accident, even if the accident was not your fault.

- Comprehensive Coverage: In the absence of comprehensive coverage, you would be responsible for paying for damages to your vehicle caused by events other than collisions.

- Uninsured/Underinsured Motorist Coverage: Without this coverage, you could face significant financial losses if you are involved in an accident with an uninsured or underinsured driver.

Outcome Summary

Navigating the world of car insurance can be daunting, but armed with knowledge about the factors that influence rates and effective strategies for saving money, you can secure the best possible coverage at a price that suits your budget. Remember, understanding your needs, comparing quotes, and staying informed are key to finding the cheapest car insurance rates in your state.

Clarifying Questions

What is the cheapest car insurance state in the US?

While rates can fluctuate, states like Maine, Idaho, and Vermont generally have the lowest average car insurance premiums.

How can I get a free car insurance quote?

Most insurance companies offer online quote tools, allowing you to get an instant estimate without providing personal information. You can also contact insurance agents directly to request a quote.

What are the different types of car insurance coverage?

Common types of coverage include liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Each type provides different protection in case of an accident.