Cheapest car insurance in Washington State Reddit is a popular topic, with many users seeking advice on how to save money on their premiums. The state has a complex car insurance market, with various factors influencing rates, such as driving history, age, vehicle type, and location. Navigating this landscape can be daunting, but Reddit provides a valuable platform for sharing experiences, tips, and insights.

This article explores the factors that impact car insurance rates in Washington State, Artikels different coverage options, and examines the role of Reddit in car insurance discussions. We’ll also discuss strategies for finding the cheapest car insurance, including online comparison websites, direct-to-consumer insurers, and independent insurance agents.

Understanding Car Insurance in Washington State

Car insurance is a legal requirement in Washington State, and it’s essential for protecting yourself financially in case of an accident. The cost of car insurance can vary greatly depending on several factors, and understanding these factors can help you find the most affordable coverage for your needs.

Factors Influencing Car Insurance Rates

Several factors can influence the cost of your car insurance in Washington State. These factors are used by insurance companies to assess your risk as a driver and determine your premium.

- Driving History: Your driving record is a significant factor in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will likely lead to higher premiums.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Therefore, they often face higher insurance premiums. As drivers age and gain more experience, their premiums tend to decrease.

- Vehicle Type: The type of vehicle you drive also plays a role in your insurance rates. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and potential for greater damage in accidents.

- Location: Where you live can impact your insurance rates. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents may have higher insurance premiums.

- Credit Score: In Washington State, insurance companies can use your credit score to determine your insurance rates. A good credit score is generally associated with lower premiums, while a poor credit score may lead to higher premiums.

Types of Car Insurance Coverage

Washington State law requires drivers to carry a minimum amount of liability insurance, but you can choose to purchase additional coverage to provide more comprehensive protection. Here’s a breakdown of the different types of car insurance coverage available:

- Liability Coverage: This coverage is required by law and protects you financially if you cause an accident that results in injuries or damage to another person’s property. Liability coverage typically includes bodily injury liability and property damage liability.

- Collision Coverage: This coverage pays for repairs to your vehicle if it’s damaged in an accident, regardless of who is at fault. If you have a car loan or lease, your lender may require you to have collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. It can cover your medical expenses, lost wages, and property damage.

Role of the Washington State Department of Financial Institutions (DFI)

The Washington State Department of Financial Institutions (DFI) plays a crucial role in regulating car insurance companies and protecting consumers. The DFI ensures that insurance companies operate fairly and responsibly by:

- Licensing and Supervising Insurance Companies: The DFI licenses and supervises insurance companies operating in Washington State to ensure they meet certain financial and operational standards.

- Enforcing Insurance Laws: The DFI enforces state insurance laws to protect consumers from unfair or deceptive practices by insurance companies.

- Resolving Consumer Complaints: The DFI investigates and resolves consumer complaints against insurance companies.

- Providing Consumer Education: The DFI provides consumers with information and resources about car insurance, including how to choose the right coverage and file a claim.

Finding the Cheapest Car Insurance Options

Finding the most affordable car insurance in Washington state requires careful research and comparison. There are various approaches to securing the best rates, each with its advantages and drawbacks.

Comparing Car Insurance Options

Different methods can help you find the cheapest car insurance in Washington state. Understanding these methods allows you to make informed decisions about your coverage.

- Online Comparison Websites: These platforms allow you to enter your information once and receive quotes from multiple insurance companies. This simplifies the process and helps you compare rates side-by-side. However, some websites may not include all insurance companies in their network, potentially limiting your options.

- Direct-to-Consumer Insurers: These companies operate online or through call centers, eliminating the need for traditional agents. They often offer competitive rates due to lower overhead costs. However, you might lack the personalized service and advice that independent agents provide.

- Independent Insurance Agents: These agents represent multiple insurance companies, allowing them to offer a wider range of options and find the best fit for your needs. They can provide expert guidance and negotiate rates on your behalf. However, their fees might be higher compared to direct-to-consumer insurers.

Tips for Getting the Best Car Insurance Rates

Numerous strategies can help you lower your car insurance premiums.

- Maintain a Good Driving Record: Avoiding accidents and traffic violations is crucial. A clean driving record demonstrates responsible behavior and earns you discounts from insurance companies.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in case of an accident but lowers your monthly premiums. Consider increasing your deductible if you’re comfortable with a higher upfront cost in exchange for lower premiums.

- Bundle Insurance Policies: Combining your car insurance with other policies, like homeowners or renters insurance, can often result in discounts. Bundling demonstrates loyalty and reduces administrative costs for insurance companies.

- Shop Around for Quotes: Regularly compare quotes from different insurance companies. Rates can fluctuate, and competition can lead to better deals.

Benefits and Drawbacks of Discount Programs

Discount programs offer potential savings on your car insurance premiums. However, understanding their specific requirements and limitations is essential.

- Good Student Discounts: These discounts are available to students with high GPAs. They reward academic achievement and encourage responsible behavior. However, eligibility criteria vary among insurance companies, and maintaining a good GPA is crucial to keep the discount.

- Safe Driver Discounts: These discounts are offered to drivers with clean driving records. They incentivize safe driving practices and reward responsible behavior. However, a single accident or violation can disqualify you from the discount.

- Multi-Car Discounts: These discounts apply when you insure multiple vehicles with the same company. They reward customer loyalty and streamline administrative processes for insurance companies. However, the discount may vary based on the types of vehicles and the specific coverage you choose.

Reddit’s Role in Car Insurance Discussions: Cheapest Car Insurance In Washington State Reddit

Reddit, a popular online forum, has become a valuable platform for car insurance discussions, providing a space for users to share experiences, seek advice, and engage in conversations about various aspects of insurance.

Types of Car Insurance Discussions on Reddit, Cheapest car insurance in washington state reddit

Reddit’s vast community offers a diverse range of car insurance-related discussions. Users frequently share their experiences with different insurance companies, providing reviews and ratings based on their personal encounters. This allows potential customers to gain insights into the strengths and weaknesses of various insurers.

Another common thread on Reddit is the exchange of tips and strategies for saving money on car insurance. Users share their knowledge about discounts, comparison websites, and negotiation tactics, helping others find the most affordable options.

Reddit also serves as a platform for voicing complaints and grievances against insurance companies. Users often express their frustrations with claims processes, policy terms, and customer service, raising awareness about potential issues and holding insurers accountable.

Benefits and Drawbacks of Relying on Reddit for Car Insurance Information

Reddit offers several benefits for those seeking car insurance information. The platform provides a wealth of user-generated content, offering diverse perspectives and real-life experiences. This can be particularly helpful for understanding the nuances of different insurance policies and companies. Additionally, the interactive nature of Reddit allows users to ask questions and receive responses from a wide range of individuals, potentially offering valuable insights and guidance.

However, it’s crucial to be aware of the potential drawbacks of relying solely on Reddit for car insurance information. One concern is the potential for bias and misinformation. User-generated content can be subjective and influenced by personal experiences, leading to inaccurate or misleading information. It’s essential to critically evaluate the information shared on Reddit and verify it through reliable sources.

Another drawback is the lack of professional expertise. While Reddit users may share valuable insights, they may not possess the specialized knowledge of insurance professionals. For complex insurance questions or decisions, it’s advisable to consult with a licensed insurance agent or broker.

Popular Subreddits for Car Insurance Discussions

| Subreddit | Key Features | Target Audience |

|---|---|---|

| r/personalfinance | Discussions on personal finance, including car insurance, with a focus on saving money and maximizing financial well-being. | Individuals seeking financial advice and strategies, including those looking for ways to save on car insurance. |

| r/insurance | General discussions about insurance, including car insurance, with a focus on sharing experiences, asking questions, and finding the best deals. | Individuals interested in all types of insurance, including car insurance, seeking information and advice. |

| r/cars | Discussions about cars, including car insurance, with a focus on car-related topics, such as maintenance, repairs, and purchasing. | Car enthusiasts and owners seeking information and advice on all aspects of car ownership, including insurance. |

Considerations for Choosing a Car Insurance Provider

Finding the right car insurance provider in Washington State is crucial for ensuring you have adequate coverage at a reasonable price. With numerous options available, carefully considering various factors will help you make an informed decision.

Factors to Consider

When choosing a car insurance provider, several key factors should be taken into account. This checklist will help you evaluate your options and find the best fit for your needs.

- Financial Stability: Look for companies with strong financial ratings, indicating their ability to pay claims and remain solvent in the long run. You can find this information on websites like AM Best or Standard & Poor’s.

- Customer Service: Assess the provider’s reputation for customer service by reading reviews and checking online forums. Consider factors like response times, accessibility, and the overall friendliness and helpfulness of their representatives.

- Claims Handling: Research the company’s claims handling process. Look for providers with a reputation for prompt and efficient claims processing, as well as fair settlements.

- Policy Options: Compare the different policy options offered by each provider, including coverage levels, deductibles, and discounts. Make sure the provider offers the coverage you need, such as collision, comprehensive, liability, and uninsured/underinsured motorist coverage.

- Price: Get quotes from multiple providers to compare prices and find the most competitive rates. Remember that the cheapest option isn’t always the best, as it may come with limited coverage or less favorable terms.

- Discounts: Explore the available discounts offered by each provider, such as safe driver, good student, multi-car, and bundling discounts. Taking advantage of these discounts can significantly reduce your premiums.

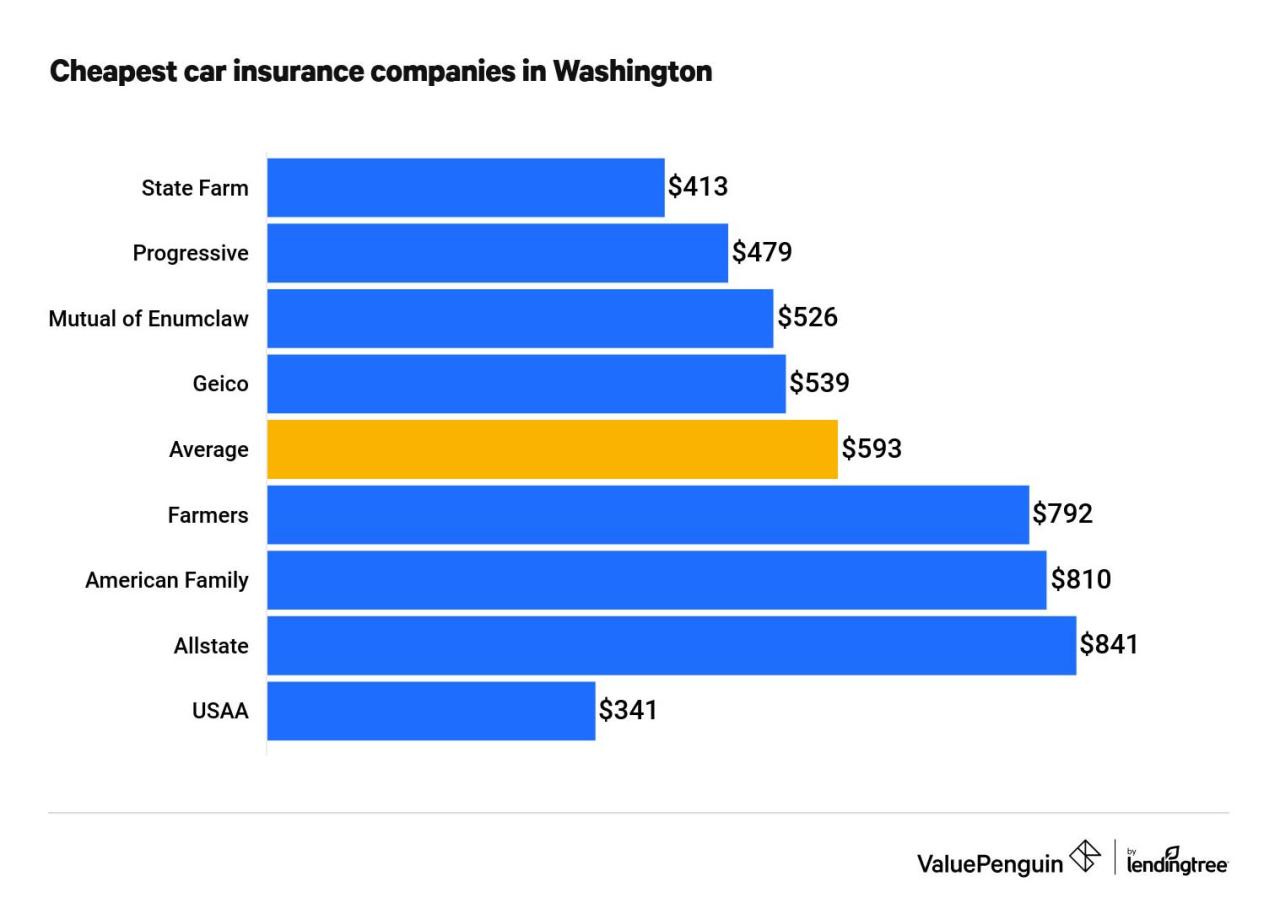

Top-Rated Car Insurance Companies in Washington State

Several car insurance companies consistently receive high customer satisfaction ratings in Washington State. Here are a few examples:

- USAA: Known for its excellent customer service, financial stability, and competitive rates, USAA primarily serves military personnel and their families. It consistently ranks high in customer satisfaction surveys and has a strong reputation for claims handling.

- Amica Mutual: Amica Mutual is a highly-rated company known for its financial strength, competitive rates, and personalized customer service. It offers a variety of policy options and discounts, making it a good choice for many drivers.

- State Farm: One of the largest insurance companies in the United States, State Farm offers a wide range of coverage options and discounts, along with a strong reputation for customer service and claims handling. Its extensive agent network provides convenient access to local representatives.

- Geico: Geico is known for its competitive rates and user-friendly online experience. It offers a variety of discounts and coverage options, making it a popular choice for many drivers. However, some customers have reported issues with claims handling.

Car Insurance Policy Options

Car insurance providers offer various policy options to cater to different needs and budgets. Here are some common types of car insurance policies in Washington State:

- Liability Coverage: This is the most basic type of car insurance, which covers damages to other vehicles or property, as well as injuries to others in an accident caused by you. Washington State requires a minimum liability coverage of $25,000 per person, $50,000 per accident, and $10,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. It’s typically optional but may be required by your lender if you have a car loan.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. It’s also typically optional but may be required by your lender.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re injured in an accident caused by an uninsured or underinsured driver. It covers your medical expenses, lost wages, and other damages.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It’s required in Washington State.

Final Summary

Ultimately, finding the cheapest car insurance in Washington State requires a comprehensive approach. By understanding the factors that influence rates, comparing quotes from different providers, and leveraging the resources available on Reddit, you can make informed decisions and potentially save money on your premiums. Remember, your driving history, age, vehicle type, and location all play a role in determining your rates, so be sure to factor these elements into your search.

Top FAQs

What are the most common types of car insurance coverage in Washington State?

The most common types of car insurance coverage in Washington State include liability, collision, comprehensive, and uninsured motorist coverage. Each type provides different levels of protection and comes with its own costs.

How can I find the cheapest car insurance in Washington State without using Reddit?

You can find the cheapest car insurance in Washington State by using online comparison websites, contacting direct-to-consumer insurers, or working with independent insurance agents. These resources allow you to compare quotes from multiple providers and identify the best deals.

What are the potential risks of relying solely on Reddit for car insurance information?

Relying solely on Reddit for car insurance information can be risky as the platform is susceptible to bias and misinformation. While Reddit can be a valuable resource for sharing experiences and tips, it’s crucial to verify information and consult with reputable sources before making decisions.