Cheapest car insurance in washington state – Navigating the world of car insurance in Washington State can feel like driving through a dense forest. Finding the cheapest car insurance isn’t just about saving money; it’s about securing the right coverage at a price that fits your budget. Understanding the factors that influence insurance rates, comparing providers, and utilizing available discounts are crucial steps in this journey.

This guide will equip you with the knowledge and tools to confidently explore the Washington State car insurance landscape, empowering you to make informed decisions and find the most affordable option for your needs.

Understanding Car Insurance in Washington State

Navigating the world of car insurance can be a daunting task, especially in a state like Washington with its unique regulations and factors influencing premiums. This guide will provide a comprehensive overview of car insurance in Washington, covering essential aspects such as required coverage, rate determinants, and the impact of driving history, vehicle type, and location on your insurance costs.

Required Car Insurance Coverage in Washington State

Washington state mandates specific car insurance coverage to ensure financial protection for drivers and victims of accidents. These coverages are designed to address various aspects of an accident, including medical expenses, property damage, and liability.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It covers the other driver’s medical expenses, lost wages, and property damage up to the limits of your policy. In Washington, the minimum liability coverage required is $25,000 per person/$50,000 per accident for bodily injury and $10,000 for property damage.

- Insurance Financial Responsibility Act (IFRA): This act mandates that drivers maintain proof of financial responsibility to cover potential damages resulting from an accident. This proof can be provided through insurance, a surety bond, or a self-insurance certificate.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you in case you are involved in an accident with an uninsured or underinsured driver. It helps cover your medical expenses and property damage. Washington requires drivers to have UM coverage with limits equal to their liability coverage, but you can choose higher limits for greater protection.

Factors Influencing Car Insurance Rates in Washington State

Several factors determine your car insurance rates in Washington, making it essential to understand how these elements affect your premiums. This knowledge can help you make informed decisions to potentially lower your costs.

- Driving History: Your driving record significantly influences your insurance rates. Accidents, traffic violations, and DUI convictions can lead to higher premiums. Maintaining a clean driving record is crucial for keeping your insurance costs down.

- Vehicle Type: The type of vehicle you drive is a major factor in determining your insurance rates. Higher-performance vehicles, luxury cars, and SUVs generally have higher insurance premiums due to their higher repair costs and potential for greater damage in accidents.

- Location: Your location in Washington state plays a role in your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency tend to have higher insurance premiums. For instance, urban areas like Seattle and Bellevue may have higher insurance costs compared to rural areas.

- Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher insurance premiums. Similarly, gender can also play a role, with certain insurance companies adjusting rates based on historical accident data.

- Credit History: In some states, insurance companies use credit history as a factor in determining insurance rates. However, this practice is not permitted in Washington.

Impact of Driving History on Insurance Premiums

Your driving history is a significant factor in determining your insurance premiums in Washington. A clean driving record translates into lower insurance costs, while incidents like accidents, traffic violations, and DUI convictions can significantly increase your premiums.

- Accidents: Any at-fault accidents you have been involved in will likely increase your insurance premiums. The severity of the accident and the extent of the damage will influence the premium increase. Even accidents where you were not at fault can lead to a slight increase in premiums.

- Traffic Violations: Traffic violations, such as speeding tickets, running red lights, and reckless driving, can also result in higher insurance premiums. The severity of the violation and the frequency of offenses will influence the premium increase.

- DUI Convictions: DUI convictions have the most significant impact on insurance premiums. Insurance companies consider DUI a serious offense, and premiums can increase dramatically after a DUI conviction. You may also face a period of non-renewal or cancellation of your policy.

Impact of Vehicle Type on Insurance Premiums

The type of vehicle you drive plays a crucial role in determining your insurance premiums in Washington. Higher-performance vehicles, luxury cars, and SUVs generally have higher insurance premiums due to their higher repair costs and potential for greater damage in accidents.

- Performance Vehicles: Vehicles with powerful engines and high-performance features, such as sports cars and muscle cars, are often associated with higher risk and greater damage in accidents. These factors contribute to higher insurance premiums.

- Luxury Cars: Luxury cars, known for their premium materials and complex features, have higher repair costs. Insurance companies factor in these costs when determining premiums, leading to higher rates for luxury vehicles.

- SUVs and Trucks: SUVs and trucks are often larger and heavier than passenger cars, making them more likely to cause significant damage in accidents. They also have higher repair costs, leading to higher insurance premiums.

Impact of Location on Insurance Premiums, Cheapest car insurance in washington state

Your location in Washington state plays a role in your insurance premiums. Areas with higher crime rates, traffic congestion, and accident frequency tend to have higher insurance premiums.

- Urban Areas: Urban areas like Seattle and Bellevue, with higher population density, traffic congestion, and crime rates, typically have higher insurance premiums.

- Rural Areas: Rural areas in Washington, with lower population density and fewer traffic hazards, generally have lower insurance premiums compared to urban areas.

Finding the Cheapest Car Insurance Options

Finding the most affordable car insurance in Washington State can feel like navigating a maze. There are many factors that influence your premium, and numerous insurance companies vying for your business. This section will provide you with the information you need to compare rates, understand coverage, and ultimately secure the best deal possible.

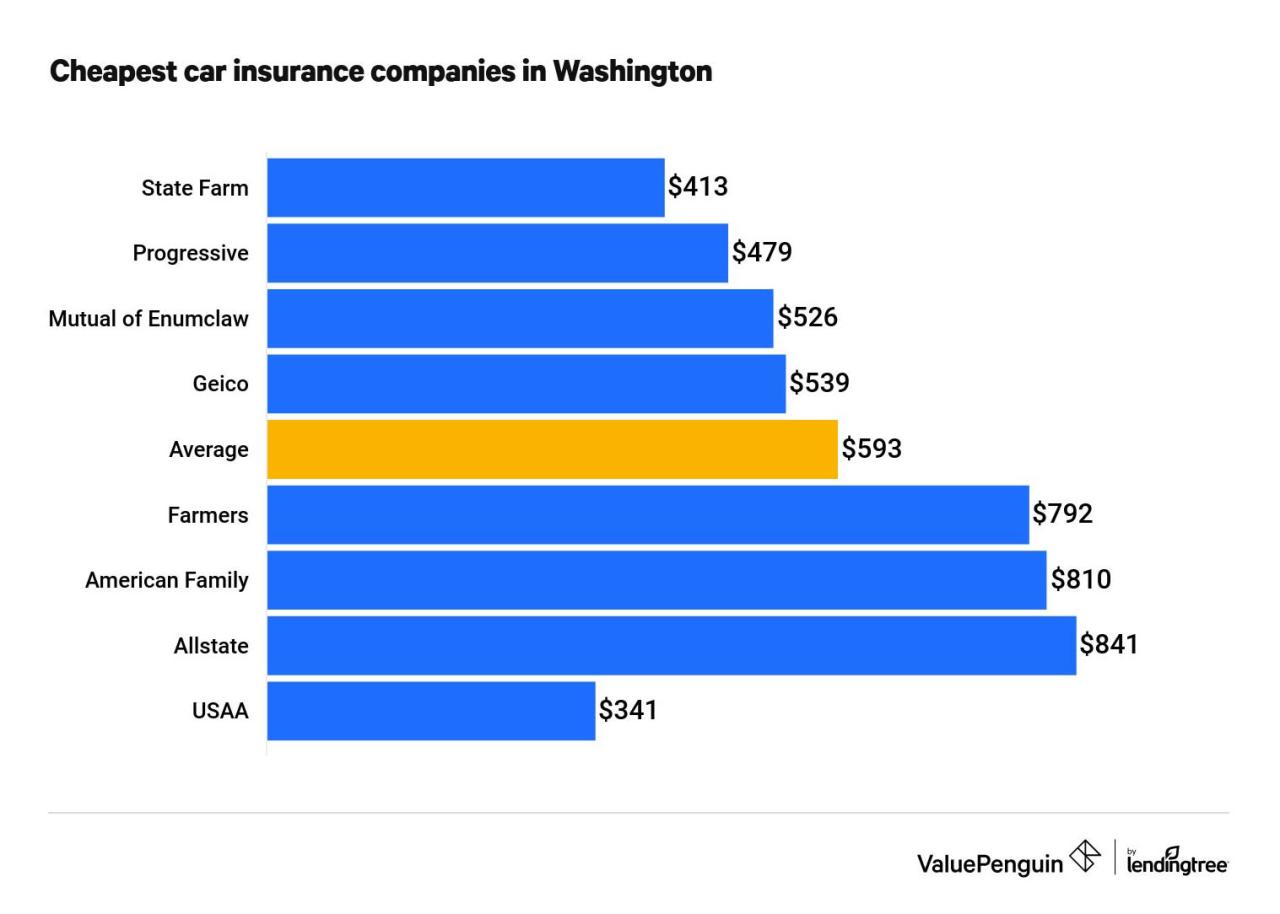

Comparing Top Car Insurance Providers in Washington State

Understanding the top car insurance providers in Washington State and their offerings can help you make informed decisions. It’s essential to consider both their rates and coverage to determine the best fit for your individual needs.

- State Farm: State Farm is a popular choice in Washington, offering competitive rates and a wide range of coverage options. They are known for their strong customer service and a variety of discounts, making them a good option for many drivers.

- Geico: Geico is another well-known insurer, often recognized for its affordable rates. They offer a streamlined online experience and have a reputation for quick claims processing.

- Progressive: Progressive is known for its innovative approach to insurance, offering features like usage-based insurance (where your driving habits influence your premium) and name-your-price tools to help you find the best deal.

- Farmers Insurance: Farmers Insurance provides a range of insurance products, including car insurance. They have a strong focus on customer service and are known for their personalized approach to policy creation.

- USAA: USAA specializes in insurance for military personnel and their families. They offer competitive rates and excellent customer service, making them a top choice for eligible drivers.

Discount Programs Offered by Insurance Companies

Many insurance companies offer discount programs to help lower your premiums. These programs often reward safe driving, responsible behavior, and certain characteristics of your vehicle.

- Good Driver Discounts: These are common and often significant discounts for drivers with clean driving records, demonstrating responsible behavior on the road.

- Safe Driver Discounts: Similar to good driver discounts, safe driver discounts reward drivers who participate in safe driving programs or have a proven track record of safe driving habits.

- Multi-Policy Discounts: Many insurers offer discounts if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Vehicle Safety Discounts: These discounts reward you for driving vehicles with safety features like anti-theft systems, airbags, and anti-lock brakes.

- Student Discounts: Some insurers offer discounts for good students who maintain a certain GPA.

Negotiating Lower Car Insurance Premiums

While comparing quotes and utilizing discounts is crucial, negotiating lower premiums can be a valuable strategy. Here are some tips:

- Shop around: Don’t settle for the first quote you receive. Get quotes from multiple insurance companies to ensure you’re getting the best deal.

- Be prepared: Before contacting an insurance company, gather all relevant information, such as your driving history, vehicle details, and current insurance coverage.

- Ask for a discount: Don’t be afraid to ask for discounts. Many insurance companies are willing to negotiate, especially if you’re a loyal customer or have a good driving record.

- Be willing to walk away: If you’re not happy with the quote, don’t be afraid to walk away. There are other insurance companies out there that may offer a better deal.

- Consider your coverage: Sometimes, you can save money by reducing your coverage, but be sure to weigh the potential risks and benefits.

Factors to Consider When Choosing Car Insurance

When shopping for car insurance in Washington state, it’s important to consider several factors beyond just the price. Choosing the right coverage and features can ensure you’re protected in case of an accident or other unforeseen event.

Coverage Limits and Deductibles

Coverage limits and deductibles play a crucial role in determining your insurance costs and the financial protection you receive. Understanding these concepts is essential for making informed decisions.

- Coverage Limits: These limits define the maximum amount your insurer will pay for specific types of claims. For example, liability coverage limits determine the maximum amount your insurer will pay for injuries or property damage you cause to others in an accident. Higher coverage limits generally result in higher premiums, but they offer greater financial protection in case of a major accident.

- Deductibles: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible usually translates to lower premiums, while a lower deductible means higher premiums. Consider your financial situation and risk tolerance when choosing a deductible. If you can afford a higher deductible, you can potentially save on premiums.

Optional Coverage

Beyond basic liability coverage, several optional coverages can enhance your protection and peace of mind.

- Roadside Assistance: This coverage provides assistance for situations like flat tires, dead batteries, and lockouts. Roadside assistance can be particularly helpful in emergencies, especially if you’re driving alone or in unfamiliar areas.

- Rental Car Reimbursement: This coverage helps cover the cost of a rental car if your vehicle is damaged or stolen and you need transportation while it’s being repaired. Rental car reimbursement can be invaluable if you rely on your car for work or other essential activities.

Car Insurance Provider Comparison

| Provider | Key Features | Pricing |

|---|---|---|

| Geico | Wide range of coverage options, competitive pricing, strong customer service | Varies depending on factors like driving history, vehicle type, and location. |

| State Farm | Extensive coverage options, strong financial stability, comprehensive customer support | Varies depending on factors like driving history, vehicle type, and location. |

| Progressive | Customizable coverage options, innovative features like Snapshot telematics program, competitive pricing | Varies depending on factors like driving history, vehicle type, and location. |

Online Resources and Tools

Finding the best car insurance rates in Washington state can be a time-consuming and confusing process. Fortunately, several online resources and tools can help you compare quotes, manage your policy, and save money.

Car Insurance Comparison Websites

Car insurance comparison websites are a valuable resource for finding the cheapest rates. These websites allow you to enter your information once and receive quotes from multiple insurers. This saves you time and effort compared to contacting each insurer individually.

- Insurify: Insurify is a popular comparison website that compares quotes from over 20 insurance companies. They offer a user-friendly interface and provide detailed information about each policy.

- Policygenius: Policygenius is another reputable comparison website that allows you to compare quotes from various insurers. They offer a comprehensive comparison tool and provide personalized recommendations.

- The Zebra: The Zebra is a comparison website that focuses on providing transparent and unbiased quotes. They allow you to compare quotes from over 100 insurers and provide detailed information about each policy.

- Compare.com: Compare.com is a comparison website that allows you to compare quotes from various insurers, including car insurance. They offer a user-friendly interface and provide detailed information about each policy.

Mobile Apps for Managing Car Insurance

Many car insurance companies offer mobile apps that allow you to manage your policy on the go. These apps can be used to:

- View your policy details

- Make payments

- Report claims

- Access roadside assistance

- Update your contact information

Here are some popular car insurance apps:

- State Farm: The State Farm app allows you to manage your policy, pay your bills, file claims, and access roadside assistance.

- Geico: The Geico app allows you to manage your policy, pay your bills, file claims, and access roadside assistance.

- Progressive: The Progressive app allows you to manage your policy, pay your bills, file claims, and access roadside assistance.

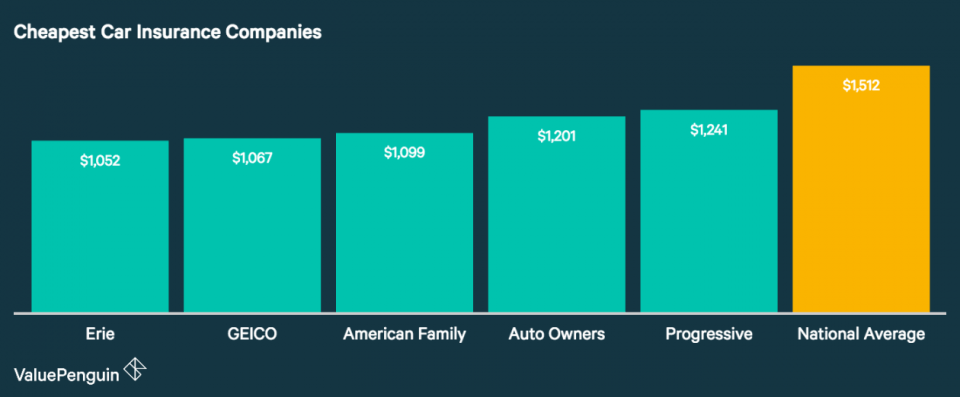

Benefits of Obtaining Quotes from Multiple Insurers

It’s crucial to obtain quotes from multiple insurers to find the best rates. This is because each insurer uses different factors to determine your premiums.

- Comparison Shopping: Getting quotes from multiple insurers allows you to compare prices and coverage options. This can help you find the most affordable policy that meets your needs.

- Finding Hidden Discounts: Different insurers offer various discounts, and you might miss out on savings if you only get quotes from a few companies. By comparing quotes, you can discover discounts that you might not have known about.

- Negotiating Lower Rates: Once you have quotes from multiple insurers, you can use this information to negotiate a lower rate with your current insurer. If you find a better rate with another company, you can use that quote to leverage a better deal from your current insurer.

Tips for Saving on Car Insurance

Saving money on car insurance is possible, and often comes down to simple changes you can make to your driving habits and car choices. Here are some tips to help you lower your premiums in Washington State.

Lowering Your Premiums

Making changes to your driving habits and car choices can have a significant impact on your car insurance premiums.

- Maintain a Clean Driving Record: Avoiding traffic violations and accidents is the most effective way to lower your insurance costs. Insurance companies reward safe drivers with lower premiums.

- Increase Your Deductible: A higher deductible means you pay more out-of-pocket in case of an accident, but it can result in lower premiums. Consider increasing your deductible if you are comfortable with a higher out-of-pocket expense.

- Bundle Your Policies: Combining your car insurance with other policies like home or renters insurance can often lead to discounts. Check with your insurer to see if bundling options are available.

- Take a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount.

- Ask About Discounts: Insurance companies offer various discounts, such as good student discounts, safe driver discounts, and multi-car discounts. Inquire about these discounts and see if you qualify.

Good Driving Habits

Safe driving practices can lead to lower insurance premiums and a safer driving experience overall.

- Avoid Distracted Driving: Distracted driving, such as texting or talking on the phone while driving, increases the risk of accidents and can lead to higher insurance rates.

- Obey Speed Limits: Speeding is a major cause of accidents and can result in higher insurance premiums.

- Maintain Your Vehicle: Regular maintenance, including oil changes, tire rotations, and brake inspections, helps ensure your vehicle is in good working order and reduces the risk of breakdowns or accidents.

- Drive Safely: Practicing defensive driving techniques, such as maintaining a safe following distance and being aware of your surroundings, can help prevent accidents and lower your insurance costs.

Car Safety Features

Investing in vehicles with safety features can lead to lower insurance premiums as they demonstrate a commitment to safety.

- Anti-lock Braking System (ABS): ABS helps prevent wheel lock-up during braking, improving vehicle control and reducing the risk of accidents.

- Electronic Stability Control (ESC): ESC helps maintain vehicle stability during cornering or sudden maneuvers, reducing the risk of skidding or rollovers.

- Airbags: Airbags deploy in the event of a collision, providing cushioning and protection for occupants.

- Backup Camera: Backup cameras help drivers see behind their vehicles, reducing the risk of backing accidents.

- Lane Departure Warning: Lane departure warning systems alert drivers if they drift out of their lane, helping prevent accidents.

Summary: Cheapest Car Insurance In Washington State

Ultimately, finding the cheapest car insurance in Washington State requires a balance of research, comparison, and negotiation. By understanding the factors that impact your rates, comparing quotes from multiple providers, and taking advantage of available discounts, you can find the best possible deal. Remember, car insurance is an essential investment, and finding the right balance between affordability and comprehensive coverage is key to protecting yourself on the road.

FAQ Insights

What are the minimum car insurance requirements in Washington State?

Washington State requires drivers to carry liability insurance, which covers damage to others’ property or injuries to others in an accident caused by you. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How can I get a free car insurance quote?

Many car insurance providers offer free online quotes. Simply enter your information, including your driving history, vehicle details, and desired coverage levels, and the website will generate a personalized quote.

What are some common car insurance discounts?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for safety features like anti-theft devices or airbags.