Cheapest car insurance in united states – Cheapest car insurance in the United States is a hot topic, especially for budget-conscious drivers. Navigating the complex world of insurance premiums can feel overwhelming, but understanding the factors that influence costs can help you find the best deals.

From your driving history to the type of vehicle you own, various elements contribute to your insurance rates. This guide explores the key considerations, strategies, and resources to help you secure the most affordable car insurance coverage.

Understanding Car Insurance Costs

Car insurance premiums are determined by a complex interplay of factors that assess your risk as a driver. These factors are carefully evaluated by insurance companies to calculate the likelihood of you filing a claim and the potential cost of that claim.

Factors Influencing Car Insurance Premiums

Insurance companies consider a variety of factors when determining your car insurance premium. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

- Driving History: Your driving record is a significant factor in determining your premium. A clean driving history with no accidents or traffic violations will generally result in lower premiums. Conversely, accidents, speeding tickets, or DUI convictions will increase your premiums, reflecting a higher perceived risk.

- Vehicle Type: The type of car you drive significantly impacts your insurance costs. Luxury cars, sports cars, and vehicles with high repair costs are generally more expensive to insure due to their higher risk of damage and higher repair bills. Conversely, older, less expensive cars typically have lower insurance premiums.

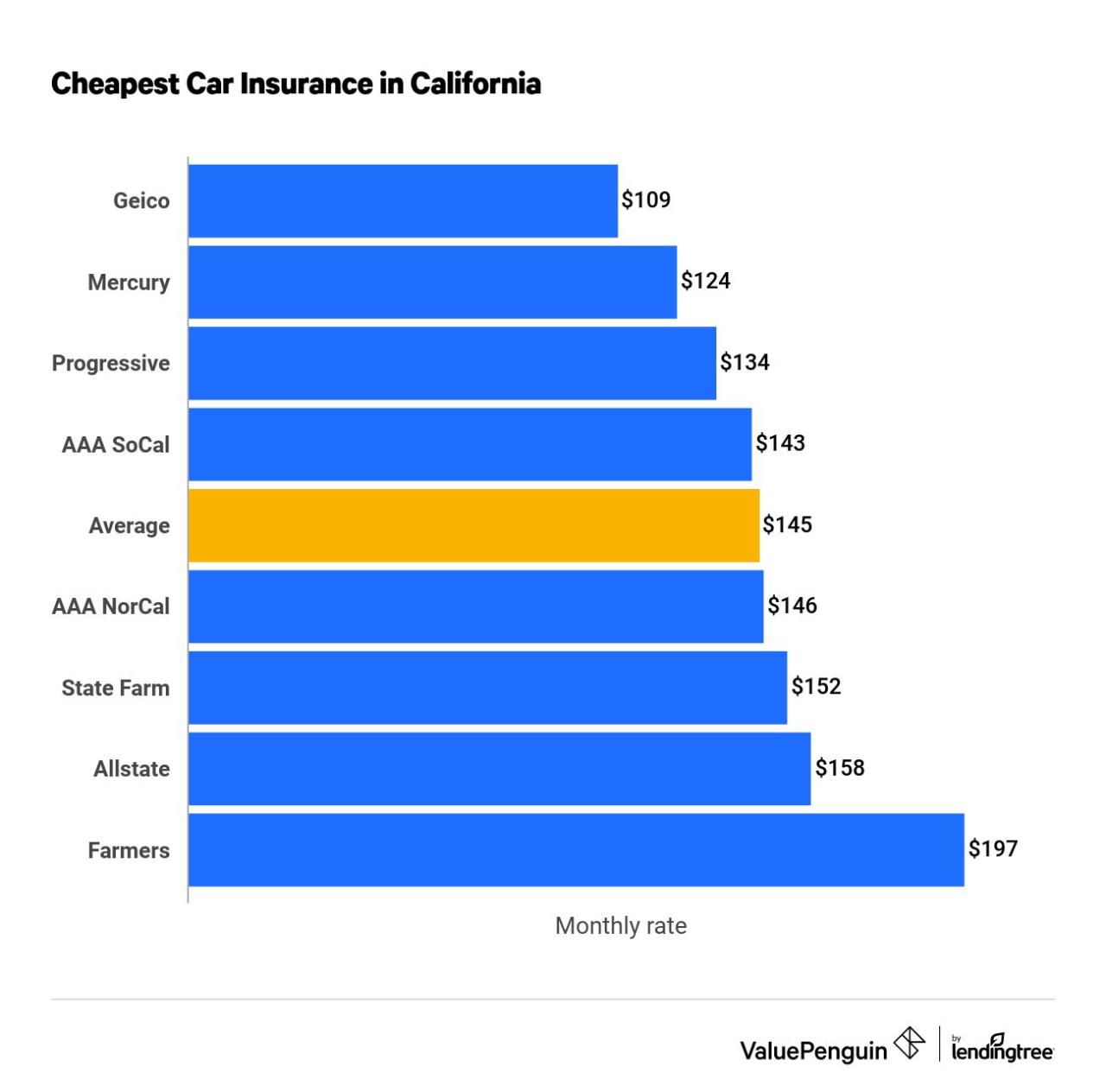

- Location: Your location plays a significant role in your insurance rates. Areas with higher rates of car theft, accidents, or other driving-related incidents tend to have higher insurance premiums. Factors like population density, traffic congestion, and weather conditions can also influence rates.

- Coverage Options: The type and amount of coverage you choose directly affects your premiums. Higher coverage limits, such as comprehensive and collision coverage, offer greater protection but come at a higher cost. Choosing a higher deductible can lower your premiums, but you will be responsible for a larger out-of-pocket expense if you need to file a claim.

- Credit Score: In many states, insurance companies use your credit score as a factor in determining your premium. A higher credit score generally indicates a lower risk of filing a claim, resulting in lower premiums. While the use of credit scores for insurance purposes is controversial, it remains a common practice in many areas.

Finding the Cheapest Options

Finding the cheapest car insurance involves understanding your needs, comparing different options, and leveraging strategies to secure competitive quotes. It’s about making informed decisions to ensure you’re adequately covered without overpaying.

Comparing Car Insurance Types

Car insurance policies come in various forms, each offering different levels of coverage and costs. Understanding these types is crucial for making the right choice for your situation.

- Liability Coverage: This is the most basic type of car insurance, covering damages to other vehicles or property caused by an accident you’re at fault for. It includes bodily injury liability and property damage liability.

- Collision Coverage: This covers damage to your own vehicle in case of an accident, regardless of fault. This is usually optional and may not be necessary for older vehicles with low market value.

- Comprehensive Coverage: This protects your vehicle from damage caused by non-collision events like theft, vandalism, or natural disasters. Like collision coverage, it’s optional and depends on your vehicle’s value and your risk tolerance.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. It’s essential, especially in areas with high rates of uninsured drivers.

- Personal Injury Protection (PIP): This covers medical expenses for you and your passengers in case of an accident, regardless of fault. It’s often required in some states, but its coverage and cost vary.

The cost of each type of coverage depends on factors like your driving history, location, vehicle type, and chosen deductibles. Choosing the right combination of coverage is essential to finding the most affordable option that meets your needs.

Obtaining Competitive Quotes

Getting quotes from multiple providers is key to finding the cheapest car insurance. Here are some tips:

- Use Online Comparison Tools: Websites like Insurance.com, NerdWallet, and Bankrate allow you to compare quotes from various insurers simultaneously, saving you time and effort.

- Contact Insurers Directly: Reach out to insurers you’re interested in and request quotes. This gives you a chance to discuss your specific needs and get personalized recommendations.

- Ask for Discounts: Most insurers offer discounts for various factors like good driving records, safety features in your vehicle, and bundling multiple insurance policies. Be sure to inquire about these discounts when getting quotes.

- Negotiate: Don’t be afraid to negotiate your rates, especially if you’re a loyal customer or have a good driving history. Explain your situation and see if the insurer is willing to adjust their rates.

Shopping for the Cheapest Car Insurance

Here’s a step-by-step guide to finding the most affordable car insurance:

- Assess Your Needs: Determine the level of coverage you need based on your vehicle’s value, your financial situation, and your risk tolerance.

- Gather Information: Collect details about your vehicle, driving history, and any relevant discounts you qualify for.

- Use Comparison Tools: Utilize online comparison websites to get quotes from multiple insurers simultaneously.

- Contact Insurers Directly: Reach out to insurers you’re interested in for personalized quotes and to discuss specific needs.

- Compare Quotes: Analyze the quotes you receive, considering factors like coverage, deductibles, and discounts.

- Negotiate: Discuss your options with the insurer and try to negotiate a lower rate.

- Choose the Best Option: Select the policy that offers the best balance of coverage, price, and customer service.

Key Considerations for Choosing Insurance

Choosing the cheapest car insurance is important, but it’s equally crucial to select a policy that provides adequate coverage for your specific needs. This involves understanding your individual driving habits, vehicle usage, and risk tolerance, and then carefully evaluating different coverage options.

Understanding Your Individual Needs, Cheapest car insurance in united states

Your driving habits, vehicle usage, and risk tolerance play a significant role in determining your insurance needs. If you frequently drive long distances, for instance, you might require higher liability coverage. Conversely, if you rarely use your car, you may find that basic liability coverage is sufficient.

Coverage Options

Here’s a breakdown of common car insurance coverage options, their benefits, and drawbacks:

Liability Coverage

This is the most basic type of car insurance and is typically required by law. Liability coverage protects you financially if you cause an accident that results in injury or damage to another person or their property.

- Benefits: Provides financial protection against lawsuits and claims arising from accidents you cause.

- Drawbacks: Does not cover damage to your own vehicle.

Collision Coverage

This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Benefits: Covers damage to your vehicle, regardless of fault, allowing you to get it repaired or replaced.

- Drawbacks: Typically has a deductible, meaning you pay a certain amount out-of-pocket before the insurance kicks in.

Comprehensive Coverage

This coverage protects your vehicle against damage from events other than accidents, such as theft, vandalism, fire, or natural disasters.

- Benefits: Provides financial protection against damage to your vehicle from non-accident events.

- Drawbacks: Typically has a deductible, and may not cover all types of damage.

Uninsured/Underinsured Motorist Coverage

This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

- Benefits: Helps cover your medical expenses and property damage if the other driver doesn’t have sufficient insurance.

- Drawbacks: May have limits on the amount of coverage provided.

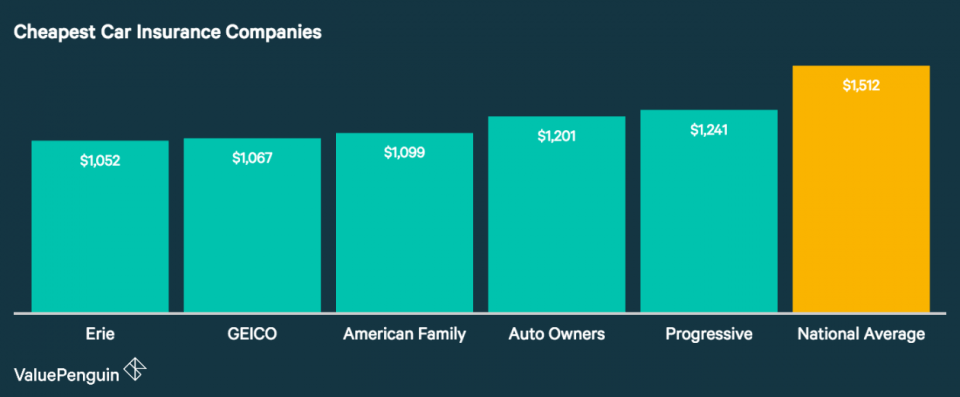

Comparing Insurance Providers

The cost of car insurance can vary significantly between different providers. It’s essential to compare quotes from multiple insurers to find the best deal. Here’s a table comparing coverage levels and costs associated with different insurance providers (this is just an example, you’ll need to get quotes from actual insurance companies):

| Insurance Provider | Liability Coverage | Collision Coverage | Comprehensive Coverage | Uninsured Motorist Coverage | Estimated Annual Premium |

|—|—|—|—|—|—|

| Company A | $50,000/$100,000 | $1,000 deductible | $500 deductible | $50,000/$100,000 | $1,200 |

| Company B | $25,000/$50,000 | $500 deductible | $250 deductible | $25,000/$50,000 | $1,000 |

| Company C | $100,000/$300,000 | $0 deductible | $0 deductible | $100,000/$300,000 | $1,500 |

Saving Money on Car Insurance

Car insurance premiums can vary significantly, and understanding the factors that influence these costs is crucial to securing the best possible rates. This section will explore various strategies and tactics to help you save money on your car insurance.

Common Discounts

Insurance companies offer a range of discounts to incentivize safe driving practices and responsible behavior. These discounts can significantly reduce your premiums.

- Good Student Discount: This discount is typically available to students who maintain a certain GPA or academic standing. It reflects the lower risk associated with academically focused individuals.

- Safe Driver Discount: This discount rewards drivers with a clean driving record, free from accidents or traffic violations. It acknowledges the lower risk posed by drivers who demonstrate safe driving habits.

- Multi-Car Discount: Insuring multiple vehicles with the same company often results in a discount, as the insurer benefits from insuring multiple vehicles within the same household.

- Multi-Policy Discount: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can also lead to significant savings. This approach benefits the insurer by consolidating multiple policies under one umbrella.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and earn you a discount on your premiums. These courses often cover strategies for avoiding accidents and improving driving skills.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarms or tracking systems, can deter theft and reduce the risk of a claim. Insurance companies often reward these proactive measures with discounts.

- Loyalty Discount: Many insurance companies offer discounts to long-term customers who have maintained their policies for an extended period. This recognizes the value of customer loyalty and retention.

Improving Your Driving Record

A clean driving record is crucial for securing lower insurance premiums. By avoiding accidents and traffic violations, you demonstrate responsible driving habits and reduce your risk profile.

- Defensive Driving: Adopting defensive driving techniques, such as maintaining a safe distance from other vehicles, anticipating potential hazards, and avoiding distractions, can significantly reduce your risk of accidents. These practices can also contribute to a better driving record.

- Traffic Violation Prevention: Adhering to traffic laws and avoiding speeding, running red lights, and other violations is essential for maintaining a clean driving record. These violations can increase your premiums and reflect poorly on your driving habits.

Increasing Your Deductible

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Raising your deductible can lower your monthly premiums, but it also means you will have to pay more in the event of a claim.

“Consider the trade-off between higher deductibles and lower premiums, carefully weighing your financial preparedness in case of an accident.”

- Financial Assessment: Evaluate your financial situation and determine the deductible amount you can comfortably afford in case of a claim. A higher deductible may be a viable option if you have a strong emergency fund or are confident in your ability to cover smaller repair costs.

- Risk Tolerance: Consider your risk tolerance and driving habits. If you have a history of minor accidents or believe you are at a higher risk of being involved in a collision, a lower deductible may be more prudent.

Bundling Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant savings. Insurance companies offer these discounts to encourage customers to consolidate their insurance needs under one provider.

- Multiple Policy Discounts: Explore the bundling options offered by your insurance company and compare them to other providers. You may find that bundling your policies can result in substantial savings compared to purchasing them separately.

- Policy Review: Periodically review your insurance policies to ensure you are still receiving the best rates and discounts. Your insurance needs may change over time, and you may be eligible for different discounts as your circumstances evolve.

Negotiating with Insurance Agents

While insurance rates are often determined by factors beyond your control, you can still negotiate with insurance agents to secure the best possible rates.

- Shop Around: Obtain quotes from multiple insurance companies to compare rates and discounts. This competitive approach can help you identify the most favorable offers.

- Loyalty Negotiation: If you have been a loyal customer of your current insurance company for an extended period, consider discussing your rate with your agent. Express your satisfaction with their services and inquire about potential discounts or adjustments to your premium.

- Policy Review: Review your policy with your agent to ensure you are receiving all available discounts and that your coverage aligns with your current needs. This can help identify potential areas for negotiation and optimization.

Additional Factors to Consider: Cheapest Car Insurance In United States

When searching for the cheapest car insurance, remember that cost isn’t the only factor. You also need to consider factors like state-specific regulations, insurance company stability, and the quality of customer service.

State-Specific Regulations and Insurance Laws

State-specific regulations significantly impact car insurance premiums. These regulations dictate minimum coverage requirements, how insurers calculate premiums, and how they handle disputes. Understanding these regulations is crucial to finding the best deal.

For example, some states require drivers to carry higher liability limits than others. This can lead to higher premiums in those states.

Insurance Company Financial Stability and Customer Service

Choosing a financially stable insurance company is vital, especially in the event of a major claim. A financially stable company is more likely to be able to pay out claims promptly and fairly. Additionally, consider the company’s reputation for customer service. You want to ensure that you can easily contact the company and resolve any issues quickly.

For example, you can check an insurance company’s financial strength rating with organizations like A.M. Best or Standard & Poor’s.

Reviewing and Updating Your Car Insurance Policy

It’s essential to review your car insurance policy periodically to ensure you have adequate coverage and are paying a fair price. Your needs may change over time, such as when you get a new car, move to a new state, or add a driver to your policy. You should also consider updating your policy if you have any major life changes, like getting married or having children.

For example, if you’ve recently purchased a new car, you may need to increase your coverage limits. Similarly, if you’ve moved to a new state with higher liability requirements, you may need to adjust your policy accordingly.

Ultimate Conclusion

Finding the cheapest car insurance in the United States requires a combination of research, comparison, and strategic planning. By understanding the factors that influence premiums, exploring different coverage options, and leveraging available discounts, you can significantly reduce your insurance costs. Remember, taking the time to shop around and compare quotes is essential to securing the best possible rates.

Expert Answers

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever you experience a significant life change, such as a change in your driving record, vehicle, or address.

What is a deductible, and how does it affect my premiums?

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible typically leads to lower premiums, while a lower deductible results in higher premiums.

Can I bundle my car and home insurance policies to save money?

Yes, bundling your car and home insurance policies with the same provider can often lead to significant discounts.