Cheapest auto insurance Washington state can be a challenging quest, but it’s essential to find the right coverage at an affordable price. Navigating the complexities of auto insurance in Washington can feel overwhelming, but understanding the mandatory requirements, available coverage options, and factors influencing premiums can help you make informed decisions.

From comparing quotes from different providers to exploring discounts and special offers, this guide will equip you with the knowledge and strategies to secure the most cost-effective auto insurance policy. Whether you’re a new driver, seasoned veteran, or simply seeking a better deal, this information will empower you to make smart choices and save money on your auto insurance.

Understanding Auto Insurance in Washington State

Driving in Washington State requires you to have auto insurance. This protects you and others from financial losses in case of accidents. The state mandates certain minimum coverage levels, and you can choose additional coverage to suit your needs and budget.

Mandatory Auto Insurance Coverage Requirements

Washington State law requires all drivers to have specific auto insurance coverage. This ensures that drivers have financial protection in case of an accident. Here are the mandatory coverages:

- Liability Coverage: This covers the costs of injuries or damages you cause to others in an accident. It is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages for injuries you cause to others. Washington State requires a minimum of $25,000 per person and $50,000 per accident.

- Property Damage Liability: This covers damages to another person’s vehicle or property in an accident. The minimum requirement is $10,000.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. Washington State requires minimum coverage of $25,000 per person and $50,000 per accident for bodily injury and $10,000 for property damage.

Types of Auto Insurance Coverage, Cheapest auto insurance washington state

While mandatory coverage is essential, you can choose additional coverage to enhance your protection. Here are common types of auto insurance:

- Collision Coverage: This covers damages to your vehicle if you are involved in an accident, regardless of fault. This coverage is usually optional, but it can be beneficial if you have a newer car or a loan on your vehicle.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. This coverage is also typically optional but can be valuable to protect your investment.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of fault. This coverage is usually optional but can provide peace of mind in case of an accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other damages for you and your passengers, regardless of fault. This coverage is optional in Washington State but can be helpful in situations where liability is unclear or the other driver is uninsured.

- Rental Reimbursement: This coverage pays for a rental car while your vehicle is being repaired after an accident. This can be helpful to ensure you have transportation while your vehicle is out of commission.

- Roadside Assistance: This coverage provides assistance with situations such as flat tires, jump starts, and towing. This can be a valuable addition to your policy, especially if you drive frequently.

Factors Influencing Auto Insurance Premiums

Several factors can influence your auto insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

- Driving Record: Your driving history, including accidents, traffic violations, and DUI convictions, significantly impacts your premiums. A clean driving record typically leads to lower premiums.

- Vehicle Type: The make, model, and year of your vehicle can influence your premiums. Newer, more expensive vehicles often have higher insurance costs due to their higher repair costs and potential for theft.

- Age and Gender: Your age and gender can affect your premiums. Younger drivers and male drivers tend to have higher premiums due to their higher risk of accidents.

- Location: Your location can impact your premiums, as accident rates and crime rates vary across different areas. Areas with higher accident or crime rates may have higher premiums.

- Credit History: In some states, insurance companies use your credit history as a factor in determining your premiums. This practice is controversial, but it is legal in Washington State.

- Driving Habits: Your driving habits, such as mileage driven, commuting distance, and driving history, can influence your premiums. Drivers with shorter commutes and fewer miles driven may receive lower premiums.

- Coverage Levels: The level of coverage you choose can also affect your premiums. Higher coverage limits generally result in higher premiums.

- Discounts: Insurance companies offer various discounts to reduce your premiums. These discounts can include good student discounts, safe driver discounts, multi-car discounts, and more.

Finding the Cheapest Auto Insurance Options

Finding the most affordable auto insurance in Washington State requires careful comparison and consideration of various factors. It’s essential to explore different insurance providers and understand the features and discounts available to you.

Comparing Auto Insurance Quotes

It’s crucial to compare quotes from multiple insurance companies to find the best deal. Several methods can be used to gather these quotes, each with its own advantages and disadvantages.

- Contacting Insurance Companies Directly: This method allows you to speak with an insurance agent and ask specific questions about their policies. However, it can be time-consuming to contact multiple companies individually.

- Using Online Comparison Tools: Online comparison websites allow you to enter your information once and receive quotes from various insurance providers. This is a quick and efficient way to compare options, but it may not provide as much personalized attention as contacting companies directly.

Benefits of Online Insurance Comparison Tools

Online comparison tools offer numerous benefits for consumers seeking affordable auto insurance.

- Convenience: Online tools allow you to compare quotes from the comfort of your home, eliminating the need for phone calls or in-person visits.

- Time-Saving: Instead of contacting each insurance company individually, you can enter your information once and receive quotes from multiple providers simultaneously.

- Transparency: Online tools often provide detailed information about each policy, including coverage limits, deductibles, and discounts.

Considering Discounts and Special Offers

Insurance companies offer various discounts and special offers to lower your premiums. These discounts can significantly impact your overall cost.

- Good Driver Discounts: Maintaining a clean driving record with no accidents or violations can earn you a significant discount.

- Safe Vehicle Discounts: Cars with advanced safety features, such as anti-theft devices or airbags, may qualify for discounts.

- Bundling Discounts: Combining your auto insurance with other policies, such as homeowners or renters insurance, can often result in a discount.

- Payment Discounts: Some insurance companies offer discounts for paying your premiums in full or opting for automatic payments.

Factors Affecting Auto Insurance Costs

Your auto insurance premium is determined by various factors that assess your risk as a driver. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Factors Influencing Auto Insurance Premiums

Insurance companies use a complex system to calculate your premiums, considering several key factors:

- Age and Driving Experience: Younger drivers, particularly those under 25, often have higher premiums due to their lack of experience and higher risk of accidents. As you gain experience and age, your premiums generally decrease.

- Driving History: Your driving record plays a significant role in determining your premium. A clean driving record with no accidents or traffic violations will lead to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can result in higher premiums.

- Vehicle Type: The type of vehicle you drive influences your insurance costs. High-performance cars, luxury vehicles, and newer models are generally more expensive to insure due to their higher repair costs and potential for theft.

- Location: Your location significantly impacts your premiums. Areas with higher traffic density, crime rates, and accident rates tend to have higher insurance costs. For example, insurance premiums in Seattle might be higher than in rural areas of Washington State.

- Credit History: In some states, including Washington, insurance companies can use your credit history as a factor in determining your premiums. This practice is based on the idea that individuals with good credit are more likely to be responsible drivers.

- Coverage Options: The type and amount of coverage you choose will affect your premiums. Comprehensive and collision coverage, which protect against damage to your vehicle, are typically more expensive than liability coverage, which covers damages to other vehicles or property.

Impact of Driving Habits and Safety Features

Your individual driving habits and the safety features of your vehicle also influence your premiums:

- Driving Habits: Safe driving practices, such as avoiding speeding, aggressive driving, and distracted driving, can reduce your risk of accidents and potentially lower your premiums. Some insurance companies offer discounts for safe driving habits, such as telematics programs that track your driving behavior.

- Safety Features: Vehicles equipped with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are generally considered safer and can qualify for discounts on your premiums.

Average Auto Insurance Costs Across Washington State

Average auto insurance premiums can vary significantly across different regions of Washington State. For example, insurance costs in urban areas like Seattle and Bellevue might be higher than in smaller towns and rural areas. Factors like traffic density, crime rates, and the prevalence of accidents can contribute to these regional differences.

Tips for Saving on Auto Insurance

Finding affordable auto insurance in Washington State is a priority for many drivers. Fortunately, there are several strategies you can implement to potentially reduce your premiums and save money.

Improving Your Driving Record

A clean driving record is a significant factor in determining your insurance rates. Maintaining a good driving history can significantly reduce your premiums.

- Avoid Traffic Violations: Speeding tickets, reckless driving citations, and DUI convictions can significantly increase your insurance rates. Drive defensively, obey traffic laws, and avoid risky driving behaviors.

- Take Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safe driving practices. In Washington, some insurance companies may offer discounts for completing such courses.

- Maintain a Safe Driving History: Avoiding accidents is crucial. Even minor accidents can affect your insurance rates. Practice safe driving habits, such as maintaining a safe following distance, being aware of your surroundings, and avoiding distractions while driving.

Improving Your Credit Score

While it may seem counterintuitive, your credit score can impact your auto insurance rates in some states, including Washington. Insurance companies may use your credit history as a proxy for risk assessment.

- Check Your Credit Report Regularly: Monitor your credit report for errors or fraudulent activity. You can obtain a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually at AnnualCreditReport.com.

- Pay Bills on Time: Make timely payments on your credit cards, loans, and other bills. Late payments can negatively impact your credit score.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio (the amount of credit you use compared to your total credit limit) below 30%.

Bundling Policies

Bundling your auto insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant discounts.

- Contact Your Insurance Provider: Inquire about bundling options and the potential discounts available.

- Compare Quotes: Obtain quotes from multiple insurance providers to compare bundling discounts and find the best overall value.

Choosing the Right Insurance Provider

Finding the right auto insurance provider is crucial in ensuring you get the best coverage at the most affordable price. It involves evaluating different providers based on their offerings, customer service, and financial stability.

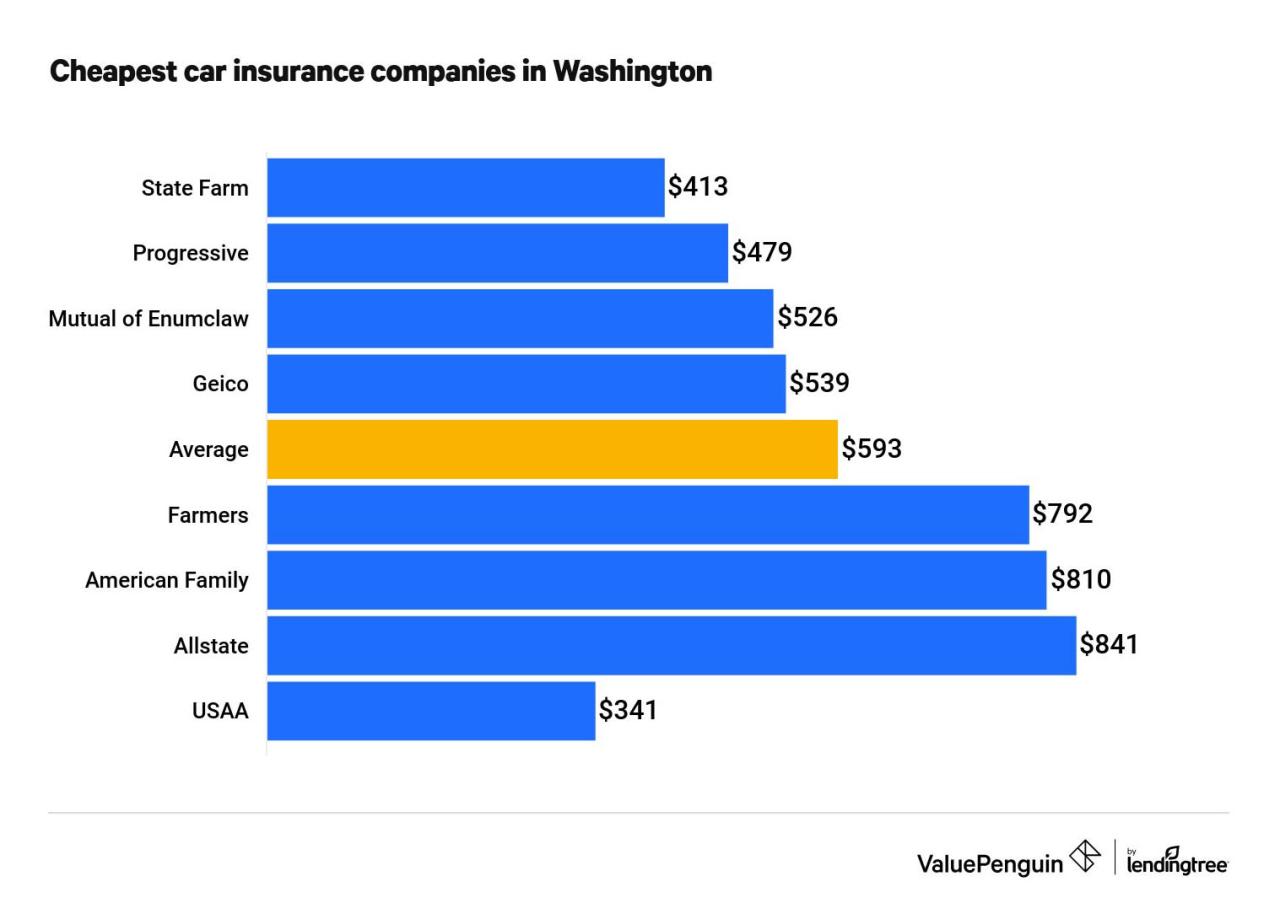

Comparing Top Auto Insurance Providers in Washington State

This table compares some of the top auto insurance providers in Washington State, considering factors such as coverage options, discounts, customer satisfaction, and financial strength:

| Provider | Coverage Options | Discounts | Customer Satisfaction | Financial Strength |

|—|—|—|—|—|

| State Farm | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Good driver, safe driver, multi-policy, vehicle safety, defensive driving | 4.2/5 stars | A++ (A.M. Best) |

| Geico | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Good driver, multi-policy, defensive driving, military, student | 4.0/5 stars | A++ (A.M. Best) |

| Progressive | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Good driver, multi-policy, safe driver, defensive driving, vehicle safety | 3.8/5 stars | A+ (A.M. Best) |

| USAA | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Good driver, multi-policy, safe driver, military, student | 4.5/5 stars | A++ (A.M. Best) |

| Farmers | Comprehensive, collision, liability, uninsured/underinsured motorist, personal injury protection | Good driver, multi-policy, safe driver, defensive driving, vehicle safety | 3.9/5 stars | A+ (A.M. Best) |

Key Features and Benefits

Each provider offers unique features and benefits that can influence your decision.

- State Farm: Known for its extensive network of agents, personalized service, and a wide range of discounts.

- Geico: Emphasizes affordability and convenience with its online and mobile tools, making it easy to manage your policy.

- Progressive: Offers a variety of coverage options, including usage-based insurance programs that reward safe driving habits.

- USAA: Primarily serves military personnel and their families, known for its exceptional customer service and financial strength.

- Farmers: Offers a strong focus on customer satisfaction and personalized service, with a wide range of coverage options.

Customer Satisfaction Ratings and Financial Stability

Customer satisfaction and financial stability are crucial considerations when choosing an insurance provider.

- Customer satisfaction ratings: Reflect the overall experience of policyholders, encompassing factors such as claims handling, customer service, and communication. These ratings can be found on websites like J.D. Power and Consumer Reports.

- Financial stability: Indicates a provider’s ability to pay claims and remain solvent. You can check a provider’s financial strength ratings from reputable agencies like A.M. Best.

Understanding Your Policy

It’s crucial to understand the terms and conditions of your auto insurance policy. This will help you make informed decisions and ensure you have the coverage you need in case of an accident.

Key Terms and Conditions

Understanding the key terms and conditions of your policy is essential for navigating the complexities of auto insurance.

- Coverage Types: Different types of coverage protect you against various risks. These include liability coverage, which protects you financially if you cause an accident, collision coverage, which covers damage to your vehicle in an accident, and comprehensive coverage, which covers damage from events like theft, vandalism, or natural disasters.

- Deductibles: This is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically results in lower premiums.

- Limits: Your policy specifies the maximum amount your insurance company will pay for each type of coverage.

- Exclusions: Certain situations are not covered by your policy. These can include driving under the influence or using your vehicle for business purposes.

Filing a Claim

Navigating the claims process can be daunting, but understanding the steps involved can help you smoothly file a claim.

- Contact your insurance company: Immediately report the accident or incident to your insurance company.

- Gather information: Collect details about the accident, including the date, time, location, and the names and contact information of any other parties involved.

- Provide documentation: Your insurance company will likely require you to provide documentation such as a police report, photos of the damage, and medical records.

- Follow up: Stay in contact with your insurance company and keep track of the progress of your claim.

Keeping Accurate Records

Maintaining detailed records of your insurance policy is vital for ensuring smooth and efficient claims processing.

- Policy details: Keep a copy of your policy, including your policy number, coverage details, deductibles, and limits.

- Payment history: Keep records of your premium payments and any changes to your policy.

- Claims history: Document any claims you have filed, including the date, incident details, and the outcome.

Final Review: Cheapest Auto Insurance Washington State

Finding the cheapest auto insurance Washington state doesn’t have to be a stressful ordeal. By understanding the key factors that influence premiums, comparing quotes, and exploring available discounts, you can confidently secure the best coverage at a price that fits your budget. Remember, being informed is the key to navigating the world of auto insurance and finding the perfect policy for your needs and wallet.

General Inquiries

What are the mandatory auto insurance coverages in Washington State?

Washington State requires all drivers to carry liability insurance, which covers damages to others in case of an accident. This includes bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage.

How do I file a claim with my auto insurance provider?

Contact your insurance provider immediately after an accident. They will guide you through the claims process, which typically involves providing details about the incident, filing necessary paperwork, and potentially undergoing an inspection.

What are some tips for improving my driving record?

To improve your driving record, focus on safe driving practices, avoid traffic violations, and complete any required defensive driving courses. A clean driving record can significantly lower your auto insurance premiums.