Cheapest auto insurance in New York State sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complex world of auto insurance in New York can feel like driving through a dense urban jungle, but with the right knowledge and strategies, you can find affordable coverage that fits your needs. This guide delves into the intricacies of New York’s auto insurance landscape, providing insights into factors that influence premiums, strategies for finding the best deals, and tips for reducing your overall costs.

From understanding New York’s unique insurance regulations to comparing major providers and exploring specific needs, this comprehensive guide equips you with the knowledge to make informed decisions and secure the most cost-effective auto insurance in the Empire State. Whether you’re a seasoned driver or a new motorist, this guide serves as your trusted companion on the road to finding the cheapest auto insurance in New York.

Understanding New York’s Auto Insurance Landscape

Navigating the world of auto insurance in New York can feel like driving through a dense city during rush hour. There are unique factors that influence insurance costs, regulations that differ from other states, and a variety of coverage options to consider. This guide will help you understand the key aspects of New York’s auto insurance landscape so you can make informed decisions.

New York’s No-Fault System

New York State operates under a no-fault insurance system, which means that after an accident, each driver’s own insurance company is responsible for covering their medical expenses and lost wages, regardless of who was at fault. This system aims to streamline the claims process and reduce lawsuits. However, it also has implications for insurance costs.

Key Factors Influencing Auto Insurance Premiums

Your auto insurance premium in New York is determined by a complex interplay of factors. These factors are designed to assess your individual risk profile and ensure that you pay a fair price for the coverage you need.

Driving History

Your driving history plays a significant role in determining your auto insurance premium. A clean driving record with no accidents or violations will generally result in lower premiums. However, if you have a history of accidents, speeding tickets, or other traffic violations, your premium will likely be higher.

- Accidents: Each accident, regardless of fault, can increase your premium. The severity of the accident, such as injuries or property damage, can further impact the increase.

- Traffic Violations: Speeding tickets, DUI/DWI offenses, and other traffic violations can significantly raise your premiums. These violations indicate a higher risk of future accidents.

- Driving Record Points: New York State uses a point system to track traffic violations. Each violation earns points, and accumulating points can lead to higher insurance premiums and even license suspension.

Age

Age is a significant factor in auto insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. As drivers age and gain more experience, their risk profile decreases, leading to lower premiums.

- Young Drivers: Insurance companies often charge higher premiums for young drivers due to their lack of experience and higher risk of accidents.

- Mature Drivers: Drivers over 65 may also face higher premiums, although the increase is often less significant than for young drivers. This is due to factors like age-related health conditions or slower reaction times.

Vehicle Type

The type of vehicle you drive is another key factor in determining your auto insurance premium. Some vehicles are considered higher risk due to their performance, cost to repair, or theft susceptibility.

- Performance Vehicles: Sports cars, high-performance SUVs, and luxury vehicles are often associated with higher premiums due to their speed and potential for accidents.

- Cost to Repair: Vehicles with expensive parts or complex repair procedures can lead to higher premiums. Insurance companies consider the cost of repairs in case of an accident.

- Theft Risk: Vehicles that are more prone to theft, such as luxury cars or high-end SUVs, may have higher premiums. Insurance companies consider the risk of theft and the cost of replacement.

Location

Where you live can also impact your auto insurance premium. Insurance companies consider the risk of accidents and crime in different areas.

- Urban Areas: Urban areas with high traffic density and congestion often have higher premiums due to the increased risk of accidents.

- Rural Areas: Rural areas with lower population density and less traffic may have lower premiums. However, factors like wildlife accidents or longer distances between emergency services can influence rates.

Credit Score

While not as widely used as in other states, credit score can still influence auto insurance premiums in New York. Insurance companies believe that credit score can reflect an individual’s overall financial responsibility, which can be correlated with their driving habits.

- Credit Score and Risk: A lower credit score may indicate a higher risk of filing claims, leading to higher premiums. Insurance companies often use credit score as a factor in determining rates, although it’s not the only factor considered.

- New York Regulations: New York State has regulations regarding the use of credit score in insurance pricing. Insurance companies must provide you with information about how your credit score is used and allow you to dispute inaccurate information.

Types of Coverage

The type of coverage you choose can significantly impact your premium.

- Liability Coverage: This is the most basic type of coverage and covers damage or injuries you cause to others in an accident. Higher liability limits will result in higher premiums.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you’re involved in an accident, regardless of fault. This type of coverage can significantly increase your premium.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, or natural disasters. This coverage is typically optional and can impact your premium.

Strategies for Finding Affordable Auto Insurance: Cheapest Auto Insurance In New York State

Navigating New York’s auto insurance landscape can feel like a maze, but there are strategies you can employ to find the cheapest options. This section will Artikel a step-by-step guide, explore helpful resources, and provide tips for securing discounts.

A Step-by-Step Guide to Finding Affordable Auto Insurance

The first step is to understand your individual needs and preferences. Consider factors like your driving history, vehicle type, coverage requirements, and budget. Once you have a clear picture of your needs, you can begin the process of comparing quotes and securing the best deal.

- Gather Your Information: Before you start comparing quotes, have your driving history, vehicle information, and personal details readily available. This will streamline the process and ensure you receive accurate quotes.

- Compare Quotes from Multiple Insurers: Don’t settle for the first quote you receive. Shop around and compare quotes from at least three to five different insurers. Online comparison websites, such as The Zebra, Insurance.com, and Policygenius, can make this process quick and easy.

- Explore Different Coverage Options: While comprehensive and collision coverage may seem appealing, they can significantly increase your premiums. Consider whether you need these coverages or if you can save by opting for liability-only coverage. If your vehicle is older, you may also consider dropping collision coverage altogether.

- Negotiate Your Premium: Don’t be afraid to negotiate with insurers. They may be willing to offer discounts or adjust your coverage to fit your needs. Highlight your clean driving record, good credit history, and any safety features your vehicle has. You can also explore bundling your auto insurance with other insurance policies, such as home or renters insurance.

- Review Your Policy Regularly: Don’t just set it and forget it. Review your policy annually to ensure it still meets your needs and that you’re not overpaying for coverage. You may be able to adjust your coverage or secure additional discounts as your circumstances change.

Resources and Tools for Comparing Quotes

There are a number of resources and tools available to help you compare auto insurance quotes and identify potential savings.

- Online Comparison Websites: Websites like The Zebra, Insurance.com, and Policygenius allow you to compare quotes from multiple insurers in one place. These websites are typically free to use and can save you time and effort.

- Insurance Agents: Independent insurance agents can provide personalized advice and help you find the best coverage options. They can also negotiate with insurers on your behalf and may be able to secure discounts that you might not be aware of.

- Consumer Reports: Consumer Reports provides detailed reviews and ratings of auto insurance companies. Their website and publications can help you identify reputable insurers and understand their strengths and weaknesses.

Tips for Negotiating with Insurance Companies

Negotiating with insurance companies can be a daunting task, but with the right approach, you can secure a better deal.

- Be Prepared: Before you start negotiating, gather all your information, including your driving history, vehicle information, and any relevant documentation. This will allow you to present a strong case for a lower premium.

- Highlight Your Strengths: Emphasize your clean driving record, good credit history, and any safety features your vehicle has. These factors can make you a more desirable customer for insurers.

- Don’t Be Afraid to Walk Away: If you’re not satisfied with the offer, don’t be afraid to walk away and explore other options. Insurers may be more willing to negotiate if they know you’re not afraid to take your business elsewhere.

- Be Persistent: Negotiating can take time and effort. Be persistent and don’t give up easily. If you’re willing to put in the work, you can often secure a lower premium.

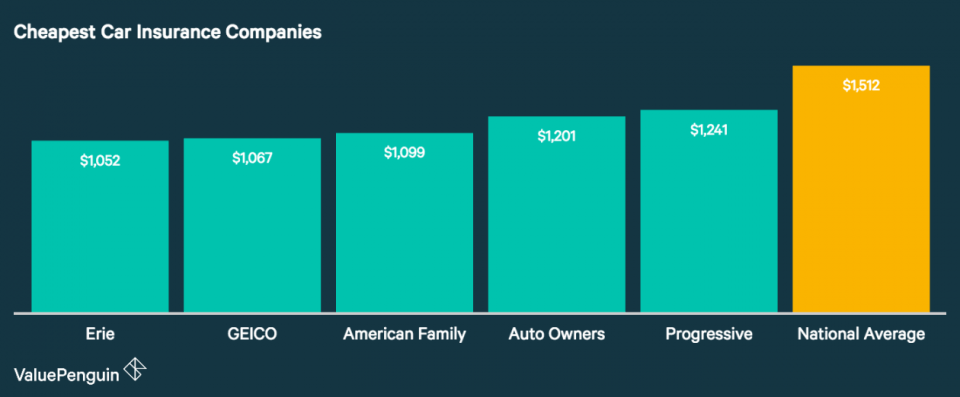

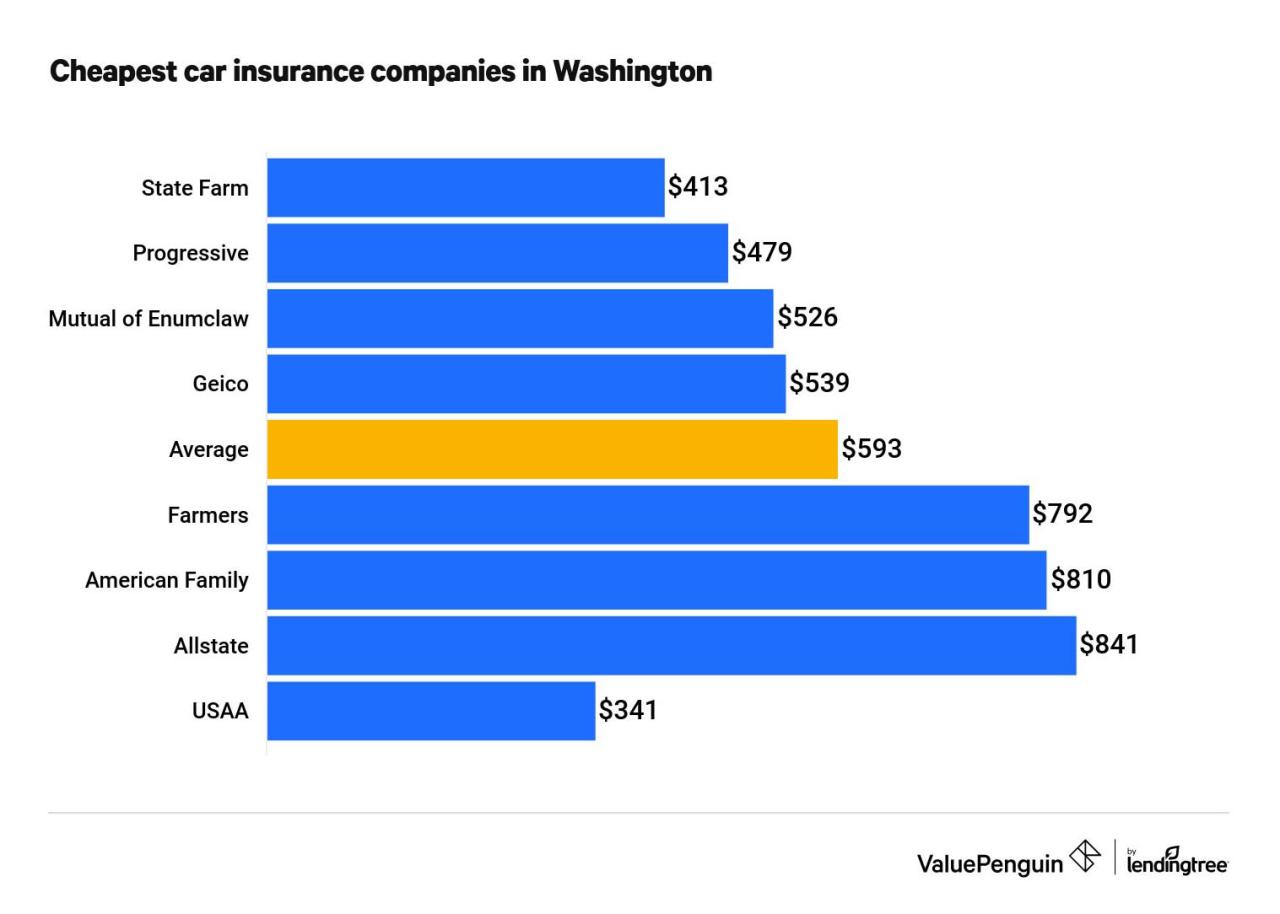

Comparison of Major Auto Insurance Providers in New York

Choosing the right auto insurance provider can significantly impact your overall cost. Navigating the vast landscape of insurance companies in New York can be overwhelming, so understanding the key factors that differentiate providers is essential.

Comparison of Top Auto Insurance Providers in New York

Here’s a table comparing some of the top auto insurance companies in New York based on average premiums, customer satisfaction ratings, and coverage options:

| Provider | Average Premium | J.D. Power Customer Satisfaction Rating | Unique Features/Discounts |

|---|---|---|---|

| Geico | $1,320 | 4 out of 5 |

|

| State Farm | $1,450 | 4.5 out of 5 |

|

| Progressive | $1,380 | 4 out of 5 |

|

| Allstate | $1,500 | 3.5 out of 5 |

|

| Liberty Mutual | $1,400 | 4 out of 5 |

|

Considerations for Drivers with Specific Needs

Not everyone fits into the average driver profile, and your individual circumstances can significantly impact your auto insurance rates. Understanding the factors that influence your premiums is crucial for finding affordable coverage.

Drivers with a Poor Driving Record

A poor driving record, including accidents, traffic violations, or DUI convictions, will significantly increase your insurance premiums. Insurance companies view these incidents as indicators of higher risk, leading to higher rates.

To mitigate the impact of a poor driving record, consider the following:

- Defensive Driving Courses: Completing a defensive driving course can demonstrate your commitment to safer driving habits. Some insurance companies offer discounts for completing these courses.

- Maintain a Clean Driving Record: After a violation, focus on maintaining a clean driving record for several years to demonstrate improvement and potentially qualify for lower rates.

- Shop Around: Compare quotes from multiple insurance companies, as they may have different risk tolerance levels and offer more competitive rates for drivers with a less-than-perfect record.

Drivers with High-Risk Vehicles

Certain vehicles are considered high-risk due to their performance, cost to repair, or likelihood of theft. Sports cars, luxury vehicles, and vehicles with powerful engines often fall into this category.

Finding affordable insurance for high-risk vehicles may require specific strategies:

- Consider Older Models: Older models of the same vehicle may have lower insurance premiums due to their lower value and reduced risk of theft.

- Explore Safety Features: Vehicles with advanced safety features like anti-theft systems, airbags, and collision avoidance technology may qualify for discounts.

- Compare Quotes: Obtain quotes from various insurance companies to compare rates for specific high-risk vehicles.

Drivers with Multiple Drivers in a Household

When multiple drivers share a vehicle, insurance companies often factor in the driving records and risk profiles of all drivers. This can lead to higher premiums if one or more drivers have a poor driving record.

Strategies for managing multiple drivers in a household include:

- Bundle Policies: Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Compare Quotes: Compare quotes from different insurers to find the best rates for your specific household driving situation.

- Consider Separate Policies: If one driver has a significantly higher risk profile, consider purchasing separate auto insurance policies for each driver to potentially reduce overall costs.

Tips for Reducing Auto Insurance Costs

Navigating the world of auto insurance in New York can feel like a maze, especially when trying to find the most affordable option. Fortunately, there are several strategies you can implement to significantly reduce your premiums. These strategies involve a combination of proactive measures, informed choices, and responsible driving habits. By understanding these strategies and incorporating them into your approach, you can achieve substantial savings on your auto insurance costs.

Increasing Your Deductible

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible means you pay more upfront in the event of an accident, but your premiums will be lower. This is a common strategy for drivers who are confident in their driving abilities and are comfortable shouldering a larger financial responsibility in the event of an accident.

Bundling Policies

Insurance companies often offer discounts when you bundle multiple policies, such as auto and homeowners or renters insurance. This practice is known as multi-policy discounting, and it allows you to secure comprehensive coverage for your various needs at a reduced rate. By bundling your policies, you can potentially save a significant amount of money compared to purchasing each policy individually.

Maintaining a Good Driving Record

Your driving record plays a crucial role in determining your insurance premiums. A clean driving record with no accidents, traffic violations, or DUI convictions can significantly lower your rates. Insurance companies view drivers with a history of responsible driving as less risky, and they are more likely to offer lower premiums. Conversely, drivers with a history of accidents or violations are considered higher risk and may face higher premiums.

Participating in Driver Safety Courses

Enrolling in defensive driving courses can demonstrate your commitment to safe driving practices and potentially lead to lower insurance premiums. These courses, often offered by organizations like the American Automobile Association (AAA), provide valuable insights into safe driving techniques, accident prevention strategies, and the legal implications of traffic violations. By successfully completing these courses, you can demonstrate your dedication to responsible driving, which can be a factor in securing lower insurance rates.

Installing Safety Features in Your Vehicle

Modern vehicles are equipped with a wide range of safety features, including anti-lock brakes (ABS), electronic stability control (ESC), and airbags. These features can significantly reduce the risk of accidents and injuries, and insurance companies often recognize this by offering discounts to drivers who have these features installed in their vehicles. Investing in safety features can be a smart move for both your personal well-being and your insurance premiums.

Avoiding Speeding and Distracted Driving, Cheapest auto insurance in new york state

Driving habits have a direct impact on your insurance rates. Speeding and distracted driving are among the most common causes of accidents and are heavily penalized by insurance companies. These habits increase the likelihood of accidents, resulting in higher premiums. Conversely, practicing safe driving habits, such as adhering to speed limits, avoiding distractions, and maintaining a safe following distance, can lower your risk profile and potentially lead to lower insurance premiums.

Understanding Insurance Policies and Coverage

Navigating the world of auto insurance can be daunting, especially with the numerous policies and coverage options available. Understanding the key components of an auto insurance policy is crucial for making informed decisions and ensuring you have the right protection in case of an accident.

Coverage Limits

Coverage limits determine the maximum amount your insurer will pay for a covered claim. They are typically expressed in dollar amounts, and they can vary significantly depending on the type of coverage and the insurer. For example, liability coverage limits may specify the maximum amount your insurer will pay for bodily injury or property damage caused to others in an accident.

Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. For instance, if you have a $500 deductible for collision coverage and your car is damaged in an accident, you will need to pay the first $500 of repair costs, and your insurance will cover the remaining expenses. A higher deductible typically translates to lower premiums, while a lower deductible means higher premiums.

Exclusions

Exclusions are specific events or situations that are not covered by your auto insurance policy. These can include, for example, damage caused by wear and tear, acts of war, or driving under the influence of alcohol or drugs. It’s important to carefully review the exclusions in your policy to understand what situations are not covered.

Types of Coverage

- Liability Coverage: This is the most common type of auto insurance coverage and is required in most states. It covers damages you cause to others, including their vehicles, property, and medical expenses, if you are found at fault in an accident. It’s essential to have sufficient liability coverage to protect yourself financially in case of a serious accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident with another vehicle or object. It is typically optional, but it is recommended for drivers who have financed or leased their vehicles, as lenders often require collision coverage.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-collision events, such as theft, vandalism, fire, hail, or natural disasters. It is also optional, but it is recommended for drivers who have newer vehicles or vehicles with a high value.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance. It covers your medical expenses and property damage in such situations.

- Personal Injury Protection (PIP): In some states, PIP coverage is mandatory. It covers your own medical expenses and lost wages, regardless of who is at fault in an accident.

Understanding the Fine Print

Reading and understanding the fine print of your auto insurance policy is crucial. This includes carefully reviewing the coverage limits, deductibles, exclusions, and any other specific terms and conditions. If you are unsure about any part of your policy, do not hesitate to contact your insurance agent or company for clarification.

Ending Remarks

Finding the cheapest auto insurance in New York State is a journey that requires careful planning and informed choices. By understanding the key factors that influence premiums, utilizing available resources, and implementing cost-saving strategies, you can navigate this complex landscape and secure affordable coverage that meets your specific needs. Remember, this guide serves as a starting point for your search, and it’s always wise to shop around, compare quotes, and consult with insurance professionals to ensure you’re making the most informed decision for your driving needs.

Detailed FAQs

What are the mandatory auto insurance coverages in New York?

New York State requires all drivers to have liability coverage, personal injury protection (PIP), and uninsured/underinsured motorist coverage.

How can I compare auto insurance quotes from different companies?

You can use online comparison tools, contact insurance brokers, or directly request quotes from individual insurance companies.

What are some common discounts offered by auto insurance companies in New York?

Discounts are often available for good driving records, safe driving courses, multiple car policies, and certain vehicle safety features.

Can I lower my auto insurance premiums by increasing my deductible?

Yes, increasing your deductible generally lowers your premium, but you’ll pay more out-of-pocket if you need to file a claim.