Navigating the world of auto insurance can be a daunting task, especially when you’re looking for the most affordable options. Finding the cheapest auto insurance by state is a common concern for many drivers. Factors like your driving history, vehicle type, and even your location can significantly impact your premiums. This guide will delve into the key elements that influence auto insurance costs, providing valuable insights and tips to help you secure the best possible rates.

Understanding how insurance companies calculate premiums and the specific factors that affect them in each state is crucial. We’ll explore state-specific regulations, compare average insurance premiums across different states, and identify the factors that contribute to higher or lower rates. By understanding these nuances, you can make informed decisions about your coverage and potentially save money on your auto insurance.

Understanding Auto Insurance Costs

Auto insurance is a necessity for most car owners, but the cost can vary widely. Understanding the factors that influence your premiums can help you find the best coverage at the most affordable price.

Factors Influencing Auto Insurance Premiums

Several factors determine your auto insurance premiums. These include:

- Your driving record: Your driving history, including accidents, tickets, and other violations, significantly impacts your premiums. A clean driving record typically leads to lower premiums.

- Your age and gender: Younger drivers, particularly males, are statistically more likely to be involved in accidents, leading to higher premiums.

- Your location: Insurance rates vary by state and even by zip code. Areas with higher crime rates or more traffic congestion tend to have higher premiums.

- Your vehicle: The make, model, year, and safety features of your vehicle influence your premium. Newer, more expensive vehicles with advanced safety features generally have higher premiums.

- Your credit history: In many states, insurance companies can use your credit score to determine your premiums. People with good credit scores typically receive lower rates.

- Your coverage: The amount and type of coverage you choose will affect your premium. More comprehensive coverage, such as collision and comprehensive, will typically cost more.

- Your driving habits: How much you drive, where you drive, and whether you use your vehicle for business purposes can impact your premium.

Common Types of Auto Insurance Coverage

Understanding the different types of auto insurance coverage is crucial for choosing the right policy.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage up to the limits of your policy.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, or a natural disaster.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient insurance.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other expenses if you are injured in an accident, regardless of who is at fault.

How Insurance Companies Calculate Premiums

Insurance companies use a complex formula to calculate your auto insurance premiums.

The formula typically considers factors like your driving record, age, gender, location, vehicle, credit history, coverage, and driving habits.

Each factor is assigned a weight, and the final premium is calculated based on the sum of all the weighted factors. Insurance companies also use sophisticated algorithms and statistical models to assess risk and determine premiums.

State-Specific Regulations and Factors

State laws and regulations play a significant role in shaping auto insurance costs. These regulations can impact everything from the types of coverage required to the rates insurance companies can charge. This section delves into how state-specific regulations and other factors influence auto insurance premiums.

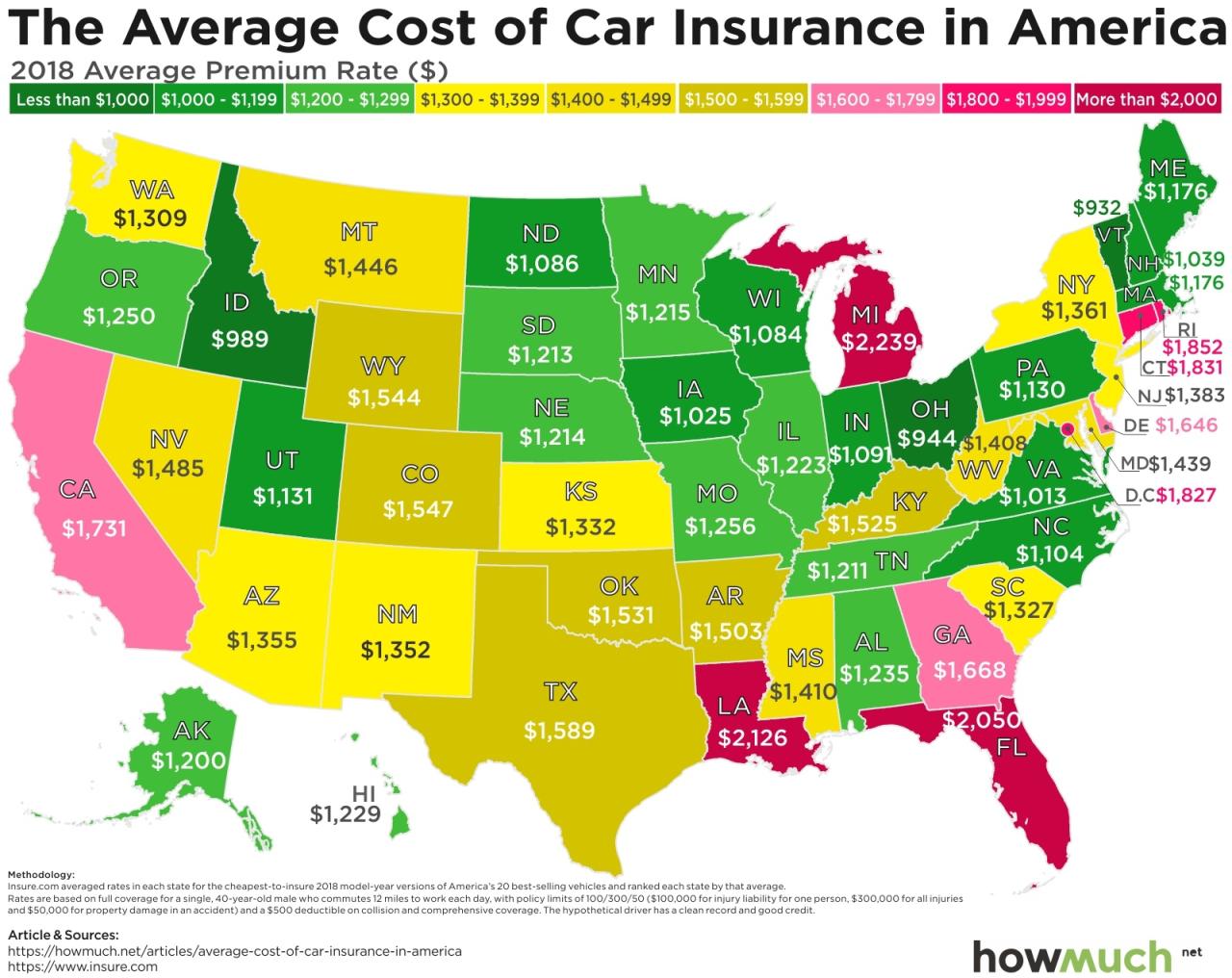

Average Insurance Premiums Across States

The average auto insurance premiums vary significantly across different states. This variation is largely due to differences in state regulations, traffic density, accident rates, and other factors.

- States with the Highest Average Premiums: States like Michigan, Louisiana, and Florida tend to have higher average premiums. These states often have a combination of factors that contribute to higher costs, such as a high number of uninsured drivers, frequent severe weather events, and a higher number of claims.

- States with the Lowest Average Premiums: States like Maine, Idaho, and North Dakota typically have lower average premiums. These states often have a lower number of accidents, less traffic congestion, and a higher percentage of insured drivers.

State-Level Factors Influencing Premiums

Here are some key state-level factors that can influence auto insurance premiums:

- Traffic Density: States with high traffic density, such as New York City or Los Angeles, tend to have higher accident rates. This increased risk of accidents leads to higher insurance premiums.

- Accident Rates: States with higher accident rates, such as Louisiana or Florida, typically have higher insurance premiums. This is because insurance companies need to pay out more claims in these states.

- Demographics: Certain demographic factors, such as age, driving experience, and credit score, can also impact insurance premiums. States with a higher proportion of young drivers or drivers with poor credit scores may have higher average premiums.

- Cost of Repairs: The cost of car repairs can also vary significantly by state. States with higher labor costs or a higher concentration of luxury vehicles may have higher average premiums.

- Uninsured Motorist Coverage: Some states require drivers to carry uninsured motorist coverage, which protects them in case they are involved in an accident with an uninsured driver. This requirement can lead to higher premiums.

- Minimum Coverage Requirements: The minimum amount of insurance coverage required by law varies from state to state. States with higher minimum coverage requirements typically have higher average premiums.

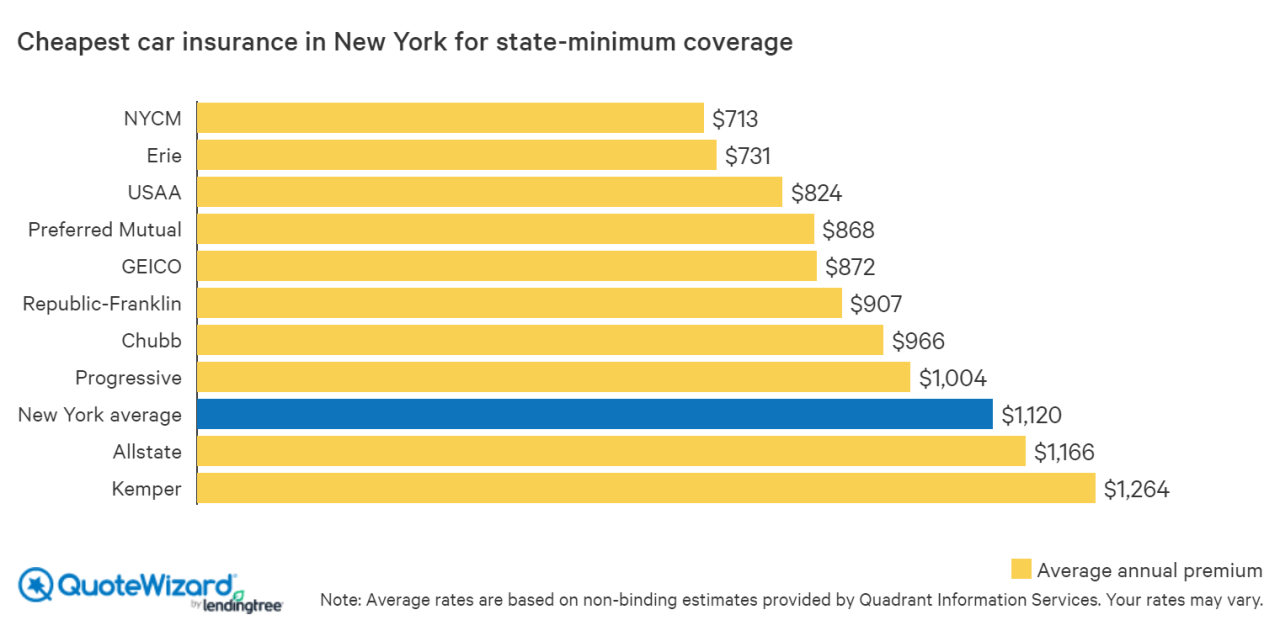

Finding the Cheapest Auto Insurance in Each State

Navigating the world of auto insurance can feel overwhelming, especially when trying to find the most affordable option. With rates varying significantly across states, it’s essential to understand the factors that influence pricing and how to effectively compare quotes. This section will delve into the average auto insurance rates in different states, highlighting the top-rated companies for affordability. We’ll also provide insights on how to obtain accurate quotes to ensure you’re getting the best possible deal.

Average Auto Insurance Rates by State

Auto insurance premiums vary significantly from state to state, influenced by factors like traffic density, accident rates, and state regulations. The table below provides a snapshot of average annual premiums across different states, offering a starting point for your comparison.

| State | Average Annual Premium | Top 3 Cheapest Companies |

|---|---|---|

| Alabama | $1,386 | 1. Geico 2. State Farm 3. Nationwide |

| Alaska | $2,058 | 1. USAA 2. Geico 3. State Farm |

| Arizona | $1,628 | 1. Geico 2. State Farm 3. Progressive |

| Arkansas | $1,292 | 1. Geico 2. State Farm 3. Nationwide |

| California | $2,142 | 1. Geico 2. State Farm 3. Progressive |

| Colorado | $1,764 | 1. USAA 2. Geico 3. State Farm |

| Connecticut | $2,022 | 1. Geico 2. State Farm 3. Nationwide |

| Delaware | $1,654 | 1. Geico 2. State Farm 3. Nationwide |

| Florida | $2,458 | 1. Geico 2. State Farm 3. Progressive |

| Georgia | $1,586 | 1. Geico 2. State Farm 3. Nationwide |

| Hawaii | $2,684 | 1. USAA 2. Geico 3. State Farm |

| Idaho | $1,422 | 1. Geico 2. State Farm 3. Nationwide |

| Illinois | $1,946 | 1. Geico 2. State Farm 3. Progressive |

| Indiana | $1,542 | 1. Geico 2. State Farm 3. Nationwide |

| Iowa | $1,486 | 1. Geico 2. State Farm 3. Nationwide |

| Kansas | $1,354 | 1. Geico 2. State Farm 3. Nationwide |

| Kentucky | $1,462 | 1. Geico 2. State Farm 3. Nationwide |

| Louisiana | $2,186 | 1. Geico 2. State Farm 3. Progressive |

| Maine | $1,784 | 1. Geico 2. State Farm 3. Nationwide |

| Maryland | $1,822 | 1. Geico 2. State Farm 3. Nationwide |

| Massachusetts | $1,986 | 1. Geico 2. State Farm 3. Nationwide |

| Michigan | $2,254 | 1. Geico 2. State Farm 3. Progressive |

| Minnesota | $1,642 | 1. Geico 2. State Farm 3. Nationwide |

| Mississippi | $1,322 | 1. Geico 2. State Farm 3. Nationwide |

| Missouri | $1,514 | 1. Geico 2. State Farm 3. Nationwide |

| Montana | $1,586 | 1. Geico 2. State Farm 3. Nationwide |

| Nebraska | $1,394 | 1. Geico 2. State Farm 3. Nationwide |

| Nevada | $1,922 | 1. Geico 2. State Farm 3. Progressive |

| New Hampshire | $1,686 | 1. Geico 2. State Farm 3. Nationwide |

| New Jersey | $2,014 | 1. Geico 2. State Farm 3. Nationwide |

| New Mexico | $1,694 | 1. Geico 2. State Farm 3. Progressive |

| New York | $1,954 | 1. Geico 2. State Farm 3. Nationwide |

| North Carolina | $1,622 | 1. Geico 2. State Farm 3. Nationwide |

| North Dakota | $1,374 | 1. Geico 2. State Farm 3. Nationwide |

| Ohio | $1,674 | 1. Geico 2. State Farm 3. Nationwide |

| Oklahoma | $1,442 | 1. Geico 2. State Farm 3. Nationwide |

| Oregon | $1,894 | 1. Geico 2. State Farm 3. Progressive |

| Pennsylvania | $1,842 | 1. Geico 2. State Farm 3. Nationwide |

| Rhode Island | $1,934 | 1. Geico 2. State Farm 3. Nationwide |

| South Carolina | $1,562 | 1. Geico 2. State Farm 3. Nationwide |

| South Dakota | $1,342 | 1. Geico 2. State Farm 3. Nationwide |

| Tennessee | $1,434 | 1. Geico 2. State Farm 3. Nationwide |

| Texas | $1,986 | 1. Geico 2. State Farm 3. Progressive |

| Utah | $1,522 | 1. Geico 2. State Farm 3. Nationwide |

| Vermont | $1,854 | 1. Geico 2. State Farm 3. Nationwide |

| Virginia | $1,734 | 1. Geico 2. State Farm 3. Nationwide |

| Washington | $1,914 | 1. Geico 2. State Farm 3. Progressive |

| West Virginia | $1,454 | 1. Geico 2. State Farm 3. Nationwide |

| Wisconsin | $1,614 | 1. Geico 2. State Farm 3. Nationwide |

| Wyoming | $1,494 | 1. Geico 2. State Farm 3. Nationwide |

Obtaining Accurate Quotes, Cheapest auto insurance by state

To obtain accurate quotes, it’s crucial to provide insurance companies with complete and accurate information about your driving history, vehicle details, and coverage preferences. Here’s a step-by-step guide to ensure you’re getting the most relevant quotes:

- Gather your driving history: This includes your driving record, any accidents or violations, and the number of years you’ve been licensed.

- Provide vehicle details: Include the year, make, model, and VIN of your vehicle.

- Specify coverage preferences: Determine the level of coverage you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Compare quotes from multiple companies: Don’t settle for the first quote you receive. Compare quotes from at least three to five different insurance companies to ensure you’re getting the best possible deal.

- Ask about discounts: Many insurance companies offer discounts for safe driving, good student status, multiple vehicle insurance, and other factors. Inquire about any available discounts to potentially lower your premium.

Remember that auto insurance rates can fluctuate based on individual factors, so it’s essential to obtain personalized quotes from different companies to find the most affordable option for your specific needs.

Tips for Lowering Auto Insurance Costs

Auto insurance premiums can be a significant expense, but there are several strategies you can implement to reduce your costs. By taking proactive steps to manage your risk and shop around for the best rates, you can save money on your insurance premiums.

Improving Your Driving Record

A clean driving record is essential for obtaining lower insurance premiums. Insurance companies consider your driving history as a major factor in determining your rates.

- Avoid traffic violations: Speeding tickets, reckless driving citations, and DUI convictions can significantly increase your insurance premiums. Driving safely and obeying traffic laws is crucial for maintaining a good driving record.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may earn you a discount on your insurance premiums. Many states offer these courses, and some insurers may even offer them for free.

- Maintain a good credit score: While not a direct factor in all states, your credit score can sometimes influence your insurance rates. A good credit score can indicate responsible financial behavior, which insurance companies may associate with responsible driving habits.

Bundling Policies

Bundling your auto insurance with other policies, such as homeowners or renters insurance, can often result in significant savings.

- Bundling policies with the same insurer: When you bundle multiple policies with the same insurance company, they may offer you a discount for combining your coverage. This is a common practice among insurance companies, as it simplifies their operations and reduces their administrative costs.

- Comparing bundled rates from different insurers: It’s important to compare bundled rates from different insurance companies to ensure you’re getting the best deal. Some insurers may offer more attractive discounts or have better coverage options for bundled policies.

Increasing Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Increasing your deductible can lead to lower premiums.

- Understanding the trade-off: Increasing your deductible means you’ll pay more if you have an accident, but it also means you’ll pay less for your insurance premiums. It’s important to weigh the potential cost of a higher deductible against the savings on your premiums.

- Adjusting deductibles based on risk tolerance: Consider your financial situation and risk tolerance when deciding on your deductible. If you have a larger emergency fund or are comfortable with a higher out-of-pocket expense, you may be able to increase your deductible and save more on premiums.

Choosing a Safe Vehicle

The type of vehicle you drive can also impact your insurance premiums. Vehicles with safety features, such as anti-theft devices, airbags, and stability control, tend to have lower insurance rates.

- Researching safety ratings: Before purchasing a vehicle, research its safety ratings from organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA). Vehicles with higher safety ratings often receive lower insurance premiums.

- Considering anti-theft features: Vehicles equipped with anti-theft devices, such as alarms, immobilizers, and tracking systems, are less likely to be stolen, which can result in lower insurance premiums.

Comparing Quotes from Multiple Insurance Companies

Getting quotes from multiple insurance companies is essential for finding the cheapest auto insurance.

- Using online comparison tools: Several online comparison tools allow you to enter your information once and receive quotes from multiple insurance companies. This can save you time and effort in the quote-gathering process.

- Contacting insurance companies directly: You can also contact insurance companies directly to obtain quotes. This allows you to ask specific questions about their coverage options and discounts.

Negotiating with Insurance Companies

Once you’ve received quotes from multiple insurance companies, you can negotiate with them to try to lower your premiums.

- Highlighting your good driving record: Emphasize your clean driving history and any defensive driving courses you’ve completed. This demonstrates your commitment to safe driving and may persuade the insurer to offer a lower rate.

- Inquiring about discounts: Ask about any available discounts, such as good student discounts, multi-car discounts, or discounts for safety features on your vehicle.

- Comparing quotes: Be prepared to compare quotes from different insurers and highlight any discrepancies in pricing or coverage. This can create leverage in your negotiation with the insurance company.

Understanding Your Coverage Needs

Choosing the right auto insurance coverage is crucial, as it directly impacts your financial protection in the event of an accident or other covered event. While finding the cheapest insurance is important, it’s equally important to ensure you have adequate coverage to protect yourself and your finances.

Under-insuring your vehicle can have severe consequences, leaving you financially vulnerable to significant losses. For example, if you have a minimal liability coverage and cause an accident resulting in substantial damages and injuries, you could be personally liable for the difference, potentially leading to significant debt or even bankruptcy.

Understanding Different Coverage Options

Different coverage options cater to specific needs, and understanding these options is essential for making informed decisions.

- Liability Coverage: This covers damages and injuries you cause to others in an accident. It’s essential to have sufficient liability coverage to protect yourself from financial ruin in the event of a serious accident.

- Collision Coverage: This covers damages to your vehicle in an accident, regardless of fault. This coverage is particularly valuable if you have a newer or more expensive vehicle, as it helps cover repair or replacement costs.

- Comprehensive Coverage: This covers damages to your vehicle from non-accident events like theft, vandalism, or natural disasters. This coverage is especially important if you live in an area prone to such events.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who is uninsured or underinsured. This coverage is vital as it helps cover your medical expenses and vehicle repairs even if the other driver cannot afford to pay.

- Medical Payments Coverage: This coverage pays for your medical expenses, regardless of fault, in the event of an accident. This coverage is essential for protecting yourself from significant medical bills.

Examples of Coverage Needs

Here are some examples of situations where specific coverage options might be particularly valuable:

- High-Value Vehicle: If you own a luxury or high-performance vehicle, having comprehensive and collision coverage is crucial to protect your investment in case of damage or theft.

- Driving in a High-Risk Area: If you live in an area with a high frequency of accidents or theft, having higher liability coverage and comprehensive coverage is recommended to mitigate potential risks.

- Limited Financial Resources: If you have limited financial resources, having sufficient liability coverage is crucial to avoid potential financial ruin in the event of a serious accident.

- Frequent Travel: If you frequently travel long distances or drive in unfamiliar areas, having uninsured/underinsured motorist coverage is essential to protect yourself in case of an accident with an uninsured driver.

Final Wrap-Up

Ultimately, finding the cheapest auto insurance by state requires a combination of understanding your individual needs, comparing quotes from multiple insurance companies, and employing smart strategies to lower your premiums. By following the tips and insights provided in this guide, you can confidently navigate the auto insurance landscape and secure the best possible rates for your situation.

General Inquiries: Cheapest Auto Insurance By State

What is the best way to compare auto insurance quotes?

Use online comparison websites or contact multiple insurance companies directly to get personalized quotes. Be sure to provide accurate information to ensure the quotes are accurate.

How often should I review my auto insurance policy?

It’s recommended to review your policy at least annually, or whenever there are significant changes in your life, such as a new car, a change in driving record, or a move to a different state.

Can I get a discount if I bundle my auto and home insurance?

Yes, many insurance companies offer discounts for bundling multiple policies. Ask about these options when getting quotes.