Cheap state minimum car insurance Texas is a crucial aspect of responsible driving in the Lone Star State. While Texas law mandates certain minimum coverage levels, finding affordable options that meet your specific needs can be challenging. This guide explores the intricacies of Texas car insurance requirements, factors influencing costs, and strategies for securing the most cost-effective coverage.

Understanding the minimum coverage requirements is the first step. Texas law requires drivers to carry liability insurance, which covers damages to other vehicles or injuries to others in an accident caused by you. However, liability coverage alone might not be enough to protect you financially. This guide delves into additional coverage options like collision and comprehensive, offering a comprehensive overview of the various types of car insurance available in Texas.

Understanding Texas Minimum Car Insurance Requirements

Driving in Texas requires you to have a minimum amount of car insurance coverage, as mandated by the state. This ensures that you are financially protected in case of an accident, and it also protects other drivers on the road.

Texas Minimum Car Insurance Coverage

Texas requires all drivers to have a minimum amount of liability insurance. This coverage protects you from financial losses if you cause an accident that injures someone or damages their property. The minimum liability coverage requirements are:

- Bodily Injury Liability: This covers medical expenses, lost wages, and other damages for injuries caused to other people in an accident. The minimum requirement is $30,000 per person and $60,000 per accident.

- Property Damage Liability: This covers damages to another person’s vehicle or property. The minimum requirement is $25,000 per accident.

Penalties for Driving Without Minimum Insurance

Driving without the required minimum car insurance in Texas is a serious offense. If you are caught driving without insurance, you can face the following penalties:

- Fines: You can be fined up to $350 for driving without insurance.

- License Suspension: Your driver’s license can be suspended for up to six months if you are caught driving without insurance.

- Vehicle Impoundment: Your vehicle can be impounded if you are caught driving without insurance.

- Court Costs: You may have to pay court costs and other fees if you are found guilty of driving without insurance.

Factors Influencing Car Insurance Costs in Texas

In Texas, several factors influence the cost of car insurance premiums. Understanding these factors can help you make informed decisions about your coverage and potentially save money.

Age and Driving Experience

Your age and driving experience significantly impact your car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Insurance companies consider this increased risk when setting premiums. As you gain more driving experience and reach a certain age, your rates typically decrease.

Driving History

Your driving record is a critical factor in determining your insurance costs. A clean driving history with no accidents, tickets, or violations will generally result in lower premiums. However, if you have a history of accidents or traffic violations, your insurance rates will likely increase.

Vehicle Type, Cheap state minimum car insurance texas

The type of vehicle you drive plays a significant role in your insurance costs. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to insure due to their higher repair costs and increased risk of theft. Conversely, less expensive and smaller vehicles typically have lower insurance premiums.

Location

Where you live in Texas can also affect your car insurance rates. Urban areas with higher population densities and more traffic tend to have higher accident rates, leading to higher insurance premiums. Rural areas with lower traffic volume and fewer accidents may have lower rates.

Credit Score

Your credit score can surprisingly impact your car insurance premiums in Texas. Insurance companies use credit score as a proxy for risk assessment, believing that individuals with good credit are more likely to be responsible drivers. A higher credit score can lead to lower premiums, while a lower credit score may result in higher rates.

Coverage Levels

The amount of coverage you choose will also affect your premiums. Higher coverage limits, such as liability limits and comprehensive and collision coverage, will generally result in higher premiums. However, choosing the right coverage levels can provide you with greater financial protection in case of an accident.

Deductibles

Your deductible is the amount you agree to pay out of pocket in case of an accident before your insurance coverage kicks in. Higher deductibles typically result in lower premiums, as you are taking on more financial risk. Conversely, lower deductibles mean higher premiums, but you will have less out-of-pocket expenses in case of an accident.

Discounts

Several discounts are available to help lower your car insurance premiums in Texas. These discounts can include:

- Good student discounts

- Safe driver discounts

- Multi-car discounts

- Multi-policy discounts

- Anti-theft device discounts

- Defensive driving course discounts

It’s essential to shop around and compare quotes from different insurance companies to find the best rates. You can also consider increasing your deductible, taking advantage of available discounts, and maintaining a good driving record to potentially lower your insurance costs.

Finding Affordable Car Insurance Options in Texas

Finding the right car insurance policy in Texas can be a daunting task, especially if you’re looking for the most affordable option. With so many insurance companies and policy options available, it’s essential to understand your needs and compare different offers to make an informed decision.

Types of Car Insurance Policies

Texas law requires all drivers to carry at least the minimum liability coverage, but you can choose to purchase additional coverage to protect yourself financially in case of an accident. Here’s a breakdown of the different types of car insurance policies available in Texas:

- Liability Coverage: This is the minimum coverage required by law in Texas. It covers damages to other people’s property or injuries to other people if you cause an accident. Liability coverage is divided into two parts: bodily injury liability (BI) and property damage liability (PD).

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged by something other than an accident, such as theft, vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who’s at fault in an accident.

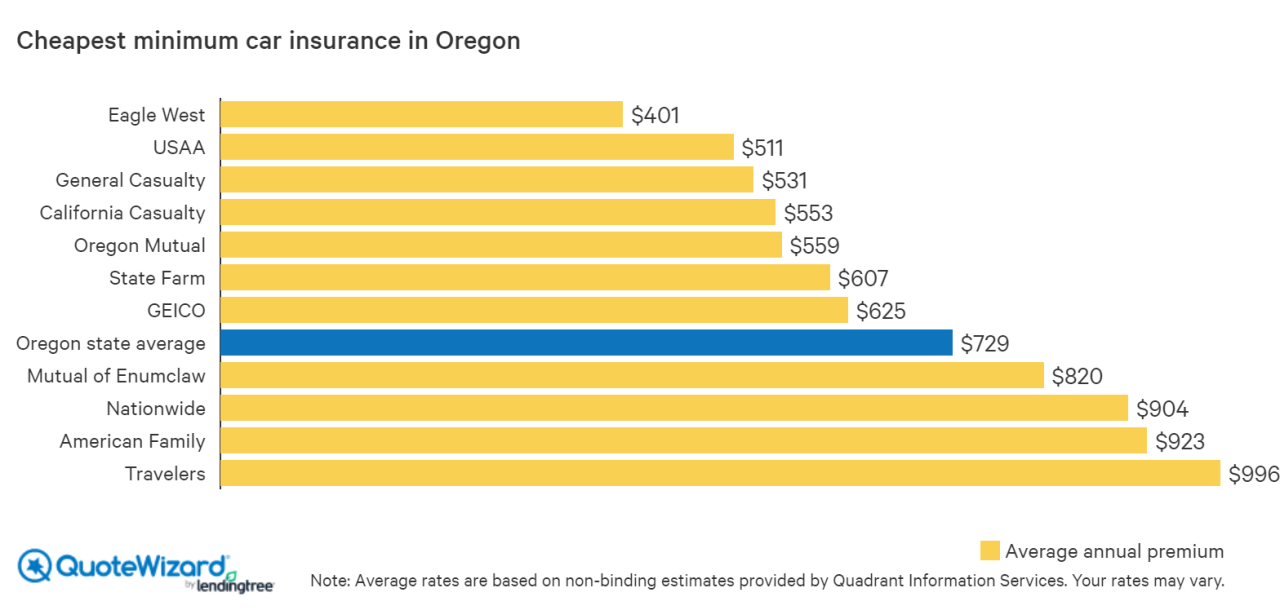

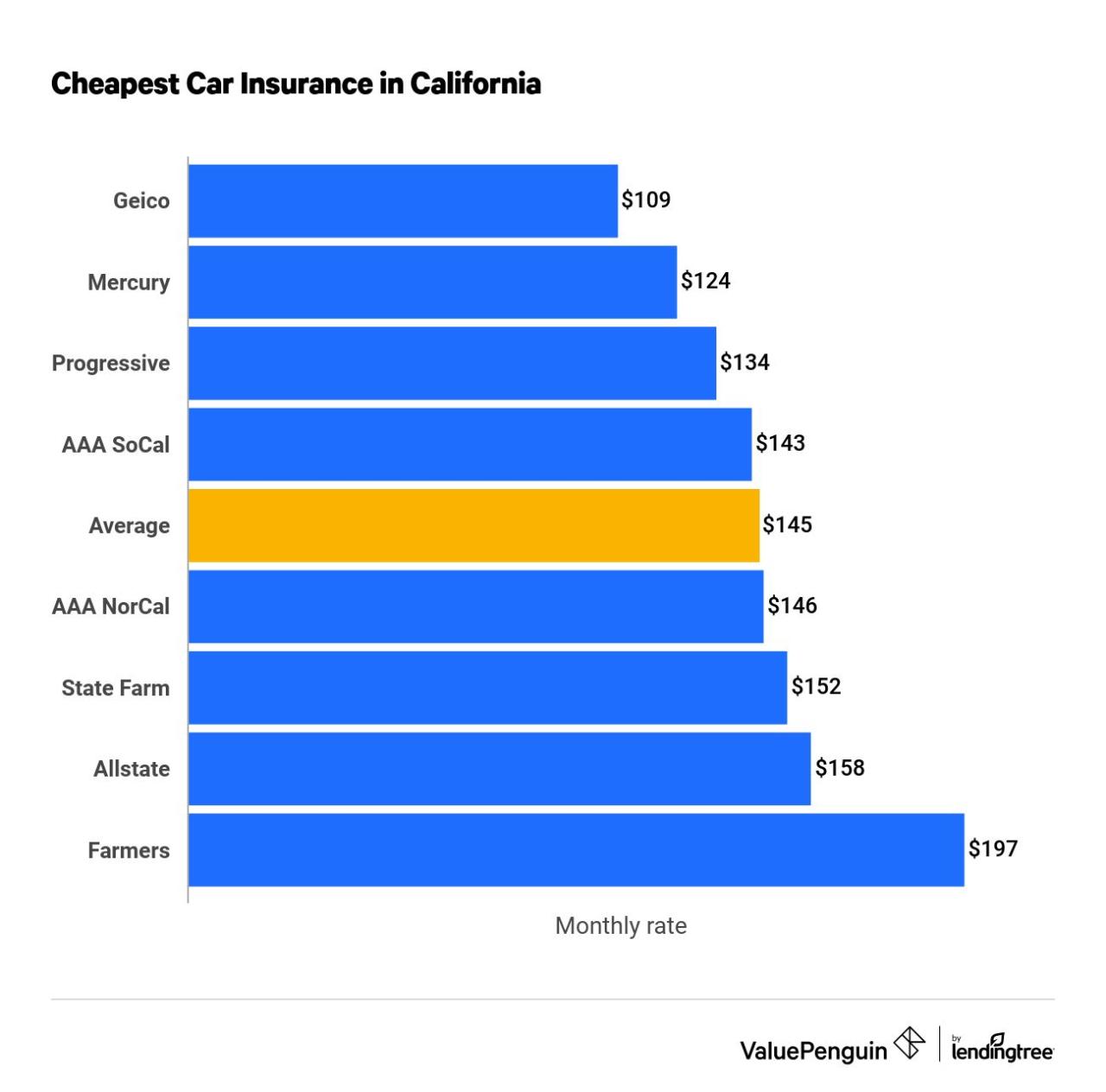

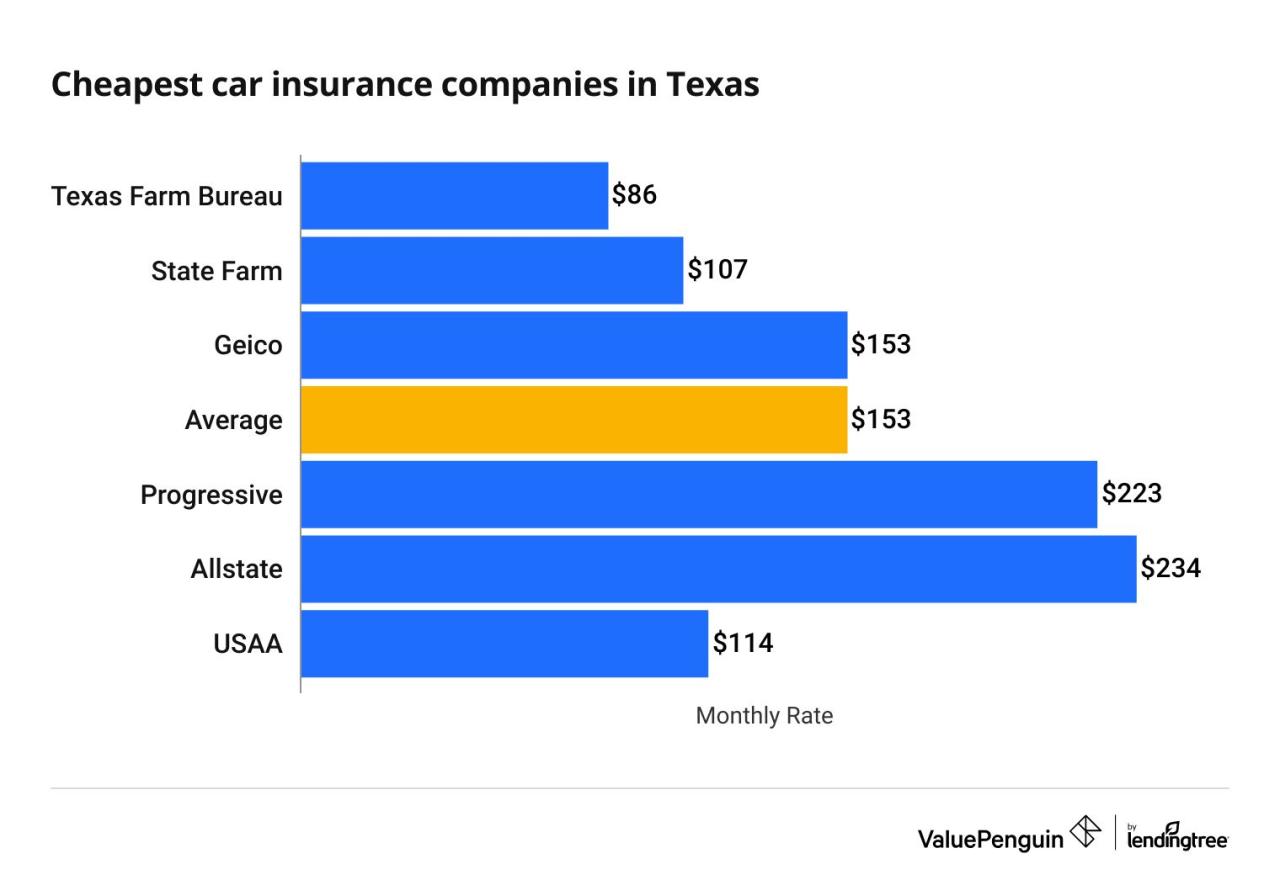

Comparing Car Insurance Premiums and Coverage

The cost of car insurance in Texas can vary widely depending on several factors, including your driving history, age, location, and the type of vehicle you drive. To find the best deal, it’s important to compare quotes from different insurance companies. Here’s a sample table comparing premiums and coverage options from various insurance providers:

| Insurance Company | Liability Coverage (BI/PD) | Collision Coverage | Comprehensive Coverage | Monthly Premium |

|---|---|---|---|---|

| State Farm | $30,000/$60,000/$25,000 | $1,000 deductible | $500 deductible | $100 |

| Geico | $30,000/$60,000/$25,000 | $1,000 deductible | $500 deductible | $95 |

| Progressive | $30,000/$60,000/$25,000 | $1,000 deductible | $500 deductible | $105 |

| Allstate | $30,000/$60,000/$25,000 | $1,000 deductible | $500 deductible | $110 |

Note: This is just a sample table and actual premiums may vary based on individual circumstances.

Benefits and Drawbacks of Online Insurance Comparison Tools

Online insurance comparison tools can be a valuable resource for finding affordable car insurance options in Texas. These tools allow you to compare quotes from multiple insurance companies simultaneously, saving you time and effort.

- Benefits:

- Convenience: You can compare quotes from the comfort of your own home, at any time of day or night.

- Time-Saving: You don’t have to contact each insurance company individually to get a quote.

- Transparency: You can see the coverage options and premiums from different insurance companies side-by-side, making it easier to compare and contrast.

- Drawbacks:

- Limited Information: Online comparison tools may not provide all the information you need, such as discounts or special features offered by some insurance companies.

- Potential Bias: Some comparison tools may be biased towards certain insurance companies, which could affect the results.

- Inaccurate Information: Occasionally, online comparison tools may provide inaccurate information, so it’s important to verify the details with the insurance company directly.

Exploring Discount Opportunities

Lowering your car insurance premiums in Texas is possible by taking advantage of the numerous discounts offered by insurance companies. These discounts can significantly reduce your overall costs, making your car insurance more affordable.

Types of Discounts

Car insurance companies in Texas offer a wide range of discounts to help policyholders save money. Here are some common discounts:

- Safe Driver Discounts: These discounts are awarded to drivers with a clean driving record, demonstrating responsible driving habits. Typically, you need to be accident-free for a certain period to qualify. The longer you maintain a safe driving record, the higher the discount you may receive.

- Good Student Discounts: Insurance companies recognize that good students tend to be more responsible, and this translates into safer driving habits. To qualify for this discount, you or your child must maintain a certain GPA or be on the honor roll.

- Multi-Car Discounts: Insuring multiple vehicles with the same company can lead to significant savings. This discount incentivizes you to bundle your insurance policies and encourages loyalty to a single provider.

- Anti-theft Device Discounts: Installing anti-theft devices like alarms or tracking systems in your vehicle can deter theft, reducing the risk for insurance companies. These devices can significantly lower your premiums.

- Loyalty Discounts: Car insurance companies often reward long-term customers with loyalty discounts. The longer you stay with the same company, the more you may save.

- Defensive Driving Course Discounts: Completing a defensive driving course demonstrates your commitment to safe driving practices. This course helps you learn techniques for avoiding accidents and can earn you a discount on your premiums.

- Military Discounts: Some insurance companies offer discounts to active military personnel and veterans as a way of recognizing their service.

- Group Discounts: If you belong to a specific group or organization, such as an alumni association or professional group, you may be eligible for a discount.

Discount Savings

Here’s a table illustrating potential savings for some common discounts:

| Discount Type | Average Savings |

|---|---|

| Safe Driver Discount | 5-15% |

| Good Student Discount | 10-20% |

| Multi-Car Discount | 10-25% |

| Anti-theft Device Discount | 5-10% |

Remember: Discount availability and specific savings may vary depending on the insurance company, your location, and your individual circumstances. It’s essential to contact your insurance provider to inquire about the discounts you qualify for.

Considerations for Choosing a Cheap Car Insurance Provider

Finding the cheapest car insurance in Texas is only half the battle. It’s equally important to choose a provider that offers reliable coverage, excellent customer service, and financial stability. This ensures you’re not only getting a good deal but also peace of mind knowing you’re protected in case of an accident.

Reputable and Affordable Car Insurance Providers in Texas

Several reputable and affordable car insurance providers operate in Texas. Here are some of the most popular options:

- State Farm: Known for its extensive coverage options and strong financial stability, State Farm consistently ranks high in customer satisfaction surveys.

- Geico: Geico is known for its competitive rates and user-friendly online platform. They offer a variety of discounts and have a strong reputation for quick claims processing.

- Progressive: Progressive is another popular choice, offering a wide range of coverage options and personalized pricing based on individual driving habits.

- USAA: While USAA primarily serves military members and their families, they offer competitive rates and excellent customer service.

- Farmers: Farmers is a well-established provider known for its personalized service and strong financial standing.

Comparing Key Features and Customer Satisfaction Ratings

It’s crucial to compare key features and customer satisfaction ratings before making a decision. Here’s a table comparing some popular providers:

| Provider | Average Annual Premium | Customer Satisfaction Rating | Key Features |

|---|---|---|---|

| State Farm | $1,200 | 4.5/5 | Wide coverage options, strong financial stability, excellent customer service |

| Geico | $1,100 | 4.2/5 | Competitive rates, user-friendly online platform, quick claims processing |

| Progressive | $1,150 | 4.0/5 | Personalized pricing, wide range of coverage options, innovative features |

| USAA | $1,050 | 4.8/5 | Competitive rates, excellent customer service, dedicated to serving military families |

| Farmers | $1,250 | 4.3/5 | Personalized service, strong financial standing, extensive coverage options |

Note: These figures are estimates and may vary based on individual factors such as driving history, vehicle type, and location.

Choosing the Right Insurance Provider

Consider the following factors when choosing a car insurance provider:

- Coverage needs: Determine the level of coverage you require, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Budget: Compare quotes from different providers to find the most affordable option that meets your coverage needs.

- Customer service: Look for providers with a strong reputation for excellent customer service, including prompt claims processing and helpful representatives.

- Financial stability: Choose a provider with a solid financial standing to ensure they can pay claims in the event of an accident.

- Discounts: Explore available discounts such as good driver, safe driver, multi-car, and bundling discounts to further reduce your premium.

Understanding Coverage Limits and Deductibles

Choosing the right coverage limits and deductibles for your car insurance is crucial, as they directly affect how much you pay in premiums and how much you pay out of pocket in case of an accident. Understanding the relationship between these factors is essential for making informed decisions about your car insurance policy.

Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for a specific type of claim. For instance, bodily injury liability coverage limits how much your insurer will pay for injuries to others in an accident you cause. Higher coverage limits offer more protection but typically result in higher premiums.

Here’s an example:

– Let’s say you have bodily injury liability coverage limits of $25,000 per person and $50,000 per accident. If you cause an accident that injures two people, and their combined medical expenses exceed $50,000, you would be personally responsible for the remaining amount.

Deductibles

A deductible is the amount you pay out of pocket before your insurance coverage kicks in. Higher deductibles generally mean lower premiums, while lower deductibles lead to higher premiums.

Here’s an example:

– If you have a $500 deductible for collision coverage and you’re in an accident that causes $2,000 worth of damage to your car, you would pay the first $500, and your insurance would cover the remaining $1,500.

The Relationship Between Coverage Limits and Deductibles

Coverage limits and deductibles work together to determine your financial responsibility in the event of an accident. Choosing the right combination depends on your individual risk tolerance and financial situation.

Tips for Saving Money on Car Insurance

In Texas, car insurance is a necessity, but it doesn’t have to break the bank. By following a few simple tips, you can significantly reduce your car insurance costs and keep more money in your pocket.

Maintaining a Clean Driving Record

A clean driving record is a key factor in determining your car insurance premiums. Insurance companies consider drivers with a history of accidents, traffic violations, and DUI convictions as higher risks, resulting in higher premiums.

Maintaining a clean driving record is crucial for securing affordable car insurance rates.

Taking Defensive Driving Courses

Taking a defensive driving course can not only enhance your driving skills but also potentially lower your insurance premiums. These courses teach safe driving practices, accident avoidance techniques, and traffic laws, demonstrating your commitment to responsible driving.

Completing a defensive driving course can demonstrate your commitment to safe driving practices and potentially lead to lower insurance premiums.

Bundling Insurance Policies

Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can often lead to significant discounts. Insurance companies reward policyholders who bundle multiple policies with them, recognizing the loyalty and reduced administrative costs associated with multiple policies.

Bundling multiple insurance policies with the same provider can often lead to significant discounts on your car insurance premiums.

Parking Your Car in a Garage or Safe Location

Parking your car in a garage or a safe location can potentially reduce your insurance premiums. Insurance companies recognize that vehicles parked in garages or secure locations are less susceptible to theft, vandalism, and weather damage, resulting in lower risks and potentially lower premiums.

Parking your car in a garage or a secure location can demonstrate a lower risk to insurance companies, potentially leading to lower premiums.

Comparing Quotes from Multiple Insurance Providers

It’s essential to compare quotes from multiple insurance providers before choosing a policy. Insurance companies have varying pricing structures and coverage options, so comparing quotes ensures you find the most affordable and comprehensive policy that meets your needs.

Always compare quotes from multiple insurance providers to find the most affordable and comprehensive car insurance policy.

Last Word

Navigating the complexities of car insurance in Texas can be daunting, but by understanding the legal requirements, factors influencing costs, and available discount opportunities, you can find affordable coverage that meets your needs. Remember to shop around, compare quotes, and leverage available discounts to secure the best possible deal. With careful planning and research, you can drive with peace of mind knowing you have adequate protection while staying within your budget.

Clarifying Questions: Cheap State Minimum Car Insurance Texas

What happens if I drive without the required minimum car insurance in Texas?

Driving without the required minimum car insurance in Texas is illegal and can result in hefty fines, suspension of your driver’s license, and even jail time. Furthermore, if you cause an accident without insurance, you will be personally responsible for all damages and injuries.

Can I get car insurance if I have a poor driving record?

Yes, you can still get car insurance even if you have a poor driving record. However, your premiums will likely be higher. Insurance companies consider your driving history a significant factor in determining your risk and, therefore, your rates.

What are some common discounts offered by car insurance companies in Texas?

Common discounts include safe driver discounts, good student discounts, multi-car discounts, and bundling discounts for combining your car insurance with other policies like home or renters insurance.