Cheap state minimum car insurance can seem like a tempting option, especially for those on a tight budget. However, understanding the limitations and potential risks associated with this type of coverage is crucial before making a decision.

Navigating the world of car insurance can be overwhelming, with various factors influencing costs and coverage options. This guide aims to provide a comprehensive overview of cheap state minimum car insurance, exploring its requirements, cost considerations, and potential drawbacks.

Understanding Minimum Car Insurance Requirements

Driving a car without minimum car insurance is illegal in all states. Every state has its own set of minimum car insurance requirements that drivers must comply with. These requirements are in place to protect drivers and other road users in case of an accident.

Consequences of Driving Without Minimum Car Insurance

Driving without minimum car insurance can have serious consequences. These include:

- Fines and penalties: Drivers caught driving without minimum car insurance can face hefty fines, license suspension, and even jail time, depending on the state and the number of offenses.

- Increased insurance premiums: If you get caught driving without insurance, you may have difficulty getting insurance in the future. If you do find insurance, you will likely have to pay much higher premiums.

- Financial responsibility for accidents: If you are involved in an accident without insurance, you will be personally responsible for covering all damages and injuries. This could include medical bills, property damage, and legal fees.

Types of Coverage Included in Minimum Car Insurance

Minimum car insurance policies typically include the following types of coverage:

- Liability coverage: This coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical bills, property damage, and legal fees.

- Personal injury protection (PIP): This coverage pays for your medical bills and lost wages if you are injured in an accident, regardless of who is at fault.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

Minimum Car Insurance Requirements by State

State minimum car insurance requirements vary widely. For example, in California, the minimum liability coverage is $15,000 per person and $30,000 per accident for bodily injury, and $5,000 for property damage. In Texas, the minimum liability coverage is $30,000 per person and $60,000 per accident for bodily injury, and $25,000 for property damage. It is essential to check with your state’s Department of Motor Vehicles to determine the specific minimum requirements for your state.

Note: The minimum car insurance requirements are just that – minimums. It is always advisable to have more coverage than the minimum required by your state to protect yourself financially in the event of an accident.

Factors Influencing Car Insurance Costs

The price you pay for car insurance is influenced by a variety of factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

Driving History

Your driving history plays a significant role in determining your car insurance premiums. Insurance companies consider your past driving record, including accidents, traffic violations, and driving convictions. A clean driving record with no accidents or violations usually translates to lower premiums. Conversely, drivers with a history of accidents or traffic violations are considered higher risk and may face higher premiums.

A driver with multiple accidents or DUI convictions will likely pay significantly more for car insurance compared to a driver with a clean record.

Age, Cheap state minimum car insurance

Your age is another key factor in determining car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk profile leads to higher insurance premiums for young drivers. As drivers gain experience and age, their risk profile decreases, and their premiums generally become lower.

A 20-year-old driver may pay double the premium of a 40-year-old driver with a similar driving history and vehicle.

Vehicle Type

The type of vehicle you drive also impacts your insurance premiums. Sports cars, luxury vehicles, and high-performance cars are generally more expensive to repair and replace, leading to higher insurance premiums. Conversely, smaller, less expensive vehicles typically have lower premiums.

A driver of a high-performance sports car may pay significantly more for insurance compared to a driver of a compact sedan.

Location

The location where you live also plays a role in your car insurance premiums. Areas with higher crime rates, more traffic congestion, and more accidents tend to have higher insurance premiums. Urban areas often have higher premiums compared to rural areas.

A driver living in a major city may pay more for insurance than a driver living in a small town, even with the same driving history and vehicle.

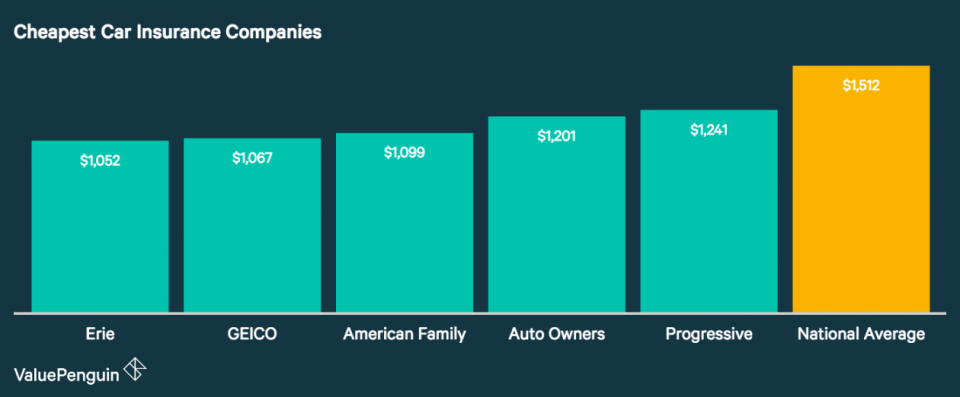

Finding Affordable Minimum Car Insurance

Securing affordable minimum car insurance is a crucial step in responsible car ownership. Understanding your options and employing effective strategies can significantly impact your insurance costs.

Comparing Quotes from Multiple Insurance Providers

Comparing quotes from various insurance providers is a fundamental step in finding the most affordable minimum car insurance. This practice allows you to assess different coverage options, pricing structures, and discounts, ultimately leading to a more informed decision.

- Online Comparison Websites: Platforms like Compare.com, Insurance.com, and The Zebra allow you to enter your information once and receive quotes from multiple insurance providers simultaneously. This streamlines the comparison process and saves time.

- Directly Contacting Insurance Providers: Reaching out to individual insurance companies directly can provide more personalized quotes and insights into their specific offerings. This approach allows you to discuss your needs and preferences in detail, potentially leading to tailored recommendations.

- Working with an Insurance Broker: Insurance brokers act as intermediaries, connecting you with various insurance providers. They can help you navigate the complex insurance landscape and identify the best options based on your individual circumstances.

Tips for Finding Cheap Minimum Car Insurance

Several strategies can help you secure affordable minimum car insurance:

- Maintain a Good Driving Record: A clean driving record is a significant factor in determining your insurance premiums. Avoiding accidents, traffic violations, and DUI offenses can significantly reduce your costs.

- Increase Your Deductible: A higher deductible means you pay more out of pocket in case of an accident, but it can lead to lower premiums. Consider increasing your deductible if you are comfortable with a higher upfront cost in exchange for lower monthly payments.

- Bundle Your Policies: Combining your car insurance with other insurance policies, such as homeowners or renters insurance, can often result in discounts. Check with your insurance provider to see if bundling options are available.

- Explore Discounts: Insurance companies offer various discounts based on factors like good student status, safe driving courses, and vehicle safety features. Research available discounts and ensure you are taking advantage of all applicable options.

- Shop Around Regularly: Insurance rates can fluctuate over time, so it is essential to shop around regularly and compare quotes from different providers. This practice can help you identify potential savings and ensure you are getting the best possible rate.

Average Minimum Car Insurance Premiums by State

The average minimum car insurance premiums vary significantly across different states. The following table showcases average premiums for top insurance companies in selected states:

| State | Progressive | Geico | State Farm | Allstate |

|---|---|---|---|---|

| California | $650 | $600 | $680 | $720 |

| Florida | $700 | $650 | $750 | $800 |

| Texas | $550 | $500 | $580 | $620 |

| New York | $800 | $750 | $850 | $900 |

Note: These are average premiums and may vary based on individual factors such as driving history, vehicle type, and coverage levels.

Understanding the Coverage of Minimum Car Insurance: Cheap State Minimum Car Insurance

Minimum car insurance, while legally required, provides the bare minimum coverage. It’s essential to understand its limitations to make informed decisions about your car insurance needs.

Limitations of Minimum Car Insurance Coverage

Minimum car insurance typically includes liability coverage for bodily injury and property damage to others, and possibly some personal injury protection (PIP) for the policyholder. However, it doesn’t cover damage to your own vehicle or other expenses that might arise from an accident.

Potential Financial Risks Associated with Minimum Car Insurance

Having only minimum car insurance can expose you to significant financial risks in the event of an accident.

- Cost of Repairs: If you’re at fault in an accident, minimum insurance won’t cover the cost of repairing your vehicle. You’ll be responsible for paying these expenses out of pocket.

- Medical Expenses: If you’re injured in an accident, minimum car insurance may not cover your medical bills, especially if you’re at fault. This could lead to substantial financial burdens.

- Lost Wages: If you’re unable to work due to an accident, minimum insurance won’t cover your lost wages.

- Legal Fees: If you’re involved in a lawsuit following an accident, minimum insurance won’t cover your legal fees.

Examples of Situations Where Minimum Car Insurance Might Not Be Sufficient

- An accident involving multiple vehicles or injuries: In such cases, the costs of repairs, medical expenses, and legal fees can quickly exceed the limits of minimum coverage.

- An accident involving a high-value vehicle: If you’re involved in an accident with a luxury car or a vehicle with significant modifications, the cost of repairs could far exceed your minimum coverage.

- An accident involving a hit-and-run driver: If the other driver flees the scene, you might be left with significant expenses and no coverage from their insurance.

Alternatives to Minimum Car Insurance

While minimum car insurance provides the bare minimum coverage required by law, it might not be enough to protect you financially in case of a serious accident. Exploring alternative car insurance options that offer more comprehensive coverage is crucial to ensure your financial security and peace of mind.

These alternatives offer a wider range of coverage, potentially including higher liability limits, collision and comprehensive coverage, and additional benefits such as roadside assistance or rental car reimbursement. While they may come at a higher cost, the added protection they provide can be invaluable in the event of an accident.

Types of Alternative Car Insurance

There are several alternative car insurance options available, each with its own set of benefits and drawbacks. Here are some of the most common alternatives:

- Full Coverage Car Insurance: This type of insurance offers the most comprehensive protection, covering a wide range of situations, including accidents, theft, vandalism, and natural disasters. It typically includes liability coverage, collision coverage, comprehensive coverage, and other optional benefits.

- Higher Liability Limits: While minimum car insurance often has a low liability limit, increasing your liability limits can provide greater financial protection if you are found at fault in an accident. This can be particularly important for drivers with high-value assets or a family to protect.

- Collision and Comprehensive Coverage: These coverages are optional in most states but can provide significant financial protection. Collision coverage pays for repairs or replacement of your vehicle if you are involved in an accident, while comprehensive coverage covers damage caused by non-collision events such as theft, vandalism, or natural disasters.

- Additional Benefits: Some insurance companies offer additional benefits such as roadside assistance, rental car reimbursement, and accident forgiveness. These benefits can be helpful in the event of an accident or other unforeseen circumstances.

Comparing Minimum Car Insurance with Alternatives

It’s helpful to compare the features and costs of minimum car insurance with alternative options to make an informed decision. Here’s a table that highlights the key differences:

| Feature | Minimum Car Insurance | Full Coverage Car Insurance | Higher Liability Limits |

|---|---|---|---|

| Liability Coverage | Minimum Required by Law | Higher Limits | Higher Limits |

| Collision Coverage | Not Included | Included | Not Included |

| Comprehensive Coverage | Not Included | Included | Not Included |

| Additional Benefits | Limited or None | May Include Roadside Assistance, Rental Car Reimbursement, etc. | May Include Roadside Assistance, Rental Car Reimbursement, etc. |

| Cost | Lowest Cost | Highest Cost | Moderate Cost |

Tips for Saving on Car Insurance

Car insurance is a necessity for most drivers, but it can also be a significant expense. However, there are several ways to reduce your car insurance premiums and save money. By taking advantage of discounts, improving your driving record, and making smart choices about your coverage, you can lower your insurance costs without sacrificing essential protection.

Maintaining a Good Driving Record

A clean driving record is one of the most significant factors influencing your car insurance rates. Maintaining a good driving record is crucial for keeping your premiums low. Here are some tips:

- Avoid traffic violations: Every traffic ticket, from speeding to running a red light, can increase your insurance premiums. Drive cautiously and follow all traffic laws to avoid penalties.

- Avoid accidents: Accidents are another major factor that can raise your insurance rates. Defensive driving techniques can help you prevent accidents and maintain a clean driving record.

- Consider a defensive driving course: Taking a defensive driving course can help you improve your driving skills and reduce your risk of accidents. Many insurance companies offer discounts for completing these courses.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premiums.

- Higher deductible, lower premium: A higher deductible means you pay more in the event of an accident, but you’ll pay less in premiums each month.

- Evaluate your risk tolerance: Before increasing your deductible, consider your financial situation and your risk tolerance. Can you afford to pay a higher deductible if you need to file a claim?

- Balance risk and cost: Find a balance between a higher deductible and a lower premium that suits your budget and risk appetite.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Combined coverage, discounted rates: Many insurance companies offer discounts for bundling multiple policies. This can save you money on both your car insurance and other insurance policies.

- Shop around for the best deals: Compare quotes from different insurance companies to find the best bundling deals.

- Review your policies periodically: Ensure your bundled policies still meet your needs and that you’re getting the best discounts.

Common Car Insurance Discounts

Insurance companies offer various discounts to reduce your premiums. Here are some common car insurance discounts you may be eligible for:

- Good student discount: Students with good grades may qualify for this discount.

- Safe driver discount: Drivers with a clean driving record often receive this discount.

- Multi-car discount: Having multiple vehicles insured with the same company can lead to a discount.

- Anti-theft device discount: Installing anti-theft devices in your car, such as alarms or tracking systems, can lower your premiums.

- Loyalty discount: Long-term customers may qualify for this discount.

- Pay-in-full discount: Paying your entire premium upfront may lead to a discount.

- Telematics discount: Using a telematics device that tracks your driving habits can earn you a discount.

Epilogue

Ultimately, the decision to opt for cheap state minimum car insurance is a personal one. Weighing the potential savings against the risks involved is essential. Remember, while minimum coverage may be legally sufficient, it may not provide adequate protection in the event of a serious accident. Consulting with an insurance professional can help you determine the best coverage for your individual needs and financial situation.

Questions and Answers

What happens if I get into an accident with only minimum car insurance?

Your coverage will only pay for the minimum required by your state. You may be responsible for covering additional costs beyond your coverage limits.

Can I increase my coverage after purchasing minimum car insurance?

Yes, you can usually increase your coverage at any time. However, you may have to pay a higher premium.

How often should I review my car insurance policy?

It’s a good idea to review your policy at least once a year to ensure it still meets your needs and consider if you can qualify for any new discounts.