Cheap state minimum auto insurance can be tempting, but it’s crucial to understand what you’re getting. While it might seem like a way to save money, it often comes with limited coverage, leaving you vulnerable in case of an accident. This guide will explore the ins and outs of state minimum auto insurance, outlining its requirements, costs, pros, cons, and alternatives.

We’ll delve into factors that affect the cost of minimum auto insurance, including your age, driving history, vehicle type, and location. We’ll also examine the potential risks associated with having only minimum coverage, emphasizing the need for adequate protection in case of accidents or claims.

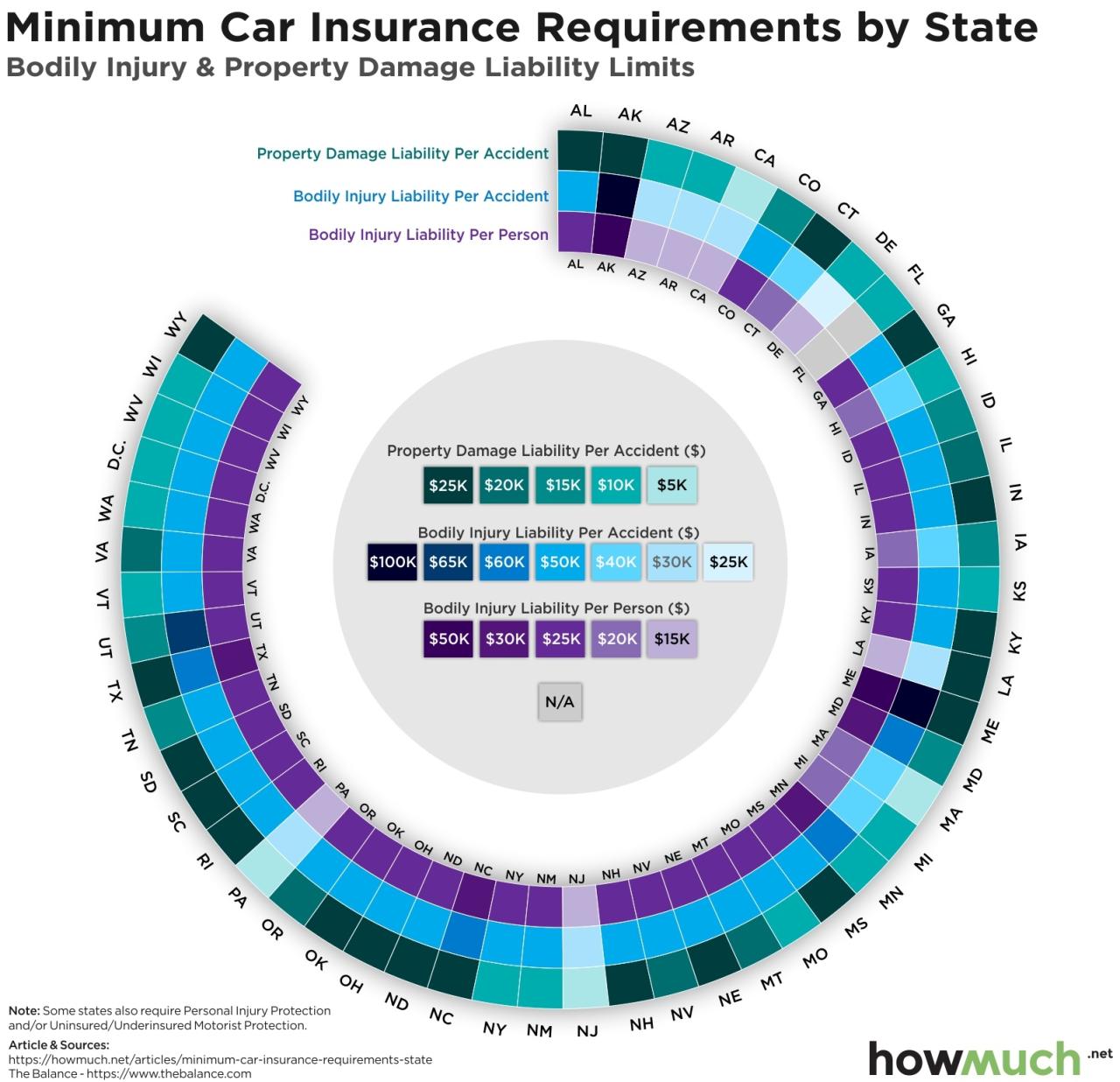

State Minimum Auto Insurance Requirements

Every state in the U.S. has minimum auto insurance requirements that drivers must meet to legally operate a vehicle. These requirements are designed to protect drivers and their passengers from financial hardship in the event of an accident.

Consequences of Driving Without Minimum Required Insurance

Driving without the minimum required auto insurance can result in serious consequences. These include:

- Fines and penalties: Drivers caught operating a vehicle without the minimum required insurance face fines and penalties, which can vary depending on the state and the number of offenses.

- License suspension or revocation: In some states, driving without insurance can lead to license suspension or revocation, making it impossible to legally drive a vehicle.

- Impoundment of vehicle: Your vehicle may be impounded until you provide proof of insurance.

- Financial responsibility: If you are involved in an accident without insurance, you will be personally responsible for all costs associated with the accident, including medical bills, property damage, and legal fees. This can lead to significant financial hardship.

Minimum Auto Insurance Coverage Requirements by State

The following table summarizes the minimum auto insurance coverage requirements for each state:

| State | Liability Coverage | Personal Injury Protection (PIP) | Uninsured/Underinsured Motorist Coverage (UM/UIM) |

|---|---|---|---|

| Alabama | 25/50/25 | Optional | Optional |

| Alaska | 50/100/25 | Optional | Optional |

| Arizona | 15/30/10 | Optional | Optional |

| Arkansas | 25/50/25 | Optional | Optional |

| California | 15/30/5 | Optional | Optional |

| Colorado | 25/50/15 | Optional | Optional |

| Connecticut | 20/40/10 | Optional | Optional |

| Delaware | 15/30/10 | Optional | Optional |

| Florida | 10/20/10 | Required | Optional |

| Georgia | 25/50/25 | Optional | Optional |

| Hawaii | 20/40/10 | Optional | Optional |

| Idaho | 25/50/15 | Optional | Optional |

| Illinois | 20/40/15 | Optional | Optional |

| Indiana | 25/50/10 | Optional | Optional |

| Iowa | 20/40/15 | Optional | Optional |

| Kansas | 25/50/10 | Optional | Optional |

| Kentucky | 25/50/10 | Optional | Optional |

| Louisiana | 15/30/10 | Optional | Optional |

| Maine | 50/100/25 | Optional | Optional |

| Maryland | 30/60/15 | Optional | Optional |

| Massachusetts | 20/40/5 | Optional | Optional |

| Michigan | 20/40/10 | Optional | Optional |

| Minnesota | 30/60/10 | Optional | Optional |

| Mississippi | 25/50/10 | Optional | Optional |

| Missouri | 25/50/10 | Optional | Optional |

| Montana | 25/50/10 | Optional | Optional |

| Nebraska | 25/50/25 | Optional | Optional |

| Nevada | 15/30/10 | Optional | Optional |

| New Hampshire | 25/50/10 | Optional | Optional |

| New Jersey | 15/30/5 | Optional | Optional |

| New Mexico | 25/50/10 | Optional | Optional |

| New York | 25/50/10 | Optional | Optional |

| North Carolina | 30/60/25 | Optional | Optional |

| North Dakota | 25/50/10 | Optional | Optional |

| Ohio | 25/50/10 | Optional | Optional |

| Oklahoma | 25/50/10 | Optional | Optional |

| Oregon | 25/50/20 | Optional | Optional |

| Pennsylvania | 15/30/5 | Optional | Optional |

| Rhode Island | 25/50/25 | Optional | Optional |

| South Carolina | 25/50/25 | Optional | Optional |

| South Dakota | 25/50/10 | Optional | Optional |

| Tennessee | 25/50/15 | Optional | Optional |

| Texas | 30/60/25 | Optional | Optional |

| Utah | 25/65/15 | Optional | Optional |

| Vermont | 25/50/10 | Optional | Optional |

| Virginia | 25/50/20 | Optional | Optional |

| Washington | 25/50/10 | Optional | Optional |

| West Virginia | 25/50/10 | Optional | Optional |

| Wisconsin | 25/50/10 | Optional | Optional |

| Wyoming | 25/50/10 | Optional | Optional |

Factors Affecting Minimum Auto Insurance Costs

The cost of minimum auto insurance can vary significantly depending on a number of factors. Understanding these factors can help you make informed decisions about your insurance coverage and potentially save money.

Driver Age

Your age is one of the most significant factors influencing your minimum auto insurance rates. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies consider this higher risk and charge higher premiums to young drivers. As you age and gain more driving experience, your rates typically decrease.

Driving History

Your driving record plays a crucial role in determining your insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower rates. However, if you have a history of accidents, speeding tickets, or other driving offenses, your insurance premiums will likely be higher.

Vehicle Type

The type of vehicle you drive also affects your minimum auto insurance costs. Sports cars and luxury vehicles are generally more expensive to repair or replace, so insurance companies charge higher premiums for these vehicles. On the other hand, smaller and less expensive vehicles tend to have lower insurance rates.

Location

The location where you live can also influence your minimum auto insurance costs. Areas with higher crime rates, traffic congestion, or a higher number of accidents tend to have higher insurance premiums. This is because insurance companies face a greater risk of claims in these areas.

Table Comparing Average Minimum Auto Insurance Costs

Here is a table comparing the average cost of minimum auto insurance for different driver profiles and vehicle types in [State Name]:

| Driver Profile | Vehicle Type | Average Annual Premium |

|—|—|—|

| 20-year-old driver with clean driving record | Sedan | $750 |

| 20-year-old driver with one speeding ticket | Sedan | $1,000 |

| 35-year-old driver with clean driving record | SUV | $900 |

| 35-year-old driver with one accident | SUV | $1,200 |

| 50-year-old driver with clean driving record | Sports Car | $1,500 |

| 50-year-old driver with one accident | Sports Car | $2,000 |

Note: These are just average estimates and actual premiums may vary depending on individual circumstances and insurance company.

Pros and Cons of Minimum Auto Insurance: Cheap State Minimum Auto Insurance

Purchasing only the minimum required auto insurance coverage can be tempting, especially if you’re looking to save money on your premiums. However, it’s crucial to weigh the pros and cons carefully before making this decision.

Advantages of Minimum Auto Insurance

Having only the minimum required coverage can result in lower premiums. This can be especially beneficial for individuals on a tight budget or those who drive older vehicles with lower market values.

- Lower Premiums: The primary advantage of minimum auto insurance is the reduced cost. You’ll pay less for your policy compared to those who opt for higher coverage levels.

Disadvantages of Minimum Auto Insurance

While minimum auto insurance can save you money, it offers limited protection in the event of an accident. If you’re involved in a serious accident, the minimum coverage may not be enough to cover your expenses, potentially leaving you financially vulnerable.

- Limited Coverage: Minimum coverage typically only covers the bare minimum requirements, such as bodily injury liability and property damage liability. It may not provide sufficient protection for other expenses like medical bills, lost wages, or damage to your own vehicle.

- Financial Vulnerability: In the event of a serious accident, the minimum coverage may not be enough to cover all your expenses. This could leave you with significant out-of-pocket costs, potentially impacting your financial stability.

Real-Life Examples of Inadequate Minimum Coverage

Let’s consider a few scenarios where minimum coverage might not be sufficient:

- High Medical Expenses: If you’re involved in an accident causing severe injuries to yourself or others, your minimum coverage might not be enough to cover the medical bills. You could be left responsible for the remaining costs, potentially leading to financial hardship.

- Damage to Your Vehicle: Minimum coverage typically doesn’t cover damage to your own vehicle. If your car is totaled in an accident, you’ll be responsible for replacing it, even if you weren’t at fault. This can be a significant financial burden, especially if you have an older vehicle with a lower market value.

- Uninsured/Underinsured Motorist Coverage: If you’re hit by an uninsured or underinsured driver, minimum coverage might not be enough to compensate for your losses. You’ll need to rely on your own funds to cover the expenses, potentially leading to significant financial hardship.

Alternatives to Minimum Auto Insurance

While state minimum auto insurance is the bare minimum requirement, it may not provide sufficient protection in case of a serious accident. Alternatives to minimum auto insurance offer more comprehensive coverage, which can provide greater peace of mind and financial security.

Higher Liability Limits

Higher liability limits offer greater financial protection in case of an accident where you are at fault. Minimum liability limits may not be enough to cover the costs of injuries, property damage, or legal expenses. Increasing your liability limits can provide additional coverage and protect your assets from financial ruin.

For example, if you are involved in an accident that results in $100,000 in damages, and your liability limits are only $25,000, you will be personally responsible for the remaining $75,000.

Full Coverage, Cheap state minimum auto insurance

Full coverage auto insurance includes comprehensive and collision coverage in addition to liability insurance. Comprehensive coverage protects you against damage to your vehicle caused by events like theft, vandalism, or natural disasters. Collision coverage covers damage to your vehicle in an accident, regardless of who is at fault.

Full coverage is generally more expensive than minimum auto insurance, but it can provide significant financial protection in case of a major accident or unexpected damage to your vehicle.

Other Coverage Options

In addition to higher liability limits and full coverage, other coverage options can provide additional protection:

- Uninsured/Underinsured Motorist Coverage: Protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other expenses related to injuries you sustain in an accident, regardless of who is at fault.

- Rental Car Coverage: Provides reimbursement for rental car expenses if your vehicle is damaged or totaled in an accident.

- Roadside Assistance: Offers services like towing, flat tire changes, and jump starts.

Comparing Coverage and Costs

The following table summarizes the coverage and estimated costs of different auto insurance options:

| Option | Coverage | Estimated Cost |

|---|---|---|

| State Minimum | Liability, Property Damage Liability, Personal Injury Protection (in some states) | $500 – $1,000 per year |

| Higher Liability Limits | Liability, Property Damage Liability, Personal Injury Protection (in some states), with higher limits | $600 – $1,200 per year |

| Full Coverage | Liability, Property Damage Liability, Personal Injury Protection (in some states), Collision, Comprehensive | $1,000 – $2,000 per year |

Tips for Finding Affordable Minimum Auto Insurance

Finding the cheapest minimum auto insurance can be a challenge, but with some effort, you can find a policy that meets your needs without breaking the bank. There are several strategies you can use to reduce your premiums and get the best value for your money.

Comparing Quotes from Multiple Insurers

It is essential to compare quotes from multiple insurers before settling on a policy. This will give you a better understanding of the available options and help you find the most competitive rates. Here are some tips for obtaining quotes from different insurers:

- Use an online insurance comparison website. These websites allow you to enter your information once and receive quotes from multiple insurers simultaneously, saving you time and effort.

- Contact insurers directly. You can call or visit the websites of individual insurance companies to request quotes. This gives you more control over the information you provide and allows you to ask specific questions about their policies.

- Use a local insurance broker. Brokers can help you compare quotes from multiple insurers and find the best policy for your needs. They can also provide expert advice and guidance throughout the process.

Understanding the Terms and Conditions

Once you have received quotes from multiple insurers, it is crucial to carefully review the terms and conditions of each policy. This will help you understand the coverage you are getting and ensure that it meets your needs. Here are some key factors to consider:

- Deductible: The deductible is the amount you pay out of pocket before your insurance coverage kicks in. A higher deductible generally leads to lower premiums, but it also means you will have to pay more in the event of an accident.

- Coverage limits: Coverage limits determine the maximum amount your insurance company will pay for certain types of claims. Higher coverage limits typically result in higher premiums.

- Exclusions: Exclusions are specific situations or events that are not covered by your insurance policy. It is important to understand what is and is not covered to avoid surprises later.

Exploring Options for Reducing Premiums

There are several ways to reduce your minimum auto insurance premiums. Some of these options include:

- Bundle your policies. If you have other insurance policies, such as homeowners or renters insurance, bundling them with your auto insurance can often lead to discounts.

- Ask about discounts. Most insurers offer various discounts, such as safe driver discounts, good student discounts, and multi-car discounts. Be sure to inquire about any discounts you may qualify for.

- Improve your driving record. A clean driving record is essential for keeping your premiums low. Avoid traffic violations and accidents to maintain a good driving history.

- Consider increasing your deductible. Increasing your deductible can lower your premiums, but it also means you will have to pay more out of pocket in the event of an accident.

- Shop around regularly. Insurance rates can change over time, so it is essential to compare quotes from multiple insurers every year to ensure you are getting the best deal.

Considerations for Choosing Minimum Auto Insurance

Choosing minimum auto insurance is a personal decision that should be made after carefully considering your individual needs and circumstances. While it might seem like a cost-effective option, it’s essential to understand the potential risks involved and weigh them against your financial resources and driving habits.

Potential Risks of Minimum Coverage

Purchasing only the minimum auto insurance coverage might seem like a good way to save money, but it could leave you financially vulnerable in the event of an accident. Here are some potential risks associated with minimum coverage:

- Insufficient Coverage for Injuries: Minimum coverage often only covers bodily injury liability up to a certain limit, which may not be enough to cover the medical expenses of the other driver or passengers involved in an accident. If the costs exceed your coverage limits, you could be held personally liable for the remaining amount.

- Limited Property Damage Coverage: Minimum coverage may not adequately cover the cost of repairs or replacement for the other driver’s vehicle if you are at fault in an accident. You could be responsible for paying the difference between your coverage limit and the actual cost of repairs.

- Lack of Uninsured/Underinsured Motorist Coverage: Minimum coverage typically does not include uninsured/underinsured motorist (UM/UIM) coverage, which protects you if you are hit by an uninsured or underinsured driver. This can leave you financially responsible for your own medical expenses and vehicle repairs.

- Higher Out-of-Pocket Costs: Even if you have minimum coverage, you will still be responsible for paying deductibles and other out-of-pocket expenses. This can significantly impact your finances, especially in the case of a major accident.

Scenarios Where Minimum Coverage Might Be Insufficient

- Accidents Involving Multiple Vehicles or Injuries: In a multi-vehicle accident with multiple injuries, the costs for medical treatment and vehicle repairs can quickly exceed the limits of minimum coverage, leaving you financially responsible for the difference.

- Accidents Involving Expensive Vehicles: If you are involved in an accident with a luxury or high-performance vehicle, the cost of repairs or replacement could be significantly higher than the limits of minimum coverage. This could leave you facing a substantial financial burden.

- Accidents Involving Serious Injuries: Accidents resulting in serious injuries, such as spinal cord injuries or brain damage, can lead to substantial medical expenses that far exceed the limits of minimum coverage. This could leave you facing significant financial hardship.

Final Conclusion

Choosing the right auto insurance policy is a personal decision that depends on your individual needs and financial resources. While minimum coverage might seem appealing at first, it’s essential to consider the potential consequences of having insufficient protection. By understanding the requirements, costs, and alternatives, you can make an informed decision that balances affordability with adequate coverage.

Essential Questionnaire

What happens if I get into an accident with only minimum coverage?

If you cause an accident and only have minimum coverage, your insurance will only cover the minimum amounts required by your state. This might not be enough to cover all the damages or injuries, leaving you financially responsible for the difference.

Is it always cheaper to go with minimum coverage?

While minimum coverage might have lower premiums, it’s important to consider the potential risks. In some cases, paying a slightly higher premium for more comprehensive coverage might be worth it in the long run.

How can I find the cheapest minimum auto insurance?

To find the cheapest minimum auto insurance, compare quotes from multiple insurers, consider discounts, and explore options for reducing premiums. It’s essential to understand the terms and conditions of each policy before making a decision.