Cheap car insurance State Farm is a common search term, reflecting the desire for affordable coverage. State Farm, a major insurance provider, offers various policies and discounts that can help you find a price that fits your budget. But how does State Farm stack up against the competition? This guide explores State Farm’s car insurance offerings, the factors that influence pricing, and strategies for getting the best deal.

We’ll delve into State Farm’s history, coverage options, and the discounts available. We’ll also examine how your driving record, vehicle type, and location affect your premiums. By understanding these factors, you can make informed decisions about your car insurance and potentially save money.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, renowned for its comprehensive coverage, competitive rates, and exceptional customer service. Established in 1922, State Farm has a long history of providing reliable insurance solutions to millions of customers nationwide.

Key Features and Benefits

State Farm car insurance offers a wide range of features and benefits designed to meet the diverse needs of its policyholders. Here are some of the key highlights:

- Comprehensive Coverage Options: State Farm provides a variety of coverage options to protect you and your vehicle in various situations, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Competitive Rates: State Farm strives to offer competitive rates by considering factors such as your driving history, vehicle type, location, and coverage options. They often provide discounts for safe driving, good student status, and multiple policy bundling.

- Excellent Customer Service: State Farm is known for its exceptional customer service, with a dedicated team of agents available to answer your questions, provide guidance, and assist with claims processing. They offer 24/7 support through various channels, including phone, online, and mobile app.

- Financial Stability: State Farm is a financially stable company with a strong track record of paying claims promptly and fairly. They are rated highly by independent rating agencies, demonstrating their commitment to financial security.

- Innovative Technology: State Farm utilizes advanced technology to enhance the customer experience. Their mobile app allows you to manage your policy, track your claims, and access roadside assistance, making it convenient to access services on the go.

Types of Car Insurance Coverage

State Farm offers a range of car insurance coverage options to protect you and your vehicle in different scenarios. Understanding the different types of coverage is crucial for choosing the right plan that suits your individual needs and budget.

- Liability Coverage: This coverage protects you financially if you are responsible for an accident that causes damage to another person’s property or injuries to another person. It typically covers bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage protects your vehicle against damage caused by a collision with another vehicle or an object. It covers repairs or replacement costs, minus your deductible.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage caused by events other than a collision, such as theft, vandalism, fire, hail, or natural disasters. It also covers repairs or replacement costs, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage up to the limits of your policy.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault coverage, covers your medical expenses and lost wages, regardless of who is at fault in an accident. It is typically required in some states.

- Rental Car Coverage: Rental car coverage provides temporary transportation if your vehicle is damaged or stolen and you need to rent a car while it is being repaired or replaced.

- Roadside Assistance: Roadside assistance coverage provides help with situations like flat tires, dead batteries, and lockouts. It can include towing services, jump starts, and tire changes.

Factors Influencing Car Insurance Costs

Car insurance premiums are calculated based on various factors that assess the risk of you being involved in an accident. Insurers use a complex system to determine your individual risk, and this directly impacts the cost of your insurance.

Driving History

Your driving history is a crucial factor in determining your car insurance premiums. A clean driving record with no accidents, violations, or claims indicates a lower risk profile, resulting in lower premiums. Conversely, a history of accidents, traffic violations, or insurance claims raises your risk profile, leading to higher premiums.

- Accidents: A recent accident, even if you were not at fault, can significantly increase your premiums. The severity of the accident, the number of accidents, and the time elapsed since the last accident all play a role.

- Traffic Violations: Speeding tickets, DUI/DWI convictions, and other traffic violations can also lead to higher premiums. These violations demonstrate a higher risk of future accidents.

- Insurance Claims: Filing claims for car repairs or medical expenses can increase your premiums. The number of claims and the cost of those claims are considered.

Vehicle Type

The type of vehicle you drive also influences your car insurance costs. Certain vehicles are considered riskier than others due to their safety features, performance, and theft risk.

- Safety Features: Cars with advanced safety features, such as anti-lock brakes, airbags, and stability control, are generally considered safer and therefore attract lower premiums.

- Performance: High-performance vehicles, like sports cars or luxury vehicles, are often associated with higher speeds and riskier driving, resulting in higher premiums.

- Theft Risk: Vehicles with a higher theft risk, such as expensive models or those with desirable features, are likely to have higher premiums due to the potential for theft claims.

Location

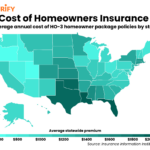

Your location is a significant factor in determining your car insurance costs. Insurance premiums are often higher in areas with high traffic density, higher crime rates, or a greater number of accidents.

- Traffic Density: Areas with heavy traffic are more prone to accidents, leading to higher insurance premiums.

- Crime Rates: High crime rates, particularly those involving car theft or vandalism, can lead to higher premiums.

- Accident History: Areas with a history of high accident rates will often have higher insurance premiums.

Other Factors

- Age and Gender: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents, leading to higher premiums. Gender can also play a role, with some insurers charging different rates for men and women.

- Credit Score: Your credit score can influence your insurance premiums. A good credit score often reflects responsible financial behavior, which can be associated with lower risk.

- Marital Status: Married individuals tend to have lower insurance premiums compared to single individuals. This is often attributed to the assumption that married drivers may be more responsible.

- Driving Habits: Your driving habits, such as the number of miles you drive annually, can also influence your premiums. Drivers who commute long distances or drive frequently may have higher premiums.

Risk Assessment

Insurance companies use sophisticated risk assessment models to determine your individual risk profile. These models consider a wide range of factors, including your driving history, vehicle type, location, and other demographic information.

The risk assessment process involves analyzing your individual characteristics to estimate the likelihood of you being involved in an accident.

State Farm Discounts and Savings

Saving money on your car insurance is always a good thing, and State Farm offers a variety of discounts to help you do just that. By taking advantage of these discounts, you can potentially lower your premium and keep more money in your pocket.

State Farm Discounts

State Farm offers a wide range of discounts that can help you save on your car insurance premium. These discounts are categorized into different groups based on your vehicle, driving habits, and other factors. Here are some of the most common State Farm discounts:

Driver-Based Discounts

These discounts are based on your driving experience, safety record, and other factors related to your driving habits.

- Good Driver Discount: This discount is offered to drivers with a clean driving record, meaning no accidents or traffic violations. The discount amount varies depending on your driving history and the state you live in.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your car insurance.

- Safe Driver Discount: This discount is often combined with the Good Driver Discount and is offered to drivers who have not been involved in any accidents or received any traffic violations for a certain period.

- Student Discount: Students who maintain good grades (typically a B average or higher) may qualify for a discount on their car insurance. This discount is often available to students who are enrolled full-time in a college or university.

- Multi-Policy Discount: This discount is available if you bundle your car insurance with other insurance policies from State Farm, such as homeowners, renters, or life insurance.

Vehicle-Based Discounts

These discounts are based on the type of vehicle you own, its safety features, and other factors related to your car.

- Anti-theft Device Discount: Installing anti-theft devices, such as an alarm system or a tracking device, can help prevent car theft and earn you a discount on your car insurance.

- New Car Discount: If you purchase a new car, you may qualify for a discount on your car insurance, as newer cars often have more safety features.

- Good Student Discount: This discount is available if you have a vehicle with safety features like airbags, anti-lock brakes, or electronic stability control.

- Vehicle Usage Discount: This discount is offered to drivers who use their car for specific purposes, such as commuting to work or school.

Other Discounts

These discounts are not based on your driving habits or your vehicle but on other factors, such as your occupation or your membership in certain organizations.

- Military Discount: Active military personnel and veterans may qualify for a discount on their car insurance.

- Group Discount: If you belong to a certain group or organization, such as an alumni association or a professional organization, you may be eligible for a group discount on your car insurance.

- Paid-in-Full Discount: Paying your car insurance premium in full upfront can often earn you a discount.

Eligibility Criteria and Benefits

To qualify for these discounts, you typically need to meet certain criteria, such as having a clean driving record, completing a defensive driving course, or installing anti-theft devices. The benefits of each discount vary depending on the specific discount and your individual circumstances.

Comparing and Contrasting Discount Programs

Not all discounts are created equal. Some discounts may offer greater savings than others, and some discounts may be more easily attainable than others. It’s important to compare and contrast the different discount programs available to you to determine which ones are most beneficial for your specific situation.

For example, the Good Driver Discount is typically a significant discount, but it requires maintaining a clean driving record. The Anti-theft Device Discount can also offer substantial savings, but it requires the installation of an anti-theft device.

When comparing and contrasting different discount programs, consider factors such as the amount of the discount, the eligibility criteria, and the ease of obtaining the discount. By carefully evaluating these factors, you can choose the discounts that are most likely to help you save money on your car insurance.

Finding Cheap Car Insurance with State Farm

Finding the right car insurance policy for you doesn’t have to be a stressful process. State Farm offers a straightforward and user-friendly approach to getting a quote and comparing coverage options. This section provides a step-by-step guide to navigate the process, understand how to customize your policy, and uncover potential savings opportunities.

Getting a Quote from State Farm

State Farm makes it easy to get a car insurance quote. You can obtain a quote online, over the phone, or by visiting a local agent.

- Online Quote: Visit State Farm’s website and enter your basic information, including your zip code, date of birth, and driving history. The website will guide you through the process, asking for details about your vehicle and desired coverage.

- Phone Quote: Call State Farm’s customer service line and provide the same information you would online. A representative will help you obtain a quote and answer any questions you may have.

- Agent Quote: Locate a State Farm agent in your area and schedule an appointment. This allows you to discuss your insurance needs in person and get personalized advice.

Comparing Coverage Options and Customizing Policies

State Farm offers a range of coverage options to meet different needs and budgets. To find the most suitable policy, it’s important to understand the various coverage types and their implications.

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of fault.

Negotiating Lower Premiums and Maximizing Savings

State Farm offers various discounts and savings programs to help you reduce your car insurance premiums.

- Good Driver Discount: This discount is offered to drivers with a clean driving record.

- Safe Driver Discount: This discount is often available to drivers who have completed a defensive driving course.

- Multi-Policy Discount: State Farm offers discounts if you bundle your car insurance with other insurance policies, such as homeowners or renters insurance.

- Anti-theft Device Discount: This discount is available if your vehicle has anti-theft devices installed.

- Pay-in-Full Discount: This discount is often offered for paying your annual premium in full upfront.

- Loyalty Discount: State Farm may offer discounts to customers who have been insured with them for a certain period of time.

Customer Experience and Reviews

State Farm is one of the largest and most well-known insurance companies in the United States, and its car insurance policies are popular with many drivers. But what do customers actually think about State Farm car insurance? Let’s take a look at some customer testimonials and reviews, as well as the company’s reputation for customer service and claims handling.

Customer Testimonials and Reviews

Customer reviews provide valuable insights into a company’s performance and how it treats its customers. State Farm has a generally positive reputation among its policyholders, with many customers praising the company’s friendly and helpful customer service, as well as its quick and efficient claims handling process.

Here are some examples of customer testimonials and reviews:

“I’ve been with State Farm for over 10 years and have always been happy with their service. They are always there to help when I need them, and their claims process is very smooth.” – John S.

“I recently had to file a claim after an accident, and State Farm was fantastic. They were very responsive and helpful throughout the entire process. I would definitely recommend them to anyone.” – Mary L.

“I love the fact that State Farm has a strong reputation for customer service. I feel like I can always count on them to be there for me when I need them.” – David M.

However, it’s important to note that not all customer reviews are positive. Some customers have complained about issues such as long wait times for customer service, difficulty getting claims approved, and high premiums.

Customer Service and Claims Handling

State Farm is known for its commitment to providing excellent customer service. The company has a large network of agents and representatives who are available to assist customers with their insurance needs. State Farm also offers a variety of online and mobile tools that make it easy for customers to manage their policies and file claims.

In terms of claims handling, State Farm has a reputation for being fair and efficient. The company has a dedicated claims team that is available 24/7 to assist customers with their claims. State Farm also offers a variety of resources to help customers understand the claims process and navigate the complexities of filing a claim.

Overall Satisfaction Levels

Overall, State Farm enjoys high levels of customer satisfaction. The company consistently ranks high in customer satisfaction surveys, such as the J.D. Power U.S. Auto Insurance Satisfaction Study. In the 2023 study, State Farm ranked among the top performers in overall satisfaction, customer interaction, price, and claims.

State Farm’s strong reputation for customer service, claims handling, and overall satisfaction is a testament to the company’s commitment to providing a positive experience for its policyholders.

Alternatives to State Farm

State Farm is a well-known and respected car insurance provider, but it’s not the only option available. There are several other reputable insurers offering competitive rates, comprehensive coverage, and unique features. Comparing these alternatives can help you find the best car insurance policy for your needs and budget.

Comparing Car Insurance Providers

This section explores the key aspects to consider when comparing car insurance providers, including pricing, coverage, and features.

- Pricing: Car insurance rates vary significantly based on factors like driving history, vehicle type, location, and coverage levels. Comparing quotes from multiple insurers is crucial to find the most affordable option.

- Coverage: Car insurance policies provide different levels of protection, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Understanding the specific coverage offered by each insurer is essential to ensure you have adequate protection in case of an accident.

- Features: Insurers offer additional features and benefits that can enhance your policy, such as roadside assistance, rental car reimbursement, and accident forgiveness. Comparing these features can help you find a policy that meets your specific needs and preferences.

Popular Car Insurance Alternatives to State Farm

Here are some of the most popular car insurance providers known for their competitive pricing, comprehensive coverage, and excellent customer service:

- Geico: Geico is renowned for its competitive rates and straightforward online quoting process. They offer a wide range of coverage options and discounts, making them a popular choice for budget-conscious drivers.

- Progressive: Progressive is known for its innovative features, such as its Name Your Price tool, which allows you to set a budget and find policies that fit within it. They also offer a variety of discounts and coverage options.

- Allstate: Allstate is a well-established insurer offering a wide range of coverage options and discounts, including Drive Safe & Save, which rewards safe driving habits.

- USAA: USAA is a highly-rated insurer that exclusively serves active and retired military personnel and their families. They offer competitive rates, excellent customer service, and a wide range of discounts.

Choosing the Right Car Insurance Provider

Ultimately, the best car insurance provider for you depends on your individual needs and preferences. Consider these factors when making your decision:

- Price: Compare quotes from multiple insurers to find the most affordable option.

- Coverage: Ensure the policy provides the level of protection you need.

- Features: Look for features that enhance your policy, such as roadside assistance or accident forgiveness.

- Customer service: Consider the insurer’s reputation for customer service and claims handling.

- Financial stability: Choose an insurer with a strong financial rating, ensuring they can fulfill their obligations in case of a claim.

Comparing Quotes and Coverage, Cheap car insurance state farm

Using online comparison tools and getting quotes from multiple insurers can help you find the best car insurance policy for your needs.

“Don’t settle for the first quote you get. Shop around and compare prices, coverage, and features from different insurers.”

Closing Summary: Cheap Car Insurance State Farm

Finding cheap car insurance is a priority for many drivers, and State Farm offers a range of options to consider. By understanding the factors that impact your premiums and exploring the discounts available, you can increase your chances of securing affordable coverage. Remember to compare quotes from multiple insurers, including State Farm, to ensure you’re getting the best value for your needs.

Question Bank

How can I get a free quote from State Farm?

You can easily get a quote online, over the phone, or by visiting a local State Farm agent.

Does State Farm offer coverage for rental cars?

Yes, State Farm offers rental car coverage as part of your policy. You may need to pay an additional premium for this coverage.

What is the difference between liability and collision coverage?

Liability coverage protects you financially if you cause an accident, while collision coverage covers damage to your own vehicle in an accident.

What are the benefits of bundling my car and home insurance with State Farm?

Bundling your policies can often result in significant discounts on your premiums.