Cheap car insurance in Washington State sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of car insurance can feel like a daunting task, especially when you’re looking for affordable coverage. In Washington, finding the right balance between cost and protection is crucial, as the state has specific requirements and factors that influence premiums. This guide will explore the intricacies of car insurance in Washington, providing valuable insights into the factors that affect your rates, the types of coverage available, and practical tips for securing the most affordable policy.

Understanding the basics of car insurance in Washington is essential. The state mandates specific coverage levels, including liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. Failing to meet these requirements can result in hefty fines and even license suspension. Beyond these mandatory coverages, additional options like collision and comprehensive insurance can offer extra protection for your vehicle. As you delve deeper into the world of car insurance, you’ll discover that your driving history, vehicle type, and location all play a significant role in determining your premiums. This guide will break down these factors and provide practical tips for navigating the complex world of car insurance in Washington.

Understanding Washington State Car Insurance Requirements

Driving in Washington State requires you to have car insurance to protect yourself and others in case of an accident. The state has specific requirements for car insurance coverage, which are designed to ensure financial responsibility for drivers and to protect victims of accidents.

Minimum Car Insurance Coverage Requirements

Washington State law mandates that all drivers carry a minimum amount of car insurance coverage. This coverage is divided into three main categories:

- Liability Coverage: This coverage protects you financially if you are at fault in an accident. It covers the other driver’s medical expenses, lost wages, and property damage up to the limits of your policy. In Washington, the minimum liability coverage requirements are:

- Bodily Injury Liability: $25,000 per person/$50,000 per accident

- Property Damage Liability: $10,000 per accident

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, lost wages, and property damage. Washington requires drivers to have a minimum of $25,000 per person/$50,000 per accident in UM/UIM coverage. You can choose to purchase additional UM/UIM coverage, which is often recommended to provide greater protection.

- Financial Responsibility Coverage: This coverage is mandatory in Washington State and is typically included as part of your liability coverage. It covers the cost of damages to another person’s property, including vehicles, if you are at fault in an accident.

Penalties for Driving Without Required Coverage, Cheap car insurance in washington state

Driving without the minimum required car insurance coverage in Washington State can result in severe penalties, including:

- Fines: Drivers caught without the minimum required insurance can face fines of up to $1,000.

- License Suspension: The Washington State Department of Licensing (DOL) can suspend your driver’s license if you fail to provide proof of insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Increased Insurance Premiums: Even if you obtain insurance after being caught driving without it, your premiums may be significantly higher for a period of time.

Washington State Department of Licensing’s Role in Car Insurance Regulations

The Washington State Department of Licensing (DOL) is responsible for enforcing car insurance regulations and ensuring that all drivers comply with the law. The DOL:

- Issues Driver’s Licenses: The DOL issues driver’s licenses to individuals who meet the state’s requirements, including having car insurance.

- Registers Vehicles: The DOL registers vehicles in Washington State and requires proof of insurance for registration.

- Enforces Insurance Laws: The DOL works with law enforcement agencies to enforce insurance laws and investigate reports of uninsured drivers.

- Provides Information: The DOL provides information and resources to drivers about car insurance requirements and how to obtain coverage.

Factors Influencing Car Insurance Costs in Washington: Cheap Car Insurance In Washington State

Several factors influence car insurance premiums in Washington, making it crucial to understand how these factors can affect your overall cost. These factors are assessed by insurance companies to determine the risk associated with insuring you, ultimately affecting the price you pay for coverage.

Age

Your age plays a significant role in determining your car insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents due to lack of experience and higher risk-taking behavior. As drivers gain experience and age, their premiums generally decrease, reflecting a lower risk profile.

Driving History

Your driving history is a major factor in calculating your car insurance premiums. A clean driving record with no accidents, violations, or traffic tickets translates to lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will result in higher premiums. Insurance companies consider this data to assess your risk of future accidents.

Vehicle Type

The type of vehicle you drive also impacts your insurance premiums. High-performance vehicles, luxury cars, and SUVs tend to have higher insurance premiums due to their higher repair costs, increased risk of theft, and higher likelihood of accidents. Conversely, older, less expensive vehicles typically have lower insurance premiums.

Location

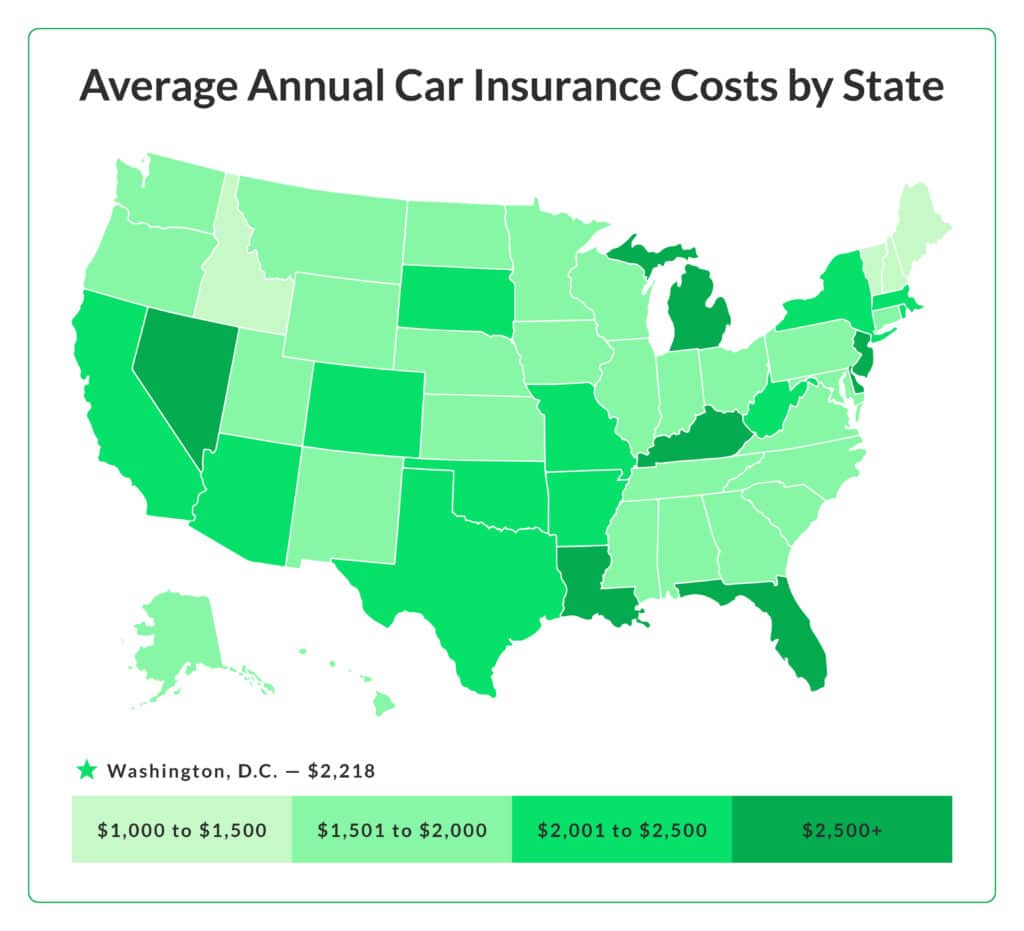

Your location within Washington state significantly influences your car insurance premiums. Areas with higher crime rates, traffic congestion, and accident rates generally have higher insurance premiums. Conversely, areas with lower crime rates and less traffic congestion typically have lower insurance premiums.

Credit Score

While not directly related to driving ability, your credit score can affect your car insurance premiums in Washington. Insurance companies use credit scores as an indicator of financial responsibility. Individuals with good credit scores are considered less risky and may qualify for lower premiums. Conversely, those with poor credit scores may face higher premiums due to a perceived higher risk of claims.

Driving Habits

Your driving habits can also influence your insurance premiums. Factors like driving mileage, commute distance, and driving time of day can impact your risk profile. For instance, drivers who frequently commute long distances during rush hour are considered higher risk than those who drive less frequently or during off-peak hours.

Finding Affordable Car Insurance Options

In Washington, securing affordable car insurance requires careful consideration of various factors and available options. By understanding the different types of policies, comparing quotes from multiple providers, and exploring potential discounts, you can find a policy that fits your needs and budget.

Reputable Car Insurance Providers in Washington

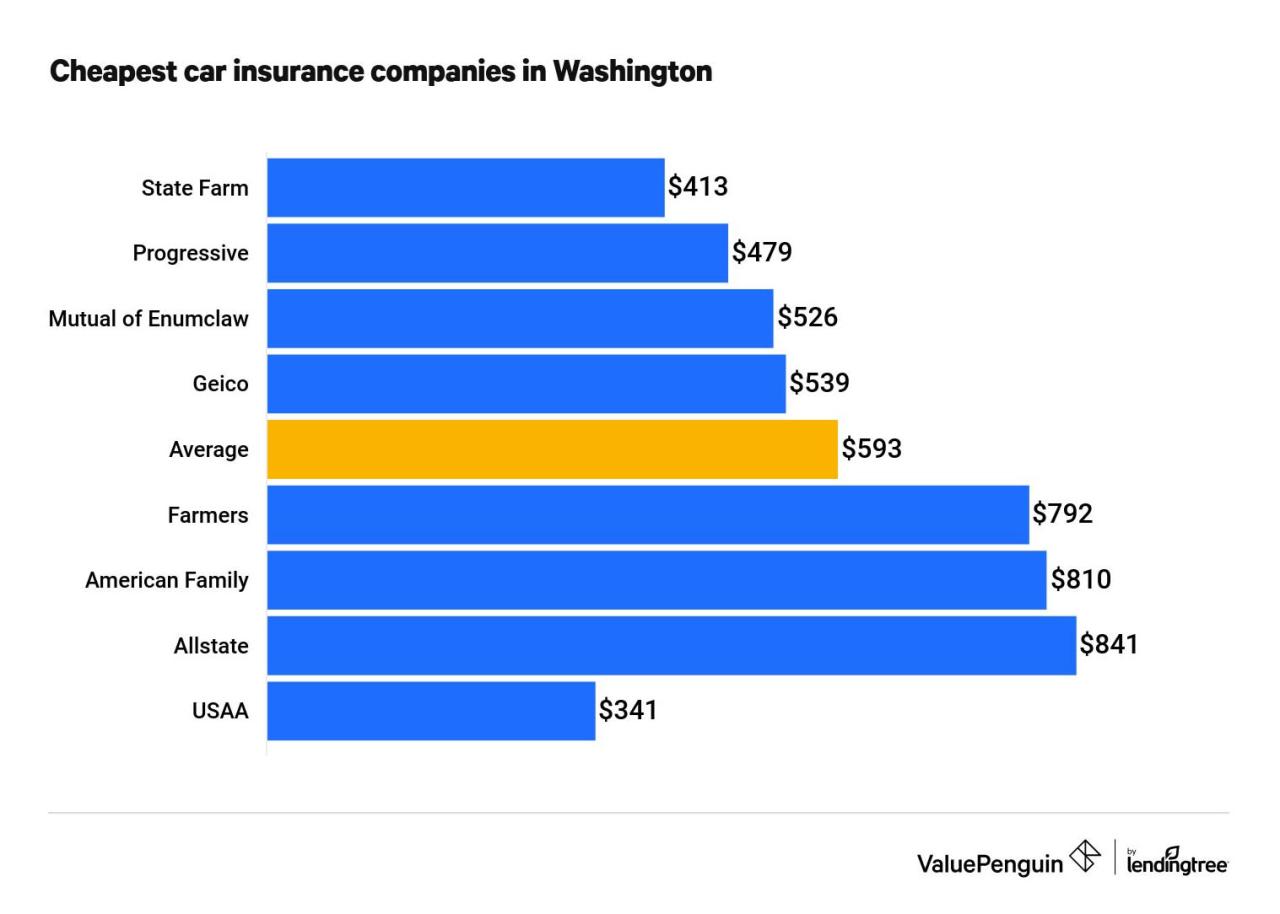

A wide range of reputable insurance providers operate in Washington, offering diverse coverage options and price points. It’s essential to compare quotes from multiple companies to find the best fit for your specific needs.

- State Farm: Known for its extensive network of agents and comprehensive coverage options, State Farm is a popular choice in Washington.

- Geico: Geico is recognized for its competitive pricing and convenient online tools, making it an attractive option for budget-conscious drivers.

- Progressive: Progressive offers a variety of insurance products, including personalized discounts and a user-friendly online platform.

- Farmers Insurance: Farmers Insurance provides a wide range of insurance options, including auto, home, and business coverage, with a strong focus on customer service.

- USAA: USAA is a reputable insurer specializing in serving military members and their families, offering competitive rates and excellent customer service.

- Liberty Mutual: Liberty Mutual is known for its innovative features, including telematics programs that reward safe driving habits with lower premiums.

- Allstate: Allstate provides a wide range of insurance products, including auto, home, and life insurance, with a strong focus on customer satisfaction.

Types of Car Insurance Policies

Understanding the different types of car insurance policies is crucial for choosing the right coverage for your needs. Each policy offers specific protection, and the combination of policies you choose can significantly impact your premiums.

- Liability Insurance: This is the most basic type of car insurance, required by law in Washington. It covers damages to other people and their property if you are at fault in an accident. Liability insurance typically includes bodily injury liability and property damage liability.

- Collision Coverage: Collision coverage protects your vehicle against damage caused by collisions with other vehicles or objects. This coverage pays for repairs or replacement of your car, minus your deductible.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage from events other than collisions, such as theft, vandalism, fire, or natural disasters. This coverage also pays for repairs or replacement of your car, minus your deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you and your passengers if you are injured in an accident caused by an uninsured or underinsured driver. It helps cover medical expenses, lost wages, and other related costs.

- Personal Injury Protection (PIP): This coverage, also known as no-fault insurance, covers your medical expenses and lost wages regardless of who is at fault in an accident. It is required in Washington.

Average Car Insurance Premiums in Washington

| Insurance Company | Average Annual Premium |

|---|---|

| State Farm | $1,500 |

| Geico | $1,400 |

| Progressive | $1,350 |

| Farmers Insurance | $1,600 |

| USAA | $1,250 |

| Liberty Mutual | $1,450 |

| Allstate | $1,550 |

Note: These average premiums are estimates and can vary significantly based on individual factors, such as driving history, vehicle type, coverage levels, and location.

Tips for Saving on Car Insurance

In Washington State, like many other places, car insurance is a necessity. While it’s essential, it doesn’t have to break the bank. By taking proactive steps and understanding the factors that influence your premiums, you can significantly reduce your insurance costs.

Maintaining a Good Driving Record

A clean driving record is the cornerstone of affordable car insurance. In Washington, points are assigned to your driving record for traffic violations. These points can lead to increased insurance premiums. Driving safely, avoiding speeding tickets, and following traffic laws are crucial. Here are some tips:

- Defensive Driving Courses: Enroll in a defensive driving course approved by the Washington State Department of Licensing. This can reduce points on your driving record and potentially earn you a discount on your insurance.

- Avoid Distractions: Minimize distractions while driving, such as using your phone or eating. Focus on the road and anticipate potential hazards.

- Maintain Your Vehicle: Regularly check your car’s tires, brakes, lights, and other essential components. Proper maintenance helps prevent accidents and can demonstrate responsible vehicle ownership to insurers.

Bundling Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in significant savings. Insurance companies often offer discounts for bundling multiple policies with them.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your monthly premium. However, it’s important to ensure you can comfortably afford a higher deductible in case of an accident. Consider the potential financial impact before making this decision.

Car Insurance Discounts Available in Washington

Insurance companies in Washington offer various discounts to policyholders. These discounts can be substantial and significantly lower your premiums. Here are some common car insurance discounts available in Washington:

- Good Student Discount: Students with good grades often qualify for this discount, rewarding academic achievement.

- Safe Driver Discount: Maintaining a clean driving record for a specific period can earn you this discount, demonstrating responsible driving habits.

- Multi-Car Discount: Insuring multiple vehicles with the same company can result in a discount for each car.

- Anti-theft Device Discount: Installing anti-theft devices in your car, such as alarms or GPS trackers, can make your vehicle less attractive to thieves and qualify you for a discount.

- Loyalty Discount: Some insurers offer discounts to long-term policyholders who have maintained a good driving record.

- Pay-in-Full Discount: Paying your annual premium upfront may earn you a discount compared to making monthly payments.

Common Car Insurance Scams and How to Avoid Them

Be aware of common car insurance scams to protect yourself and your finances. Scammers may try to take advantage of your need for affordable insurance. Here are some common scams and how to avoid them:

- Fake Insurance Companies: Be cautious of companies that seem too good to be true, offering incredibly low premiums. Verify the legitimacy of the company with the Washington State Office of the Insurance Commissioner.

- Phishing Scams: Be wary of emails or phone calls claiming to be from your insurance company, asking for personal information or requesting payment. Never provide sensitive details over unsolicited contact.

- Fake Accident Claims: Be aware of staged accidents where individuals intentionally cause collisions to file fraudulent claims. If you’re involved in an accident, document the details and report it to your insurance company.

- Ghosting: This scam involves someone pretending to be insured when they’re not. If you’re involved in an accident with someone claiming to be insured, ask for proof of coverage and report the incident to your insurance company.

Navigating Car Insurance Claims in Washington

Filing a car insurance claim in Washington can be a stressful experience, but understanding the process and your rights can help you navigate it smoothly. This section will guide you through the steps involved in filing a claim, provide insights into dealing with insurance adjusters, and Artikel your responsibilities as a driver in an accident.

Filing a Car Insurance Claim in Washington

When you’re involved in a car accident, the first step is to ensure everyone is safe. Then, you should:

- Contact the authorities: Call 911 if anyone is injured or if there’s significant damage to property. This will also document the accident and create a record for your insurance claim.

- Exchange information: Get the other driver’s contact information, insurance details, and license plate number. It’s also a good idea to take photos of the damage to both vehicles and the accident scene.

- Report the accident to your insurance company: You’ll need to notify your insurance company about the accident as soon as possible. They’ll guide you through the claims process and provide instructions on how to proceed.

- Gather supporting documents: Collect any relevant documents, such as police reports, medical records, and repair estimates, which will help support your claim.

Dealing with Insurance Adjusters

Once you’ve reported the accident, your insurance company will assign an adjuster to your claim. The adjuster will investigate the accident and assess the damage to your vehicle. It’s important to:

- Be honest and cooperative: Provide the adjuster with accurate information about the accident and your injuries. Don’t make false statements or exaggerate your claims.

- Understand your rights: You have the right to be represented by an attorney if you wish. You also have the right to review the adjuster’s findings and negotiate a settlement that you feel is fair.

- Document all communication: Keep a record of all your interactions with the adjuster, including dates, times, and any agreements made. This can be helpful if there are any disputes later on.

- Don’t rush into signing anything: Carefully review any documents before signing them, and don’t be pressured into accepting a settlement that you’re not comfortable with.

Driver Responsibilities After an Accident

Washington state law requires drivers involved in an accident to:

- Stop at the scene: You must stop immediately at the scene of an accident, even if there is only property damage.

- Provide assistance: If someone is injured, you’re legally obligated to provide reasonable assistance, such as calling for emergency services.

- Exchange information: You must exchange your contact information and insurance details with the other driver(s) involved.

- Report the accident: You must report the accident to the authorities if there is injury or property damage exceeding $1,000.

Outcome Summary

In the end, securing cheap car insurance in Washington state involves a combination of understanding your state’s requirements, choosing the right coverage for your needs, and taking advantage of available discounts. By carefully considering these factors and actively engaging in the process, you can find affordable car insurance that provides the peace of mind you deserve.

FAQ Guide

What are the minimum car insurance requirements in Washington State?

Washington state requires all drivers to have liability, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage.

How can I get a discount on my car insurance in Washington?

You can get discounts for maintaining a good driving record, bundling policies, taking a defensive driving course, and having safety features in your vehicle.

What are some common car insurance scams in Washington?

Be wary of scams that involve fake insurance cards, claims for non-existent accidents, and offers for “too good to be true” rates.

How do I file a car insurance claim in Washington?

Contact your insurance company as soon as possible after an accident. They will guide you through the claim process.