Navigating the world of auto insurance in Washington State can feel like driving through a maze. Finding cheap auto insurance washington state is a common goal, but it requires careful planning and research. Understanding the state’s mandatory insurance requirements, the factors that influence costs, and available discounts are essential for securing affordable coverage.

Washington State mandates liability insurance for all drivers, but the specific coverage levels can vary depending on individual circumstances. Beyond basic liability, drivers can choose additional coverage like collision and comprehensive, which offer protection against damages to your vehicle. The Washington State Department of Licensing plays a vital role in regulating the auto insurance market, ensuring fair practices and consumer protection.

Understanding Washington State Auto Insurance

Driving in Washington State requires you to have auto insurance, which is mandatory. This ensures financial protection for yourself and others in case of an accident. Understanding the different types of coverage available is crucial to ensure you have adequate protection.

Washington State’s Mandatory Insurance Requirements

Washington State law mandates that all drivers carry a minimum amount of liability insurance. This protects others in case you cause an accident. These minimum requirements are:

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $10,000 for property damage liability per accident

This means that if you cause an accident that results in injuries to others, your insurance will cover up to $25,000 per person and up to $50,000 total for all injuries in that accident. If you damage someone’s property, your insurance will cover up to $10,000 in damages.

Types of Auto Insurance Coverage

While liability insurance is mandatory, you can choose to purchase additional coverage to protect yourself further. Some common types of auto insurance coverage include:

- Collision Coverage: This covers damages to your vehicle in case of an accident, regardless of who is at fault. This is particularly important if you have a newer or financed vehicle.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters. This can be helpful if your vehicle is parked in an area prone to these risks.

- Uninsured/Underinsured Motorist Coverage: This protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your damages. This can be crucial in a state like Washington, where uninsured drivers are prevalent.

- Personal Injury Protection (PIP): This covers medical expenses, lost wages, and other related expenses for you and your passengers, regardless of who is at fault in an accident. This is not mandatory in Washington, but it can be beneficial.

- Medical Payments Coverage: This covers medical expenses for you and your passengers, regardless of who is at fault in an accident. However, it has a lower limit than PIP and does not cover lost wages.

Washington State Department of Licensing’s Role

The Washington State Department of Licensing (DOL) plays a crucial role in regulating auto insurance in the state. They are responsible for:

- Licensing and regulating insurance companies: The DOL ensures that insurance companies operating in Washington meet specific financial and operational standards.

- Enforcing insurance requirements: The DOL verifies that drivers have the minimum required insurance and takes action against those who do not comply.

- Providing information and resources: The DOL provides information and resources to consumers about auto insurance, including how to file complaints and find affordable coverage.

Factors Influencing Auto Insurance Costs in Washington

Several factors influence your auto insurance premiums in Washington State. These factors are used to assess your risk as a driver and determine how much you’ll pay for coverage.

Age and Driving Experience

Your age and driving experience are key factors in determining your insurance premiums. Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This higher risk translates to higher insurance premiums. As you gain more experience and reach your mid-20s, your premiums typically decrease.

Driving History

Your driving history plays a crucial role in determining your insurance premiums. A clean driving record with no accidents or traffic violations will generally result in lower premiums. However, accidents, speeding tickets, DUI convictions, and other traffic offenses can significantly increase your premiums.

Vehicle Type

The type of vehicle you drive is another factor that influences your insurance costs. Some vehicles are considered more expensive to repair or replace, while others are considered safer. For example, sports cars and luxury vehicles often have higher insurance premiums due to their higher repair costs and potential for higher speeds.

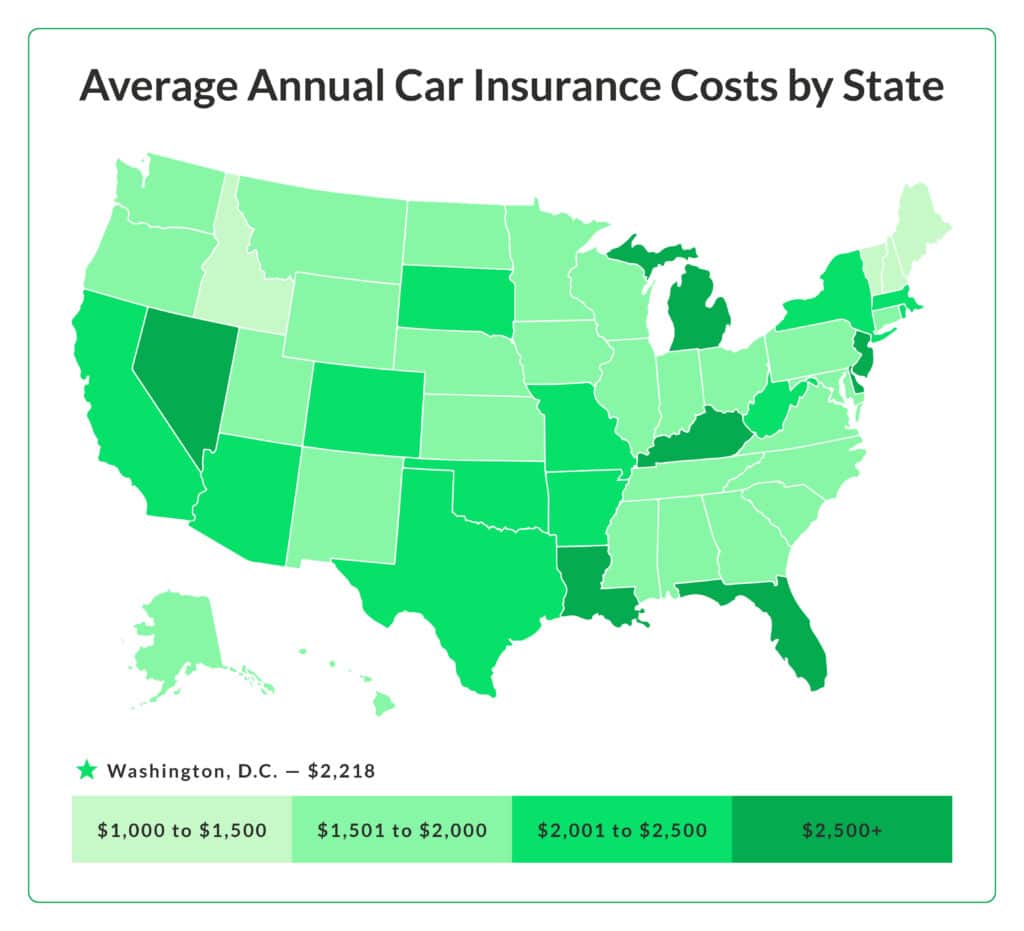

Location

Where you live in Washington can significantly impact your insurance premiums. Urban areas with high traffic density and crime rates generally have higher insurance premiums due to the increased risk of accidents and theft. Rural areas with lower traffic density and crime rates typically have lower premiums.

Credit Score

Your credit score can influence your insurance premiums in Washington. While this practice is not universal, some insurance companies believe that individuals with good credit are more financially responsible and less likely to file claims. This can lead to lower premiums.

Coverage Levels

The level of coverage you choose can also affect your insurance premiums. Higher coverage limits, such as higher liability limits, will typically result in higher premiums.

Deductibles

Your deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically means lower premiums.

Discounts

Several discounts can help reduce your auto insurance premiums in Washington. These discounts can be based on factors such as:

- Good student discounts

- Safe driver discounts

- Multi-car discounts

- Multi-policy discounts

- Defensive driving course discounts

- Anti-theft device discounts

Finding Affordable Auto Insurance Options

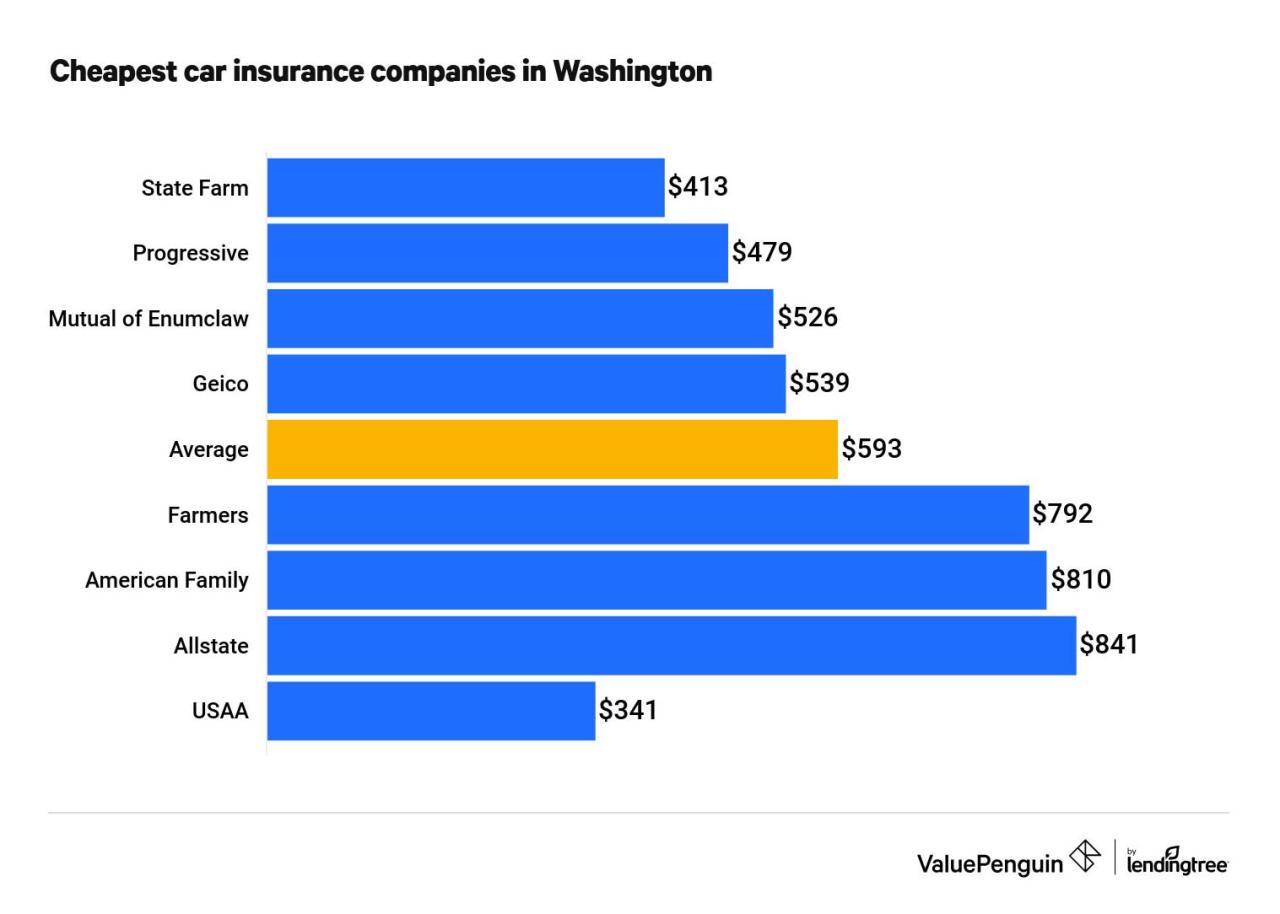

Finding the most affordable auto insurance in Washington can feel like a daunting task. Fortunately, several strategies can help you secure a policy that fits your budget without compromising coverage.

Using Comparison Websites

Comparison websites can be invaluable resources for finding cheap auto insurance. These platforms allow you to enter your details and receive quotes from multiple insurance companies simultaneously. This lets you compare prices, coverage options, and discounts, enabling you to make an informed decision.

Choosing Direct Insurers

Direct insurers, often operating solely online, can offer competitive rates. These companies typically have lower overhead costs than traditional insurance companies, which they often pass on to customers in the form of lower premiums.

Exploring Discounts

Most insurance companies offer discounts to reduce your premiums. Here are some common discounts to inquire about:

- Good driver discounts: Reward drivers with clean driving records.

- Safe driver discounts: Encourage safe driving practices.

- Multi-car discounts: Offer savings when insuring multiple vehicles with the same company.

- Multi-policy discounts: Provide discounts for bundling auto insurance with other types of insurance, like homeowners or renters insurance.

- Anti-theft device discounts: Reward drivers who install anti-theft devices in their vehicles.

- Good student discounts: Offer lower rates to students who maintain good grades.

Negotiating with Insurance Companies, Cheap auto insurance washington state

While you can’t always negotiate the base price of your policy, you can explore options for lowering your premium.

- Review your coverage: Consider if you need all the coverage you currently have. Reducing unnecessary coverage can often lead to lower premiums.

- Increase your deductible: A higher deductible means you pay more out of pocket if you have an accident but often results in lower premiums.

- Shop around: Don’t be afraid to compare quotes from different insurers and use the information to negotiate with your current provider.

State-Specific Programs

Washington State offers various programs designed to make auto insurance more affordable for certain individuals and families.

- The Low-Income Auto Insurance Program (LIAIP): This program helps low-income Washington residents obtain affordable auto insurance through a partnership with insurance companies. The program offers subsidized premiums based on income and household size.

- The Washington State Department of Social and Health Services (DSHS): DSHS offers financial assistance programs for eligible individuals who need help paying for auto insurance.

Understanding Insurance Policies and Coverage

Your auto insurance policy is a contract between you and your insurance company, outlining the terms and conditions of your coverage. It’s essential to understand the different types of coverage, the limits, and the exclusions to ensure you have adequate protection in case of an accident.

Deductibles and Their Impact on Premiums

The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. A higher deductible typically translates to lower premiums, while a lower deductible means higher premiums.

- Comprehensive Deductible: This applies to damages caused by events like theft, vandalism, or natural disasters.

- Collision Deductible: This applies to damages caused by collisions with another vehicle or object.

For example, if you have a $500 deductible for collision coverage and you are in an accident that results in $2,000 in damages, you would pay $500, and your insurance company would cover the remaining $1,500.

Filing a Claim and Resolving Disputes

If you need to file a claim, it’s essential to contact your insurance company as soon as possible.

- Report the accident: Provide details of the incident, including the date, time, location, and any injuries.

- Gather evidence: Collect any relevant documentation, such as police reports, witness statements, and photos of the damage.

- Follow up: Regularly follow up with your insurance company to ensure your claim is processed promptly.

If you have a dispute with your insurance company, you can try to resolve it through their internal complaint process. If you are unable to reach a resolution, you can contact the Washington State Office of the Insurance Commissioner.

Understanding Policy Terms and Conditions

It’s important to read your policy carefully and understand the following key terms:

- Coverage Limits: The maximum amount your insurance company will pay for a covered loss.

- Exclusions: Specific events or situations that are not covered by your policy.

- Premium: The amount you pay for your insurance coverage.

Understanding these terms will help you make informed decisions about your insurance coverage and avoid any surprises when you need to file a claim.

Safe Driving Practices and Discounts

In Washington State, safe driving is not only crucial for your own well-being but also for your wallet. Maintaining a clean driving record can significantly reduce your auto insurance premiums. Let’s explore the benefits of safe driving and the discounts available to those who practice it.

Discounts for Safe Driving

Insurance companies in Washington recognize and reward safe drivers with various discounts. Here are some common discounts you can benefit from:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, meaning no accidents or traffic violations for a specific period. The duration required for eligibility and the discount percentage vary depending on the insurance company.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount. These courses teach valuable techniques for avoiding accidents and improving driving skills.

- Multi-Car Discount: Insuring multiple vehicles with the same company often qualifies you for a discount. This is a common practice among insurance providers.

Maintaining a Safe Driving Record

A clean driving record is essential for lower insurance premiums. Here are some tips to maintain a safe driving record:

- Obey Traffic Laws: This may seem obvious, but strictly adhering to speed limits, traffic signals, and other rules of the road is crucial.

- Avoid Distractions: Driving while distracted, such as using a cell phone or texting, can lead to accidents and negatively impact your insurance rates.

- Maintain Your Vehicle: Regular maintenance, including tire checks, oil changes, and brake inspections, helps ensure your vehicle is in optimal condition and reduces the risk of accidents.

- Drive Defensively: Anticipate potential hazards and be prepared to react accordingly. This includes being aware of your surroundings and maintaining a safe distance from other vehicles.

Importance of Financial Responsibility: Cheap Auto Insurance Washington State

Driving without insurance in Washington State is not only illegal but also carries significant financial and legal consequences. It’s crucial to understand the importance of financial responsibility when it comes to driving, as accidents can happen unexpectedly, leaving you with substantial financial burdens if you’re not adequately insured.

Consequences of Driving Without Insurance

The state of Washington mandates that all drivers carry at least the minimum required auto insurance coverage. This is known as “Financial Responsibility” and ensures that drivers can cover the costs of damages and injuries caused by accidents. Driving without insurance in Washington State can lead to:

- License Suspension: If you’re caught driving without insurance, your driver’s license will be suspended. You will not be allowed to drive legally until you provide proof of insurance and pay any fines or penalties imposed by the state.

- Fines and Penalties: You can face significant fines and penalties for driving without insurance. These penalties can range from hundreds to thousands of dollars, depending on the severity of the violation and your driving history.

- Impoundment of Vehicle: Your vehicle may be impounded until you provide proof of insurance. This can result in additional fees and storage costs.

- Court Appearances: You may be required to appear in court to answer charges related to driving without insurance. This can lead to further legal expenses and potentially a criminal record.

Financial Implications of Accidents

Even if you’re a careful driver, accidents can still happen. If you’re involved in an accident and don’t have insurance, you’ll be personally responsible for covering all costs, including:

- Property Damage: Repairing or replacing damaged vehicles or other property involved in the accident.

- Medical Expenses: Covering the medical bills of anyone injured in the accident, including yourself, passengers, and other drivers.

- Legal Fees: Paying legal fees for any lawsuits filed against you by the other party involved in the accident.

- Lost Wages: If you’re unable to work due to injuries or legal proceedings, you’ll have to cover your own lost wages.

These costs can quickly add up, potentially leading to significant financial hardship. In some cases, you may even face bankruptcy if you’re unable to cover the expenses.

Maintaining Adequate Insurance Coverage

Maintaining adequate insurance coverage is crucial to protect yourself financially and legally in the event of an accident. It’s essential to understand the different types of coverage available and choose a policy that meets your specific needs and budget. This includes:

- Liability Coverage: This covers the costs of damages and injuries you cause to others in an accident.

- Collision Coverage: This covers the costs of repairing or replacing your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This covers damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage to cover your losses.

By maintaining adequate insurance coverage, you can protect yourself from significant financial losses and legal liabilities in the event of an accident. It’s a wise investment in your financial security and peace of mind.

Conclusive Thoughts

In the end, securing cheap auto insurance in Washington State is a balancing act between finding the right coverage and managing costs. By understanding the factors that influence premiums, utilizing comparison websites and available discounts, and maintaining a safe driving record, drivers can increase their chances of finding affordable insurance that meets their needs. Remember, driving responsibly and being financially prepared are crucial for navigating the roads and ensuring peace of mind.

FAQ Corner

What is the minimum liability coverage required in Washington State?

Washington requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability, and $10,000 for property damage liability.

How often should I review my auto insurance policy?

It’s recommended to review your policy at least annually, or whenever there are significant life changes like a new car, a change in your driving record, or a move to a new location.

What are some common discounts available for auto insurance in Washington?

Common discounts include good driver discounts, multi-car discounts, safe driver courses, and discounts for anti-theft devices or safety features.