Moving to a new state often involves a lot of adjustments, and one of the most important is updating your car insurance. Changing car insurance to a different state requires more than just notifying your current provider; it necessitates understanding the unique regulations, coverage options, and potential cost variations that come with your new location.

This guide provides a comprehensive overview of the process, from comparing insurance rates and finding the right coverage to making the switch and saving money on your premiums. Whether you’re relocating across the country or just to a neighboring state, this information will help you navigate the complexities of car insurance in your new environment.

Understanding the Process

Switching your car insurance when moving to a new state is a common occurrence, and it’s important to understand the process to ensure a smooth transition. This involves notifying your current insurer, researching new insurance options, and getting a new policy in place.

Getting a New Policy

Before you move, it’s crucial to contact your current insurer and inform them about your upcoming relocation. This step is important for several reasons. First, it allows your insurer to accurately calculate your premium based on the new state’s regulations and risk factors. Second, it ensures a smooth transition and avoids any potential gaps in your coverage.

- Contact Your Current Insurer: Inform your current insurer about your move as soon as possible. Provide them with the date of your move and your new address. They will guide you through the necessary steps and may be able to provide you with a quote for your coverage in the new state.

- Gather Necessary Information: Before contacting new insurance providers, gather essential information, such as your driver’s license, vehicle registration, and a list of your current coverage details. This information will help you compare quotes accurately.

- Research New Insurance Providers: Once you’ve informed your current insurer, start researching insurance providers in your new state. You can use online comparison websites or contact insurance agents directly. Consider factors like coverage options, premiums, customer service, and financial stability when making your decision.

- Get Quotes and Compare Options: Request quotes from different insurance providers in your new state. Compare the coverage options, premiums, and any discounts offered. It’s essential to ensure that the new policy meets your specific needs and provides adequate coverage for your vehicle.

- Choose a Provider and Finalize the Policy: Once you’ve chosen a provider, finalize the policy details. This includes confirming your coverage options, premiums, and payment plan. Ensure you understand the terms and conditions of the policy before signing any paperwork.

- Cancel Your Old Policy: After securing your new insurance policy, notify your current insurer about the cancellation of your existing policy. Ensure you understand the cancellation process and any applicable fees or penalties. You may need to provide them with proof of your new policy.

Factors to Consider

When switching car insurance to a different state, it’s essential to understand the variations in regulations and factors that can impact your premiums.

State-Specific Regulations and Requirements

Every state has its own set of car insurance laws, which can significantly impact your coverage and costs. Some states mandate specific coverage types, while others have more lenient requirements.

- Minimum Liability Coverage: This coverage protects you financially if you cause an accident. States have varying minimum liability limits, influencing the cost of your policy.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have adequate insurance or is uninsured. States have different requirements for this coverage.

- Personal Injury Protection (PIP): Some states mandate PIP coverage, which covers medical expenses and lost wages after an accident, regardless of fault. States without mandatory PIP coverage might offer it as an optional add-on.

Factors Influencing Insurance Rates

Several factors can influence your car insurance rates in a new state. Understanding these factors can help you make informed decisions about your coverage and potentially reduce your premiums.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, significantly impacts your insurance rates. A clean driving record generally results in lower premiums.

- Vehicle Type: The type of vehicle you drive influences your insurance rates. Sports cars and luxury vehicles are often considered higher risk and attract higher premiums than more affordable, standard vehicles.

- Coverage Needs: The type and amount of coverage you choose directly affect your insurance premiums. Higher coverage limits typically result in higher premiums.

- Location: Your new state’s location and the specific area within that state can influence your insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency often have higher insurance premiums.

- Credit Score: In some states, your credit score can be a factor in determining your insurance rates. A higher credit score might result in lower premiums.

Potential Impact of Higher or Lower Insurance Costs

Moving to a state with higher or lower insurance costs can have a significant impact on your budget.

- Higher Insurance Costs: If you move to a state with higher insurance costs, you might need to adjust your budget to accommodate the increased expense. This might involve reducing other expenses or exploring ways to lower your insurance premiums.

- Lower Insurance Costs: Moving to a state with lower insurance costs can be beneficial, allowing you to allocate more of your budget to other expenses or save money. However, it’s crucial to ensure that the lower premiums don’t come at the expense of inadequate coverage.

Finding the Right Coverage

You’ve chosen your new state, but now it’s time to ensure you have the right car insurance coverage for your specific needs. Navigating the world of car insurance can be overwhelming, especially when moving to a new state with different regulations and potential risks.

Understanding Different Types of Coverage

Different types of car insurance coverage provide protection for various situations. Knowing which ones are essential for you is crucial.

- Liability Coverage: This is the most basic type of insurance and is usually required by law. It covers damages to other people’s property or injuries caused by you in an accident. It’s split into two parts: bodily injury liability and property damage liability. For example, if you cause an accident and injure another driver, bodily injury liability would cover their medical expenses, while property damage liability would cover repairs to their car.

- Collision Coverage: This covers damage to your vehicle in a collision with another vehicle or an object, regardless of fault. If you’re financing or leasing your car, your lender may require collision coverage. It’s important to weigh the cost of this coverage against the value of your car. For example, if you have an older car with a lower value, it might not be worth the cost of collision coverage.

- Comprehensive Coverage: This protects your car from damage caused by events other than collisions, such as theft, vandalism, hailstorms, or falling objects. Like collision coverage, the value of your car should be considered. It’s generally a good idea for newer vehicles, as it can help protect your investment.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. It’s highly recommended, especially in areas with a higher number of uninsured drivers.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. It’s often required in certain states, but it’s a good idea to consider it even if it’s not mandatory.

Researching and Comparing Quotes

Once you understand the different types of coverage, you can start comparing quotes from various insurance providers in your new state. This will help you find the best coverage at the most affordable price.

- Use Online Comparison Tools: Many websites allow you to enter your information and receive quotes from multiple insurance companies simultaneously. This can save you time and effort.

- Check with Your Current Provider: Your current insurance company may offer coverage in your new state. It’s worth checking with them to see if they can provide a competitive quote.

- Get Quotes from Local Agents: Local insurance agents can provide personalized advice and help you find the right coverage for your specific needs. They can also explain the different coverage options and answer any questions you may have.

- Consider Your Driving History: Your driving record, including any accidents or traffic violations, can significantly affect your insurance premiums. Be prepared to provide your driving history when you request quotes.

- Ask About Discounts: Many insurance companies offer discounts for things like safe driving, good grades, multiple vehicles, or bundling your insurance policies. Be sure to ask about any available discounts.

Comparing Coverage Options and Costs

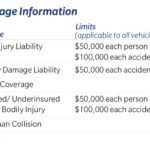

Here’s a table comparing common car insurance coverage options and their potential costs, highlighting key differences:

| Coverage Type | Description | Potential Cost | Key Differences |

|---|---|---|---|

| Liability Coverage | Covers damages to others in an accident | Lower cost | Required by law, covers damage to other people’s property and injuries caused by you |

| Collision Coverage | Covers damage to your vehicle in a collision | Higher cost | Optional, covers damage to your vehicle, regardless of fault |

| Comprehensive Coverage | Covers damage to your vehicle from non-collision events | Higher cost | Optional, covers damage to your vehicle from events like theft, vandalism, or natural disasters |

| Uninsured/Underinsured Motorist Coverage | Protects you if you’re hit by an uninsured driver | Moderate cost | Highly recommended, especially in areas with many uninsured drivers |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages in an accident | Moderate cost | Often required in certain states, helps cover your own medical expenses and lost wages |

Making the Switch: Changing Car Insurance To A Different State

Switching your car insurance to a different state is a relatively straightforward process. You will need to contact your current insurance provider and let them know that you are moving. They may be able to provide you with a new policy that covers you in your new state. Alternatively, you can shop around for a new insurance provider that offers coverage in your new state.

Obtaining a New Insurance Policy, Changing car insurance to a different state

Once you have decided on a new insurance provider, you will need to provide them with some information. This includes your driver’s license, vehicle registration, and proof of residency. You will also need to provide them with information about your driving history and any accidents you have been involved in. Once you have provided this information, the insurance provider will be able to give you a quote for your new policy.

Required Documentation

The specific documentation required to finalize the switch may vary depending on the state. However, you will generally need to provide the following:

- Proof of residency. This could include a utility bill, lease agreement, or voter registration card.

- Vehicle registration. This will show that you own the vehicle and that it is registered in the state where you are moving.

- Driver’s license. Your driver’s license should be valid in the state where you are moving.

Checklist for a Smooth Transition

To ensure a smooth transition to a new insurance provider, consider the following checklist:

- Contact your current insurance provider and inform them of your move. They may be able to provide you with a new policy that covers you in your new state.

- Shop around for different insurance providers and compare quotes.

- Gather all of the required documentation, including proof of residency, vehicle registration, and driver’s license.

- Choose a new insurance provider and finalize your new policy.

- Cancel your old insurance policy once your new policy is in effect.

Tips for Saving Money

Moving to a new state often means adjusting to a new cost of living, and car insurance is no exception. You may find that rates in your new state are higher or lower than what you were paying previously. Fortunately, there are several strategies you can employ to keep your car insurance premiums in check.

Negotiating Rates with Insurance Providers

It’s always a good idea to shop around and compare quotes from multiple insurance companies. This can help you identify the best deals available. When you’re negotiating rates with insurance providers, here are some strategies to keep in mind:

- Ask about discounts: Many insurance companies offer discounts for things like good driving records, safe driving courses, multiple policies, and even being a member of certain organizations. Be sure to ask about all the discounts you may be eligible for.

- Bundle your policies: If you have multiple insurance needs, such as home, renters, or life insurance, bundling your policies with the same provider can often lead to significant savings.

- Consider increasing your deductible: Raising your deductible, the amount you pay out of pocket before your insurance kicks in, can help lower your premiums. This is a good option if you’re comfortable with a higher out-of-pocket expense in the event of an accident.

- Shop around every year: Your insurance needs and driving habits may change over time. It’s a good idea to shop around for new quotes every year to ensure you’re still getting the best rate.

Final Review

Moving to a new state can be exciting, but it’s essential to ensure you’re adequately protected on the road. By understanding the process of changing car insurance, comparing rates, and finding the right coverage, you can confidently navigate this transition and enjoy peace of mind while driving in your new home.

Questions and Answers

Do I need to change my car insurance immediately after moving?

It’s generally recommended to change your car insurance within 30 days of moving to a new state. Some states require you to notify your insurer within a specific timeframe.

Can I keep my current car insurance policy after moving?

While you might be able to keep your current policy for a short period, most insurers won’t cover you in a different state for long. You’ll likely need to obtain a new policy in your new state.

What documents do I need to switch car insurance providers?

You’ll typically need your driver’s license, vehicle registration, proof of residency, and possibly your current insurance policy details.