Car registered in one state and insured in another: a common scenario for many, especially those who move frequently or work across state lines. While it might seem like a simple matter of convenience, this practice can lead to unexpected legal and financial consequences. This article delves into the complexities of this practice, exploring the legal considerations, insurance coverage, financial implications, practical considerations, and common scenarios.

From understanding the nuances of state laws and insurance policies to navigating the process of obtaining registration and insurance in different states, we’ll shed light on the potential pitfalls and benefits of this practice. By understanding the implications of registering a car in one state and insuring it in another, you can make informed decisions that best suit your needs and protect your interests.

Legal Considerations

Registering a car in one state and insuring it in another is a common practice, especially for people who move frequently or work in different states. However, it is important to understand the legal implications of this practice. While it is generally permissible to register a car in one state and insure it in another, there are several potential legal issues that could arise.

State Laws Regarding Vehicle Registration and Insurance

State laws regarding vehicle registration and insurance vary significantly. Each state has its own set of rules and regulations regarding the registration and insurance of vehicles. These laws can be complex and difficult to navigate, particularly when dealing with multiple states. It is important to understand the specific laws of the states involved in your situation.

- For example, some states require residents to register their vehicles within a certain timeframe after moving to the state. Failure to comply with these requirements can result in fines or other penalties.

- Similarly, some states have minimum insurance requirements that must be met in order to operate a vehicle legally within the state. These requirements may differ from the minimum insurance requirements in other states.

- Additionally, some states have reciprocity agreements with other states, which means that drivers from those states are exempt from certain registration or insurance requirements.

Insurance Coverage

Registering a car in one state and insuring it in another is a common practice, but it’s crucial to understand how this arrangement might affect your insurance coverage. The differences in state laws, regulations, and insurance company practices can lead to discrepancies in the coverage you receive.

Coverage Differences Based on State of Registration and Insurance

The state where your car is registered determines the minimum liability insurance requirements you must meet. These requirements dictate the minimum coverage levels for bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. The state where you purchase your insurance policy may have different requirements or coverage options available.

For instance, if your car is registered in a state with a higher minimum liability limit than the state where you purchase your insurance, you might find yourself underinsured in the event of an accident. Conversely, if your car is registered in a state with lower minimum requirements but you purchase insurance in a state with higher requirements, you might have more comprehensive coverage than necessary.

Coverage Comparison Across Different States and Insurance Companies

Insurance companies operate within specific state regulations, leading to variations in coverage offerings and pricing. Some states may have more stringent regulations regarding coverage options, while others may allow for more flexibility. Additionally, insurance companies may offer different coverage packages and discounts depending on the state of operation.

For example, a particular insurance company might offer a comprehensive coverage package in one state but only a basic liability coverage package in another. Similarly, discounts for safe driving or good credit history might be available in one state but not in another.

Potential Coverage Gaps

When registering a car in one state and insuring it in another, potential gaps in coverage may arise. This can occur due to discrepancies in state laws, insurance company practices, or the specific coverage options chosen.

For example, if you are involved in an accident in a state where your car is not registered, your insurance company might not cover the full extent of damages based on the state’s minimum liability requirements. Similarly, if you choose a basic liability coverage package in a state with higher minimum requirements, you might be underinsured in the event of a serious accident.

It’s essential to carefully review your insurance policy and understand the specific coverage provided in both the state of registration and the state of insurance. Consulting with an insurance agent can help you identify any potential gaps in coverage and ensure you have adequate protection.

Financial Implications

Registering a car in one state and insuring it in another can have significant financial implications, impacting both the cost of registration and insurance. It’s essential to carefully analyze these costs to determine if this practice is financially beneficial or not.

Comparison of Registration Costs

The cost of registering a car varies considerably from state to state. Several factors influence these costs, including the vehicle’s age, make, and model, as well as the state’s specific registration fees and taxes.

- For instance, in states like California, registration fees are generally higher due to factors like the state’s population density and its robust public transportation system.

- Conversely, states like Wyoming often have lower registration fees, reflecting their lower population density and reliance on personal vehicles.

By registering a car in a state with lower registration fees, individuals may potentially save money. However, it’s crucial to consider the long-term implications of this decision, such as the potential for higher insurance premiums or the inconvenience of needing to maintain two vehicle registrations if you move to a different state.

Comparison of Insurance Premiums

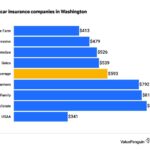

Insurance premiums also vary widely across states, influenced by factors such as the cost of living, the frequency of accidents, and the availability of healthcare services.

- States with high populations and traffic congestion, such as New York and California, often have higher insurance premiums due to the increased risk of accidents.

- Conversely, states with lower population densities and less traffic congestion, such as Wyoming and Montana, may have lower insurance premiums.

Insuring a car in a state with lower insurance premiums can potentially save money. However, it’s crucial to ensure that the insurance policy meets your specific needs and provides adequate coverage.

Potential Savings and Costs

The financial implications of registering a car in one state and insuring it in another depend on various factors, including the specific states involved, the vehicle’s characteristics, and the individual’s driving history.

- In some cases, individuals may be able to save money on both registration and insurance by choosing states with lower costs.

- However, it’s essential to weigh the potential savings against the potential costs, such as the inconvenience of maintaining two registrations or the risk of inadequate insurance coverage.

For example, if you live in a state with high registration and insurance costs, you might consider registering your car in a neighboring state with lower costs. However, you should carefully assess the potential risks and benefits before making such a decision.

Practical Considerations

Registering a car in one state and insuring it in another can present both practical advantages and challenges. Understanding the process and potential hurdles can help you make an informed decision.

Obtaining Registration in Different States

The process of registering a car varies by state. Generally, you’ll need to:

- Provide proof of ownership, such as a title or bill of sale.

- Show proof of insurance.

- Pass an emissions test, if required by the state.

- Pay applicable registration fees.

In some states, you may also need to undergo a safety inspection. You can find specific requirements for your desired state on the Department of Motor Vehicles (DMV) website.

Obtaining Insurance in Different States

Securing insurance in a state different from where your car is registered can be straightforward. Most insurance companies operate nationwide. However, some nuances exist:

- State-Specific Coverage Requirements: Each state has its own minimum insurance coverage requirements. Make sure your policy meets the requirements of the state where you are registering your car.

- Premium Differences: Insurance premiums can vary by state based on factors like accident rates, cost of living, and other state-specific variables. You may find that your premium is higher or lower depending on where you insure your car.

- No-Fault Laws: Some states have “no-fault” insurance laws, which dictate how accidents are handled. If you are registering your car in a no-fault state, you may need to adjust your insurance coverage accordingly.

Logistical Challenges

- Proof of Residency: Some states may require you to provide proof of residency to register your car. If you are not physically living in the state where you are registering your car, you may need to find a way to demonstrate residency, such as renting a mailbox or having a relative’s address.

- Insurance Verification: States often require insurance verification during the registration process. You may need to provide your insurance company with your new registration information to ensure proper verification.

- Out-of-State Inspections: Some states may require you to have your car inspected in the state where it is registered, even if you are insuring it in a different state. This can create logistical challenges if you are not physically located in the registration state.

Common Scenarios

Registering a car in one state and insuring it in another can be a strategic move for certain individuals and situations. This approach can lead to cost savings, access to better coverage options, or even be necessary due to specific circumstances.

Scenarios for Registering a Car in One State and Insuring in Another, Car registered in one state and insured in another

This section Artikels common scenarios where this practice can be beneficial.

- State of Residence vs. State of Employment: If you reside in one state but work in another, registering your car in the state where you work may offer lower insurance premiums. This is because insurance rates are often influenced by factors such as traffic density, accident rates, and the cost of living. For example, someone living in a rural area of a low-cost state might find it advantageous to register their car in a neighboring state with a higher cost of living but lower insurance rates.

- Frequency of Travel: Individuals who frequently travel between states might benefit from registering their car in the state where they spend the most time. This can simplify insurance coverage and ensure you have adequate protection while driving in that state. For instance, a person who lives in California but spends most of their time working and driving in Nevada might find it more convenient to register their car in Nevada.

- Insurance Coverage Options: Some states offer more comprehensive or specialized insurance coverage options than others. If you need a particular type of coverage that is not readily available in your state of residence, registering your car in another state with more favorable options might be beneficial. For example, someone who frequently drives in mountainous terrain might seek out a state that offers comprehensive coverage for off-road driving.

- Cost Savings: As mentioned earlier, insurance premiums can vary significantly between states. By registering your car in a state with lower insurance rates, you can potentially save a considerable amount of money on your annual premiums. This is particularly relevant for individuals with high-risk profiles or those who drive luxury vehicles.

Best Practices: Car Registered In One State And Insured In Another

Navigating the complexities of registering a car in one state and insuring it in another requires careful planning and adherence to best practices. Understanding the factors involved in choosing the appropriate state for registration and insurance, and consulting with legal and insurance professionals, are crucial steps in this process.

Choosing the Appropriate State for Registration and Insurance

The decision of where to register your car and obtain insurance should be based on a comprehensive assessment of your individual circumstances and the specific requirements of each state.

- Residency: Generally, you are required to register your vehicle in the state where you reside. However, there may be exceptions for individuals who work in another state or have a second home.

- Insurance Rates: Insurance premiums vary significantly between states. Researching insurance rates in different states can help you identify the most cost-effective option.

- Vehicle Registration Fees: States have different fees associated with vehicle registration. Comparing registration fees in various states can help you minimize your overall costs.

- Vehicle Inspection Requirements: Some states require regular vehicle inspections, while others do not. Consider the inspection requirements of each state when making your decision.

- Traffic Laws and Penalties: Each state has its own traffic laws and penalties. Understanding the traffic regulations in the state where you register your vehicle is essential.

Consulting with Legal and Insurance Professionals

Seeking professional advice from legal and insurance experts is highly recommended when registering a car in one state and insuring it in another.

- Legal Professionals: A legal professional can provide guidance on the legal implications of registering a car in one state and insuring it in another. They can help you understand your rights and obligations and ensure you are in compliance with all applicable laws.

- Insurance Professionals: An insurance professional can help you find the best insurance policy for your needs. They can explain the coverage options available in different states and help you choose the most appropriate policy.

Conclusion

Ultimately, the decision of whether or not to register a car in one state and insure it in another depends on your individual circumstances and needs. While it may seem like a simple matter of convenience, it’s crucial to carefully consider the legal, financial, and practical implications before making a decision. Consulting with legal and insurance professionals can provide valuable insights and guidance, ensuring that you make the best choice for your situation.

Question Bank

Is it legal to register a car in one state and insure it in another?

Generally, yes, but it’s important to understand the specific laws of both states involved. Some states may have stricter requirements or limitations.

What happens if I get into an accident in a state where my car is not registered?

Your insurance coverage will typically apply, but you may need to provide additional documentation to prove your insurance status in the state where the accident occurred.

Can I save money by registering my car in a state with lower registration fees?

Potentially, but you should also consider the cost of insurance, which may be higher in a different state.

What if I move to a new state but keep my car registered in the old one?

You may need to update your registration and insurance within a certain timeframe after moving, depending on the state laws.