Car insurance with state ID is an essential aspect of securing your vehicle and yourself on the road. Your state ID plays a crucial role in verifying your identity and ensuring you meet the necessary requirements for car insurance coverage. This guide delves into the importance of state IDs in the car insurance process, exploring the benefits, requirements, and potential consequences of providing it.

Understanding how state IDs are used for verification and identification is key to navigating the car insurance landscape. From the types of IDs accepted to the potential risks of not providing one, this information empowers you to make informed decisions about your car insurance policy.

Understanding Car Insurance and State IDs: Car Insurance With State Id

Your state ID plays a crucial role in obtaining and maintaining car insurance. It serves as a primary form of identification, verifying your identity and allowing insurance companies to access important information about you.

Types of State IDs and Their Relevance to Car Insurance

State IDs are issued by individual states and serve as proof of identity and residency. Different types of state IDs are available, each with its own specific purpose and relevance to car insurance.

- Driver’s License: This is the most common type of state ID and is essential for driving legally. It provides your name, address, date of birth, and driver’s license number, which are crucial for insurance purposes.

- State ID Card: This card is issued to individuals who do not have a driver’s license but need a form of identification. It typically contains similar information to a driver’s license, such as your name, address, and date of birth.

- Non-Driver ID Card: This card is specifically designed for individuals who do not drive but require a form of identification. It may not contain driving-related information but will include your name, address, and date of birth.

How State IDs are Used for Verification and Identification

State IDs are used extensively in the car insurance process for verification and identification.

- Policy Application: When you apply for car insurance, you will be required to provide your state ID information. This helps the insurance company verify your identity and confirm your residency.

- Proof of Identity: Your state ID serves as proof of identity when you need to make a claim. Insurance companies may request your ID to confirm your identity and prevent fraud.

- Driving Record Access: Your driver’s license number allows insurance companies to access your driving record, which is crucial in determining your insurance premium.

Benefits of Providing State ID for Car Insurance

Providing your state ID when applying for car insurance is a crucial step in the process. It helps ensure that you are who you say you are and that you are legally allowed to drive. Doing so offers several advantages, making it beneficial for both you and the insurance company.

Advantages of Providing State ID

Providing your state ID allows the insurance company to verify your identity and driving record, leading to several benefits:

- Accurate Policy Creation: Your state ID provides essential information, including your name, address, and date of birth, ensuring the insurance policy is created correctly and tailored to your specific needs.

- Accurate Risk Assessment: By verifying your driving history, the insurance company can accurately assess your risk profile. This allows them to offer you the most appropriate coverage and premiums based on your driving record.

- Reduced Fraud Risk: Providing your state ID helps prevent insurance fraud. It verifies your identity and reduces the likelihood of someone else claiming to be you or using your information to obtain coverage.

Potential Risks of Not Providing State ID

Not providing your state ID can lead to several potential issues:

- Policy Denial: Insurance companies typically require proof of identity before issuing a policy. Failing to provide your state ID could result in your application being denied.

- Delayed Processing: If you do not provide your state ID, the insurance company will need to verify your identity through other means, which can delay the processing of your application.

- Suspicion of Fraud: Not providing your state ID can raise suspicion of fraud, leading to further investigation and potentially delaying or even denying your claim in the future.

Requirements for State ID in Car Insurance

Providing your state-issued ID is a crucial step in securing car insurance. This helps insurers verify your identity and ensure you are who you claim to be. Most states have specific requirements regarding the type of ID accepted and any additional documentation needed.

State-Specific Requirements for State ID in Car Insurance, Car insurance with state id

The specific requirements for state ID in car insurance can vary from state to state. The following table provides an overview of the common requirements:

| State | ID Type Required | Additional Requirements |

|---|---|---|

| Alabama | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Alaska | Driver’s License or State ID Card | None |

| Arizona | Driver’s License or State ID Card | None |

| Arkansas | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| California | Driver’s License or State ID Card | None |

| Colorado | Driver’s License or State ID Card | None |

| Connecticut | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Delaware | Driver’s License or State ID Card | None |

| Florida | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Georgia | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Hawaii | Driver’s License or State ID Card | None |

| Idaho | Driver’s License or State ID Card | None |

| Illinois | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Indiana | Driver’s License or State ID Card | None |

| Iowa | Driver’s License or State ID Card | None |

| Kansas | Driver’s License or State ID Card | None |

| Kentucky | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Louisiana | Driver’s License or State ID Card | None |

| Maine | Driver’s License or State ID Card | None |

| Maryland | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Massachusetts | Driver’s License or State ID Card | None |

| Michigan | Driver’s License or State ID Card | None |

| Minnesota | Driver’s License or State ID Card | None |

| Mississippi | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Missouri | Driver’s License or State ID Card | None |

| Montana | Driver’s License or State ID Card | None |

| Nebraska | Driver’s License or State ID Card | None |

| Nevada | Driver’s License or State ID Card | None |

| New Hampshire | Driver’s License or State ID Card | None |

| New Jersey | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| New Mexico | Driver’s License or State ID Card | None |

| New York | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| North Carolina | Driver’s License or State ID Card | None |

| North Dakota | Driver’s License or State ID Card | None |

| Ohio | Driver’s License or State ID Card | None |

| Oklahoma | Driver’s License or State ID Card | None |

| Oregon | Driver’s License or State ID Card | None |

| Pennsylvania | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Rhode Island | Driver’s License or State ID Card | None |

| South Carolina | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| South Dakota | Driver’s License or State ID Card | None |

| Tennessee | Driver’s License or State ID Card | None |

| Texas | Driver’s License or State ID Card | None |

| Utah | Driver’s License or State ID Card | None |

| Vermont | Driver’s License or State ID Card | None |

| Virginia | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Washington | Driver’s License or State ID Card | None |

| West Virginia | Driver’s License or State ID Card | Proof of residency (utility bill, bank statement) |

| Wisconsin | Driver’s License or State ID Card | None |

| Wyoming | Driver’s License or State ID Card | None |

Process of Providing State ID for Car Insurance

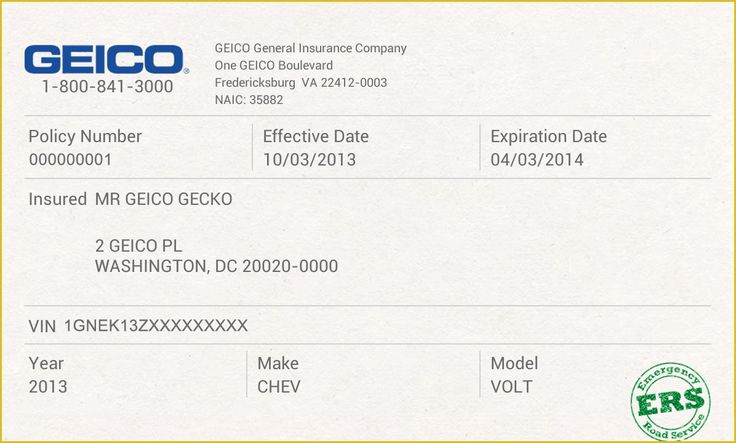

The process of providing your state ID for car insurance is straightforward. The following flowchart illustrates the general steps involved:

[Flowchart illustration would be here]

1. Contact an Insurance Agent or Broker: Begin by reaching out to an insurance agent or broker. They can help you find the best car insurance policy based on your needs and budget.

2. Provide Your State ID: During the application process, you will be asked to provide your state-issued ID. This is typically a driver’s license or state ID card.

3. Verify Your Identity: The insurance company will verify your identity using your state ID. They may also ask for additional documentation, such as proof of residency.

4. Complete the Application: Once your identity has been verified, you can complete the rest of the application process.

5. Receive Your Policy: After your application has been approved, you will receive your car insurance policy.

Consequences of Not Providing State ID

While it may seem like a minor detail, providing your state ID when applying for car insurance is crucial. Failure to do so can lead to various issues, impacting your ability to secure coverage and even causing legal repercussions.

Potential Consequences of Not Providing State ID

Failing to provide your state ID can have several negative consequences, affecting both your insurance coverage and your legal standing.

- Delayed or Denied Coverage: Insurance companies rely on state IDs to verify your identity and confirm your eligibility for coverage. Without it, they may delay or deny your application altogether, leaving you uninsured and vulnerable.

- Higher Premiums: Some insurance companies may view the lack of a state ID as a risk factor, potentially leading to higher premiums. They might perceive it as a sign of potential instability or a lack of transparency, leading to increased costs for you.

- Difficulty in Claim Processing: In the event of an accident, providing your state ID is essential for claim processing. Without it, insurance companies may struggle to verify your identity and process your claim efficiently, delaying your compensation.

- Legal Complications: Driving without proper identification, including your state ID, can lead to legal issues. Depending on your state’s laws, you could face fines, license suspension, or even arrest.

Examples of Scenarios

Let’s consider some real-life situations where not providing your state ID could lead to complications:

- Scenario 1: Accident with Uninsured Driver: Imagine you’re involved in an accident with an uninsured driver. Without your state ID, the insurance company may have difficulty verifying your identity and processing your claim. This could lead to delays in receiving compensation for damages, adding to your stress and financial burden.

- Scenario 2: Traffic Stop: During a routine traffic stop, if you cannot provide a valid state ID, you could face fines or even be detained. This situation can escalate quickly, potentially leading to legal complications and a negative impact on your driving record.

Legal Implications of Not Providing State ID

In most states, driving without a valid driver’s license and proper identification, including your state ID, is illegal. Failure to comply with these laws can result in fines, license suspension, or even arrest. The severity of the consequences depends on the specific laws in your state and the circumstances of the situation.

Protecting Personal Information

Providing your state ID for car insurance is essential for verifying your identity and ensuring accurate policy details. However, it’s crucial to understand how insurance companies handle your personal information and take steps to protect your privacy.

Importance of Protecting Personal Information

Sharing your state ID with an insurance company means entrusting them with sensitive personal information. This information could be misused if not handled securely. Identity theft and fraud are serious concerns, and it’s vital to be aware of potential risks.

Insurance Company Practices for Protecting Personal Information

Insurance companies are legally obligated to protect the personal information of their customers. They implement various security measures to safeguard this data.

Tips for Protecting Personal Information

- Verify the Insurance Company’s Privacy Policy: Before providing any personal information, review the company’s privacy policy to understand how they collect, use, and protect your data. Look for clear explanations of data security measures and how they handle data sharing.

- Limit Information Sharing: Provide only the information required for the insurance application. Don’t share unnecessary details, such as your Social Security number, unless explicitly requested.

- Secure Your Documents: Keep your state ID and other personal documents in a safe place, away from unauthorized access. Consider using a secure file cabinet or a fireproof safe.

- Monitor Your Credit Reports: Regularly check your credit reports for any suspicious activity. This can help you detect potential identity theft early on.

- Be Cautious Online: Be wary of phishing scams or websites that request personal information without a legitimate reason. Always double-check the website’s authenticity before submitting any data.

Closing Notes

Ultimately, providing your state ID for car insurance is a vital step in securing comprehensive coverage. By understanding the benefits, requirements, and consequences involved, you can ensure a smooth and secure experience while protecting yourself and your vehicle on the road. Remember to safeguard your personal information, and don’t hesitate to reach out to your insurance provider with any questions.

Clarifying Questions

What types of state IDs are typically accepted for car insurance?

Most insurance companies accept standard driver’s licenses, state-issued IDs, and military IDs. However, it’s always best to confirm with your specific insurance provider.

Can I use a temporary driver’s license for car insurance?

In most cases, temporary driver’s licenses are accepted. However, you may need to provide additional documentation, such as a proof of address or a learner’s permit, depending on the insurer’s policies.

What happens if I lose my state ID and need to get car insurance?

If you lose your state ID, you can usually provide other forms of identification, such as a passport or a birth certificate, along with a police report or a temporary ID. Contact your insurance provider for specific instructions.