Car insurance when moving states sets the stage for a journey of navigating new regulations and finding the best coverage for your needs. Whether you’re moving across the country or just to a neighboring state, understanding how car insurance requirements differ is crucial. This guide will provide a comprehensive overview of the key factors to consider, helping you make informed decisions throughout the process.

Each state has its own unique set of car insurance laws, dictating the minimum coverage levels required for drivers. This means that the policy you’ve relied on for years in your current state might not meet the requirements of your new home. Additionally, factors like your driving history, the type of vehicle you drive, and your new location can significantly influence your insurance premiums.

Understanding State-Specific Car Insurance Requirements

Every state in the United States has its own unique set of car insurance requirements, so understanding these differences is crucial when you move to a new state. While some basic coverage types are generally mandatory across the country, the specific details, such as minimum coverage amounts, coverage types, and additional requirements, can vary significantly.

Minimum Coverage Requirements

Minimum coverage requirements dictate the minimum amount of financial protection you must have to legally drive in a state. These requirements typically include liability coverage, which protects you financially if you cause an accident that injures someone or damages their property.

- For instance, in California, the minimum liability coverage requirements are $15,000 per person for bodily injury, $30,000 per accident for bodily injury, and $5,000 for property damage.

- However, in New York, the minimum liability coverage requirements are $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 for property damage.

It’s important to note that minimum coverage requirements are just that – minimums. You may want to consider higher coverage limits to ensure you have adequate financial protection in the event of a serious accident.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage protects you if you are involved in an accident with a driver who does not have adequate insurance or is uninsured altogether.

- For example, some states require uninsured motorist coverage, while others make it optional.

- States may also have different minimum coverage limits for uninsured/underinsured motorist coverage.

This coverage is essential because it can help cover your medical expenses, lost wages, and other damages if you are injured in an accident caused by an uninsured or underinsured driver.

Personal Injury Protection (PIP)

Personal injury protection (PIP) coverage, sometimes referred to as no-fault insurance, covers your own medical expenses, lost wages, and other related expenses after an accident, regardless of who was at fault.

- Some states, such as Florida and Michigan, require PIP coverage, while others do not.

- States that do require PIP coverage may have different minimum coverage limits and deductibles.

PIP coverage can be particularly beneficial if you are injured in an accident where the other driver is at fault, as it can help cover your expenses while you wait for the other driver’s insurance company to resolve the claim.

Transferring Your Existing Policy

Moving to a new state can be an exciting time, but it’s also a good opportunity to review your car insurance policy. Your current insurer might not provide coverage in your new state, or you might find that your current policy doesn’t meet the new state’s requirements.

Notifying Your Current Insurer

It’s crucial to inform your current insurer about your move as soon as possible. This allows them to adjust your policy accordingly and ensure you have the right coverage in your new state. You can usually notify your insurer by phone, email, or through their online portal. Be sure to provide them with your new address and the date you plan to move.

Obtaining a New Car Insurance Policy

Moving to a new state often means getting a new car insurance policy. Your current insurer may not cover you in your new state, or you might find more affordable options. Here’s how to get a new car insurance policy in your new state.

Steps Involved in Getting a New Car Insurance Policy

To get a new car insurance policy, you’ll need to follow these steps:

- Gather your information: This includes your driver’s license, vehicle registration, proof of insurance, and any other relevant documents, such as your driving history report.

- Contact insurance companies: Research and compare quotes from different insurance companies in your new state.

- Provide information: You’ll need to provide the insurance company with your personal information, vehicle details, and driving history.

- Choose a policy: Once you’ve compared quotes and chosen a policy, you’ll need to sign the contract and pay your first premium.

- Cancel your old policy: Make sure to cancel your old car insurance policy once you’ve secured your new one.

Comparing Car Insurance Quotes

When comparing quotes, it’s essential to consider factors like:

- Coverage: Make sure the coverage you choose meets your needs.

- Deductibles: Higher deductibles typically lead to lower premiums.

- Discounts: Check for discounts that you qualify for, such as good driver discounts or multi-car discounts.

- Customer service: Read reviews and consider the insurance company’s reputation for customer service.

Factors Affecting Car Insurance Premiums

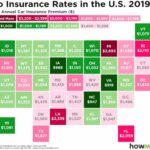

Several factors can influence your car insurance premiums in your new state:

- Driving history: Your driving record, including accidents and traffic violations, significantly impacts your premium.

- Vehicle type: The make, model, and year of your car can affect your insurance cost. Some vehicles are considered riskier to insure than others.

- Location: Your new state’s overall risk profile and the specific location within the state can affect your premiums. Areas with higher crime rates or more traffic accidents tend to have higher insurance costs.

- Age and gender: In some states, your age and gender can influence your premiums.

- Credit score: In some states, insurance companies use your credit score to assess your risk. A higher credit score typically leads to lower premiums.

Potential Coverage Gaps and Overlaps

Moving to a new state can involve changes to your car insurance coverage, potentially leading to gaps or overlaps in your protection. Understanding these potential issues and taking proactive steps to address them is crucial for ensuring continuous and adequate coverage.

Ensuring Continuous Coverage During the Move

It’s essential to maintain continuous coverage throughout the moving process to avoid any potential gaps in your insurance. This is particularly important if you’re driving your vehicle to your new state. Here are some steps to ensure continuous coverage:

- Notify Your Current Insurer: Inform your current insurer about your move well in advance, ideally at least a week before your departure. Provide them with your new address and the date you plan to move. This will allow them to update your policy and ensure you have the right coverage for your new location.

- Request a Certificate of Insurance: Obtain a certificate of insurance from your current insurer. This document confirms your current coverage and can be helpful if you need to show proof of insurance during the move.

- Consider Temporary Coverage: If you’re driving your vehicle to your new state, it’s a good idea to consider temporary insurance coverage. This can be a short-term policy that bridges the gap between your current coverage and your new policy in the new state.

Avoiding Duplicate or Unnecessary Coverage

Moving to a new state might require you to adjust your car insurance coverage to comply with the new state’s requirements. It’s important to avoid paying for duplicate or unnecessary coverage.

- Review Your Current Policy: Carefully review your current policy and identify any coverage that might be redundant or unnecessary in your new state. This could include things like personal injury protection (PIP) or uninsured motorist coverage (UM) that might be required or optional in your new state.

- Compare Quotes: Get quotes from multiple insurers in your new state to compare coverage options and pricing. This will help you identify the best value for your needs and avoid paying for unnecessary coverage.

- Consult with an Agent: An insurance agent can help you navigate the complexities of moving and changing insurance policies. They can provide expert advice and help you find the right coverage for your specific situation.

Addressing Coverage Gaps

It’s crucial to address any potential coverage gaps that might arise during the moving process. This includes:

- Temporary Coverage Lapse: If you’re moving to a state with different insurance requirements, there might be a temporary lapse in coverage between your current policy expiring and your new policy taking effect. To avoid this, ensure your new policy starts on the same day or before your current policy expires.

- Coverage Level Discrepancies: Some states have different minimum coverage requirements. If your current coverage doesn’t meet the minimum requirements in your new state, you might need to adjust your policy to ensure you have adequate coverage. It’s essential to review your policy and compare it with the new state’s requirements.

Tips for Avoiding Coverage Gaps and Overlaps

- Start Early: Begin the process of finding new insurance coverage well in advance of your move. This gives you ample time to research, compare quotes, and make informed decisions.

- Communicate with Your Insurer: Keep your current insurer informed about your move and any changes to your situation. This will help them adjust your policy accordingly and prevent any potential coverage gaps.

- Document Everything: Keep a record of all communication with your current and new insurers. This documentation can be helpful if any disputes arise.

Considerations for Specific Situations

Moving to a new state can involve unique car insurance considerations, particularly if you’re bringing a new vehicle or have a high-risk profile. It’s essential to understand these nuances to ensure you have adequate coverage and avoid potential gaps in protection.

Moving with a New Vehicle

When moving with a new vehicle, whether it’s a purchase or a lease, you’ll need to notify your insurer about the change. Your existing policy may not cover the new vehicle, so it’s crucial to discuss your options with your insurer.

- New Vehicle Purchase: If you’ve purchased a new vehicle, your insurer will need information about the make, model, year, and VIN (Vehicle Identification Number). They will then assess the risk associated with the new vehicle and adjust your premium accordingly.

- Leased Vehicle: Lease agreements often require specific insurance coverage, such as collision and comprehensive coverage. You’ll need to ensure your policy meets these requirements and inform your insurer about the lease.

High-Risk Drivers

Individuals considered high-risk drivers, such as young drivers or those with a history of accidents, may face challenges finding affordable car insurance in a new state. Insurance companies assess risk based on factors like age, driving history, and location, and may adjust premiums accordingly.

- Young Drivers: Young drivers typically pay higher premiums due to their lack of experience. They may benefit from exploring discounts offered by insurers, such as good student discounts or driver’s education completion discounts.

- Drivers with Accidents: Drivers with a history of accidents may face higher premiums as they are considered a higher risk. They should shop around for quotes from different insurers to find the best rates. It’s also beneficial to consider defensive driving courses to improve their driving skills and potentially lower premiums.

Specialized Coverage, Car insurance when moving states

Certain vehicles, such as classic cars or commercial vehicles, require specialized insurance coverage. It’s crucial to find an insurer that understands these unique needs and offers appropriate coverage.

- Classic Cars: Classic cars often require specialized coverage that considers their value and unique characteristics. These policies may include agreed-value coverage, which pays out the agreed-upon value of the car in case of a total loss, regardless of the actual market value.

- Commercial Vehicles: Commercial vehicles used for business purposes require specific insurance coverage that meets the requirements of the industry. This may include coverage for cargo, liability, and accidents related to business operations.

Last Recap

Moving states presents both challenges and opportunities when it comes to car insurance. By understanding the differences in state requirements, taking proactive steps to transfer or obtain new coverage, and carefully considering potential coverage gaps, you can ensure a smooth transition and maintain adequate protection on the road. Remember, it’s essential to research your options, compare quotes from multiple insurers, and seek professional advice to make the best decision for your specific situation.

Detailed FAQs: Car Insurance When Moving States

What happens to my current car insurance policy when I move?

Your current insurer may be able to extend your existing policy to your new state, but you’ll need to notify them of your move and provide your new address. However, your coverage might change based on the new state’s requirements.

Do I need to get a new car insurance policy when I move?

It’s highly recommended to get a new car insurance policy in your new state to ensure you meet the minimum coverage requirements. You can compare quotes from different insurers to find the best rates and coverage options.

How can I find out what car insurance requirements are in my new state?

You can visit the website of your new state’s Department of Motor Vehicles (DMV) or contact an insurance agent for information about car insurance requirements in your new state.

What should I do if I have a lapse in coverage while moving?

It’s important to avoid any gaps in coverage, as driving without insurance can result in penalties and fines. You can contact your current insurer to see if they offer temporary coverage while you’re in the process of moving or obtaining a new policy.