Car insurance Washington state average cost can vary significantly depending on a number of factors, including your driving history, the type of vehicle you drive, and your location. Understanding these factors can help you find the most affordable car insurance policy for your needs.

Washington state requires drivers to carry certain types of car insurance, including liability coverage, uninsured motorist coverage, and personal injury protection. However, there are also a number of optional coverages that you can purchase, such as collision coverage, comprehensive coverage, and rental reimbursement.

Understanding Car Insurance in Washington State

Driving a car in Washington State is a privilege that comes with responsibilities, including having adequate car insurance. Car insurance protects you financially if you’re involved in an accident or your vehicle is damaged. Understanding the basics of car insurance and the coverage options available is crucial for making informed decisions.

Mandatory Coverage Requirements

Washington State law requires all drivers to carry a minimum amount of car insurance to cover potential damages or injuries caused to others in an accident. This mandatory coverage includes:

- Liability Coverage: This covers damages and injuries you cause to other people or their property in an accident. It is divided into two parts:

- Bodily Injury Liability: Covers medical expenses, lost wages, and pain and suffering for the other driver and passengers.

- Property Damage Liability: Covers damage to the other driver’s vehicle or property.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This protects you if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages.

- Uninsured Motorist Coverage: Protects you if you are hit by a driver with no insurance.

- Underinsured Motorist Coverage: Protects you if you are hit by a driver with insurance that is insufficient to cover your damages.

Optional Coverage Options, Car insurance washington state average cost

While mandatory coverage protects you against basic liabilities, optional coverage can provide additional financial security in various situations. These options include:

- Collision Coverage: This covers damage to your vehicle in an accident, regardless of who is at fault. For example, if you hit a parked car or a tree, collision coverage will help pay for repairs or replacement.

- Comprehensive Coverage: This covers damage to your vehicle from events other than accidents, such as theft, vandalism, fire, or natural disasters. For example, if your car is damaged by a hailstorm, comprehensive coverage will help pay for repairs or replacement.

- Medical Payments Coverage (Med Pay): This covers medical expenses for you and your passengers, regardless of who is at fault. It is especially helpful if you are injured in an accident and the other driver’s insurance is insufficient.

- Personal Injury Protection (PIP): This coverage is similar to Med Pay, but it also covers lost wages and other expenses related to your injury.

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired or replaced after an accident.

- Roadside Assistance: This coverage provides assistance for things like flat tires, jump starts, and towing.

Factors Influencing Car Insurance Costs

Several factors play a role in determining your car insurance premiums in Washington State. These factors are evaluated by insurance companies to assess your risk profile, ultimately impacting the cost of your policy.

Vehicle Type

The type of vehicle you drive is a major factor influencing your insurance premiums. Insurance companies categorize vehicles based on factors like safety features, repair costs, and the likelihood of theft.

- Luxury and high-performance vehicles tend to have higher insurance costs due to their expensive repair costs and potential for higher risk-taking behavior by drivers. For instance, a Tesla Model S will likely have higher insurance premiums compared to a Honda Civic.

- Older vehicles may have lower insurance premiums, especially if they have depreciated significantly in value. However, they may lack modern safety features, potentially increasing your risk and insurance costs.

- Vehicles with advanced safety features like anti-lock brakes, airbags, and lane departure warnings are often associated with lower premiums due to their potential to reduce accidents.

Driving History

Your driving history is a critical factor in determining your car insurance premiums.

- A clean driving record with no accidents or traffic violations will generally result in lower premiums.

- Accidents and traffic violations, especially those resulting in injuries or property damage, will significantly increase your insurance premiums.

- Driving under the influence (DUI) convictions can lead to significantly higher premiums, sometimes even resulting in policy cancellations.

Credit Score

Surprisingly, your credit score can also affect your car insurance premiums in Washington State.

- A good credit score is generally associated with responsible financial behavior, which insurance companies may interpret as a lower risk.

- A poor credit score, on the other hand, may indicate a higher risk profile, leading to higher insurance premiums.

Age, Gender, and Location

These factors also influence car insurance premiums in Washington State.

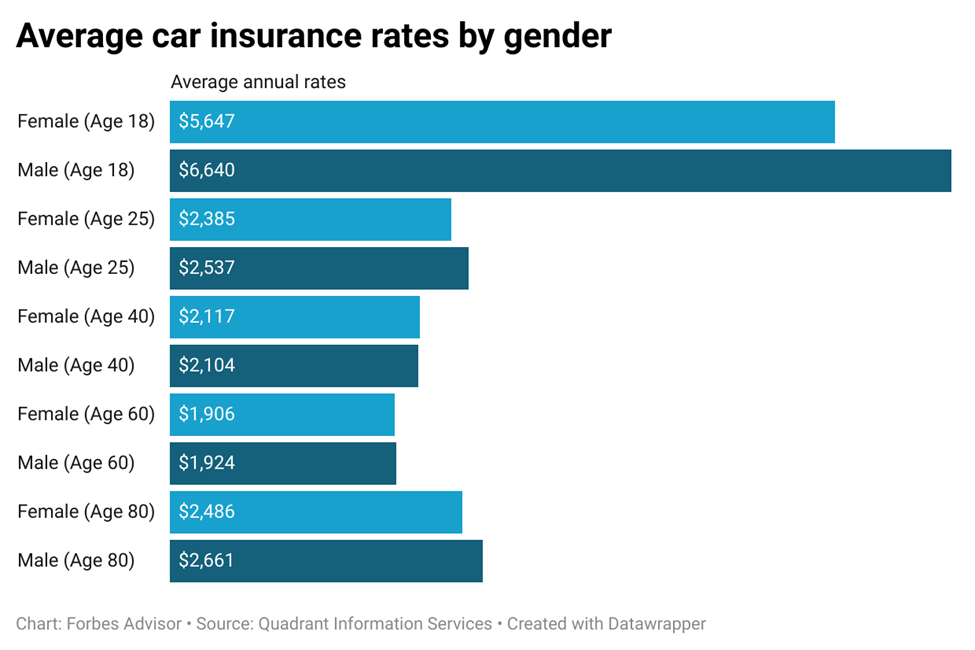

- Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. This increased risk often translates into higher premiums.

- Older drivers, however, may benefit from lower premiums as they tend to have more experience and a better driving record.

- Gender can also play a role, with some studies suggesting that men may have higher insurance premiums than women.

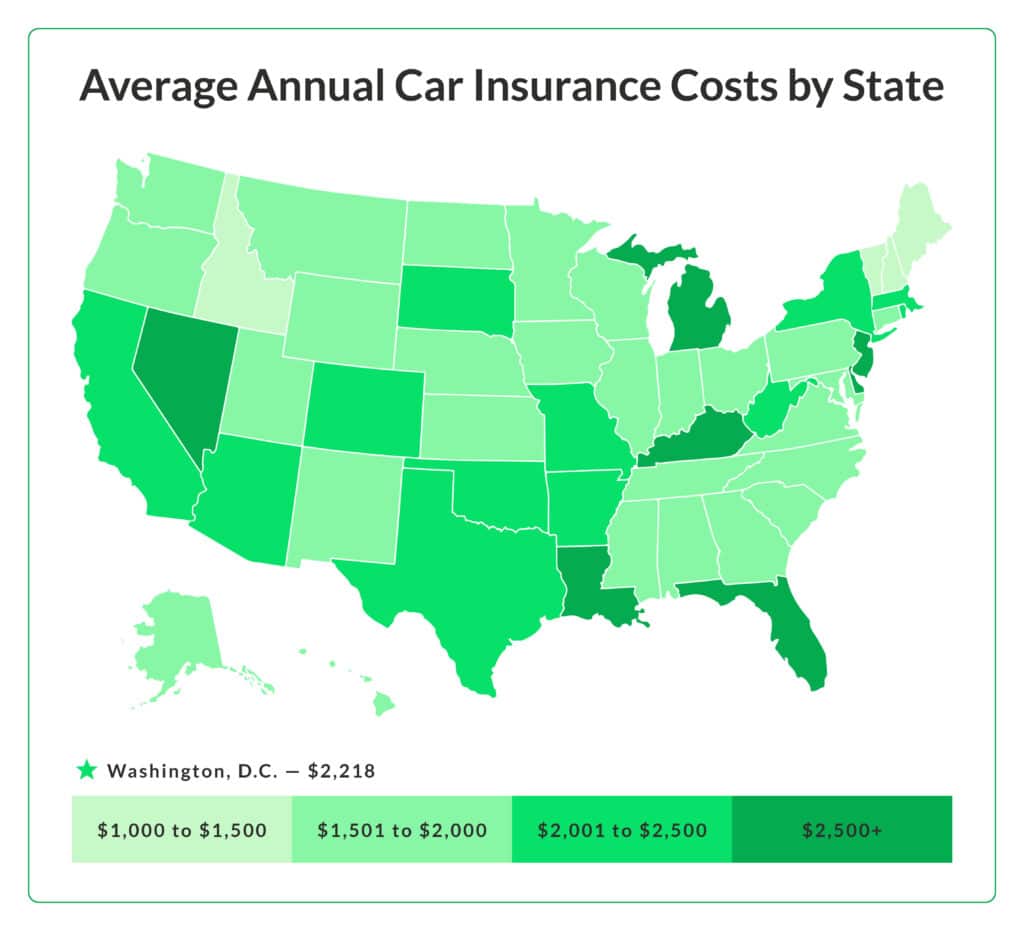

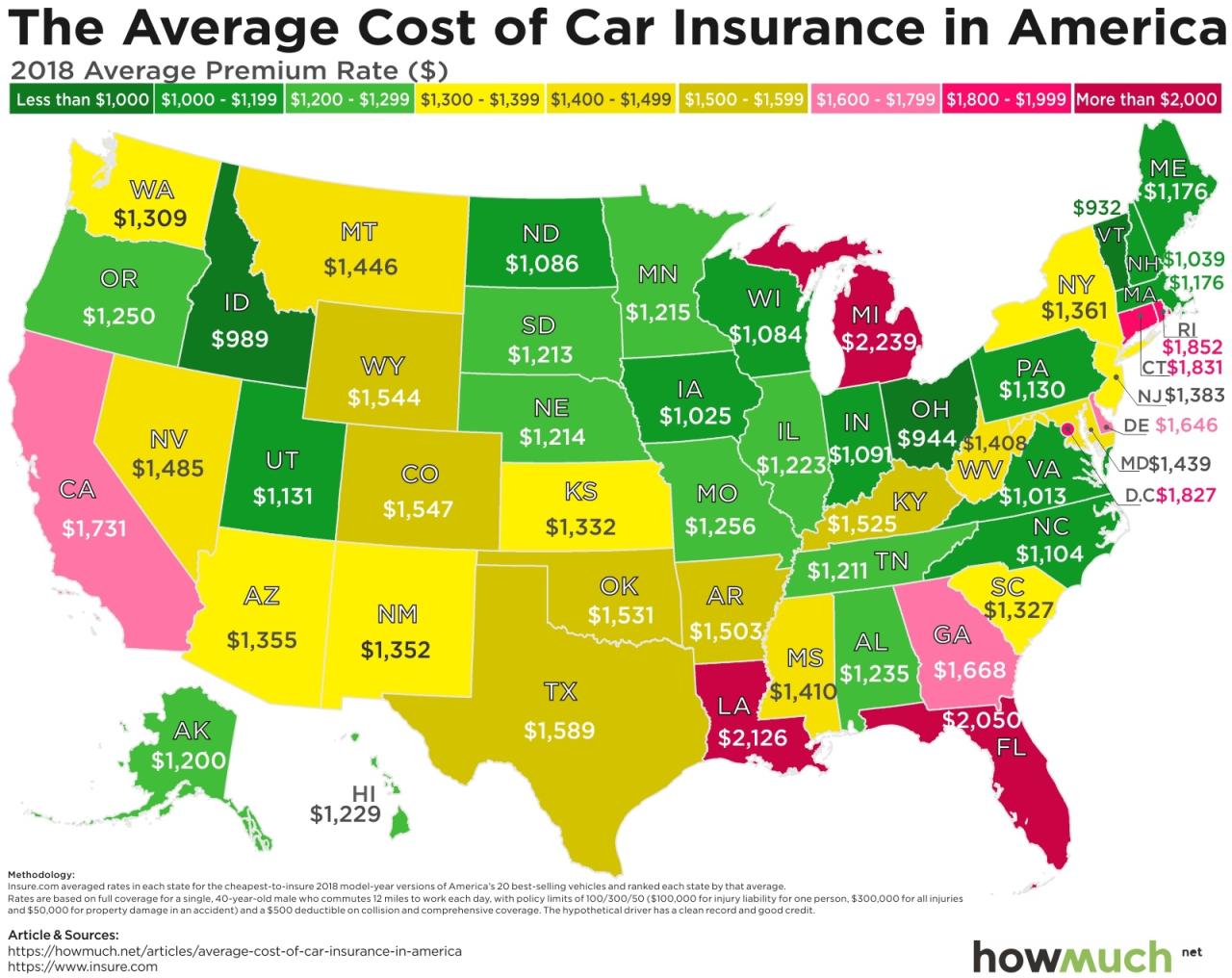

- Location is another important factor, as areas with higher crime rates or traffic congestion may have higher insurance premiums.

Average Car Insurance Costs in Washington State

The cost of car insurance in Washington State can vary widely depending on several factors. Understanding these factors can help you find the best coverage at the most affordable price.

Average Car Insurance Premiums

The average annual cost of car insurance in Washington State is around $2,000. However, this is just an average, and your actual premium will depend on several factors.

| Coverage Type | Average Cost | Factors Influencing Cost | Tips for Saving |

|---|---|---|---|

| Liability Coverage | $500 – $1,000 | Driving history, age, location | Maintain a clean driving record, consider increasing your deductible |

| Collision Coverage | $200 – $500 | Vehicle age and value, driving history, location | Consider dropping collision coverage for older vehicles |

| Comprehensive Coverage | $100 – $300 | Vehicle age and value, location, driving history | Consider dropping comprehensive coverage for older vehicles |

| Uninsured/Underinsured Motorist Coverage | $100 – $200 | State minimum requirements, driving history | Ensure you have sufficient coverage to protect yourself in case of an accident with an uninsured driver |

Factors Affecting Car Insurance Costs

Several factors can influence the cost of your car insurance in Washington State. These factors include:

- Driving History: Your driving record is one of the most significant factors affecting your car insurance premium. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, having accidents or traffic violations can significantly increase your premiums.

- Age and Gender: Younger drivers, especially those under 25, generally pay higher premiums due to their higher risk of accidents. This is because they have less experience on the road. Similarly, gender can also play a role in insurance rates, with some insurers charging higher premiums for young male drivers.

- Location: The location where you live can significantly impact your car insurance premiums. Areas with high crime rates, traffic congestion, and a higher frequency of accidents typically have higher insurance costs. This is because insurance companies assess the risk of claims in different areas.

- Vehicle Type: The type of vehicle you drive can also influence your insurance premiums. High-performance vehicles, luxury cars, and vehicles with a higher theft risk tend to have higher insurance rates. This is because these vehicles are more expensive to repair or replace in case of an accident or theft.

- Credit Score: In some states, including Washington, insurance companies may use your credit score as a factor in determining your car insurance premiums. This is because studies have shown a correlation between credit score and driving behavior. However, this practice is controversial, and some states have banned it.

Finding Affordable Car Insurance

Finding affordable car insurance in Washington State can be a challenge, but with the right strategies, you can secure a policy that fits your budget without compromising on essential coverage.

Comparing Insurance Providers

It’s crucial to compare quotes from multiple insurance providers to find the best rates. Each company uses different algorithms to calculate premiums, leading to variations in pricing.

- Use online comparison websites: Websites like Policygenius, The Zebra, and Insurance.com allow you to compare quotes from various insurers simultaneously, saving you time and effort.

- Contact insurance providers directly: While online comparison websites are convenient, reaching out to insurers directly can provide more personalized quotes and allow you to discuss specific needs and discounts.

- Consider regional insurers: Some smaller, regional insurers may offer more competitive rates than national companies, particularly for specific areas or demographics.

Bundling Insurance Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts. Insurance companies reward customers for consolidating their coverage, making bundling a valuable way to save money.

Bundling policies can lead to savings of up to 25% or more, depending on the insurer and specific policies.

- Contact your current insurer: Check if your existing insurer offers discounts for bundling your policies.

- Explore new providers: If you’re not satisfied with your current insurer’s bundling options, consider switching to a provider that offers more competitive rates for bundled policies.

Evaluating Car Insurance Quotes

When comparing quotes, it’s essential to look beyond the premium price and consider the coverage offered.

- Coverage limits: Compare the liability limits, collision coverage, and comprehensive coverage offered by each insurer.

- Deductibles: Higher deductibles generally lead to lower premiums, but you’ll pay more out of pocket if you file a claim.

- Discounts: Explore available discounts, such as safe driving, good student, and multi-car discounts.

- Customer service: Consider the insurer’s reputation for customer service and claims processing efficiency.

Impact of Driving Habits on Insurance Costs: Car Insurance Washington State Average Cost

Your driving habits play a significant role in determining your car insurance premiums. Insurance companies carefully assess your driving history and behavior to assess the risk you pose. Understanding how your driving habits affect your insurance can help you make informed decisions to potentially save money.

Driving Habits That Can Increase Insurance Costs

Your driving history is a key factor in determining your insurance premiums. Certain driving behaviors are associated with a higher risk of accidents and, consequently, higher insurance costs.

- Speeding Tickets: Speeding tickets indicate a higher risk of accidents and can significantly increase your insurance premiums. Insurance companies view speeding as a reckless behavior that increases the likelihood of accidents.

- Traffic Violations: Other traffic violations, such as running red lights, driving under the influence (DUI), or reckless driving, can also lead to higher insurance premiums. These violations demonstrate a disregard for traffic laws and safety, increasing your risk profile.

- Accidents: Any accidents you have been involved in, even if they were not your fault, can increase your insurance premiums. Insurance companies see accidents as indicators of potential future risk.

- Driving Record: Your overall driving record, including the number of tickets and accidents, is carefully reviewed by insurance companies. A clean driving record generally translates to lower premiums.

Tips for Improving Driving Habits to Save on Insurance

You can take steps to improve your driving habits and potentially lower your insurance premiums.

- Practice Defensive Driving: Defensive driving techniques emphasize anticipating potential hazards and taking precautions to avoid accidents. This includes staying alert, maintaining a safe following distance, and being aware of your surroundings.

- Avoid Distracted Driving: Distracted driving, such as texting, talking on the phone, or eating while driving, significantly increases the risk of accidents. Focus on the road and avoid distractions to maintain a safe driving environment.

- Maintain Your Vehicle: Regular maintenance, including oil changes, tire rotations, and brake inspections, helps ensure your vehicle is in good working order and reduces the risk of breakdowns or accidents.

- Avoid Driving During Peak Hours: Traffic congestion during peak hours increases the risk of accidents. If possible, try to avoid driving during these times to reduce your exposure to potential hazards.

Insurance Discounts and Savings

Saving money on your car insurance is a priority for many drivers. Fortunately, several discounts are available to help lower your premiums in Washington State. Understanding these discounts and how to qualify for them can significantly impact your overall insurance costs.

Common Car Insurance Discounts

Many car insurance companies offer discounts to help policyholders save money. Here are some common discounts:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, meaning no accidents or traffic violations. It often reflects a lower risk to the insurance company.

- Safe Driver Discount: Similar to the good driver discount, this discount is offered to drivers who demonstrate safe driving habits, often measured through telematics devices or driving history data.

- Multi-Car Discount: If you insure multiple vehicles with the same insurance company, you may be eligible for a multi-car discount. This discount reflects the lower risk associated with insuring multiple vehicles from the same household.

- Multi-Policy Discount: Similar to the multi-car discount, this discount applies when you insure multiple types of insurance, such as home, life, or renters insurance, with the same company.

- Defensive Driving Course Discount: Completing a defensive driving course can demonstrate your commitment to safe driving practices and qualify you for a discount. These courses often teach defensive driving techniques and strategies for avoiding accidents.

- Anti-theft Device Discount: Installing anti-theft devices, such as car alarms or GPS trackers, can help deter theft and lower your insurance premium. These devices can help reduce the risk of theft and make it easier to recover your vehicle.

- Good Student Discount: Students with good grades may be eligible for a good student discount. This discount recognizes students who maintain high academic performance, suggesting responsible behavior and lower risk.

- Low Mileage Discount: Drivers who drive fewer miles per year may qualify for a low mileage discount. This discount reflects the lower risk associated with driving less frequently, potentially resulting in fewer accidents.

- Loyalty Discount: Insurance companies often reward long-term customers with loyalty discounts. These discounts recognize customer loyalty and encourage continued business.

- Payment in Full Discount: Paying your insurance premium in full upfront may qualify you for a discount. This reflects the convenience and lower administrative costs for the insurance company.

- Paperless Billing Discount: Many insurance companies offer discounts for choosing paperless billing. This reflects the cost savings associated with electronic communication.

Qualifying for Discounts

To qualify for these discounts, you typically need to meet certain criteria. These criteria can vary by insurance company, so it’s important to contact your insurer directly to understand their specific requirements. For example, to qualify for the good driver discount, you may need to have a clean driving record for a specific period, such as three or five years. Similarly, for the good student discount, you may need to maintain a certain GPA or academic standing.

Potential Savings Through Discounts

Discounts can significantly impact your car insurance premiums. For example, a good driver discount could reduce your premium by 10% or more. Combining multiple discounts can result in even greater savings. It’s important to research and compare insurance quotes from different companies to find the best rates and discounts.

Filing a Car Insurance Claim

Filing a car insurance claim can be a stressful experience, but understanding the process can help you navigate it smoothly. When you’re involved in an accident, it’s crucial to take the necessary steps to protect yourself and ensure your claim is processed efficiently.

Documenting the Accident

Documenting the accident thoroughly is essential for a successful insurance claim. This documentation serves as evidence to support your claim and can help avoid disputes later on.

- Gather Contact Information: Exchange contact information with all parties involved, including their names, addresses, phone numbers, and insurance details.

- Take Photos and Videos: Capture photos and videos of the accident scene, including the damage to your vehicle, the other vehicles involved, and any relevant road signs or traffic signals.

- Get Witness Statements: If there are any witnesses to the accident, obtain their contact information and a brief statement about what they saw.

- File a Police Report: If the accident involves injuries, property damage exceeding a certain threshold, or a hit-and-run, file a police report to document the incident officially.

Steps Involved in Filing a Car Insurance Claim

Once you have documented the accident, you can start the claims process. Here are the general steps involved:

- Contact Your Insurance Company: Notify your insurance company about the accident as soon as possible. They will provide you with instructions on how to file a claim.

- Provide Necessary Information: You will need to provide your insurance company with details about the accident, including the date, time, location, and the other parties involved.

- Submit a Claim Form: Your insurance company will provide you with a claim form to complete and submit. This form will request information about the accident, your vehicle, and the damage.

- Schedule an Inspection: Your insurance company may require an inspection of your vehicle by an appraiser or adjuster to assess the damage.

- Receive a Settlement Offer: Once the damage assessment is complete, your insurance company will provide you with a settlement offer. This offer may cover the cost of repairs, replacement parts, or other expenses related to the accident.

- Negotiate the Settlement: If you disagree with the settlement offer, you can negotiate with your insurance company to reach a mutually acceptable agreement.

Tips for Navigating the Claims Process

Navigating the claims process can be challenging, but following these tips can help you avoid common pitfalls:

- Be Honest and Accurate: Provide your insurance company with accurate and complete information about the accident. Any discrepancies or inconsistencies can delay the claims process or even lead to a denial.

- Be Patient and Persistent: The claims process can take time, so be patient and persistent in following up with your insurance company. Keep detailed records of all communications and deadlines.

- Seek Professional Help: If you are having difficulty navigating the claims process, consider seeking help from a qualified insurance professional or a lawyer.

Wrap-Up

Finding affordable car insurance in Washington state is possible with some research and planning. By understanding the factors that influence car insurance costs, comparing quotes from different insurers, and taking advantage of available discounts, you can save money on your premiums. Remember to review your insurance policy regularly to ensure that you have the coverage you need and that you are getting the best possible rates.

Clarifying Questions

What are the most common car insurance discounts in Washington state?

Some common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts. You may also be eligible for discounts if you have a good credit score, are a member of certain organizations, or have completed a defensive driving course.

How can I compare car insurance quotes?

You can compare car insurance quotes online, over the phone, or by visiting an insurance agent in person. Be sure to compare quotes from multiple insurers to ensure that you are getting the best possible rate.

What should I do if I get into a car accident?

If you get into a car accident, it’s important to stay calm and document the accident as much as possible. Take pictures of the damage, exchange information with the other driver, and contact your insurance company to report the accident.