Car insurance washington state – Car insurance in Washington State is a necessity for all drivers, ensuring financial protection in case of accidents. Navigating the complex world of car insurance can be overwhelming, but understanding the state’s requirements, factors affecting rates, and available coverage options is crucial for making informed decisions. This guide provides a comprehensive overview of car insurance in Washington, empowering you to choose the right coverage and secure the best rates.

From mandatory liability coverage to optional extras like rental car reimbursement, this guide covers all aspects of car insurance in Washington. We’ll delve into the factors that influence your premiums, such as your driving history, vehicle type, age, and location. We’ll also discuss how to file a claim, navigate the claims process, and understand your rights as a policyholder.

Car Insurance Requirements in Washington State

Driving in Washington State requires you to have car insurance, which protects you and others in case of an accident. The state has specific requirements for car insurance coverage, ensuring financial responsibility and safeguarding everyone on the road.

Minimum Liability Coverage Requirements

Washington State mandates that all drivers carry a minimum amount of liability insurance to cover potential damages caused by accidents. This coverage is essential for protecting yourself financially from legal claims resulting from accidents you may cause.

- Bodily Injury Liability: This coverage protects you financially if you injure someone in an accident. The minimum requirement in Washington State is $25,000 per person and $50,000 per accident. This means that if you cause an accident resulting in injuries, your insurance will cover up to $25,000 for each injured person and a maximum of $50,000 for all injuries in a single accident.

- Property Damage Liability: This coverage protects you if you damage someone else’s property in an accident. The minimum requirement in Washington State is $10,000. This means that if you cause an accident that damages someone’s vehicle or property, your insurance will cover up to $10,000 in repairs or replacement costs.

Financial Responsibility Law

Washington State’s Financial Responsibility Law is designed to ensure that drivers have the financial means to cover damages caused by accidents. This law requires drivers to demonstrate proof of financial responsibility, typically through car insurance, to be legally allowed to drive.

The law mandates that all drivers must have at least the minimum liability coverage requirements mentioned earlier. Failing to comply with this law can result in serious consequences, including fines, license suspension, and even vehicle impoundment.

Factors Affecting Car Insurance Rates in Washington

Car insurance premiums in Washington State are influenced by a variety of factors, each contributing to the overall cost of coverage. Understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving history plays a significant role in determining your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Conversely, any traffic violations, accidents, or DUI convictions can significantly increase your rates.

- Traffic Violations: Each violation, such as speeding tickets, running red lights, or reckless driving, adds points to your driving record. The more points you accumulate, the higher your insurance premiums will be.

- Accidents: Even if you were not at fault for an accident, it will still be reflected on your driving record and can increase your premiums. The severity of the accident, such as the number of vehicles involved or the extent of damages, can further impact your rates.

- DUI Convictions: Driving under the influence (DUI) convictions are the most serious offenses and can lead to substantial premium increases. In some cases, insurance companies may even refuse to provide coverage to drivers with multiple DUI convictions.

Vehicle Type

The type of vehicle you drive is another key factor influencing your insurance rates. Insurance companies assess the risk associated with different vehicles based on factors such as:

- Make and Model: Some car models are considered safer than others, which can lead to lower insurance premiums. For example, vehicles with advanced safety features like anti-lock brakes and airbags are often associated with lower rates.

- Value: The value of your vehicle is directly related to the cost of repairs or replacement in case of an accident. More expensive vehicles generally have higher insurance premiums.

- Performance: High-performance cars with powerful engines are often considered riskier to insure, leading to higher premiums. This is because these vehicles are often associated with higher speeds and increased risk of accidents.

Age

Your age is a significant factor in determining your car insurance rates. Younger drivers are statistically more likely to be involved in accidents, which leads to higher premiums. However, rates typically decrease as you get older and gain more experience behind the wheel.

- Young Drivers: Drivers under the age of 25 often face higher premiums due to their lack of experience and increased risk of accidents.

- Mature Drivers: Drivers over the age of 65 may also face higher premiums, although this is less common than for younger drivers. However, certain conditions such as vision problems or medical conditions can lead to higher premiums.

Location

Your location plays a role in your car insurance rates. Insurance companies consider the following factors when determining premiums based on location:

- Crime Rates: Areas with higher crime rates tend to have higher car insurance premiums. This is because there is a greater risk of theft or vandalism in these areas.

- Traffic Density: Areas with heavy traffic congestion are associated with a higher risk of accidents. This can lead to higher premiums in densely populated areas.

- Weather Conditions: Regions with extreme weather conditions, such as heavy snow or frequent hurricanes, can also influence insurance rates. This is because these conditions can increase the risk of accidents and damage to vehicles.

Credit History

In some states, including Washington, insurance companies use your credit history as a factor in determining your car insurance rates.

This practice is controversial, with some arguing that it is unfair to use credit history to assess driving risk. However, insurance companies claim that credit history can be a reliable indicator of financial responsibility, which can translate into safer driving habits.

- Positive Credit History: A good credit history with a high credit score can lead to lower car insurance premiums.

- Negative Credit History: A poor credit history with a low credit score can result in higher premiums. Insurance companies may view individuals with poor credit as higher risk and therefore charge higher rates.

Types of Car Insurance Coverage in Washington: Car Insurance Washington State

Car insurance in Washington State is mandatory, and understanding the different types of coverage is crucial to ensure you have the right protection. The coverage you choose will depend on your individual needs and financial situation.

Liability Coverage

Liability coverage protects you financially if you cause an accident that injures someone or damages their property. This coverage is mandatory in Washington and is typically broken down into two parts:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages related to injuries caused by an accident you are responsible for.

- Property Damage Liability: This coverage pays for repairs or replacement costs for damage to another person’s vehicle or property caused by an accident you are responsible for.

Liability coverage limits are expressed as a pair of numbers, such as 25/50/10. The first number represents the maximum amount your insurer will pay per person for bodily injury, the second number represents the maximum amount your insurer will pay per accident for bodily injury, and the third number represents the maximum amount your insurer will pay for property damage per accident.

Washington State law requires a minimum liability coverage limit of 25/50/10.

It’s essential to choose liability limits that provide adequate protection, considering the potential costs associated with a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement costs for your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it’s essential if you want to protect yourself financially in the event of an accident.

- Benefits:

- Provides financial protection for your vehicle after an accident.

- Helps you avoid paying out-of-pocket for repairs.

- Can be essential if you have a loan or lease on your vehicle.

- Drawbacks:

- Can be expensive, especially for newer or more expensive vehicles.

- You may have to pay a deductible before your insurance kicks in.

Collision coverage can be a valuable investment, especially if you drive an older vehicle or live in an area with a high risk of accidents.

Comprehensive Coverage

Comprehensive coverage pays for repairs or replacement costs for your vehicle if it is damaged by something other than a collision, such as theft, vandalism, fire, or natural disasters. This coverage is optional, but it can be helpful to protect yourself financially from unexpected events.

- Benefits:

- Provides financial protection for your vehicle from a wide range of risks.

- Can help you avoid paying out-of-pocket for repairs.

- Can be essential if you have a loan or lease on your vehicle.

- Drawbacks:

- Can be expensive, especially if you have a high-value vehicle.

- You may have to pay a deductible before your insurance kicks in.

Comprehensive coverage can be a good idea if you live in an area prone to natural disasters or if you have a vehicle that is particularly valuable.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you financially if you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage is optional, but it can be essential to protect yourself financially if you are involved in an accident with a driver who does not have adequate insurance.

- Benefits:

- Provides financial protection if you are injured by an uninsured or underinsured driver.

- Can help you cover medical expenses, lost wages, and other damages.

- Drawbacks:

- Can be expensive, but it is often a good value for the protection it provides.

UM/UIM coverage is essential for anyone who drives in Washington State, as it provides a safety net in the event of an accident with a driver who does not have adequate insurance.

Optional Coverage Options

In addition to the basic types of coverage, there are a number of optional coverage options available that can provide additional protection. These options include:

- Rental Car Reimbursement: This coverage pays for a rental car if your vehicle is damaged in an accident and is being repaired. This can be helpful if you rely on your vehicle for transportation.

- Roadside Assistance: This coverage provides assistance with services such as towing, jump starts, flat tire changes, and lockout service. This can be helpful if you experience a breakdown or an emergency on the road.

These optional coverage options can be a valuable investment for drivers who want additional peace of mind.

Choosing the Right Car Insurance in Washington

Finding the right car insurance in Washington can feel overwhelming, with so many providers and options. It’s essential to compare quotes, understand your needs, and leverage available discounts to secure the best coverage at a competitive price.

Comparing Car Insurance Providers

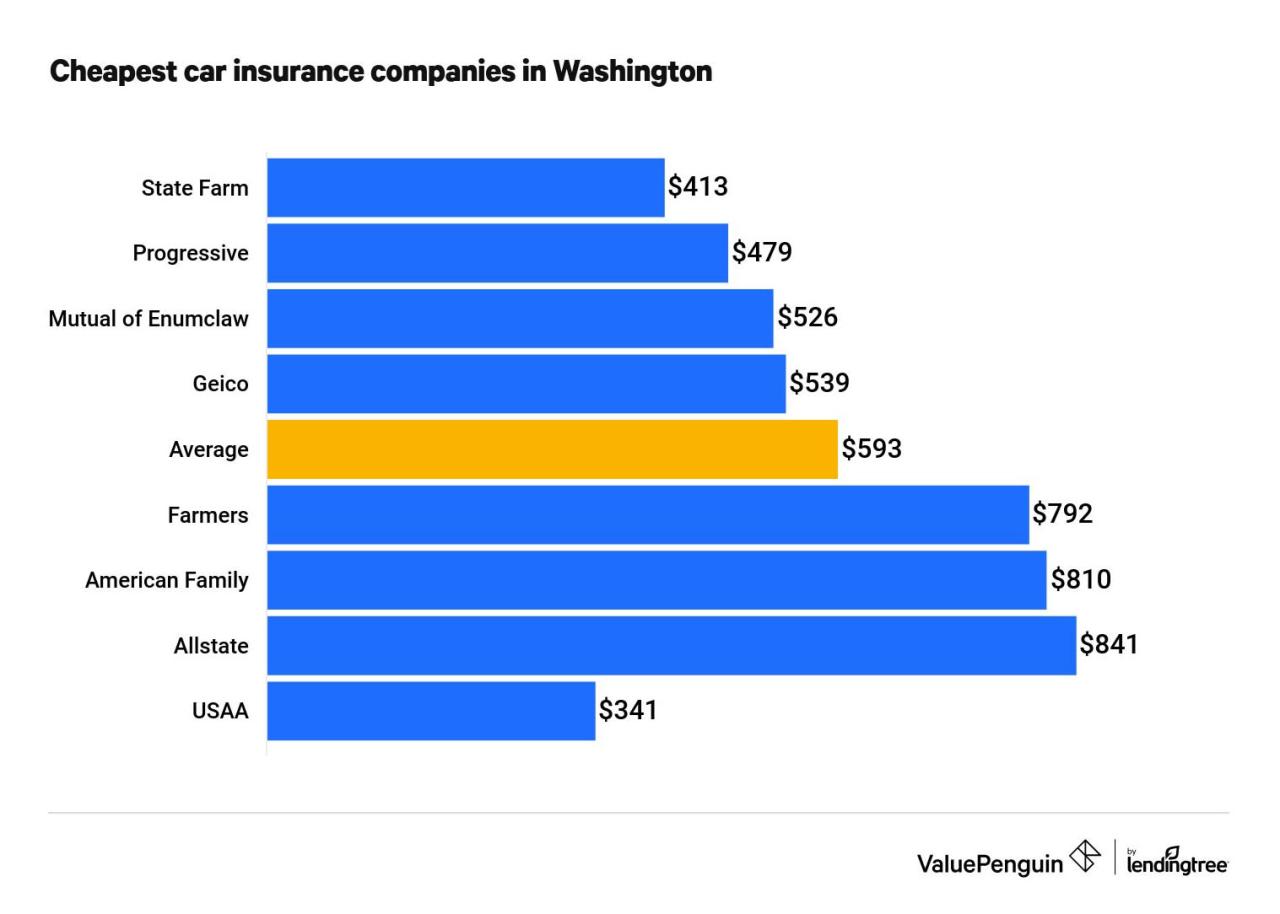

This table showcases some of the leading car insurance providers in Washington State, highlighting key features and pricing:

| Provider | Key Features | Average Annual Premium |

|—|—|—|

| Geico | Extensive discounts, strong customer service | $1,200 |

| State Farm | Wide range of coverage options, strong reputation | $1,300 |

| Progressive | Customizable policies, online quote tools | $1,100 |

| Liberty Mutual | Comprehensive coverage, strong financial stability | $1,400 |

| USAA | Exclusive to military members and their families, competitive rates | $1,000 |

These are just a few examples, and actual premiums will vary based on individual factors.

Obtaining Car Insurance Quotes

Follow these steps to gather quotes from multiple providers:

1. Gather your information: Before contacting insurers, have your driver’s license, vehicle registration, and any relevant driving history readily available.

2. Utilize online quote tools: Many providers offer convenient online quote tools, allowing you to input your information and receive instant estimates.

3. Contact insurers directly: Call or visit local insurance agents to discuss your specific needs and obtain personalized quotes.

4. Compare quotes carefully: Analyze the quotes you receive, considering factors like coverage limits, deductibles, and overall pricing.

Negotiating Insurance Rates and Securing Discounts

Here are some tips to help you negotiate better rates and maximize discounts:

* Shop around: Comparing quotes from multiple providers is crucial to ensure you’re getting the best deal.

* Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

* Improve your driving record: Maintaining a clean driving record is essential for securing lower rates.

* Consider safety features: Vehicles equipped with safety features like anti-theft devices, airbags, and anti-lock brakes can qualify for discounts.

* Ask about discounts: Inquire about available discounts, such as good student, safe driver, or multi-car discounts.

* Negotiate your deductible: A higher deductible typically translates to lower premiums.

* Pay your premium in full: Some providers offer discounts for paying your premium annually instead of monthly.

* Be prepared to switch providers: If you’re not satisfied with your current insurer, don’t hesitate to switch to a provider offering more competitive rates.

Filing a Car Insurance Claim in Washington

Filing a car insurance claim in Washington can be a daunting process, but it’s essential to navigate it correctly to ensure you receive the compensation you deserve. Understanding the steps involved and knowing what to expect can help you make informed decisions and maximize your chances of a successful claim.

Reporting an Accident to the Insurance Company

After an accident, it’s crucial to report it to your insurance company as soon as possible. This ensures that the claim is processed promptly and that you’re not jeopardizing your coverage. Here’s a step-by-step guide on how to report an accident:

- Contact Your Insurance Company: Reach out to your insurance company immediately after the accident, even if it seems minor. They’ll provide you with instructions on how to proceed and guide you through the claims process.

- Provide Accident Details: Be prepared to provide essential details about the accident, including the date, time, location, and a description of what happened. Be accurate and thorough in your account.

- File a Police Report: If the accident involves injuries or significant damage, it’s generally recommended to file a police report. This document serves as official documentation of the incident.

- Obtain Contact Information: Exchange contact information with all parties involved, including drivers, passengers, and witnesses. This information will be crucial for the claims process.

Documenting the Accident and Gathering Evidence, Car insurance washington state

Properly documenting the accident is vital to supporting your claim. This includes gathering evidence that can help establish the facts of the incident and strengthen your case.

- Take Photographs: Capture photos of the accident scene, including the damage to all vehicles involved, any skid marks, and any visible injuries. Photos serve as visual evidence of the incident.

- Get Witness Statements: If there were witnesses to the accident, obtain their contact information and ask them to provide written statements about what they saw. Witness testimonies can be valuable in supporting your claim.

- Keep a Record of Medical Expenses: If you sustained injuries, keep track of all medical bills, prescriptions, and other related expenses. This documentation will be needed to support your claim for medical coverage.

- Maintain a Detailed Accident Report: Keep a detailed record of the accident, including the date, time, location, and a description of the events. This will help you remember the details and provide accurate information to your insurance company.

Understanding the Claims Process

Once you’ve reported the accident and gathered necessary evidence, your insurance company will initiate the claims process. Here’s what you can expect:

- Claim Review: Your insurance company will review your claim and the evidence you’ve provided. They may request additional information or documentation.

- Investigation: The insurance company may conduct an investigation to verify the details of the accident and determine liability. This could involve interviewing witnesses or reviewing police reports.

- Claim Settlement: If your claim is approved, the insurance company will determine the amount of compensation you’re entitled to. This may involve covering repair costs, medical expenses, or lost wages.

- Payment: Once the claim is settled, you’ll receive payment for your covered expenses. The payment method may vary depending on your insurance policy and the specific circumstances of your claim.

Conclusion

Choosing the right car insurance in Washington requires careful consideration of your individual needs and budget. By understanding the state’s requirements, exploring different coverage options, and comparing quotes from various providers, you can find a policy that provides adequate protection while fitting your financial circumstances. This guide has provided a foundation for making informed decisions about car insurance in Washington. Remember to review your policy regularly, and don’t hesitate to contact your insurance provider with any questions or concerns.

Essential Questionnaire

What are the minimum car insurance requirements in Washington State?

Washington State requires drivers to have liability coverage, including bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. These coverages protect you financially if you cause an accident resulting in injuries or property damage to others.

How can I get a car insurance quote in Washington?

You can obtain car insurance quotes online, over the phone, or by visiting an insurance agent in person. Most insurance providers have online quote tools where you can enter your information and receive personalized quotes.

What are some common discounts available for car insurance in Washington?

Common car insurance discounts in Washington include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts (combining your car insurance with other types of insurance, like homeowners or renters insurance).