Car insurance wa state – Car insurance in Washington State is a necessity for all drivers, and understanding its intricacies is crucial. From mandatory coverage requirements to factors that influence your premium, navigating the world of car insurance can be complex. This guide aims to provide a comprehensive overview of car insurance in Washington State, covering everything from essential coverage types to strategies for finding affordable options.

Whether you’re a seasoned driver or a new car owner, understanding your rights and obligations when it comes to car insurance is essential. This guide will delve into the different types of coverage available, the factors that determine your premium, and how to find the best policy to suit your needs.

Understanding Car Insurance in Washington State

Driving a car in Washington State requires you to have car insurance. This is a legal requirement that ensures you are financially protected in case of an accident.

Mandatory Car Insurance Requirements

Washington State mandates that all drivers have liability insurance. This means that if you cause an accident, your insurance will cover the costs of the other driver’s injuries and property damage. The minimum liability coverage requirements are:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage per accident

Types of Car Insurance Coverage

While liability insurance is mandatory, you can choose to purchase additional coverage to protect yourself further. Here are some common types of car insurance coverage:

- Collision Coverage: This coverage pays for repairs or replacement of your car if it’s damaged in an accident, regardless of who is at fault. It’s typically required if you have a loan on your car.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your car if it’s damaged due to events other than an accident, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re injured in an accident caused by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

- Personal Injury Protection (PIP): This coverage pays for medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault.

Common Car Insurance Exclusions

Car insurance policies typically have exclusions, which are situations where coverage is not provided. Some common exclusions in Washington State include:

- Driving under the influence of alcohol or drugs: Most insurance policies will not cover damages caused by drivers who are intoxicated.

- Driving without a valid driver’s license: If you’re driving without a valid license, your insurance may not cover damages.

- Intentional acts: Insurance policies generally don’t cover damages caused by intentional acts, such as driving into another car on purpose.

- Racing or other illegal activities: If you’re involved in a car accident while participating in racing or other illegal activities, your insurance may not cover the damages.

Factors Influencing Car Insurance Rates

Car insurance premiums in Washington State are calculated based on a variety of factors. These factors are designed to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is a major factor in determining your car insurance rates. This includes your past driving record, such as accidents, traffic violations, and driving under the influence (DUI) convictions. A clean driving record generally translates to lower premiums.

- Accidents: A history of accidents, especially at-fault accidents, can significantly increase your insurance premiums. Insurance companies view this as a higher risk of future accidents.

- Traffic Violations: Speeding tickets, reckless driving citations, and other traffic violations can also lead to higher insurance rates. These violations indicate a higher likelihood of risky driving behavior.

- DUI Convictions: DUI convictions have the most severe impact on insurance premiums. They demonstrate a significant risk to the insurer and can result in significantly higher rates or even denial of coverage.

Age

Age is another key factor in determining insurance premiums. Younger drivers, especially those under 25, generally have higher rates due to their lack of experience and higher risk of accidents. As drivers gain experience and age, their rates typically decrease.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums.

- Vehicle Value: More expensive vehicles are generally more expensive to insure because the cost of repairs and replacement is higher.

- Safety Features: Vehicles with advanced safety features, such as anti-lock brakes, airbags, and stability control, may qualify for discounts, as they reduce the risk of accidents and injuries.

- Performance: High-performance vehicles, such as sports cars and SUVs, are often considered riskier to insure due to their potential for higher speeds and accidents.

Location

Your location in Washington State can significantly impact your insurance premiums.

- Urban vs. Rural: Urban areas with high population density and traffic congestion generally have higher insurance rates due to increased risk of accidents.

- Crime Rates: Areas with higher crime rates can also have higher insurance rates, as there is a greater risk of theft and vandalism.

- Weather Conditions: Areas with severe weather conditions, such as heavy snowfall or frequent storms, can also have higher insurance rates due to the increased risk of accidents.

Hypothetical Scenario

Consider two drivers, both 25 years old, with clean driving records, living in Seattle, Washington. Driver A drives a 2015 Honda Civic, while Driver B drives a 2023 Tesla Model S. Even though they have similar driving records and ages, Driver B is likely to pay significantly higher insurance premiums due to the higher value and performance of the Tesla.

Finding Affordable Car Insurance in WA

Finding affordable car insurance in Washington State is essential for every driver. You want to ensure you’re adequately protected while also staying within your budget. Here’s a comprehensive guide to help you navigate the car insurance landscape in WA and find the best deal for your needs.

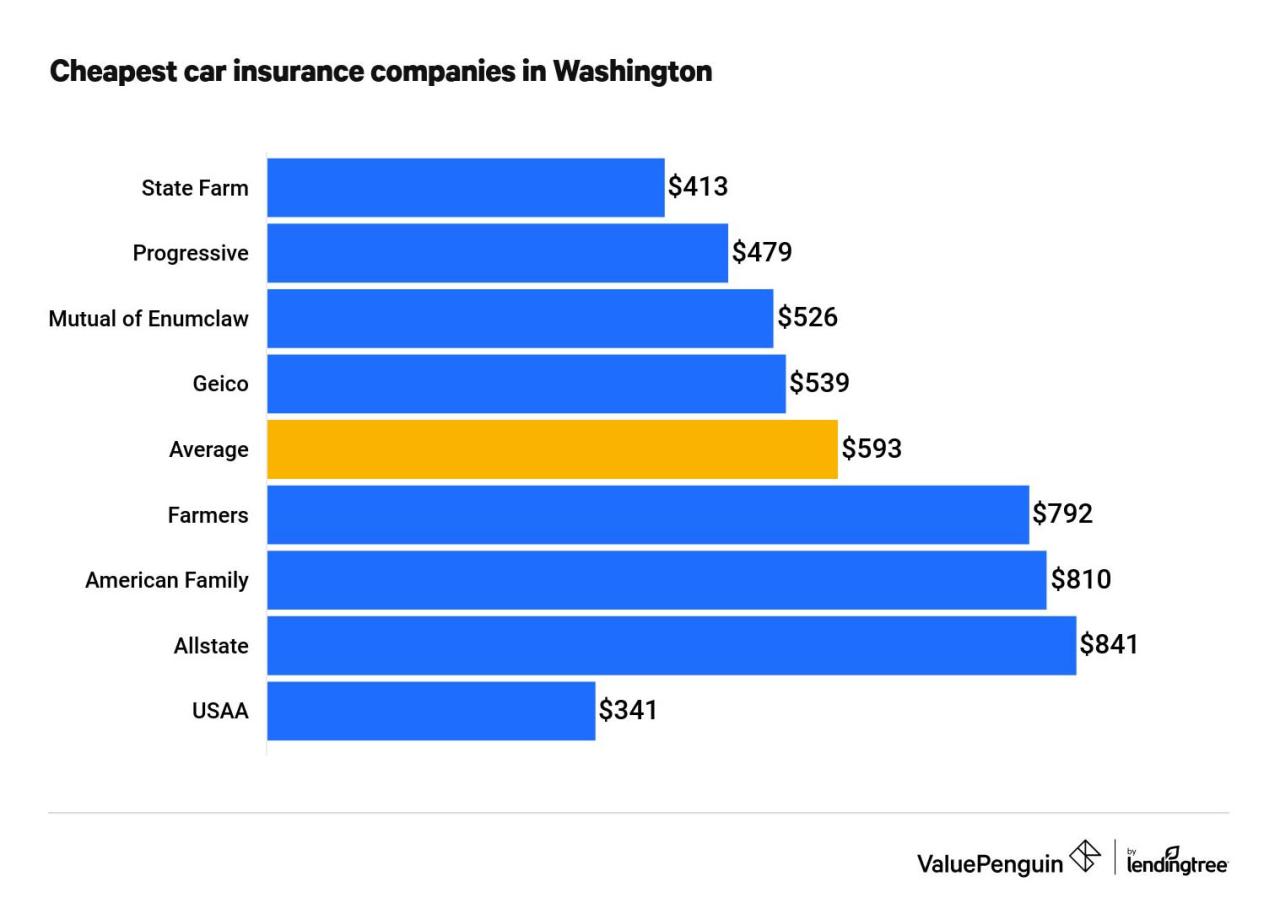

Major Car Insurance Providers in Washington

A wide range of insurance companies operate in Washington, offering various coverage options and pricing structures. Understanding the different providers and their offerings is crucial for making an informed decision.

- State Farm: Known for its extensive network of agents and customer service, State Farm offers a broad range of coverage options, including comprehensive, collision, liability, and uninsured motorist coverage.

- Geico: Geico is a popular choice for drivers seeking competitive rates and online convenience. They offer various coverage options and are known for their easy-to-use website and mobile app.

- Progressive: Progressive is known for its personalized coverage options and its “Name Your Price” tool, which allows drivers to set a budget and find a policy that fits their needs.

- Farmers Insurance: Farmers offers a range of coverage options and is known for its personalized service and commitment to customer satisfaction.

- USAA: USAA specializes in serving military members and their families. They offer competitive rates and excellent customer service, known for their strong financial stability and commitment to members.

- Liberty Mutual: Liberty Mutual offers a wide range of coverage options and is known for its strong financial rating and customer service.

- Allstate: Allstate is known for its “Good Hands” marketing campaign and its commitment to customer service. They offer a range of coverage options and discounts.

- Nationwide: Nationwide offers a wide range of insurance products, including car insurance. They are known for their financial stability and customer service.

Comparing Car Insurance Providers

When comparing different car insurance providers, it’s essential to consider factors such as coverage options, pricing, and customer service.

| Provider | Coverage Options | Pricing | Customer Service |

|---|---|---|---|

| State Farm | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Excellent |

| Geico | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Good |

| Progressive | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Good |

| Farmers Insurance | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Excellent |

| USAA | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Excellent |

| Liberty Mutual | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Good |

| Allstate | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Good |

| Nationwide | Comprehensive, Collision, Liability, Uninsured Motorist | Competitive | Good |

Strategies for Finding Affordable Car Insurance

Finding the most affordable car insurance policy requires research and comparison. Several strategies can help you secure the best rates.

- Shop Around: Get quotes from multiple insurance companies to compare rates and coverage options. This will give you a better understanding of the market and help you find the best deal.

- Bundle Your Policies: Consider bundling your car insurance with other insurance policies, such as homeowners or renters insurance. Many insurance companies offer discounts for bundling policies.

- Improve Your Credit Score: Your credit score can impact your car insurance rates. Improving your credit score can lead to lower premiums. It is important to note that insurance companies are not allowed to use credit scores to determine rates in Washington State. However, it is still a good idea to improve your credit score, as it can have a positive impact on your overall financial well-being.

- Take a Defensive Driving Course: Completing a defensive driving course can demonstrate your commitment to safe driving and potentially earn you a discount on your car insurance.

- Consider a Higher Deductible: Choosing a higher deductible can lower your monthly premiums. However, ensure you can afford to pay the deductible if you need to file a claim.

- Ask About Discounts: Inquire about available discounts, such as good driver discounts, safe driver discounts, multi-car discounts, and student discounts.

- Maintain a Good Driving Record: Avoid traffic violations and accidents, as these can significantly increase your car insurance rates.

Important Considerations for Car Insurance in WA

Car insurance in Washington State is not just a legal requirement but also a crucial safety net in case of accidents or other unforeseen events. Understanding the implications of driving without insurance, the process for filing a claim, and how to protect yourself from fraud can significantly enhance your peace of mind and financial security.

Driving Without Car Insurance in Washington State

Driving without car insurance in Washington State is illegal and can result in serious consequences. The state mandates all drivers to have at least the minimum liability insurance coverage, which includes:

- $25,000 for bodily injury per person

- $50,000 for bodily injury per accident

- $10,000 for property damage

If you are caught driving without insurance, you could face penalties such as:

- Fines: Up to $1,000 for a first offense and even higher for subsequent offenses.

- License suspension: Your driver’s license could be suspended until you obtain insurance.

- Impoundment of your vehicle: Your car could be impounded until you provide proof of insurance.

- Higher insurance premiums: Even after obtaining insurance, you may face higher premiums due to your previous driving record.

Furthermore, if you are involved in an accident without insurance, you could be held personally liable for all damages, including medical expenses, property repairs, and lost wages. This could lead to significant financial hardship and even bankruptcy.

Filing a Car Insurance Claim in WA, Car insurance wa state

If you are involved in an accident, it is important to file a claim with your insurance company promptly. The following steps can guide you through the process:

- Report the accident to your insurance company: You can usually do this by phone or online. Be prepared to provide details about the accident, including the date, time, location, and the other parties involved.

- Gather information: Collect as much information as possible about the accident, including the names, addresses, and insurance information of all parties involved. Take photos of the damage to your vehicle and the scene of the accident. If possible, obtain contact information from any witnesses.

- File a claim: Your insurance company will provide you with a claim form that you need to complete and submit. Be sure to provide all the necessary information and supporting documentation.

- Cooperate with your insurance company: Your insurance company may request additional information or documentation, such as a police report or medical records. It is important to cooperate fully with their investigation.

- Negotiate a settlement: Once your insurance company has completed its investigation, they will offer you a settlement. You have the right to negotiate this settlement if you believe it is not fair.

Protecting Yourself from Insurance Fraud in WA

Insurance fraud is a serious crime that can cost individuals and insurance companies millions of dollars each year. It is important to be aware of common insurance fraud schemes and how to protect yourself. Here are some tips:

- Be cautious of unsolicited offers: If you receive an offer for insurance from a company you have never heard of, be wary. Legitimate insurance companies will not contact you unsolicited.

- Verify the credentials of insurance agents: Before purchasing insurance from an agent, verify their credentials with the Washington State Office of the Insurance Commissioner. This ensures that the agent is licensed and authorized to sell insurance in the state.

- Be wary of “too good to be true” offers: If an insurance offer seems too good to be true, it probably is. Be skeptical of companies that offer extremely low premiums or coverage that seems too comprehensive.

- Report any suspected fraud: If you suspect that someone is committing insurance fraud, report it to the Washington State Office of the Insurance Commissioner. You can also report it to your insurance company.

Additional Resources and Information

Navigating the world of car insurance can sometimes feel overwhelming, especially with all the regulations and options available in Washington State. Thankfully, there are various resources available to help you make informed decisions and ensure you’re adequately protected. This section will guide you to valuable websites, organizations, and contact information to further enhance your understanding of car insurance in Washington.

Official State Websites

These websites offer comprehensive information on car insurance regulations, licensing requirements, and consumer protection in Washington State.

- Washington State Department of Licensing (DOL): The DOL website provides detailed information on driver licensing, vehicle registration, and insurance requirements. You can find answers to frequently asked questions, access online services, and report any insurance-related issues. https://www.dol.wa.gov/

- Washington Insurance Commissioner (OIC): The OIC website is a valuable resource for understanding insurance regulations, filing complaints, and accessing consumer guides on various insurance topics, including car insurance. https://www.insurance.wa.gov/

Consumer Advocacy Groups

These organizations provide unbiased advice, guidance, and support to consumers regarding car insurance and other financial matters.

- Washington State Office of the Insurance Commissioner: The OIC offers consumer education resources and assistance with insurance-related complaints. https://www.insurance.wa.gov/

- Consumer Reports: Consumer Reports provides independent ratings and reviews of car insurance companies, helping you compare prices and coverage options. https://www.consumerreports.org/

- National Association of Insurance Commissioners (NAIC): The NAIC offers information on insurance regulations, consumer protection, and resources for resolving insurance-related issues. https://www.naic.org/

Key Contact Information for Car Insurance Companies

This table Artikels the contact information for major car insurance companies operating in Washington State.

| Company | Phone Number | Website |

|---|---|---|

| State Farm | (800) 428-4883 | https://www.statefarm.com/ |

| Geico | (800) 151-151 | https://www.geico.com/ |

| Progressive | (800) 776-4737 | https://www.progressive.com/ |

| Allstate | (800) 255-7828 | https://www.allstate.com/ |

| USAA | (800) 531-8722 | https://www.usaa.com/ |

Ending Remarks

Being informed about car insurance in Washington State is not just about meeting legal requirements; it’s about protecting yourself financially in the event of an accident. By understanding the nuances of coverage options, factors influencing premiums, and strategies for finding affordable insurance, you can make informed decisions that ensure peace of mind on the road.

Questions Often Asked: Car Insurance Wa State

What happens if I get into an accident without car insurance in Washington State?

Driving without car insurance in Washington State is illegal and can result in fines, license suspension, and even jail time. You could also be held personally liable for damages caused in an accident.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least annually, or even more frequently if there are significant life changes, such as a new car, a change in driving habits, or a change in your financial situation.

What are some tips for getting a lower car insurance premium in Washington State?

Consider factors like bundling insurance policies, maintaining a good driving record, taking a defensive driving course, and comparing quotes from multiple insurers.