Car insurance through the state, also known as state-run car insurance programs, offers an alternative to traditional private insurance. These programs, often established to provide coverage to drivers who may struggle to find policies elsewhere, operate under the oversight of state governments. They can be a valuable resource for individuals seeking affordable and reliable car insurance.

This guide delves into the world of state-run car insurance programs, exploring their purpose, eligibility requirements, coverage options, costs, and the claims process. We’ll also examine the regulatory framework that governs these programs and compare them to private insurance options.

State-Run Car Insurance Programs

State-run car insurance programs are government-operated insurance plans that provide coverage for car accidents and other vehicle-related incidents. These programs are typically designed to serve individuals who have difficulty obtaining insurance through private companies, often due to factors such as poor driving records or financial instability.

History of State-Run Car Insurance Programs

The concept of state-run car insurance programs originated in the early 20th century as a response to the growing number of car accidents and the limited availability of private insurance. The first state-run car insurance program was established in 1916 in Massachusetts, and several other states followed suit in the subsequent decades. The primary objective of these programs was to ensure that all drivers had access to basic insurance coverage, regardless of their individual circumstances.

Examples of State-Run Car Insurance Programs

Several states in the United States offer state-run car insurance programs. Some notable examples include:

- Massachusetts: The Massachusetts Automobile Insurance Plan (MAIP) provides coverage to drivers who have been rejected by private insurers.

- New York: The New York State Automobile Insurance Plan (NYSAIP) is a similar program that provides coverage to high-risk drivers.

- Pennsylvania: The Pennsylvania Assigned Risk Plan (PARP) offers coverage to drivers who cannot obtain insurance through private companies.

Advantages and Disadvantages of State-Run Car Insurance Programs, Car insurance through the state

State-run car insurance programs offer both advantages and disadvantages compared to private insurance.

Advantages

- Guaranteed Coverage: State-run programs typically guarantee coverage to all eligible drivers, regardless of their driving history or financial situation.

- Lower Premiums for Some Drivers: Some drivers may find that state-run programs offer lower premiums than private insurance, particularly those who have been denied coverage by private companies.

- Access to Coverage: These programs provide access to insurance for individuals who might otherwise be unable to obtain it.

Disadvantages

- Higher Premiums for Some Drivers: In some cases, drivers with poor driving records may find that state-run programs have higher premiums than private insurance.

- Limited Coverage Options: State-run programs often have limited coverage options compared to private insurance companies.

- Potential for Higher Claims Costs: The pool of drivers covered by state-run programs may include higher-risk individuals, potentially leading to higher claims costs.

Eligibility and Coverage

State-run car insurance programs, while often less expensive than private insurance, have eligibility requirements and coverage limitations. Understanding these nuances is crucial before making an informed decision about your car insurance needs.

Eligibility Requirements

State-run car insurance programs typically have specific eligibility requirements. These programs are often designed to serve specific populations, such as low-income individuals, senior citizens, or drivers with poor driving records.

- Income Limits: Some programs may have income restrictions, ensuring they serve those with limited financial resources. For instance, a program might be limited to individuals earning below a certain threshold.

- Residency Requirements: Many programs require applicants to be residents of the specific state where the program is offered. This ensures the program benefits the local population.

- Driving Record: Certain programs may have restrictions based on driving history. Drivers with a history of accidents or violations might face limitations or higher premiums.

- Vehicle Age and Type: Some programs may have restrictions on the age and type of vehicle eligible for coverage. Older or high-performance vehicles might not be covered under certain state-run programs.

Coverage Offered

State-run car insurance programs typically offer a range of coverage options, similar to private insurance, but with some potential differences in coverage limits and options.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers medical expenses, property damage, and legal fees incurred due to the accident.

- Collision Coverage: This coverage helps pay for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This is typically optional and may have a deductible, which is the amount you pay out of pocket before the insurance covers the remaining cost.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. Like collision coverage, it’s usually optional and has a deductible.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It covers your medical expenses and property damage.

Coverage Limits and Options Compared to Private Insurance

While state-run programs offer essential coverage, they may have lower coverage limits and fewer options compared to private insurance.

- Lower Coverage Limits: State-run programs might have lower coverage limits for liability, collision, and comprehensive coverage compared to private insurance. This means you might receive less financial protection in the event of a significant accident or loss.

- Limited Coverage Options: State-run programs might offer fewer optional coverage options, such as roadside assistance, rental car reimbursement, or gap insurance. This could leave you with additional out-of-pocket expenses in certain situations.

- Higher Deductibles: Some state-run programs might have higher deductibles than private insurance. This means you’ll need to pay more out of pocket before your insurance kicks in.

Cost and Pricing

The cost of state-run car insurance is influenced by various factors, similar to private insurance. Understanding these factors helps you make informed decisions about your coverage and budget.

Factors Influencing Cost

The cost of state-run car insurance is determined by several factors, including:

- Driving Record: Your driving history, including accidents, violations, and DUI convictions, significantly impacts your premium. A clean driving record generally translates to lower premiums.

- Vehicle Type and Age: The make, model, and year of your vehicle influence the cost. Newer, more expensive vehicles tend to have higher premiums due to higher repair costs.

- Coverage Levels: The amount of coverage you choose, such as liability, collision, and comprehensive, directly impacts your premium. Higher coverage levels typically mean higher premiums.

- Location: Your location, including the state and zip code, influences the cost. Areas with higher accident rates or vehicle theft rates may have higher premiums.

- Age and Gender: Your age and gender can also influence the cost. Younger drivers, especially males, often have higher premiums due to higher risk profiles.

- Credit Score: In some states, your credit score may be used to determine your insurance premium. Individuals with higher credit scores may receive lower premiums.

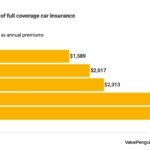

Average Cost Comparison

While exact costs vary based on individual circumstances, state-run car insurance generally aims to be competitive with private insurance options.

It’s crucial to compare quotes from multiple providers, including both state-run and private insurers, to find the best value for your needs.

Resources for Obtaining Quotes

You can obtain quotes and compare prices for state-run car insurance through various resources:

- State Insurance Website: Many states have dedicated websites for their insurance programs, where you can find information and request quotes.

- Insurance Comparison Websites: Online comparison websites allow you to enter your information and receive quotes from multiple insurers, including state-run programs.

- Insurance Agents: Local insurance agents can provide personalized guidance and help you compare options, including state-run programs.

Claims Process and Customer Service

Filing a claim with a state-run car insurance program is generally similar to the process with private insurance companies. However, there might be some variations in the specific steps and procedures.

State-run car insurance programs typically offer various customer service and support options to assist policyholders throughout the claims process. These options aim to provide a convenient and efficient experience for individuals seeking assistance.

Claims Process

State-run car insurance programs typically have a streamlined claims process designed to make it easy for policyholders to report an accident and receive compensation.

- Report the Accident: The first step is to report the accident to the insurance company as soon as possible. This can be done by phone, online, or in person.

- Gather Information: After reporting the accident, you’ll need to gather essential information, including the names and contact details of all parties involved, the location of the accident, and a description of the damage.

- File a Claim: You’ll need to file a formal claim with the insurance company, providing all the necessary information and documentation. This typically includes a police report, photographs of the damage, and any medical bills.

- Review and Approval: The insurance company will review your claim and assess the damage. Once the claim is approved, you’ll receive a payment for the covered losses.

Customer Service and Support Options

State-run car insurance programs often provide a range of customer service and support options to assist policyholders with their claims and other inquiries. These options may include:

- Phone Support: Most state-run car insurance programs have dedicated phone lines for customer service, allowing policyholders to reach representatives for assistance with their claims, policy information, or other inquiries.

- Online Resources: Many state-run car insurance programs provide online resources, such as FAQs, policy documents, and claim forms, allowing policyholders to access information and complete tasks conveniently.

- Email Support: Some state-run car insurance programs offer email support, allowing policyholders to submit inquiries and receive responses via email.

- Live Chat: Some programs may offer live chat support, enabling policyholders to engage in real-time conversations with customer service representatives.

- Mobile App: Some state-run car insurance programs have mobile apps that allow policyholders to manage their policies, report claims, and access customer service support from their smartphones.

Claims Handling and Customer Service Comparison

While state-run car insurance programs generally aim to provide efficient and responsive claims handling and customer service, it’s important to note that experiences can vary. Some policyholders may find that private insurance companies offer more personalized attention or faster claim processing times. However, state-run programs often prioritize affordability and accessibility, making them a viable option for many drivers.

Regulation and Oversight: Car Insurance Through The State

State-run car insurance programs operate within a specific regulatory framework designed to ensure fairness, transparency, and consumer protection. These programs are subject to oversight by state insurance departments, which play a crucial role in monitoring their operations and ensuring compliance with applicable laws and regulations.

State Insurance Department Oversight

State insurance departments are responsible for overseeing all insurance companies operating within their respective states, including state-run car insurance programs. Their oversight responsibilities encompass various aspects, including:

- Licensing and Authorization: State insurance departments grant licenses to insurance companies, including state-run programs, to operate within their jurisdictions. They evaluate the financial stability and operational capabilities of these programs to ensure they meet minimum requirements.

- Financial Solvency: State insurance departments monitor the financial health of state-run car insurance programs to ensure they have adequate reserves to cover claims and remain solvent. They may conduct regular audits and require programs to maintain specific capital adequacy ratios.

- Rate Regulation: Some states regulate insurance rates, including those for state-run car insurance programs. These regulations aim to ensure rates are fair and reasonable, preventing excessive pricing or discrimination against certain groups of policyholders.

- Consumer Protection: State insurance departments enforce consumer protection laws that safeguard policyholders from unfair or deceptive practices. They investigate consumer complaints, mediate disputes, and take enforcement actions against programs that violate regulations.

- Market Conduct: State insurance departments monitor the market conduct of state-run car insurance programs, including their advertising, sales practices, and claims handling procedures. They ensure these programs adhere to ethical and legal standards in their interactions with policyholders.

Consumer Protection Laws

Consumer protection laws apply to state-run car insurance programs, just as they do to private insurance companies. These laws aim to protect policyholders from unfair or deceptive practices and ensure they have access to clear and accurate information about their insurance coverage. Some key consumer protection laws include:

- Unfair Trade Practices Acts: These laws prohibit insurance companies from engaging in unfair or deceptive practices, such as misrepresenting coverage, denying claims without valid reasons, or engaging in discriminatory pricing.

- Insurance Disclosure Laws: These laws require insurance companies to provide policyholders with clear and understandable information about their coverage, including policy terms, exclusions, and premium calculations.

- Claims Handling Laws: These laws establish guidelines for insurance companies’ claims handling processes, requiring them to investigate claims promptly and fairly, provide timely payments, and explain any denials or delays.

- Consumer Complaint Procedures: State insurance departments have established procedures for consumers to file complaints against insurance companies, including state-run programs. These procedures provide a mechanism for resolving disputes and addressing consumer concerns.

Alternatives to State-Run Insurance

While state-run insurance programs offer a safety net for drivers who might struggle to find coverage through traditional insurers, there are other car insurance options available in states with these programs. Exploring these alternatives can help you find the best fit for your needs and budget.

Private Insurance Companies

Private insurance companies represent the most common alternative to state-run programs. They offer a wide range of coverage options and pricing structures, catering to diverse driver profiles.

Key Features and Benefits

- Diverse Coverage Options: Private insurers offer a wider range of coverage options compared to state-run programs, including comprehensive, collision, liability, and uninsured/underinsured motorist coverage. This flexibility allows you to customize your policy based on your specific needs and risk tolerance.

- Competitive Pricing: Private insurers often compete aggressively for customers, resulting in competitive pricing and potential discounts based on factors like good driving history, safety features, and bundled insurance policies.

- Personalized Service: Private insurers often provide personalized customer service, offering dedicated agents or representatives to assist with policy inquiries, claims processing, and other needs.

Cost Comparison

- Potential for Lower Premiums: Private insurers often offer lower premiums compared to state-run programs, especially for drivers with good driving records and low-risk profiles.

- Factors Influencing Cost: The cost of private insurance can vary based on factors like age, driving history, vehicle type, location, and coverage level.

Comparison to State-Run Programs

- Coverage Options: Private insurers generally offer a broader range of coverage options than state-run programs.

- Pricing: Private insurers may offer more competitive pricing for low-risk drivers, while state-run programs can be more affordable for high-risk drivers.

- Customer Service: Private insurers typically provide more personalized customer service, while state-run programs may have more standardized processes.

Other Alternatives

- Self-Insurance: In some states, you may be able to self-insure your vehicle if you meet specific financial requirements. This option allows you to manage your own risk and potentially save on premiums, but it also carries significant financial responsibility.

- Ride-Sharing and Transportation Networks: If you rely on public transportation or ride-sharing services for most of your travel needs, you may consider reducing your reliance on car ownership and insurance altogether.

Concluding Remarks

Navigating the complexities of car insurance can be challenging, especially when considering state-run programs. By understanding the nuances of these programs, you can make informed decisions about your insurance needs. Whether you’re looking for affordability, specific coverage options, or simply a reliable alternative, state-run car insurance programs deserve careful consideration.

FAQ Compilation

What are the benefits of state-run car insurance?

State-run car insurance programs can offer lower premiums, broader coverage options, and access to insurance for individuals who might struggle to find policies through private insurers.

How do I find out if my state offers state-run car insurance?

You can contact your state’s insurance department or visit their website to learn about available programs. Many states also have online resources that provide information about state-run car insurance options.

Are there any drawbacks to state-run car insurance?

While state-run programs can be beneficial, they may have limited coverage options compared to private insurance. Additionally, waiting times for claims processing might be longer.