Car Insurance State Farm Price: Navigating the world of car insurance can be a daunting task, especially when trying to find the best rates. State Farm, a well-established and trusted name in the industry, offers a variety of car insurance products and services. Understanding how State Farm’s pricing works and what factors influence your premiums can help you make informed decisions about your coverage.

This comprehensive guide will explore the key aspects of State Farm car insurance pricing, providing insights into the factors that affect your premiums, how to obtain accurate quotes, and how to leverage discounts and bundling options to potentially save money. We’ll also examine customer reviews and experiences to understand the overall value proposition of State Farm car insurance.

State Farm Car Insurance Overview

State Farm is a leading provider of car insurance in the United States, known for its reliability, customer service, and competitive pricing. Founded in 1922, the company has a long history of serving millions of customers across the country.

State Farm’s Car Insurance Products and Services

State Farm offers a comprehensive range of car insurance products and services to meet the diverse needs of its customers. These include:

- Liability Coverage: This essential coverage protects you financially if you are at fault in an accident, covering the other driver’s medical expenses, property damage, and legal fees.

- Collision Coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who is uninsured or underinsured.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault.

- Roadside Assistance: This service provides help with flat tires, jump starts, and other roadside emergencies.

State Farm’s Customer Service and Claims Handling Processes

State Farm is renowned for its exceptional customer service and efficient claims handling processes. The company offers a variety of ways for customers to contact them, including phone, email, and online chat.

State Farm’s claims handling process is designed to be straightforward and convenient for customers. Customers can report claims online, through the State Farm mobile app, or by phone. State Farm has a network of licensed agents and claims adjusters who are available to assist customers throughout the claims process.

Factors Influencing State Farm Car Insurance Prices

Your State Farm car insurance premium is influenced by a variety of factors, carefully considered to ensure you’re paying a fair price for the coverage you need.

Vehicle Type, Year, and Model

The type, year, and model of your vehicle play a significant role in determining your car insurance premium. This is because these factors directly impact the vehicle’s value, repair costs, and safety features. For instance, a newer, high-performance sports car will generally have a higher insurance premium compared to an older, standard sedan due to its higher value, increased risk of theft, and potentially higher repair costs.

Driving History

Your driving history is a crucial factor in determining your car insurance premium. State Farm, like most insurers, considers your past driving record, including accidents, traffic violations, and driving convictions. A clean driving record typically results in lower premiums, while a history of accidents or violations can lead to higher premiums.

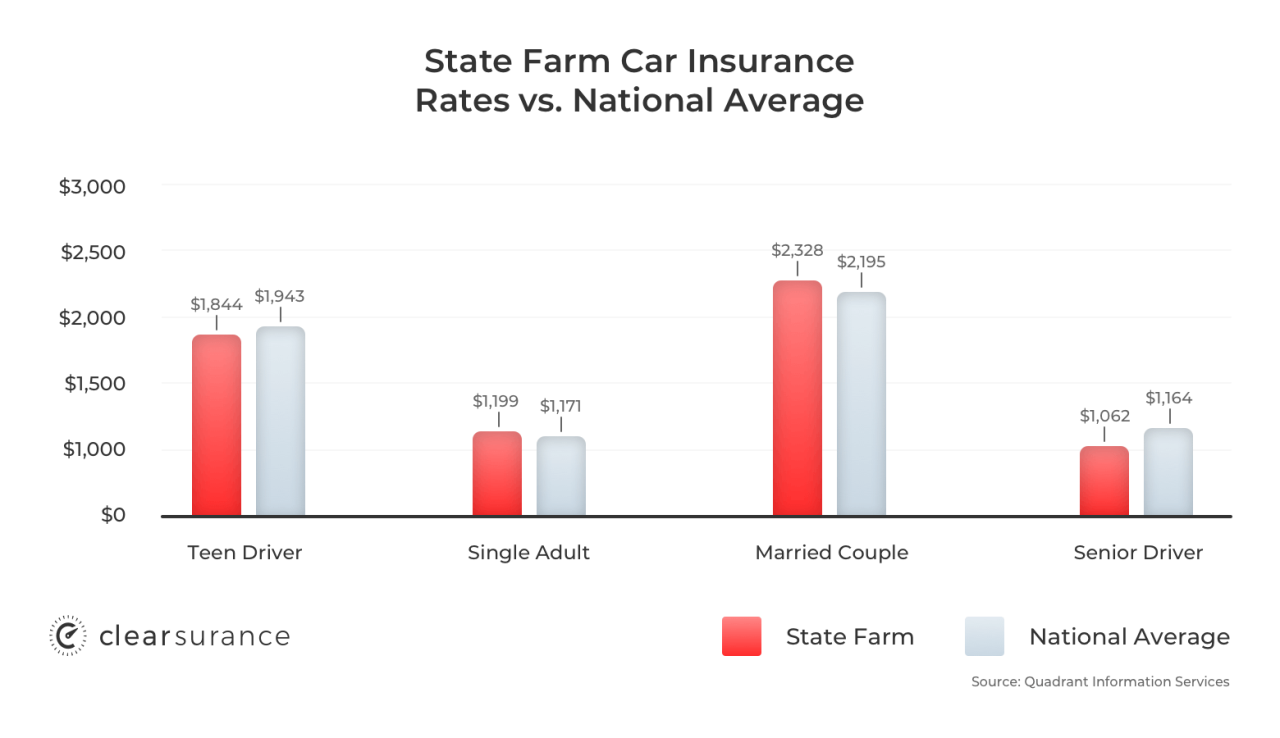

Age, Gender, and Marital Status

State Farm, like many insurers, considers your age, gender, and marital status as factors in calculating your car insurance premium. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This is because they have less driving experience and may be more prone to risky behaviors. Married individuals often have lower insurance premiums compared to single individuals, as they tend to have more stable driving habits and may be more likely to prioritize safety.

Location

Your location, including your state and zip code, can significantly impact your car insurance premium. This is because insurance companies assess the risk of accidents and theft based on the geographic location. Areas with high crime rates or heavy traffic congestion tend to have higher premiums due to the increased likelihood of accidents or vehicle theft.

Coverage Levels and Deductibles

The level of coverage you choose and your deductible amount directly affect your car insurance premium. Higher coverage levels, such as comprehensive and collision coverage, typically result in higher premiums, as they provide greater financial protection in the event of an accident or damage to your vehicle. A higher deductible, which is the amount you pay out-of-pocket before your insurance coverage kicks in, generally leads to lower premiums.

Discounts Available

State Farm offers various discounts to help policyholders save money on their car insurance premiums. These discounts can be based on factors such as good driving history, safety features in your vehicle, multiple policies with State Farm, and other factors.

For example, a driver with a clean driving record and a vehicle equipped with anti-theft devices may qualify for a significant discount on their car insurance premium.

Obtaining a State Farm Car Insurance Quote

Getting a car insurance quote from State Farm is a straightforward process. You can choose from several convenient methods to receive a personalized estimate for your coverage needs.

Methods for Obtaining a Quote

There are several ways to get a State Farm car insurance quote:

- Online: The easiest and most convenient method is to obtain a quote online through State Farm’s website. Simply provide your personal information, vehicle details, and desired coverage options. The website will generate an instant quote based on your input.

- Phone: If you prefer a more personalized approach, you can contact State Farm directly by phone. A representative will ask you questions about your needs and provide a quote based on your responses.

- Agent: You can also visit a local State Farm agent in person. This allows you to discuss your insurance needs in detail and receive personalized advice from a knowledgeable professional.

Tips for Obtaining an Accurate Quote

To ensure you receive the most accurate and competitive quote, follow these tips:

- Provide accurate information: When filling out your quote request, be truthful and precise with your details. This includes your driving history, vehicle information, and desired coverage levels. Any inaccuracies could lead to an inaccurate quote.

- Compare quotes: Don’t settle for the first quote you receive. Get quotes from multiple insurance companies to compare prices and coverage options. This allows you to find the best value for your needs.

- Consider discounts: State Farm offers a variety of discounts, such as good driver, safe driver, and multi-policy discounts. Make sure to inquire about these discounts and see if you qualify.

- Review your policy: Once you receive a quote, carefully review the policy details. Ensure that you understand the coverage limits, deductibles, and exclusions. Don’t hesitate to ask questions if anything is unclear.

Analyzing State Farm Car Insurance Prices

Understanding how State Farm car insurance prices vary across different states, demographics, and coverage levels is crucial for making informed decisions. This analysis explores these price variations and their underlying factors.

State-Wise Price Variations

State Farm car insurance premiums can differ significantly based on the state of residence. This variation is influenced by factors like the cost of living, traffic density, accident rates, and state-specific regulations.

| State | Age | Coverage Level | Average Premium |

|---|---|---|---|

| California | 30 | Full Coverage | $2,500 |

| Texas | 30 | Full Coverage | $1,800 |

| Florida | 30 | Full Coverage | $2,200 |

| New York | 30 | Full Coverage | $3,000 |

The table above showcases average premiums for a 30-year-old driver with full coverage in four different states. This data highlights the substantial differences in premiums across different states.

Demographic Factors Influencing Prices, Car insurance state farm price

State Farm car insurance premiums can also vary based on demographic factors such as age, driving history, and credit score.

- Age: Younger drivers typically pay higher premiums due to their higher risk profile. As drivers gain experience and age, their premiums generally decrease.

- Driving History: Drivers with a history of accidents or traffic violations are considered higher risk and therefore face higher premiums.

- Credit Score: In some states, State Farm uses credit score as a factor in determining insurance premiums. This practice is based on the notion that individuals with good credit history tend to be more responsible and less likely to file claims.

Coverage Level and Price Variations

The level of coverage selected also significantly impacts State Farm car insurance premiums.

- Liability Coverage: This coverage is mandatory in most states and protects you financially if you cause an accident that results in injuries or damage to another person’s property.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of fault.

- Comprehensive Coverage: This coverage protects your vehicle against damage from events like theft, vandalism, or natural disasters.

The higher the coverage level, the higher the premium. For example, a driver with full coverage, including liability, collision, and comprehensive, will generally pay a higher premium than a driver with only liability coverage.

Potential Reasons for Price Discrepancies

Several factors can contribute to the price discrepancies observed in State Farm car insurance premiums.

- Claims History: State Farm uses historical claims data to assess the risk associated with different regions, demographics, and coverage levels. Areas with higher claims frequencies may experience higher premiums.

- Competition: The level of competition in the insurance market can also influence prices. In areas with more insurance providers, competition can drive prices down.

- Cost of Repairs: The cost of vehicle repairs can vary significantly based on location and the type of vehicle. Areas with higher repair costs may experience higher insurance premiums.

- State Regulations: State regulations can impact insurance premiums by setting minimum coverage requirements and influencing the factors that insurers can consider when determining premiums.

State Farm Car Insurance Discounts and Bundling Options: Car Insurance State Farm Price

State Farm offers a wide range of discounts that can significantly reduce your car insurance premiums. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and loyalty to State Farm. Additionally, bundling multiple insurance policies with State Farm can lead to substantial cost savings.

State Farm Car Insurance Discounts

State Farm offers various discounts to help you save money on your car insurance premiums. These discounts are categorized based on different factors, such as your driving history, vehicle features, and other insurance policies you hold.

Good Driver Discounts

- Safe Driver Discount: This discount is awarded to drivers with a clean driving record, typically with no accidents or traffic violations within a specified period. State Farm may consider factors such as the severity and frequency of past incidents.

- Defensive Driving Course Discount: Completing an approved defensive driving course can demonstrate your commitment to safe driving practices. State Farm offers a discount for completing these courses, which are often offered by organizations like the American Automobile Association (AAA).

Safe Driver Discounts

- Anti-theft Device Discount: Installing anti-theft devices, such as alarm systems, GPS tracking devices, or immobilizers, can deter theft and reduce insurance risk. State Farm offers discounts for vehicles equipped with such devices.

- Good Student Discount: Students who maintain a good academic record, typically with a GPA above a certain threshold, are often considered responsible drivers. State Farm may offer a discount for students who meet these criteria.

Multi-Car Discounts

- Multi-Car Discount: If you insure multiple vehicles with State Farm, you can qualify for a multi-car discount. This discount recognizes the reduced risk associated with insuring multiple vehicles with the same insurer.

Bundling Discounts

- Bundling Discount: State Farm offers significant discounts when you bundle multiple insurance policies, such as car insurance, homeowners insurance, renters insurance, or life insurance. This discount recognizes the loyalty of customers who choose to insure multiple aspects of their lives with State Farm.

Bundling Insurance Policies

Bundling multiple insurance policies with State Farm can result in substantial cost savings. This is because State Farm rewards customers who choose to insure multiple aspects of their lives with them. When you bundle your car insurance with other policies like homeowners or renters insurance, you can typically expect a discount of 10% or more on your overall premium.

Customer Reviews and Experiences with State Farm Car Insurance

Understanding customer feedback is crucial when assessing the value of any insurance provider. State Farm, being a major player in the car insurance market, has garnered a diverse range of reviews and experiences from its policyholders. Examining these reviews allows us to gain insights into the strengths and areas for improvement in State Farm’s service offerings.

Customer Reviews and Testimonials

Customer reviews provide valuable insights into the real-world experiences with State Farm car insurance. While opinions can vary, certain common themes emerge from the reviews available on various platforms, including online review sites and social media.

- Positive Experiences: Many customers praise State Farm for its excellent customer service, responsiveness, and ease of claim filing. They appreciate the company’s commitment to resolving issues quickly and efficiently. Positive experiences often involve prompt claims processing, fair settlements, and helpful agents who provide personalized support.

- Negative Experiences: Some customers express dissatisfaction with State Farm’s pricing, claiming it is higher compared to competitors. Others report challenges with obtaining quotes or dealing with certain agents who may not be as responsive or helpful. Additionally, some customers have experienced delays in claim processing or difficulties with communication during the claim process.

Common Themes and Sentiments

Analyzing customer reviews reveals recurring themes and sentiments regarding State Farm car insurance.

- Customer Service: Customer service consistently emerges as a significant factor in customer satisfaction. Many customers commend State Farm’s agents for their professionalism, responsiveness, and willingness to assist. However, some reviews highlight instances of poor communication or unhelpful interactions with specific agents, suggesting the need for consistent training and quality control.

- Claims Process: The claims process is another critical area where customers express both positive and negative experiences. Positive reviews emphasize the ease of filing claims, prompt processing, and fair settlements. Conversely, negative reviews often mention delays, bureaucratic hurdles, and communication breakdowns during the claims process.

- Pricing: Pricing remains a key concern for many customers. While some find State Farm’s rates competitive, others perceive them as higher compared to alternative providers. This highlights the importance of comparing quotes from multiple insurers before making a decision.

Areas of Excellence and Improvement

Based on customer feedback, State Farm excels in certain areas while needing improvement in others.

- Strengths: State Farm’s customer service is often lauded for its responsiveness, helpfulness, and professionalism. The company’s reputation for fair claims processing and settlements also contributes to customer satisfaction.

- Areas for Improvement: Pricing remains a point of contention for some customers, suggesting the need for greater transparency and competitive pricing strategies. Additionally, ensuring consistent communication and efficient processing throughout the claims process is crucial for maintaining customer trust and satisfaction.

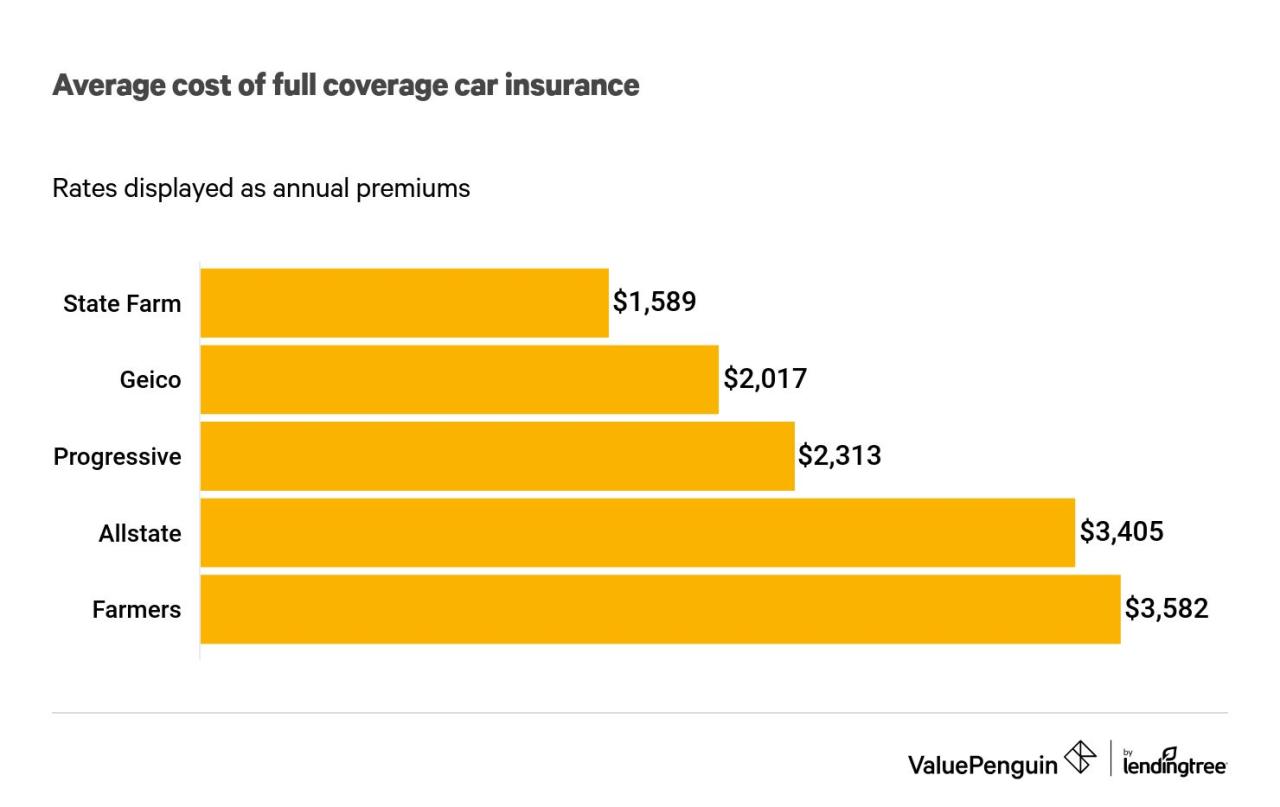

Alternatives to State Farm Car Insurance

While State Farm is a popular and well-regarded car insurance provider, it’s essential to explore other options to find the best fit for your needs and budget. The car insurance market is diverse, offering a range of coverage options, pricing structures, and customer service experiences.

Major Car Insurance Providers

Understanding the competitive landscape is crucial when making informed car insurance decisions. Here are some of the major car insurance providers in the United States, along with their strengths and key offerings:

- Progressive: Known for its innovative technology and personalized pricing models, Progressive offers a range of coverage options and discounts. Their “Name Your Price” tool allows customers to set their desired premium and receive customized quotes.

- Geico: Geico is renowned for its competitive pricing and straightforward online purchasing process. Their “15-minute” quote process is a major draw for time-conscious customers.

- Allstate: Allstate is known for its comprehensive coverage options and strong customer service reputation. They offer a wide range of discounts and have a robust claims handling process.

- Liberty Mutual: Liberty Mutual is a well-established insurer with a focus on personalized service and tailored coverage options. They offer a variety of discounts and have a strong reputation for customer satisfaction.

- USAA: USAA is a highly rated insurer that specializes in serving active military personnel, veterans, and their families. They offer competitive rates, excellent customer service, and a wide range of discounts.

Comparing State Farm to its Competitors

State Farm’s offerings are comparable to those of its major competitors in terms of coverage options and discounts. However, specific pricing and customer service experiences can vary significantly. It’s essential to compare quotes from multiple insurers to determine the best value for your individual needs.

- Pricing: State Farm’s pricing can be competitive, but it’s crucial to compare quotes from other insurers to ensure you’re getting the best deal. Factors such as your driving record, vehicle type, and location can significantly impact pricing.

- Coverage Options: State Farm offers a comprehensive range of coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Other insurers may offer unique coverage options or specialized programs.

- Discounts: State Farm offers a variety of discounts, including safe driver discounts, good student discounts, and multi-policy discounts. Other insurers may offer similar or unique discounts, so it’s essential to compare them.

- Customer Service: State Farm has a reputation for strong customer service, but individual experiences can vary. It’s important to consider customer reviews and ratings when evaluating an insurer’s customer service.

The Car Insurance Landscape

The car insurance market is constantly evolving, with new technologies and innovative offerings emerging regularly. It’s essential to stay informed about the latest trends and options available.

- Telematics: Telematics devices track your driving behavior and provide insights into your driving habits. This information can be used to offer personalized discounts or identify areas for improvement.

- Usage-Based Insurance: Usage-based insurance programs (UBI) are designed to reward safe drivers. These programs track your driving habits and offer discounts based on factors such as mileage, time of day, and braking patterns.

- Online Purchasing: Many insurers now offer online quote and purchase options, making it easier for customers to get insured quickly and conveniently.

Final Review

Ultimately, the best way to determine if State Farm car insurance is right for you is to compare quotes and evaluate their offerings against other major insurance providers. By understanding the factors that influence your premiums, leveraging available discounts, and seeking out competitive quotes, you can make an informed decision that aligns with your individual needs and budget.

Essential FAQs

How can I get a free quote from State Farm?

You can get a free quote online, over the phone, or by visiting a local State Farm agent.

What discounts are available for State Farm car insurance?

State Farm offers a wide range of discounts, including good driver, safe driver, multi-car, and bundling discounts. You can find a complete list on their website.

What are the main factors that affect my car insurance premiums?

Factors such as your driving history, vehicle type, location, age, and coverage level all play a role in determining your car insurance premiums.