Car insurance registered in different state – Car insurance registered in a different state can be a complex topic, with many factors influencing coverage and cost. Imagine moving to a new state and discovering that your car insurance policy doesn’t cover you adequately. This scenario highlights the importance of understanding the nuances of registering your car and insurance in a different state.

This guide delves into the intricacies of car insurance registration across state lines, exploring the legal requirements, impact on premiums, and key coverage considerations. We’ll discuss the consequences of driving with out-of-state registration, provide tips for a smooth transition, and share real-life examples to illustrate the complexities involved.

Understanding Car Insurance Registration Across States

Registering your car in a new state is a necessary step when you relocate. It involves notifying the state authorities about your vehicle and obtaining new registration plates and documentation. The process generally includes several steps, including obtaining a new driver’s license, passing vehicle inspections, and paying applicable fees.

Legal Requirements and Regulations

The legal requirements and regulations for registering a car in a new state vary depending on the state. Some states have more stringent requirements than others. Here’s a general overview of the common requirements:

- Proof of Ownership: You’ll need to provide proof of ownership of the vehicle, such as the title or a bill of sale.

- Vehicle Identification Number (VIN) Inspection: The vehicle’s VIN will be inspected to verify its identity.

- Emissions Testing: In some states, you’ll need to pass an emissions test to ensure your vehicle meets environmental standards.

- Insurance Proof: You’ll need to provide proof of car insurance that meets the state’s minimum requirements.

- Payment of Fees: You’ll need to pay registration fees, which may vary depending on the vehicle’s age, type, and weight.

Examples of State-Specific Registration Procedures

Here are some examples of states with different registration procedures:

- California: California requires a smog check for vehicles older than 7 years. The registration process can be done online, by mail, or in person at a Department of Motor Vehicles (DMV) office.

- Texas: Texas requires a vehicle inspection for all vehicles. The registration process can be done online, by mail, or in person at a county tax assessor-collector’s office.

- New York: New York requires a safety inspection for all vehicles. The registration process can be done online, by mail, or in person at a DMV office.

Impact of State of Registration on Insurance Coverage: Car Insurance Registered In Different State

The state where your car is registered plays a significant role in determining your car insurance premiums. This is because insurance companies base their rates on a variety of factors, including the risk of accidents and the cost of repairs in a particular state.

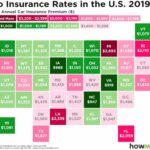

State-Specific Insurance Rates

The cost of car insurance can vary significantly across states. Several factors contribute to these variations. These include:

- Traffic Density and Accident Rates: States with higher traffic congestion and accident rates tend to have higher insurance premiums. This is because insurance companies have to pay out more claims in these areas. For example, states like California and Florida have higher traffic volumes and accident rates, which often lead to higher insurance premiums.

- Cost of Living and Repair Costs: States with higher costs of living and repair costs also tend to have higher insurance premiums. This is because insurance companies have to pay more to cover the cost of repairs and medical expenses in these areas. States like New York and Massachusetts, known for their high costs of living, typically have higher insurance premiums compared to other states.

- State Laws and Regulations: Different states have different laws and regulations regarding car insurance. Some states require higher minimum coverage limits, which can lead to higher premiums. Other states have laws that make it easier for people to sue for damages, which can also increase premiums. For instance, states with “no-fault” insurance systems, where drivers are primarily responsible for their own injuries, tend to have lower insurance premiums compared to states with “tort” systems, where drivers can sue each other for damages.

- Demographics and Driving Habits: States with a higher proportion of young drivers or drivers with a history of accidents and violations tend to have higher insurance premiums. Insurance companies view these groups as higher risks and charge accordingly.

Insurance Coverage Considerations When Registering in a New State

Moving to a new state means more than just changing your address. You also need to ensure your car insurance policy meets the requirements of your new home state. State laws and regulations vary significantly, impacting the types of coverage you need and the cost of your premiums.

It’s crucial to review your existing policy and make necessary adjustments to ensure you have adequate coverage in your new state. This includes understanding the minimum insurance requirements, exploring additional coverage options, and comparing rates from different insurance providers.

Minimum Insurance Requirements

Each state has its own set of minimum insurance requirements, often referred to as “financial responsibility laws.” These laws dictate the minimum amount of coverage you must carry to legally drive in the state. It’s crucial to be aware of these requirements as failure to comply can result in hefty fines, license suspension, or even the inability to register your vehicle.

For instance, in some states, the minimum liability coverage may be $25,000 per person and $50,000 per accident, while others require higher limits.

Coverage Options

Beyond the minimum requirements, several additional coverage options can provide you with greater protection and peace of mind.

- Collision Coverage: Covers damage to your vehicle in an accident, regardless of who is at fault. This is typically optional but is often recommended for newer vehicles or those with significant loan balances.

- Comprehensive Coverage: Protects against damage to your vehicle caused by events other than collisions, such as theft, vandalism, natural disasters, or falling objects.

- Uninsured/Underinsured Motorist Coverage: Provides coverage for injuries or damages caused by a driver who is uninsured or has insufficient insurance. This coverage is essential in case you are involved in an accident with a driver who cannot fully compensate you for your losses.

- Personal Injury Protection (PIP): Covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of who is at fault. This coverage is mandatory in some states and is optional in others.

- Rental Reimbursement: Covers the cost of renting a car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides services like towing, flat tire changes, and jump starts in case of breakdowns or emergencies.

Comparing Coverage Options

Coverage options and costs can vary significantly between states. For example, a state with a high number of uninsured drivers may require higher uninsured motorist coverage limits. Similarly, states with harsh weather conditions or a high incidence of theft may recommend comprehensive coverage.

- State-Specific Coverage: Some states may have unique coverage options tailored to their specific needs. For instance, states with significant earthquake activity may offer earthquake coverage, while states with heavy snowfall may offer coverage for damage caused by snow removal.

- Cost Comparison: It’s essential to compare rates from different insurance providers in your new state to find the best value for your needs. Rates can be influenced by factors such as your driving history, age, location, and the type of vehicle you drive.

Reviewing and Updating Your Policy

Once you’ve moved to a new state, it’s crucial to review your insurance policy to ensure it meets the new state’s requirements and provides adequate coverage. You may need to make changes to your coverage, such as increasing your liability limits or adding additional coverage options.

- Contact Your Insurance Provider: Inform your insurance provider about your move and provide them with your new address. They can then assess your policy and make any necessary adjustments.

- Get a New Quote: It’s a good idea to get quotes from other insurance providers in your new state to compare rates and coverage options. You may be able to find a better deal with a different provider.

- Review Your Policy Regularly: Even after updating your policy, it’s essential to review it regularly to ensure it still meets your needs and that you are getting the best value for your money. You may need to adjust your coverage as your circumstances change, such as adding a new driver to your policy or purchasing a new vehicle.

Consequences of Driving with Out-of-State Registration

Driving with out-of-state registration can lead to legal consequences, including fines, penalties, and even the impoundment of your vehicle. Understanding the specific laws in your state and the potential ramifications is crucial for avoiding unnecessary trouble.

Legal Consequences of Driving an Unregistered Vehicle

It’s important to understand that driving with an unregistered vehicle is a serious offense. While the specific penalties vary by state, the general consequences include:

- Fines: You could face hefty fines for driving an unregistered vehicle, which can range from a few hundred dollars to thousands depending on the severity of the offense and the state’s laws.

- Impoundment: In some cases, your vehicle may be impounded until you register it properly. This can lead to additional storage fees and inconvenience.

- Suspension of Driver’s License: Depending on the state and the frequency of violations, your driver’s license could be suspended until you register your vehicle.

- Insurance Issues: If you’re involved in an accident while driving an unregistered vehicle, your insurance coverage could be invalidated. This could leave you financially responsible for any damages or injuries.

- Legal Complications: In the event of an accident, driving an unregistered vehicle can complicate legal proceedings and make it more difficult to prove your innocence.

Penalties for Driving with Out-of-State Insurance

Driving with insurance from a different state can also have serious consequences, particularly if you’re involved in an accident.

- Invalid Insurance Coverage: In most states, your insurance coverage may not be valid if your vehicle is registered in a different state. This means you could be held personally liable for any damages or injuries caused in an accident.

- Fines and Penalties: You could face fines and penalties for driving without valid insurance in the state where you’re driving. These penalties can be substantial and vary depending on the state.

- Insurance Fraud: Driving with insurance from a different state without informing your insurer could be considered insurance fraud, which can result in serious legal consequences.

Potential Fines and Penalties

| State | Fine for Unregistered Vehicle | Fine for Out-of-State Insurance | Other Penalties |

|—|—|—|—|

| California | $500-$1,000 | $1,000-$5,000 | Impoundment, Driver’s License Suspension |

| Texas | $200-$500 | $100-$500 | Impoundment, Driver’s License Suspension |

| Florida | $100-$500 | $250-$500 | Impoundment, Driver’s License Suspension |

| New York | $100-$500 | $250-$500 | Impoundment, Driver’s License Suspension |

| Illinois | $100-$500 | $250-$500 | Impoundment, Driver’s License Suspension |

Note: The specific fines and penalties can vary depending on the severity of the offense and the specific laws in each state. It’s crucial to check with your state’s Department of Motor Vehicles (DMV) for the most up-to-date information.

Case Studies

Understanding the nuances of car insurance registration across states is best illustrated through real-life examples. These scenarios highlight the practical challenges and benefits individuals face when registering their cars in different states.

Impact of Registration Changes on Insurance Costs, Car insurance registered in different state

This section examines how changes in car registration can influence insurance premiums.

The impact of registration changes on insurance costs is multifaceted and often depends on individual circumstances. Here are some examples:

- Sarah, a college student, registered her car in her home state of California while attending college in New York. Since New York has higher insurance rates than California, Sarah benefited from keeping her car registered in her home state. However, she faced potential legal consequences if she was involved in an accident in New York while her car was registered in California. This scenario highlights the importance of considering potential legal implications when registering a car in a different state.

- John, a truck driver, frequently travels across state lines for work. He decided to register his truck in a state with lower insurance premiums, which saved him money on insurance. However, he faced the challenge of complying with different insurance requirements in each state he traveled to. This example emphasizes the need for careful research and planning when registering a car in a state with lower insurance premiums.

Outcome Summary

Navigating car insurance registration across states requires careful planning and awareness. By understanding the legal requirements, potential consequences, and insurance coverage options, you can ensure a smooth transition and avoid any unexpected surprises. Remember to review your insurance policy, update your registration, and stay informed about the regulations in your new state. With proper planning and preparation, you can confidently drive your vehicle with the appropriate insurance coverage in your new home.

Essential Questionnaire

What happens if I don’t register my car in the new state?

Driving with an unregistered vehicle can lead to fines, penalties, and even suspension of your driver’s license. It’s crucial to register your car in the new state as soon as possible to avoid legal consequences.

How do I find affordable car insurance in a new state?

Compare quotes from multiple insurance providers, consider discounts, and review coverage options to find the most affordable plan that meets your needs. You can also explore options like bundling your car and home insurance for potential savings.

Can I use my existing car insurance policy in a new state?

While you might be able to use your existing policy for a short period, it’s essential to check with your insurer about coverage limits and potential adjustments for the new state. You may need to update your policy or purchase additional coverage to meet the new state’s requirements.