Car insurance rates comparison by state is a crucial step in securing affordable and comprehensive coverage. Understanding how rates vary across the country can save you significant money. Factors like population density, traffic patterns, and state-specific regulations all play a role in determining premiums. This guide will explore the key elements that impact car insurance rates, providing insights into the factors that drive costs in different states.

The car insurance market in the United States is highly competitive, with numerous companies vying for your business. This competition can work to your advantage, as insurers often offer discounts and incentives to attract new customers. By carefully comparing rates and coverage options, you can find the best deal that meets your individual needs.

Car Insurance Rates Comparison by State

Car insurance rates vary significantly across the United States, and comparing quotes from different insurers in your state can help you find the best deal. Understanding the factors that influence car insurance premiums and the overall car insurance market in the U.S. can empower you to make informed decisions.

Factors Influencing Car Insurance Premiums

Car insurance premiums are influenced by a variety of factors, including:

- Driving Record: Your driving history, including accidents, tickets, and violations, plays a significant role in determining your insurance rates. A clean driving record usually translates to lower premiums.

- Age and Gender: Younger drivers and males generally have higher insurance rates due to their higher risk profiles. As drivers age and gain experience, their rates tend to decrease.

- Vehicle Type: The make, model, and year of your car can impact your insurance premiums. Sports cars and luxury vehicles often have higher rates due to their higher repair costs and potential for higher risk.

- Location: Car insurance rates vary by state and even by zip code. Areas with higher crime rates, traffic congestion, or a greater number of accidents tend to have higher premiums.

- Coverage Levels: The amount of coverage you choose, such as liability, collision, and comprehensive, will influence your premium. Higher coverage levels generally lead to higher premiums.

- Credit Score: In some states, insurers use your credit score as a factor in determining your insurance rates. A good credit score can often lead to lower premiums.

The Car Insurance Market in the United States

The car insurance market in the United States is highly competitive, with a wide range of insurers offering different coverage options and pricing structures.

- Major Insurers: Some of the largest car insurance companies in the U.S. include State Farm, GEICO, Progressive, Allstate, and Liberty Mutual. These companies often have a national presence and offer a variety of coverage options.

- Regional Insurers: Many regional insurers operate in specific states or regions. These companies may offer more competitive rates for certain types of drivers or vehicles.

- Direct Writers: Direct writers, such as GEICO and Progressive, sell insurance directly to consumers through their websites or call centers. These companies often have lower overhead costs and can offer more competitive rates.

- Independent Agents: Independent agents represent multiple insurance companies and can help you compare quotes from different insurers. They may have access to more specialized coverage options or can provide personalized advice.

Key Factors Affecting Car Insurance Rates

Car insurance premiums are determined by a complex interplay of factors, and understanding these factors is crucial for securing the best possible rates. While some factors are universal, their impact can vary significantly across different states.

Driver Demographics

Driver demographics play a significant role in determining insurance premiums. These factors reflect the risk associated with different driver profiles.

- Age: Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This higher risk translates into higher premiums. As drivers gain experience and age, their rates generally decrease.

- Driving History: A clean driving record with no accidents or violations is a major factor in securing lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions will significantly increase your rates.

- Gender: While this factor is controversial and subject to debate, historically, men have been found to have higher accident rates than women. As a result, men often pay higher premiums than women. However, this trend is becoming less pronounced as gender-based pricing is being challenged in some states.

- Marital Status: Statistically, married individuals tend to have lower accident rates compared to their unmarried counterparts. This is often attributed to increased responsibility and maturity associated with marriage. As a result, married drivers may enjoy lower premiums.

- Credit Score: While not directly related to driving, your credit score can be used by insurance companies to assess your overall financial responsibility. A higher credit score is generally associated with a lower risk profile, which can lead to lower premiums.

Vehicle Characteristics

The type of vehicle you drive plays a significant role in determining your insurance premiums. Insurance companies consider factors like vehicle safety features, repair costs, and theft risk.

- Vehicle Make and Model: Certain car models are known for their safety features, fuel efficiency, and lower repair costs. These vehicles tend to attract lower premiums. Conversely, models with a history of accidents or high repair costs may result in higher premiums.

- Vehicle Age: Newer vehicles typically have more advanced safety features and are less prone to breakdowns. This lower risk profile translates into lower premiums. Older vehicles, on the other hand, may have higher premiums due to potential maintenance issues and lower resale value.

- Vehicle Value: The market value of your vehicle is a crucial factor in determining premiums. A more expensive vehicle will generally attract higher premiums due to the greater financial loss in case of an accident.

- Safety Features: Vehicles equipped with advanced safety features like anti-lock brakes, airbags, and stability control are considered safer and attract lower premiums.

Location and Driving Habits

Your location and driving habits significantly influence your car insurance premiums. These factors reflect the risk associated with different geographic areas and driving patterns.

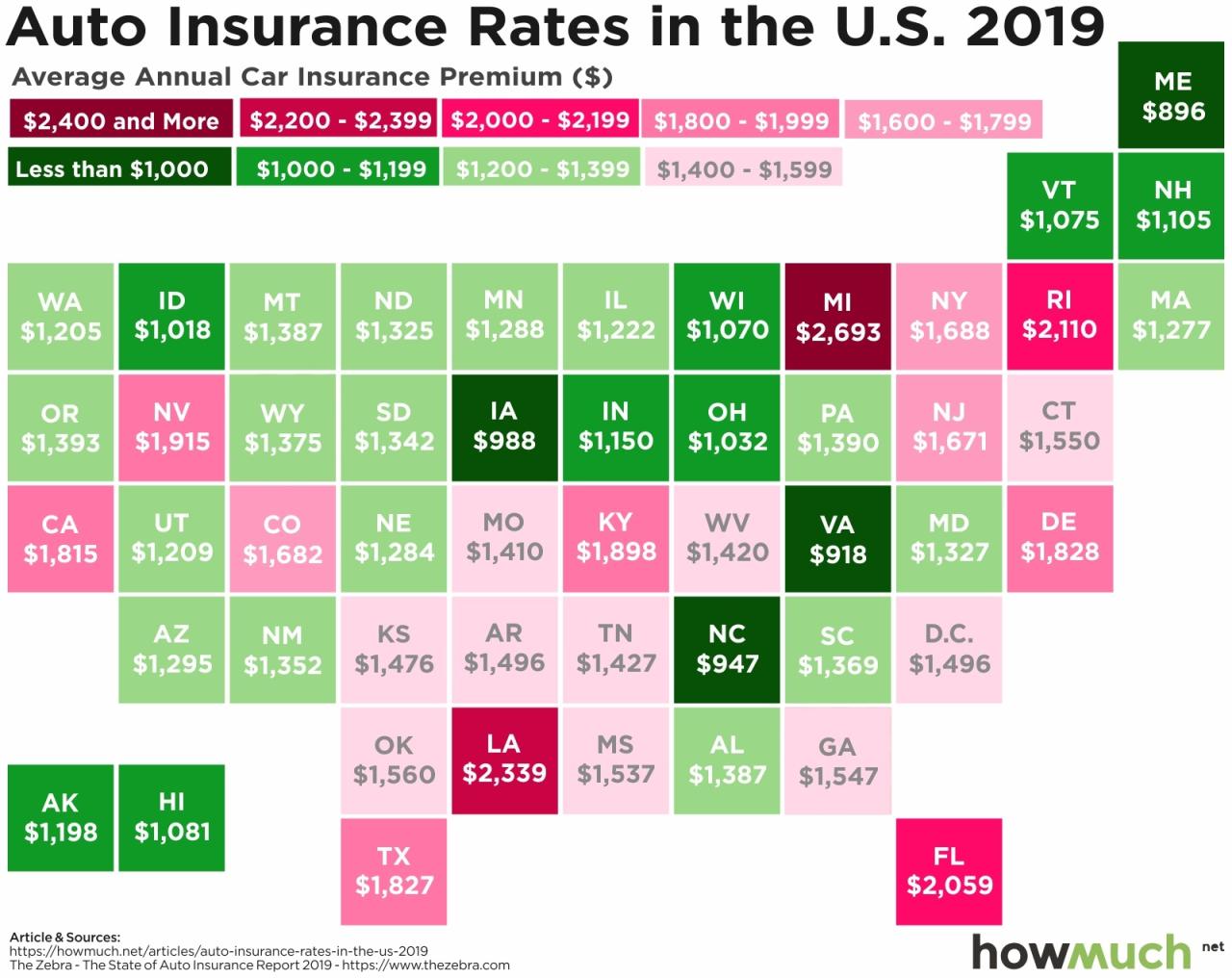

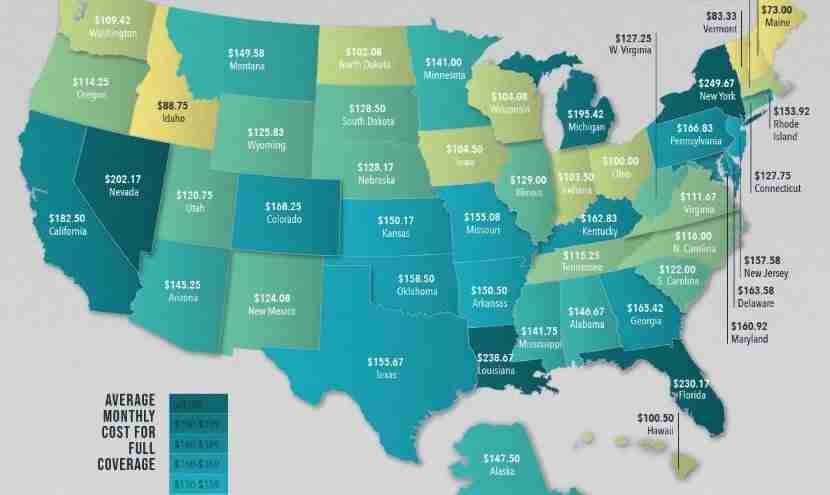

- State of Residence: Car insurance rates vary significantly across different states due to factors like traffic density, accident rates, and the cost of healthcare. For example, states with higher population density and more traffic congestion tend to have higher insurance premiums.

- Zip Code: Even within the same state, insurance rates can vary based on your zip code. Areas with higher crime rates, more accidents, or more expensive car repairs may have higher premiums.

- Driving Distance: The more you drive, the greater the risk of an accident. Insurance companies may adjust premiums based on your estimated annual mileage.

- Parking Location: Parking your vehicle in a garage or secured area can reduce the risk of theft or vandalism, leading to lower premiums.

Other Factors

In addition to the factors mentioned above, other factors can influence your car insurance premiums.

- Coverage Options: The type and amount of coverage you choose will impact your premiums. Comprehensive and collision coverage offer more protection but come at a higher cost.

- Discounts: Insurance companies offer various discounts to incentivize safe driving and responsible behavior. These discounts can include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts.

State-Specific Considerations

Car insurance rates vary significantly across states, influenced by a combination of factors. Understanding these state-specific considerations can help you make informed decisions when comparing car insurance quotes.

Average Car Insurance Premiums by State

The following table presents average car insurance premiums for different vehicle types across various states, based on data from the National Association of Insurance Commissioners (NAIC).

| State | Average Premium (Sedan) | Average Premium (SUV) | Average Premium (Truck) |

|---|---|---|---|

| California | $2,000 | $2,200 | $2,500 |

| Florida | $1,800 | $2,000 | $2,300 |

| Texas | $1,500 | $1,700 | $1,900 |

| New York | $2,300 | $2,500 | $2,800 |

| Pennsylvania | $1,700 | $1,900 | $2,100 |

Factors Influencing Car Insurance Rates by State

State-specific factors play a crucial role in determining car insurance premiums. These factors include:

- Traffic Density and Accident Rates: States with higher traffic congestion and accident rates tend to have higher car insurance premiums. For example, states like California and New York have high traffic density, leading to more accidents and higher insurance costs.

- Cost of Living and Healthcare: States with higher costs of living and healthcare expenses often have higher car insurance premiums. This is because insurance companies need to cover the costs of medical treatment and repairs in case of an accident.

- State Regulations and Laws: Each state has its own set of regulations and laws governing car insurance. These laws can impact premiums by influencing factors like minimum coverage requirements, no-fault insurance, and the availability of discounts.

- Climate and Weather Conditions: States with extreme weather conditions, such as hurricanes or earthquakes, may have higher car insurance premiums due to the increased risk of damage.

- Demographics and Driving Habits: The demographics of a state, including age, gender, and driving history, can also affect insurance rates. States with a higher proportion of young drivers or drivers with a history of accidents may have higher premiums.

State-Specific Regulations and Laws Affecting Car Insurance Premiums

State regulations and laws have a significant impact on car insurance rates. Here are some examples:

- Minimum Coverage Requirements: States have different minimum coverage requirements for car insurance, which can affect premiums. States with higher minimum coverage requirements may have higher premiums to ensure adequate coverage for accidents.

- No-Fault Insurance: Some states have no-fault insurance systems, where drivers are primarily responsible for their own injuries, regardless of fault. No-fault insurance can lead to lower premiums as it reduces the number of lawsuits and claims.

- Discounts and Rebates: States may offer various discounts and rebates for car insurance, such as safe driver discounts, good student discounts, and discounts for anti-theft devices. These discounts can significantly reduce premiums.

- Insurance Rate Regulation: Some states regulate car insurance rates to prevent excessive pricing. These regulations can affect premiums by limiting the factors insurance companies can consider when setting rates.

Comparison Tools and Resources

Finding the best car insurance rates can be a time-consuming and tedious process, but thankfully, several online comparison tools and resources can simplify the process. These tools allow you to compare quotes from multiple insurance companies simultaneously, saving you time and effort.

Reputable Car Insurance Comparison Websites

Using car insurance comparison websites offers numerous advantages, including convenience, time-saving, and the ability to compare multiple quotes side-by-side. These platforms streamline the process of finding the best car insurance rates by connecting you with a wide range of insurance providers.

- Compare.com: Compare.com is a comprehensive car insurance comparison platform that allows you to compare quotes from multiple insurance companies. It offers a user-friendly interface and provides detailed information about each insurer, including coverage options, discounts, and customer reviews.

- Insurify: Insurify is another popular car insurance comparison website that aggregates quotes from various insurance providers. It uses a sophisticated algorithm to match you with the best rates based on your individual profile and preferences. The platform also offers personalized recommendations and insights to help you make informed decisions.

- Policygenius: Policygenius is a comprehensive insurance comparison platform that specializes in car insurance, among other types of insurance. It offers a streamlined comparison process and provides personalized recommendations based on your specific needs and budget. Policygenius also offers customer support to assist you throughout the process.

- The Zebra: The Zebra is a car insurance comparison website that provides a wide range of quotes from multiple insurers. It offers a user-friendly interface and allows you to filter quotes based on your specific needs and preferences. The Zebra also provides detailed information about each insurer, including customer reviews and financial ratings.

Effectively Using Comparison Tools

To maximize the benefits of using car insurance comparison tools, follow these steps:

- Provide Accurate Information: When using comparison tools, ensure you provide accurate information about your vehicle, driving history, and other relevant factors. This will ensure you receive accurate and personalized quotes.

- Compare Multiple Quotes: Don’t settle for the first quote you receive. Compare quotes from multiple insurance companies to ensure you’re getting the best possible rates.

- Review Coverage Options: Each insurance company offers different coverage options and discounts. Carefully review the coverage options and discounts offered by each insurer to determine the best fit for your needs and budget.

- Read Reviews and Ratings: Before choosing an insurance company, read reviews and ratings from other customers. This can help you gauge the insurer’s reputation and customer satisfaction levels.

- Contact Insurers Directly: After using comparison tools, consider contacting the insurers directly to discuss your specific needs and obtain personalized quotes. This can help you negotiate better rates and ensure you’re getting the best possible coverage.

Tips for Saving on Car Insurance

Saving money on car insurance is a common goal for many drivers. While insurance rates are ultimately determined by factors beyond your control, like your state’s average rates and the overall risk profile of drivers, there are several steps you can take to potentially reduce your premiums. By making smart choices and implementing some proactive strategies, you can lower your monthly costs and keep more money in your pocket.

Maintain a Good Driving Record

A clean driving record is one of the most significant factors influencing your car insurance rates. Insurance companies consider your driving history a reliable indicator of your risk as a driver. Maintaining a good driving record can significantly impact your premiums, often leading to lower rates.

- Avoid Traffic Violations: Every speeding ticket, reckless driving citation, or DUI conviction increases your insurance premiums. These violations signal to insurance companies that you are a higher risk driver, leading to increased rates. Practicing safe driving habits and adhering to traffic laws can help you avoid these penalties.

- Be Accident-Free: Any accident, regardless of fault, can negatively impact your insurance rates. Accidents demonstrate to insurance companies that you are more likely to file a claim, increasing your risk profile. Defensive driving techniques and careful driving practices can help you avoid accidents and maintain a clean record.

- Complete Defensive Driving Courses: Completing a defensive driving course can often earn you a discount on your car insurance. These courses teach safe driving techniques and help you develop better driving habits, which can ultimately reduce your risk of accidents. Check with your insurance company to see if they offer discounts for completing such courses.

Choose the Right Coverage and Deductible

The type of coverage and deductible you choose can significantly impact your car insurance premiums. Understanding your coverage options and choosing the right combination for your needs can help you save money.

- Compare Coverage Options: Not all car insurance policies are created equal. Some offer additional coverage, such as collision and comprehensive, which can increase your premiums. Assess your needs and determine which coverage options are essential for your situation. If you have an older car with lower value, comprehensive and collision coverage may not be necessary, potentially saving you money.

- Consider Higher Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible generally translates to lower premiums. If you can afford to pay a higher deductible in the event of an accident, you can significantly reduce your monthly insurance costs. However, ensure you have the financial resources to cover the deductible if an accident occurs.

Shop Around for Quotes

Don’t settle for the first insurance quote you receive. Getting quotes from multiple insurance companies is essential to ensure you are getting the best rates possible. Each insurance company has its own pricing algorithms and factors, so rates can vary significantly.

- Use Online Comparison Tools: Several online comparison tools can help you quickly and easily get quotes from multiple insurance companies. These tools typically require you to provide basic information about your vehicle, driving history, and desired coverage. They then generate a list of quotes from different companies, allowing you to compare prices and coverage options.

- Contact Insurance Companies Directly: In addition to online comparison tools, you can also contact insurance companies directly to get quotes. This can be beneficial if you have specific questions or need personalized assistance. Be sure to ask about any available discounts or promotions they offer.

Consider Bundling Policies

Bundling your car insurance with other types of insurance, such as homeowners or renters insurance, can often result in significant savings. Insurance companies typically offer discounts for bundling policies, as it signifies a reduced risk profile for them.

Bundling policies can often lead to substantial savings on your car insurance premiums.

Take Advantage of Discounts

Many insurance companies offer discounts for various factors, such as good driving records, safety features in your car, and completing defensive driving courses. Be sure to inquire about these discounts when you are getting quotes and provide any relevant information to ensure you are receiving all applicable discounts.

- Good Student Discounts: Many insurance companies offer discounts to students who maintain good grades. This reflects the assumption that students with good grades are more responsible and safer drivers. If you are a student with a good academic record, be sure to inquire about this discount.

- Safe Driver Discounts: Insurance companies often reward drivers with clean driving records with discounts. If you have a history of safe driving, without accidents or violations, you may qualify for a safe driver discount. Be sure to provide your driving history to insurance companies to receive this discount.

- Anti-theft Device Discounts: Installing anti-theft devices in your car can reduce your insurance premiums. These devices deter theft and can help lower your risk profile, leading to potential savings. Check with your insurance company to see if they offer discounts for anti-theft devices.

- Vehicle Safety Feature Discounts: Cars with advanced safety features, such as anti-lock brakes, airbags, and electronic stability control, are often eligible for discounts. These features enhance safety and reduce the risk of accidents, making you a lower-risk driver in the eyes of insurance companies. Be sure to mention these features when getting quotes.

Review Your Policy Regularly

Once you have obtained car insurance, it is crucial to review your policy regularly to ensure you are still receiving the best rates and coverage options. Your insurance needs can change over time, such as when you get a new car or move to a different location. Reviewing your policy annually can help you identify any areas where you can save money or adjust your coverage to better suit your current circumstances.

Understanding Coverage Options

Choosing the right car insurance coverage is crucial for protecting yourself financially in case of an accident or other unforeseen events. Different types of coverage offer varying levels of protection, and understanding their benefits can help you make informed decisions.

Liability Coverage

Liability coverage is a fundamental aspect of car insurance. It protects you financially if you are at fault in an accident that causes injury or damage to others. This coverage typically covers:

- Bodily injury liability: Pays for medical expenses, lost wages, and other damages incurred by the other driver and passengers in the accident.

- Property damage liability: Covers repairs or replacement costs for the other driver’s vehicle and any other property damaged in the accident.

Liability coverage is usually required by law, and the minimum limits vary by state.

It’s essential to have sufficient liability coverage to avoid significant financial repercussions in case of an accident.

Collision Coverage, Car insurance rates comparison by state

Collision coverage protects your vehicle in case of an accident, regardless of who is at fault. This coverage pays for repairs or replacement costs for your vehicle, minus your deductible.

The deductible is the amount you pay out of pocket before your insurance coverage kicks in.

While collision coverage is not mandatory in most states, it’s highly recommended if you have a financed or leased vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient coverage. This coverage can help pay for your medical expenses, lost wages, and property damage if the other driver is unable to cover your losses.

UM/UIM coverage is typically optional, but it’s a wise investment to ensure you have financial protection in case of an accident with an uninsured or underinsured driver.

Conclusion: Car Insurance Rates Comparison By State

Navigating the world of car insurance can feel overwhelming, especially when you consider the vast differences in rates across states. But by understanding the key factors that influence premiums and utilizing available comparison tools, you can gain a clear picture of your options and make informed decisions.

Key Takeaways

The comparison of car insurance rates across states reveals several key takeaways:

- Rates vary significantly depending on location, with factors such as population density, traffic patterns, and crime rates playing a significant role.

- State-specific regulations and laws, including minimum coverage requirements and insurance fraud rates, also contribute to the variation in car insurance costs.

- Individual factors, such as your driving history, age, and credit score, can heavily influence your premiums, regardless of your state of residence.

Finding the Best Coverage

Armed with this knowledge, you can take proactive steps to find the best coverage for your needs:

- Compare rates from multiple insurers: Don’t settle for the first quote you receive. Use online comparison tools or contact insurance agents directly to get quotes from several providers.

- Consider your individual needs and circumstances: Think about your driving habits, the value of your car, and your desired level of coverage. This will help you determine the right policy for you.

- Explore discounts and savings opportunities: Many insurers offer discounts for good driving records, safety features, and bundling policies. Be sure to ask about these options to reduce your premiums.

Understanding Premiums

By actively comparing rates and understanding the factors that influence your premiums, you can make informed choices about your car insurance and ensure you are getting the best value for your money.

Last Recap

Armed with the knowledge gained from comparing car insurance rates across states, you can make informed decisions about your coverage. Remember, your driving record, vehicle type, and location all influence your premiums. By taking the time to compare quotes and explore different options, you can ensure that you are paying a fair price for the protection you need.

Answers to Common Questions

How often should I compare car insurance rates?

It’s a good idea to compare rates at least annually, or even more frequently if you have a significant life change, such as moving to a new state or getting a new car.

What are some common car insurance discounts?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts (combining car and home insurance).

What is a “black box” device in car insurance?

A “black box” device is a small device that plugs into your car’s diagnostic port and tracks your driving habits. Some insurers offer discounts to drivers who demonstrate safe driving behavior.