Car insurance quotes NY state are a crucial aspect of driving in the Empire State. Navigating New York’s unique insurance landscape can feel overwhelming, but understanding the factors that influence your premiums and the strategies for finding the best deals can empower you to make informed decisions.

This guide delves into the intricacies of New York’s car insurance system, providing valuable insights into the state’s regulations, coverage options, and key factors affecting your rates. We’ll explore the impact of driving history, vehicle type, and location, along with tips for comparing quotes and securing the most competitive prices.

Understanding Car Insurance in New York State: Car Insurance Quotes Ny State

Navigating the world of car insurance in New York can feel like driving through a maze. But understanding the basics can help you make informed decisions and find the best coverage for your needs. New York has a unique set of car insurance laws and regulations that differ from other states. These laws aim to protect drivers and passengers while ensuring fair compensation for accidents.

Required Car Insurance Coverage in New York

New York State requires all drivers to have a minimum level of liability insurance to protect themselves and others in case of an accident. This coverage is essential for financial protection in the event of an accident. Liability insurance covers the costs of damage or injuries to other people or their property if you are at fault in an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to the other party if you cause an injury in an accident. The minimum requirement in New York is $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other party’s vehicle or property if you are at fault in an accident. The minimum requirement in New York is $10,000 per accident.

New York’s No-Fault Insurance System

New York has a No-Fault insurance system, which means that your own insurance company will pay for your medical expenses and lost wages after an accident, regardless of who is at fault. This system is designed to streamline the claims process and reduce litigation.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related expenses after an accident, regardless of fault. The minimum PIP coverage in New York is $50,000 per person.

- Collision Coverage: This coverage pays for repairs or replacement of your own vehicle if it is damaged in an accident, regardless of fault. Collision coverage is optional, but it is typically recommended if you have a loan or lease on your vehicle.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your own vehicle if it is damaged by something other than an accident, such as theft, vandalism, or a natural disaster. Comprehensive coverage is optional, but it is typically recommended if you have a loan or lease on your vehicle.

Impact of No-Fault Insurance on Coverage, Car insurance quotes ny state

The No-Fault system in New York has a significant impact on how car insurance claims are handled. Under this system, your own insurance company will pay for your medical expenses and lost wages after an accident, regardless of who is at fault. This means that you will not have to sue the other driver to recover these costs. However, you may be limited in your ability to sue for pain and suffering, unless your injuries meet certain thresholds.

Factors Influencing Car Insurance Quotes in New York

Getting car insurance in New York can be a complex process, with various factors influencing the final premium you pay. Understanding these factors is crucial for securing the best possible rate.

Driving History

Your driving history is a significant factor in determining your insurance premium. A clean driving record with no accidents or violations will result in lower premiums. However, any incidents like accidents, speeding tickets, or driving while intoxicated (DWI) will significantly increase your rates. New York utilizes a points system, where each violation earns you points. Accumulating too many points can lead to suspension of your driver’s license.

- A clean driving record is essential for lower premiums.

- Accidents, tickets, and DWIs can significantly increase your rates.

- New York uses a points system, with accumulating points potentially leading to license suspension.

Age

Insurance companies consider age a crucial factor, recognizing that younger drivers are statistically more likely to be involved in accidents. Younger drivers often lack experience and have higher risk profiles, leading to higher premiums. However, as drivers age and gain experience, their premiums tend to decrease.

- Younger drivers usually pay higher premiums due to higher risk profiles.

- Premiums tend to decrease as drivers age and gain experience.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your insurance premium. Sports cars and luxury vehicles are often more expensive to repair and replace, leading to higher insurance rates. Conversely, smaller and less expensive cars typically have lower premiums.

- Expensive cars like sports cars and luxury vehicles have higher premiums due to higher repair and replacement costs.

- Smaller and less expensive cars generally have lower premiums.

Location

Your location in New York can influence your insurance premium. Areas with higher crime rates and traffic congestion tend to have higher accident rates, leading to higher insurance premiums. Urban areas often have higher premiums compared to rural areas.

- Areas with higher crime rates and traffic congestion usually have higher premiums.

- Urban areas tend to have higher premiums compared to rural areas.

Credit Score

In New York, insurance companies can consider your credit score when determining your insurance premium. This practice is controversial, with some arguing that it is irrelevant to driving ability. However, insurance companies claim that a good credit score indicates financial responsibility, which translates to a lower risk of claims.

- A good credit score can lead to lower premiums, as insurance companies associate it with financial responsibility.

- The use of credit score in determining insurance premiums is a controversial practice.

Driving Habits

Your driving habits can significantly impact your insurance premium. Companies are increasingly using telematics devices, which track your driving behavior, such as speed, braking, and acceleration. Safe driving habits, such as avoiding speeding and hard braking, can earn you discounts and lower premiums.

- Telematics devices track driving habits and can lead to discounts for safe driving.

- Safe driving habits, such as avoiding speeding and hard braking, can lower premiums.

New York’s Insurance Rating System

New York uses a complex insurance rating system to determine premiums. This system considers various factors, including your driving history, age, vehicle type, location, and credit score. The system assigns each driver a rating based on their risk profile, with higher-risk drivers paying higher premiums.

- New York’s insurance rating system considers multiple factors to assess risk and determine premiums.

- Higher-risk drivers pay higher premiums based on their assigned rating.

Finding the Best Car Insurance Quotes in New York

Finding the best car insurance quotes in New York can be a daunting task, given the numerous insurance providers and the complexity of insurance policies. However, by employing a strategic approach and understanding the factors influencing quotes, you can secure the most competitive rates that meet your needs.

Comparing Car Insurance Quotes

Comparing quotes from different insurance providers is essential to finding the best deal. This process involves gathering quotes from various companies and evaluating them based on coverage, price, and other factors. Here’s a step-by-step guide:

- Gather Information: Before contacting insurance companies, gather essential information about your vehicle, driving history, and desired coverage. This includes your vehicle identification number (VIN), driving record, and details about your coverage preferences, such as liability limits, comprehensive and collision coverage, and uninsured/underinsured motorist coverage.

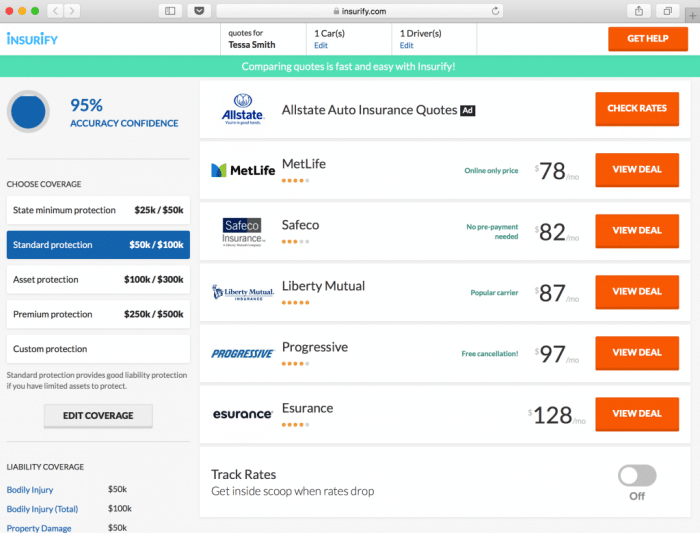

- Use Online Comparison Tools: Utilize online car insurance comparison websites to streamline the quote gathering process. These platforms allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves time and effort, enabling you to compare quotes side-by-side.

- Contact Insurance Companies Directly: In addition to online comparison tools, contact insurance companies directly to obtain quotes. This allows you to discuss your specific needs and ask questions about coverage options and pricing. Some companies may offer discounts or special promotions not available through online platforms.

- Compare Quotes Carefully: Once you have gathered quotes from several providers, compare them thoroughly. Pay attention to coverage details, deductibles, premiums, and any additional fees or discounts. Consider factors such as customer service, claims handling, and financial stability of the insurer.

- Negotiate for a Better Rate: After comparing quotes, consider negotiating with the insurers offering the most competitive rates. Mention other quotes you have received and highlight any factors that may make you a desirable customer, such as a clean driving record or a history of safe driving. Insurers may be willing to adjust their rates to secure your business.

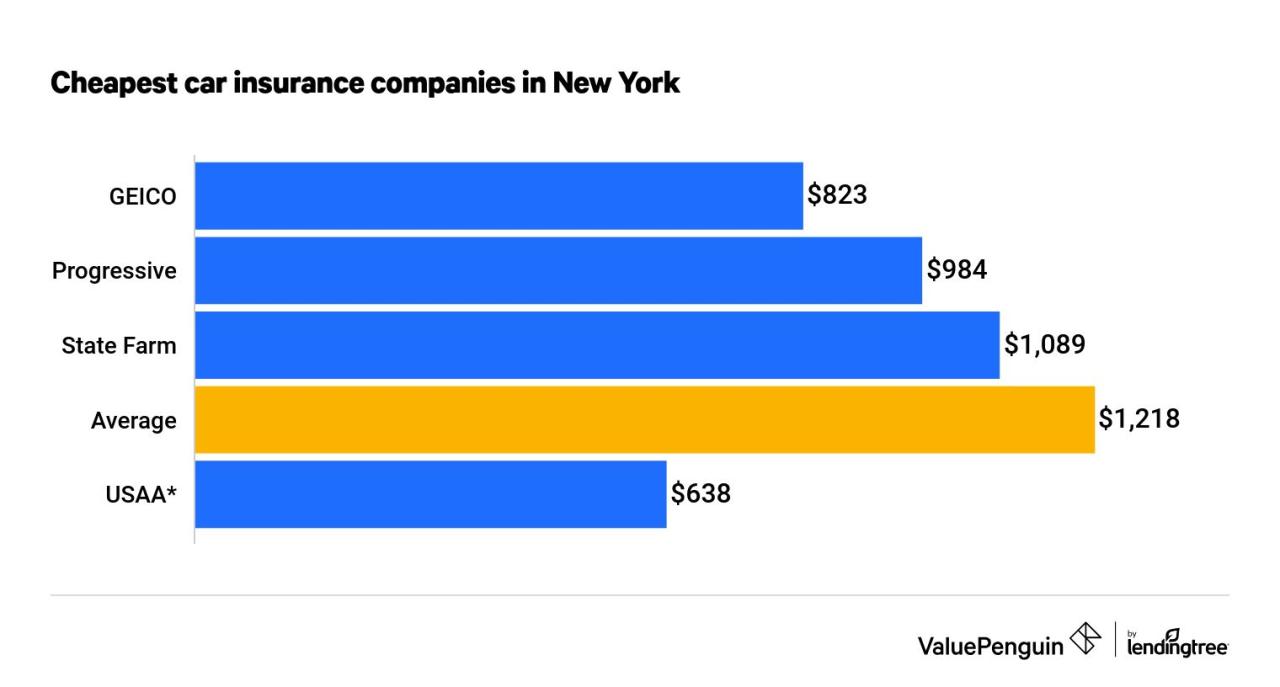

Comparing Insurance Providers in New York

Here’s a table comparing some of the leading car insurance providers in New York, highlighting their strengths, weaknesses, and key features:

| Provider | Strengths | Weaknesses | Key Features |

|---|---|---|---|

| Geico | Competitive pricing, strong customer service, wide range of coverage options | Limited availability in some areas, online-focused approach may not suit all customers | Discounts for good drivers, multiple vehicle coverage, mobile app for managing policies |

| Progressive | Innovative features, personalized coverage options, comprehensive online tools | Higher premiums in some cases, complex pricing structure | Name Your Price tool, Snapshot device for monitoring driving habits, Drive Safe & Save discount |

| State Farm | Strong financial stability, extensive agent network, wide range of insurance products | Higher premiums compared to some competitors, limited online tools | Discounts for multiple policies, Drive Safe & Save program, comprehensive coverage options |

| Allstate | Strong customer service, personalized coverage options, comprehensive mobile app | Higher premiums in some cases, limited discounts compared to competitors | Drive Safe & Save program, Drivewise mobile app for monitoring driving habits, customized coverage plans |

| Liberty Mutual | Competitive pricing, strong financial stability, comprehensive coverage options | Limited agent network in some areas, online tools may not be as user-friendly as competitors | Discounts for good drivers, multiple vehicle coverage, Drive Safe & Save program |

Remember: The best car insurance provider for you will depend on your individual needs, driving history, and financial situation.

Saving Money on Car Insurance in New York

Car insurance is a necessity for New York drivers, but it can be expensive. Fortunately, there are several ways to lower your premiums and save money. By taking advantage of discounts, comparing rates, and making smart choices, you can find affordable coverage that meets your needs.

Defensive Driving Courses

Taking a defensive driving course can help you become a safer driver and potentially lower your car insurance premiums. These courses teach you about safe driving practices, traffic laws, and how to avoid accidents. Many insurance companies offer discounts to drivers who complete an approved defensive driving course.

Bundling Policies

Bundling your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant savings. Many insurance companies offer discounts for bundling multiple policies, as they see you as a more valuable customer.

Increasing Deductibles

Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Increasing your deductible can lower your premium, but it means you’ll have to pay more in the event of an accident. Consider your financial situation and risk tolerance when deciding on your deductible.

Loyalty Programs

Many insurance companies offer loyalty programs that reward long-term customers with discounts and other benefits. These programs can be a great way to save money on your car insurance over time.

Discounts

Insurance companies offer various discounts to their policyholders. Some common discounts include:

- Good student discount: This discount is available to students who maintain a certain GPA.

- Safe driver discount: This discount is given to drivers with a clean driving record.

- Multi-car discount: This discount is offered when you insure multiple vehicles with the same company.

- Anti-theft device discount: This discount is available for vehicles equipped with anti-theft devices.

Resources and Tools

Several resources and tools can help you find the best car insurance rates and save money.

- Online comparison websites: Websites like Policygenius and The Zebra allow you to compare quotes from multiple insurance companies.

- Insurance brokers: Brokers can help you find the best coverage and negotiate rates.

- State Department of Financial Services: The New York State Department of Financial Services provides information about insurance companies and consumer rights.

Understanding Car Insurance Claims in New York

Filing a car insurance claim in New York can be a stressful experience, but understanding the process can help make it smoother. This section will Artikel the steps involved in filing a claim, the role of the New York State Department of Financial Services, and the rights and responsibilities of policyholders.

The Car Insurance Claim Process in New York

The process of filing a car insurance claim in New York typically involves the following steps:

- Report the Accident: Immediately after an accident, contact your insurance company to report the incident. Provide all the necessary details, including the date, time, location, and description of the accident. If possible, gather contact information from any other parties involved and any witnesses.

- File a Claim: Your insurance company will provide you with a claim form, which you will need to complete and submit. Be sure to include all relevant information, including details about the accident, your vehicle, and any injuries sustained.

- Investigation: Your insurance company will investigate the claim to verify the details and determine the extent of the damage. This may involve reviewing police reports, inspecting the vehicle, and interviewing witnesses.

- Negotiation: Once the investigation is complete, your insurance company will make an offer to settle the claim. You have the right to negotiate this offer and may need to provide supporting documentation, such as repair estimates or medical bills.

- Payment: If you accept the settlement offer, your insurance company will issue payment for the damages or injuries. The payment may be made directly to you, to a repair shop, or to a medical provider.

The Role of the New York State Department of Financial Services

The New York State Department of Financial Services (DFS) plays a crucial role in regulating the insurance industry in New York. This includes overseeing the handling of insurance claims.

- Consumer Protection: The DFS is responsible for ensuring that insurance companies comply with state laws and regulations and that policyholders are treated fairly.

- Dispute Resolution: If you have a dispute with your insurance company, the DFS can assist you in resolving the issue. They provide resources and information to policyholders and offer mediation services to help facilitate a resolution.

- Licensing and Oversight: The DFS is responsible for licensing insurance companies and agents and for monitoring their financial stability.

Rights and Responsibilities of Policyholders

Policyholders in New York have certain rights and responsibilities when it comes to car insurance claims.

- Right to File a Claim: Policyholders have the right to file a claim with their insurance company if they are involved in an accident.

- Right to a Fair Settlement: Policyholders are entitled to a fair and reasonable settlement for their damages or injuries.

- Right to Representation: Policyholders have the right to hire an attorney to represent them in their claim.

- Responsibility to Cooperate: Policyholders are responsible for cooperating with their insurance company during the claims process. This includes providing accurate information and documentation, and responding to requests for information in a timely manner.

- Responsibility to Act in Good Faith: Policyholders are expected to act in good faith when filing a claim. This means that they should not make false or misleading statements or attempt to defraud their insurance company.

Closing Summary

Armed with this knowledge, you can confidently approach the process of obtaining car insurance quotes in New York. Remember, the key to securing the best rates lies in understanding your needs, comparing options thoroughly, and utilizing the resources available to you. By taking a proactive approach, you can ensure you’re adequately protected on the road while minimizing your insurance costs.

FAQ Corner

What are the minimum car insurance requirements in New York?

New York State requires all drivers to have liability insurance, which covers damages to other people and their property in case of an accident. The minimum liability limits are $25,000 per person, $50,000 per accident, and $10,000 for property damage.

How does my driving record affect my car insurance rates?

Your driving record plays a significant role in determining your car insurance premiums. A history of accidents, traffic violations, or DUI convictions will likely result in higher rates. Maintaining a clean driving record is essential for securing lower premiums.

What are some common discounts available for car insurance in New York?

Many insurance companies offer discounts for various factors, including good driving records, safety features in your vehicle, bundling policies, and membership in certain organizations.