Car insurance ny state – Car insurance in NY State is a necessity for all drivers, and understanding its complexities is crucial. This guide delves into the world of car insurance in New York, covering everything from mandatory coverages to finding the best deals.

Navigating the intricacies of car insurance can be overwhelming, but this guide will equip you with the knowledge to make informed decisions and secure the right coverage for your needs. From understanding the essential requirements to discovering ways to save on premiums, we’ll break down the key aspects of car insurance in New York.

Car Insurance Requirements in NY State

Driving in New York State requires you to have car insurance. It’s not just a suggestion; it’s the law. This ensures that you’re financially protected if you’re involved in an accident, and it helps protect other drivers on the road as well. Let’s dive into the specifics of what you need to know about car insurance in New York.

Mandatory Insurance Coverages

New York State requires all drivers to have a minimum amount of liability insurance. This insurance covers damages to other people and their property if you’re at fault in an accident.

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and other damages to people injured in an accident that you caused. The minimum required limit is $25,000 per person and $50,000 per accident. This means that if you injure one person, the maximum your insurance will pay is $25,000. If you injure multiple people, the maximum payout per accident is $50,000.

- Property Damage Liability: This coverage pays for damages to other people’s vehicles or property if you’re at fault in an accident. The minimum required limit is $10,000 per accident. This means that if you damage someone’s car, the maximum your insurance will pay is $10,000.

Uninsured/Underinsured Motorist Coverage

In New York, it’s also crucial to have uninsured/underinsured motorist (UM/UIM) coverage. This coverage protects you and your passengers if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

It’s important to note that in New York, you can reject UM/UIM coverage, but it’s highly recommended to keep it.

Financial Responsibility Law

New York State has a Financial Responsibility Law that requires drivers to prove they have insurance or the financial means to cover damages if they cause an accident. This law is designed to ensure that all drivers are financially responsible for their actions on the road.

If you’re caught driving without insurance in New York, you can face serious consequences, including fines, license suspension, and even jail time.

Factors Affecting Car Insurance Premiums in NY

Several factors influence the cost of car insurance in New York, and understanding these factors can help you make informed decisions to potentially lower your premiums.

Driving History

Your driving record is a significant factor in determining your insurance rates. A clean driving history with no accidents or violations will result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions can significantly increase your rates. Insurance companies consider your driving history to assess your risk of future accidents.

Age

Age is another crucial factor in determining your insurance rates. Younger drivers, especially those under 25, tend to have higher premiums due to their higher risk of accidents. As drivers gain experience and age, their premiums generally decrease.

Location

The location where you live can impact your insurance rates. Areas with higher crime rates, traffic congestion, and accident rates often have higher premiums. Insurance companies assess the risk of accidents in different locations to adjust their rates accordingly.

Vehicle Type

The type of vehicle you drive also plays a significant role in determining your insurance rates. Sports cars, luxury vehicles, and high-performance vehicles are generally more expensive to insure due to their higher repair costs, increased risk of accidents, and potential for theft.

Credit Score

Surprisingly, your credit score can influence your car insurance premiums. Insurance companies believe that people with good credit are more financially responsible and less likely to file claims. Therefore, individuals with higher credit scores may qualify for lower insurance rates.

Table of Factors Affecting Car Insurance Premiums in NY

| Factor | Impact on Premiums |

|---|---|

| Driving History | Clean driving history = Lower premiums; Accidents, violations = Higher premiums |

| Age | Younger drivers (under 25) = Higher premiums; Older drivers = Lower premiums |

| Location | High-risk areas = Higher premiums; Low-risk areas = Lower premiums |

| Vehicle Type | High-performance, luxury vehicles = Higher premiums; Sedans, economy cars = Lower premiums |

| Credit Score | Good credit = Lower premiums; Poor credit = Higher premiums |

Types of Car Insurance Coverage in NY

In New York, you have several types of car insurance coverage to choose from, each offering different levels of protection. Understanding the different types of coverage and their benefits is crucial to making informed decisions about your car insurance policy.

Liability Coverage

Liability coverage is the most basic and legally required type of car insurance in New York. It protects you financially if you cause an accident that injures another person or damages their property. Liability coverage is divided into two parts:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident that you caused.

- Property Damage Liability: This covers the cost of repairs or replacement for the other driver’s vehicle or any other property you damage in an accident.

The minimum liability coverage required in New York is 25/50/10, meaning you must have at least $25,000 in bodily injury liability coverage per person, $50,000 in bodily injury liability coverage per accident, and $10,000 in property damage liability coverage. However, it is advisable to consider higher limits to protect yourself financially in case of a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional, but it is highly recommended if you have a car loan or lease, as your lender will likely require it.

- Benefits: It provides peace of mind knowing that your vehicle will be repaired or replaced if it is damaged in an accident, even if you are at fault.

- Limitations: There is a deductible that you must pay before your insurance company covers the remaining costs. The deductible is the amount you agree to pay out of pocket for each claim.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as:

- Theft

- Vandalism

- Fire

- Hail

- Flooding

Like collision coverage, comprehensive coverage is optional. However, it is generally a good idea to have this coverage if you have a new or expensive car.

- Benefits: It provides protection against a wide range of risks that could damage your vehicle, ensuring that you can get it repaired or replaced.

- Limitations: It typically has a deductible, similar to collision coverage, and may have limits on the amount of coverage provided for certain events.

Personal Injury Protection (PIP)

PIP coverage is a type of no-fault insurance that covers your medical expenses and lost wages, regardless of who is at fault in an accident. It is mandatory in New York, and you are required to have a minimum of $50,000 in PIP coverage.

- Benefits: It provides immediate financial assistance for medical expenses and lost wages, without having to wait for the determination of fault in an accident.

- Limitations: The coverage is limited to a certain amount, and it may not cover all medical expenses or lost wages.

Optional Coverage

While not required, certain optional coverage can provide valuable protection:

- Rental Reimbursement: This coverage helps pay for a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: This coverage provides help with services like towing, jump starts, flat tire changes, and lockout assistance.

Coverage Comparison

| Coverage Type | Purpose | Benefits | Limitations |

|—|—|—|—|

| Liability | Protects you financially if you cause an accident that injures another person or damages their property | Covers medical expenses, lost wages, and property damage for the other driver and passengers | Minimum coverage limits may not be sufficient for serious accidents |

| Collision | Pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault | Provides peace of mind knowing your vehicle will be repaired or replaced after an accident | Has a deductible, and coverage may be limited for certain types of damage |

| Comprehensive | Protects your vehicle against damages caused by events other than collisions | Provides protection against a wide range of risks that could damage your vehicle | Has a deductible, and coverage may be limited for certain events |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages, regardless of who is at fault in an accident | Provides immediate financial assistance for medical expenses and lost wages | Limited coverage amount, and may not cover all medical expenses or lost wages |

Finding the Best Car Insurance in NY: Car Insurance Ny State

Finding affordable car insurance in New York can be a challenge, but with the right approach, you can secure a policy that fits your budget and needs.

Comparing Quotes from Multiple Insurance Companies

It’s crucial to compare quotes from multiple insurance companies before settling on a policy. This allows you to identify the best rates and coverage options available. You can use online comparison websites or contact insurance companies directly to request quotes.

Strategies for Negotiating Lower Premiums

Several strategies can help you negotiate lower car insurance premiums in New York:

- Bundling Policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts. Many insurance companies offer discounts for bundling multiple policies.

- Taking Advantage of Discounts: Insurance companies offer various discounts based on factors like good driving records, safety features in your car, and completing driver education courses. Ask your insurance company about available discounts and ensure you qualify for them.

- Negotiating with Your Current Provider: If you’ve been a loyal customer with your current insurance provider, consider negotiating a lower rate. Explain your situation and inquire about available discounts or special offers.

- Increasing Your Deductible: Choosing a higher deductible can lower your premium, as you’ll pay more out of pocket in case of an accident. However, ensure you can afford the higher deductible if you need to file a claim.

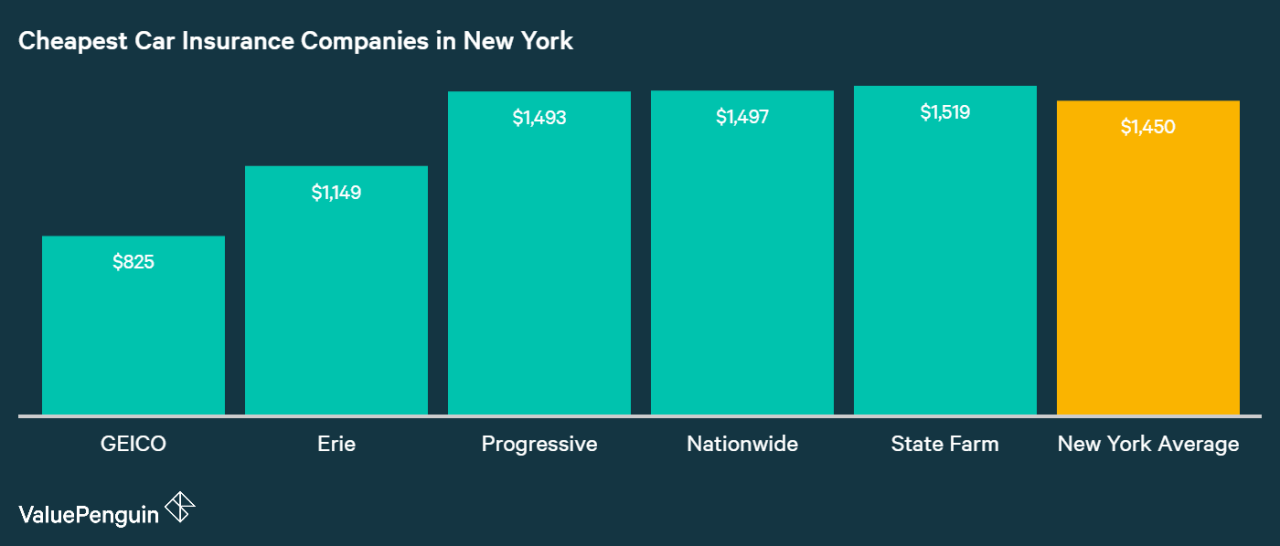

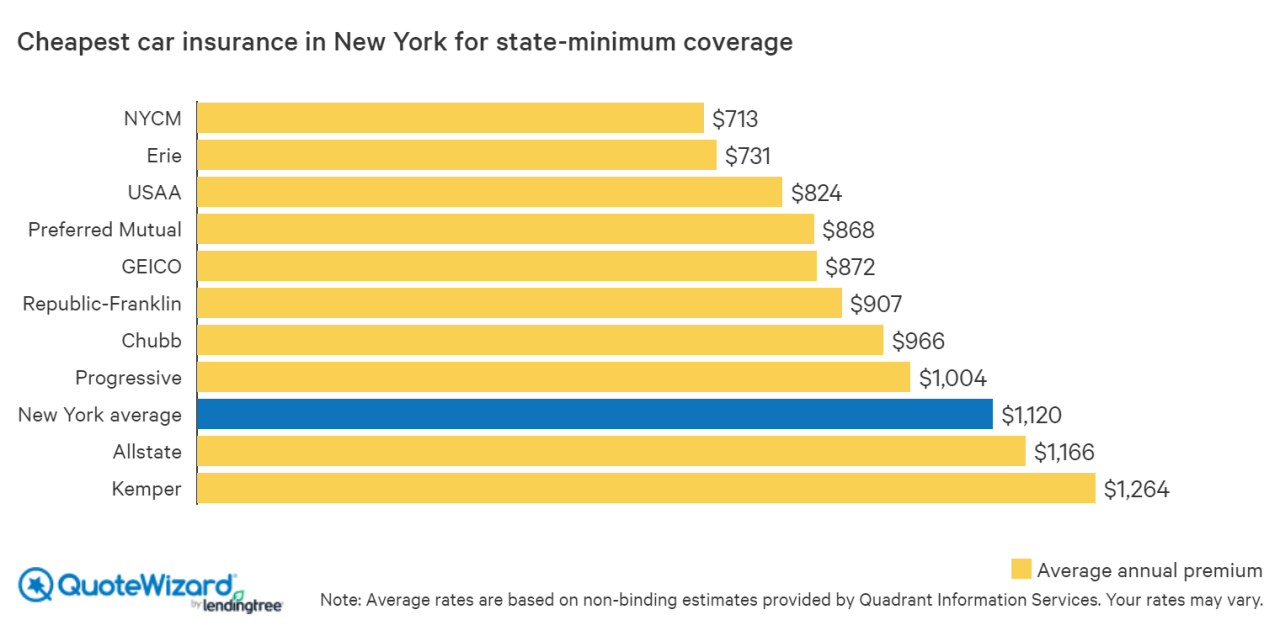

Reputable Car Insurance Companies Operating in New York

Here are some reputable car insurance companies operating in New York:

- Geico: Known for its competitive rates and wide range of coverage options.

- State Farm: A well-established company with a strong reputation for customer service.

- Progressive: Offers personalized insurance plans and innovative features like its “Name Your Price” tool.

- Allstate: Provides comprehensive coverage and various discounts for safe drivers.

- Liberty Mutual: Offers customizable policies and a strong focus on customer satisfaction.

Filing a Car Insurance Claim in NY

In the unfortunate event of a car accident, understanding the process of filing a car insurance claim is crucial. This section will guide you through the steps involved in reporting the accident, gathering necessary documentation, and resolving your claim.

Reporting the Accident and Notifying the Insurance Company

Immediately after an accident, it is essential to contact your insurance company and report the incident. The sooner you notify them, the quicker they can begin the claims process. Here’s what you need to do:

- Call your insurance company’s 24/7 claims hotline. You’ll be asked to provide basic information about the accident, including the date, time, location, and details of the other vehicles involved.

- Gather information at the scene. Exchange contact and insurance information with the other driver(s) involved. Note down the license plate numbers, vehicle descriptions, and any witness information.

- Take pictures or videos of the accident scene. Document the damage to your vehicle, the other vehicles involved, and any relevant road conditions.

- Seek medical attention if necessary. If you or anyone else is injured, prioritize medical treatment and report any injuries to your insurance company.

Documentation Required for a Claim

Your insurance company will need specific documentation to process your claim. Here’s a list of common requirements:

- Police report. If the accident involved injuries, property damage exceeding a certain threshold, or a hit-and-run, a police report is usually required.

- Medical records. If you were injured, provide your insurance company with medical records detailing your treatment and diagnosis.

- Repair estimates. Obtain estimates from reputable repair shops for the damage to your vehicle.

- Photographs or videos of the accident scene and vehicle damage. These visual aids can help support your claim.

- Your insurance policy details. Be prepared to provide your policy number and other relevant information.

Resolving Claims: Adjusters and Potential Disputes

Once you’ve reported the accident and provided the necessary documentation, your insurance company will assign an adjuster to your claim. The adjuster will investigate the accident, assess the damages, and determine the amount of compensation you’re entitled to.

- The adjuster will review the documentation you provided and may conduct their own investigation. This may include interviewing witnesses, reviewing police reports, and inspecting the damaged vehicles.

- The adjuster will negotiate a settlement with you. This settlement will cover the cost of repairs, medical expenses, and any other related expenses.

- You have the right to negotiate with the adjuster. If you disagree with the settlement offer, you can appeal the decision or seek legal advice.

Car Insurance Discounts in NY

Car insurance discounts in New York can significantly reduce your premiums. By taking advantage of these discounts, you can save money on your car insurance without compromising coverage.

Types of Car Insurance Discounts in NY, Car insurance ny state

Here are some common car insurance discounts available in New York:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, meaning no accidents or traffic violations within a specific period, typically three to five years. The discount can range from 5% to 20% or more, depending on the insurer and the driver’s history.

- Safe Driver Discount: Similar to the good driver discount, this discount is offered to drivers who have completed a defensive driving course. These courses teach safe driving practices and can reduce your risk of accidents. The discount amount varies based on the insurer and the specific course completed.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you can often qualify for a multi-car discount. This discount is typically offered as a percentage reduction on your premium for each additional vehicle you insure. The discount can be substantial, especially if you have several cars on your policy.

- Good Student Discount: This discount is available to students who maintain a high GPA or are enrolled in a college or university. It encourages academic excellence and can save you money on your car insurance. The discount percentage varies by insurer and the student’s academic standing.

- Anti-theft Device Discount: Installing anti-theft devices, such as alarm systems, GPS trackers, or immobilizers, can reduce your risk of car theft. Insurers often offer discounts to policyholders who have these devices installed, as it demonstrates their commitment to vehicle security.

- Loyalty Discount: Some insurers reward long-term customers with loyalty discounts. The longer you’ve been with an insurer, the more likely you are to receive this discount. This is a way for insurers to retain their existing customer base.

- Paperless Billing Discount: Opting for electronic communication instead of paper bills can save you money on your car insurance. Insurers often offer discounts to policyholders who choose paperless billing, as it reduces their administrative costs.

- Bundling Discount: If you bundle your car insurance with other types of insurance, such as homeowners or renters insurance, you can often get a discount. This is a common strategy for insurers to encourage customers to purchase multiple policies from them.

Maximizing Discount Opportunities

To maximize your discount opportunities, consider the following:

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial for qualifying for good driver discounts. Drive safely and defensively to maintain a clean record.

- Complete a Defensive Driving Course: Enroll in a defensive driving course to enhance your driving skills and qualify for a safe driver discount. Many online courses are available, making it convenient to complete.

- Bundle Your Insurance Policies: If you have multiple insurance needs, such as homeowners, renters, or life insurance, consider bundling them with your car insurance. This can result in significant savings.

- Shop Around for the Best Rates: Compare quotes from different insurers to find the best rates and discounts. Use online comparison tools or contact insurers directly to get quotes.

- Ask About Available Discounts: When you contact an insurer, be sure to ask about all available discounts, even if you don’t think you qualify. You might be surprised at what you’re eligible for.

- Review Your Policy Regularly: Review your car insurance policy periodically to ensure you’re still taking advantage of all available discounts and that your coverage is still adequate for your needs.

Last Recap

With this guide, you’ll have a comprehensive understanding of car insurance in New York, enabling you to navigate the process confidently and find the best coverage at the most affordable rates. Remember, comparing quotes from multiple insurers, understanding your coverage options, and taking advantage of available discounts can significantly impact your premiums. Stay informed and drive with peace of mind!

Expert Answers

What are the minimum liability limits required for car insurance in New York?

The minimum liability limits in New York are $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

How does my credit score affect my car insurance premiums?

Insurance companies in New York can use your credit score to determine your premiums. A higher credit score generally leads to lower premiums, while a lower credit score may result in higher premiums.

What are some common car insurance discounts available in New York?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and discounts for anti-theft devices.

What steps should I take if I need to file a car insurance claim in New York?

First, report the accident to the police and your insurance company. Then, gather documentation such as a police report, medical records, and photos of the damage. Your insurance company will guide you through the claim process.