Car insurance new york state – Car insurance in New York State is a crucial aspect of responsible driving. It’s not just a legal requirement, but also a financial safeguard in case of accidents. Understanding the intricacies of New York’s car insurance system, from mandatory coverages to rate influencing factors, can empower drivers to make informed decisions and find the best coverage for their needs.

This guide delves into the essential aspects of car insurance in New York, providing insights into the state’s unique requirements, the factors that affect insurance rates, and strategies for finding affordable and comprehensive coverage.

Understanding New York State Car Insurance Requirements

Driving in New York State requires you to have car insurance, and understanding the specific requirements is crucial to avoid legal consequences and ensure your financial protection. This section Artikels the mandatory coverages, minimum liability limits, and the importance of complying with the New York State Financial Responsibility Law.

Mandatory Car Insurance Coverages

New York State mandates several types of car insurance coverages to protect you and others in the event of an accident. These coverages are:

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other party’s medical expenses, lost wages, and property repairs.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages, regardless of who caused the accident. It also covers medical expenses for passengers in your vehicle.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses. It covers your medical expenses, lost wages, and property damage.

Minimum Liability Limits

New York State sets minimum liability limits for bodily injury and property damage. These limits determine the maximum amount your insurance company will pay for damages caused by you.

- Bodily Injury Liability: The minimum limit is $25,000 per person and $50,000 per accident.

- Property Damage Liability: The minimum limit is $10,000 per accident.

New York State Financial Responsibility Law

The New York State Financial Responsibility Law requires all drivers to prove they have financial means to cover damages caused by an accident. This means you must have the minimum required car insurance or demonstrate financial responsibility through other means, such as a surety bond or a deposit of cash or securities.

Consequences of Driving Without Car Insurance

Driving without car insurance in New York State is illegal and can result in severe consequences. These include:

- Fines: You can face hefty fines, which can range from $500 to $1,500 for the first offense and even higher for subsequent offenses.

- License Suspension: Your driver’s license can be suspended for a period of time, depending on the severity of the offense.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Financial Responsibility: If you cause an accident without insurance, you will be personally responsible for all damages, including medical expenses, lost wages, and property repairs.

Factors Influencing Car Insurance Rates in New York

Car insurance premiums in New York are determined by a complex interplay of factors, reflecting the unique characteristics of each driver and their vehicle. These factors are meticulously assessed by insurance companies to calculate the risk associated with insuring a particular individual and their vehicle.

Driving History

Your driving history plays a crucial role in determining your car insurance rates. Insurance companies closely examine your driving record, specifically looking for any past accidents, traffic violations, and driving convictions. A clean driving record with no incidents translates into lower premiums, as it suggests a lower risk of future accidents. Conversely, a history of accidents or violations indicates a higher risk profile, leading to increased premiums. For example, a driver with multiple speeding tickets or a DUI conviction will likely face significantly higher premiums compared to a driver with a spotless record.

Age

Age is a significant factor influencing car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk is attributed to factors such as inexperience, impulsivity, and lack of driving maturity. As a result, insurance companies typically charge higher premiums for younger drivers. Conversely, older drivers, particularly those over 65, generally pay lower premiums. This is due to their accumulated experience, better driving habits, and lower risk of accidents.

Gender

While gender-based pricing is becoming increasingly controversial and is prohibited in some states, in New York, insurance companies still consider gender as a factor in determining rates. Historically, statistics have shown that men tend to be involved in more accidents than women, leading to higher premiums for male drivers. However, it’s important to note that this trend is not universally true and is subject to change as driving patterns evolve.

Car Type and Model

The type and model of your car also significantly influence your insurance premiums. Luxury vehicles, sports cars, and high-performance vehicles are typically more expensive to repair and replace, resulting in higher insurance premiums. Conversely, smaller, less expensive vehicles generally have lower insurance costs. The safety features of your car, such as airbags, anti-lock brakes, and stability control, can also impact your rates. Vehicles with advanced safety features are often considered safer and therefore attract lower premiums.

Location

Your location, specifically your zip code, is a key factor in determining your car insurance rates. Insurance companies assess the risk of accidents and theft in different areas. For example, urban areas with high traffic density and crime rates typically have higher insurance premiums compared to rural areas with lower population density and lower crime rates.

Driving Habits

Your driving habits, such as the number of miles you drive annually and your driving patterns, can also affect your insurance premiums. Drivers who commute long distances or frequently drive in high-traffic areas are generally considered higher risk and may face higher premiums. Similarly, drivers who frequently drive at night or during rush hour are also assessed as higher risk.

Credit Score

Surprisingly, your credit score can also influence your car insurance rates in New York. Insurance companies have found a correlation between credit score and driving behavior. Individuals with good credit scores tend to be more financially responsible, which is often associated with safer driving habits. As a result, insurance companies may offer lower premiums to drivers with good credit scores. Conversely, drivers with poor credit scores may face higher premiums, as they are considered a higher risk.

Types of Car Insurance Coverage in New York

New York State requires all drivers to carry a minimum amount of car insurance to cover potential financial losses in case of an accident. The types of coverage available in New York can be categorized into mandatory and optional coverages. Each type of coverage has its benefits and limitations, and it’s crucial to understand these differences to choose the right insurance policy for your needs.

Liability Coverage

Liability coverage is the most basic and essential type of car insurance in New York. It protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers the following:

- Bodily Injury Liability: This coverage pays for medical expenses, lost wages, and pain and suffering of the other driver and passengers if you are at fault in an accident.

- Property Damage Liability: This coverage pays for repairs or replacement of the other driver’s vehicle and any other property damaged in an accident if you are at fault.

The minimum liability coverage requirements in New York are:

$25,000 per person for bodily injury

$50,000 per accident for bodily injury

$10,000 per accident for property damage

These limits are the minimum required by law, but it’s generally recommended to carry higher liability limits to protect yourself from significant financial losses in the event of a serious accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault. This coverage is optional, but it’s often recommended if you have a newer or financed vehicle. If you choose not to have collision coverage, you’ll be responsible for paying for repairs or replacement out of pocket.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damage caused by events other than an accident, such as theft, vandalism, fire, hail, or falling objects. This coverage is also optional, but it’s often recommended if you have a newer or financed vehicle.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you and your passengers if you are involved in an accident with a driver who is uninsured or has insufficient insurance to cover your losses. This coverage pays for medical expenses, lost wages, and pain and suffering. UM/UIM coverage is optional in New York, but it’s highly recommended.

Optional Coverages, Car insurance new york state

While not mandatory, there are several optional coverages available in New York that can provide additional protection:

- Rental Reimbursement: This coverage helps pay for a rental car if your vehicle is damaged or stolen and is being repaired.

- Roadside Assistance: This coverage provides assistance in case of a flat tire, dead battery, or lockout. It often includes towing services.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident. It is separate from your health insurance and can help cover out-of-pocket medical expenses.

Finding the Best Car Insurance in New York

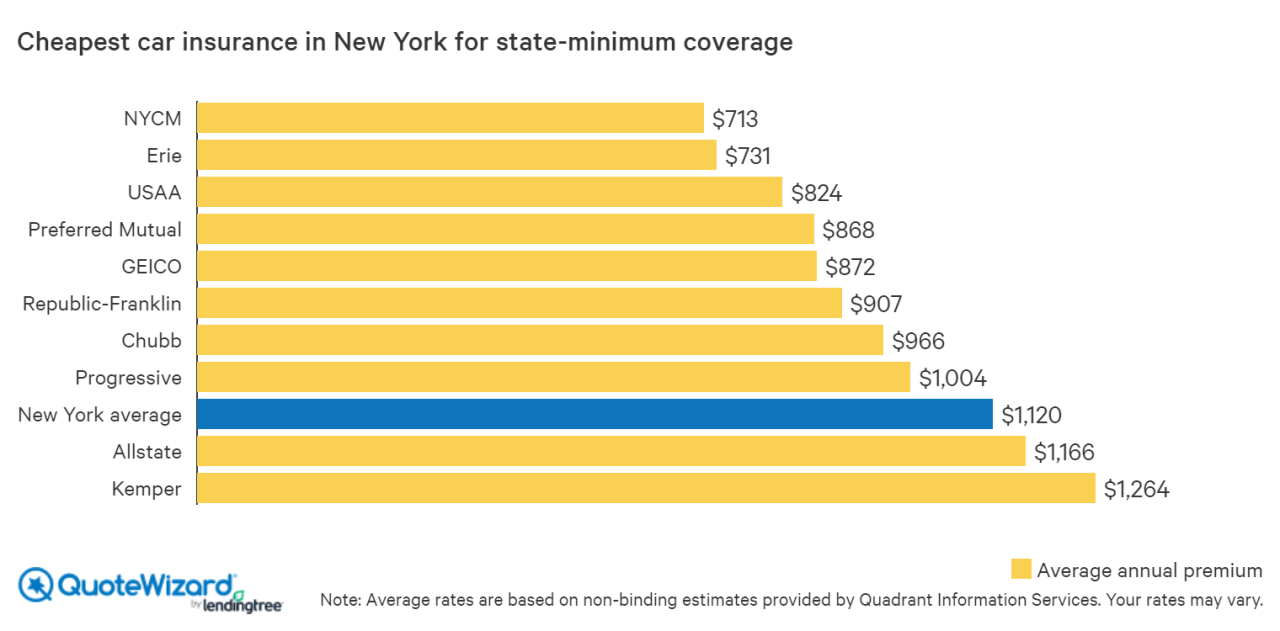

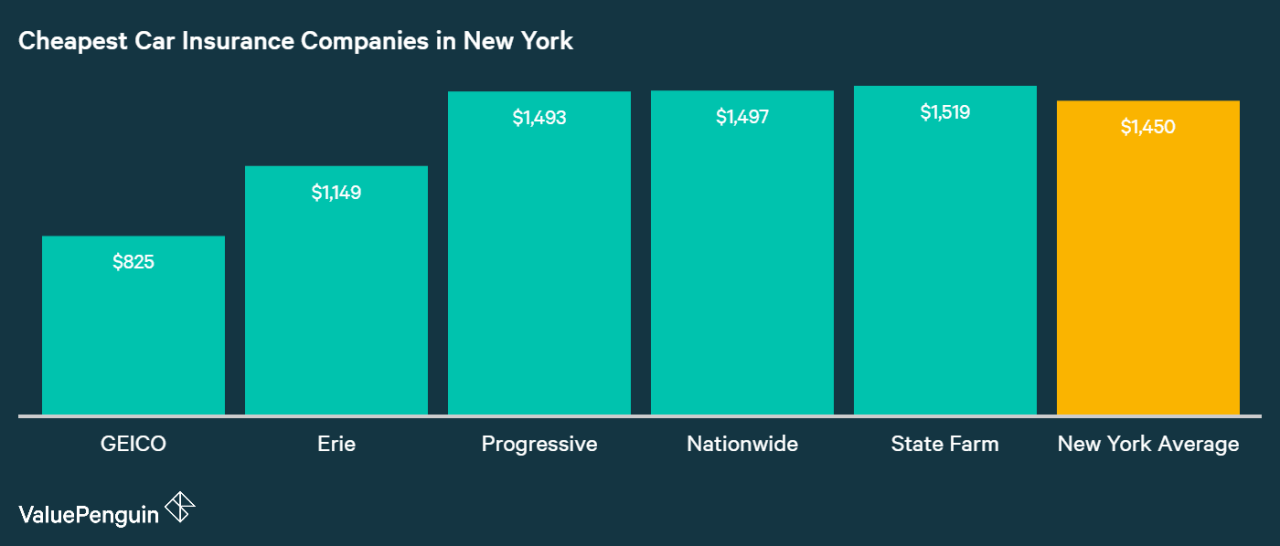

Finding the best car insurance in New York involves comparing quotes from different providers and considering factors like coverage, price, and customer service. To ensure you’re getting the best deal, it’s crucial to understand the process of comparing quotes, exploring discounts, and reviewing your policy regularly.

Comparing Car Insurance Quotes

Comparing quotes from different car insurance providers is essential to finding the best deal. You can use online comparison websites, contact insurance agents directly, or use a combination of both methods.

- Online Comparison Websites: Websites like The Zebra, Insurance.com, and Policygenius allow you to compare quotes from multiple providers simultaneously. This provides a quick overview of available options and helps you identify the best deals.

- Contacting Insurance Agents: Speaking with insurance agents directly allows you to discuss your specific needs and get personalized recommendations. This can be beneficial if you have complex insurance requirements or prefer a more hands-on approach.

When comparing quotes, consider factors like coverage, deductibles, and premiums. Make sure you understand the terms and conditions of each policy before making a decision.

Exploring Discounts and Special Offers

Car insurance companies often offer discounts and special offers to lower your premiums. Taking advantage of these discounts can significantly reduce your overall insurance costs.

- Good Driver Discounts: Many insurance companies offer discounts to drivers with clean driving records, demonstrating a history of safe driving practices.

- Safety Feature Discounts: Cars equipped with advanced safety features like anti-theft systems, airbags, and anti-lock brakes can qualify for discounts, reflecting the reduced risk of accidents.

- Bundling Discounts: Combining your car insurance with other insurance policies like homeowners or renters insurance can lead to significant savings through bundling discounts.

- Payment Discounts: Paying your premium in full or opting for automatic payments can sometimes result in discounts, reflecting the convenience and reliability associated with these payment methods.

Reviewing Your Insurance Policy Regularly

It’s important to review your car insurance policy regularly to ensure it still meets your needs and reflects any changes in your circumstances. This includes factors like:

- Changes in Driving Habits: If you’ve reduced your driving mileage or switched to a safer vehicle, you might be eligible for lower premiums. Updating your policy to reflect these changes can result in significant savings.

- Changes in Coverage Needs: As your life changes, your insurance needs may also change. For instance, if you purchase a new car, increase your assets, or have a family, you might need to adjust your coverage levels. Regular policy reviews help ensure you have adequate protection.

- New Discounts and Offers: Insurance companies frequently introduce new discounts and special offers. Reviewing your policy ensures you’re taking advantage of any available discounts that could lower your premiums.

Filing a Claim with Your Insurance Company

In the unfortunate event of an accident, it’s essential to know how to file a claim with your insurance company.

- Contact Your Insurance Company: Immediately report the accident to your insurance company, providing details of the incident, including the date, time, location, and any injuries involved.

- Gather Information: Collect relevant information, such as the names and contact details of all parties involved, including witnesses. Take pictures of the accident scene and any damages to your vehicle.

- Follow Your Insurance Company’s Instructions: Your insurance company will provide instructions on how to proceed with the claim. This may involve filing a police report, providing additional documentation, or scheduling an inspection of your vehicle.

By following these steps and maintaining open communication with your insurance company, you can navigate the claims process efficiently and ensure your claim is processed promptly.

New York State’s No-Fault System

New York State operates under a no-fault insurance system for car accidents. This system aims to simplify the claims process and provide prompt medical benefits to accident victims, regardless of who is at fault. It also helps reduce the number of lawsuits related to car accidents.

Understanding the No-Fault System

The no-fault system in New York means that after a car accident, each driver involved files a claim with their own insurance company for coverage of their injuries and damages, regardless of who caused the accident. This eliminates the need to determine fault in most cases, streamlining the claims process and reducing litigation.

Benefits of the No-Fault System

- Faster Claims Processing: By eliminating the need to determine fault initially, claims are processed more quickly, providing faster access to medical benefits for accident victims.

- Reduced Litigation: The no-fault system helps reduce the number of lawsuits related to car accidents, as drivers are typically compensated by their own insurance companies, regardless of fault.

- Lower Insurance Premiums: The reduced litigation and faster claims processing can lead to lower insurance premiums for drivers in New York.

Limitations of the No-Fault System

- Limited Coverage for Pain and Suffering: The no-fault system generally does not cover pain and suffering damages unless the injuries meet specific thresholds, such as “serious injury” or “permanent consequential limitation of use of a body organ or member.”

- Potential for Disputes: While the system aims to reduce litigation, disputes can still arise regarding the extent of injuries or the amount of compensation.

- Limited Coverage for Non-Economic Damages: The system primarily focuses on covering economic losses like medical expenses and lost wages, with limited coverage for non-economic damages like pain and suffering.

Personal Injury Protection (PIP) Coverage

Personal Injury Protection (PIP) coverage is a mandatory component of car insurance in New York. It provides benefits for medical expenses, lost wages, and other related expenses for the insured and their family members, regardless of who caused the accident. PIP coverage is a key element of the no-fault system, ensuring that accident victims have access to immediate medical care and financial support.

Filing a Claim under the No-Fault System

- Report the Accident: Immediately report the accident to your insurance company and the police.

- Seek Medical Attention: If you are injured, seek medical attention as soon as possible. Your insurance company will need documentation of your injuries and treatment.

- File a PIP Claim: File a claim with your insurance company for PIP benefits to cover your medical expenses, lost wages, and other related expenses.

- Provide Necessary Documentation: Provide your insurance company with all necessary documentation, including medical bills, wage statements, and accident reports.

- Follow Up on Your Claim: Follow up with your insurance company regularly to ensure your claim is being processed promptly and to address any questions or concerns.

New York State’s Driver Safety Programs

New York State offers various driver safety programs designed to enhance driving skills, promote safe driving practices, and reduce accidents. These programs provide drivers with valuable knowledge and skills that can significantly impact their driving behavior and, consequently, their insurance premiums.

Benefits of Participating in Driver Safety Programs

Participating in driver safety programs can yield several benefits for drivers in New York State. These programs are designed to enhance driving skills, promote safe driving practices, and ultimately reduce accidents. Here are some key benefits:

- Improved Driving Skills: Driver safety programs provide practical instruction and guidance on essential driving techniques, such as defensive driving strategies, hazard perception, and safe vehicle handling. This knowledge and skill enhancement can contribute to safer driving habits and a reduced risk of accidents.

- Reduced Insurance Premiums: Participating in certain approved driver safety programs can lead to discounts on your car insurance premiums. Insurance companies often recognize the value of these programs and reward drivers who demonstrate a commitment to safe driving.

- Enhanced Road Safety: By promoting safe driving practices and reducing the number of accidents, driver safety programs contribute to a safer driving environment for everyone on the road.

- Point Reduction: Some programs offer the opportunity to reduce points on your driving record, which can be particularly beneficial if you have received traffic violations.

- Increased Confidence: Participating in a driver safety program can boost your confidence behind the wheel, as you gain a better understanding of safe driving practices and develop more effective driving skills.

How to Enroll in Driver Safety Programs

Enrolling in a driver safety program in New York State is generally straightforward. Here’s a general process:

- Identify Approved Programs: The New York State Department of Motor Vehicles (DMV) maintains a list of approved driver safety programs. You can access this list online or contact the DMV directly for information.

- Contact the Program Provider: Once you’ve identified a program that meets your needs, contact the provider directly to inquire about enrollment requirements, course schedules, and fees.

- Complete the Course: Most driver safety programs involve classroom instruction, online learning, or a combination of both. You’ll need to complete the program’s curriculum to earn a certificate of completion.

- Submit Proof of Completion: After completing the program, you’ll typically need to submit a copy of your certificate of completion to the DMV or your insurance company to receive any applicable benefits.

Impact of Driver Safety Programs on Insurance Premiums

Driver safety programs can have a positive impact on your car insurance premiums. Insurance companies often offer discounts to drivers who participate in approved programs. These discounts can vary depending on the program, the insurance company, and your individual driving record.

- Discount Eligibility: To be eligible for a discount, you must complete the program and provide proof of completion to your insurance company. Some programs may require you to maintain a clean driving record for a specific period before you can qualify for the discount.

- Discount Amount: The amount of the discount can range from a few percent to a significant percentage of your premium, depending on the factors mentioned above. It’s always best to contact your insurance company directly to inquire about the specific discounts they offer for driver safety programs.

Epilogue: Car Insurance New York State

Navigating the complexities of car insurance in New York can feel overwhelming, but armed with the right information, drivers can confidently choose the best coverage for their circumstances. By understanding the state’s regulations, comparing quotes, and exploring available discounts, drivers can ensure they are adequately protected while minimizing their insurance costs.

FAQ Summary

What happens if I get into an accident without car insurance in New York?

Driving without car insurance in New York is illegal and can result in fines, license suspension, and even jail time. You could also be held financially responsible for any damages or injuries caused in the accident.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there are significant life changes, such as a new car purchase, marriage, or a change in your driving record. This helps ensure your coverage is still adequate and you’re getting the best possible rates.

What is the difference between collision and comprehensive coverage?

Collision coverage protects your car from damage caused by an accident, regardless of who is at fault. Comprehensive coverage covers damage to your car from events like theft, vandalism, or natural disasters.

Can I get a discount on my car insurance if I have a good driving record?

Yes, many insurance companies offer discounts for drivers with clean driving records. This can include discounts for being accident-free or for having a safe driving history.