Car insurance in Washington state is a necessity for all drivers, ensuring financial protection in the event of an accident. Understanding the state’s requirements, factors influencing insurance rates, and finding the best coverage for your needs is crucial. This guide will delve into the intricacies of car insurance in Washington, providing valuable insights and practical advice for drivers.

From mandatory coverages and minimum liability limits to optional protections and factors affecting premiums, we’ll explore the landscape of car insurance in Washington. We’ll also guide you through the process of comparing quotes, negotiating rates, and filing claims, empowering you to make informed decisions about your insurance.

Understanding Washington State Car Insurance Requirements

Driving in Washington State requires you to have car insurance to protect yourself and others in case of an accident. The state has specific requirements for the minimum coverage you must have, and there are also optional coverages that can provide additional protection. Understanding these requirements is crucial for ensuring you’re legally compliant and financially prepared in case of an unexpected event.

Mandatory Car Insurance Coverages in Washington State

The state of Washington requires all drivers to have the following minimum liability coverages:

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. It covers the costs of medical expenses, lost wages, property damage, and legal fees.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your losses. It can help pay for medical expenses, lost wages, and property damage.

The minimum liability limits required by law are:

- $25,000 for injury or death to one person in an accident.

- $50,000 for injury or death to multiple people in an accident.

- $10,000 for property damage in an accident.

These limits may not be enough to cover all your expenses in a serious accident. Consider increasing your liability limits to provide greater financial protection.

Optional Car Insurance Coverages

In addition to mandatory coverages, you can also purchase optional car insurance coverages to provide additional protection:

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by events other than an accident, such as theft, vandalism, fire, or hail.

- Medical Payments Coverage (Med Pay): This coverage pays for medical expenses for you and your passengers, regardless of who is at fault in an accident.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other expenses related to your injuries in an accident, regardless of who is at fault.

Optional coverages can help you avoid significant out-of-pocket expenses in case of an accident. You should carefully consider your individual needs and financial situation when deciding which optional coverages to purchase.

Factors Influencing Car Insurance Rates in Washington

Car insurance premiums in Washington, like in any other state, are influenced by a multitude of factors. These factors are used by insurance companies to assess your risk as a driver and determine how much you’ll pay for coverage. Understanding these factors can help you make informed decisions about your insurance and potentially save money.

Age and Driving Experience

Your age and driving experience play a significant role in your car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. This increased risk is reflected in higher premiums. As you gain more driving experience and reach your mid-20s, your rates typically decrease.

Driving History

Your driving history is another critical factor. Insurance companies carefully review your driving record to assess your risk. A clean record with no accidents, tickets, or violations will generally lead to lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions will likely result in higher rates.

Vehicle Type

The type of vehicle you drive also influences your insurance rates. Sports cars and luxury vehicles are often considered higher risk due to their performance and cost of repair. Therefore, their insurance premiums tend to be higher than those for more economical and standard vehicles.

Location

Where you live in Washington can significantly impact your car insurance rates. Areas with higher crime rates, traffic congestion, and accident frequency tend to have higher insurance premiums. This is because insurance companies face a greater risk of paying claims in these areas.

Credit Score

In Washington, insurance companies are allowed to consider your credit score when setting your car insurance rates. This practice is controversial, as some argue that it doesn’t accurately reflect driving risk. However, insurance companies often use credit score as a proxy for financial responsibility, assuming that individuals with good credit are more likely to pay their premiums on time.

Coverage Levels

The amount of coverage you choose will also impact your premium. Comprehensive and collision coverage, which protect you against damage to your vehicle from accidents and other events, are typically more expensive than liability coverage, which only covers damages to others.

Finding the Best Car Insurance in Washington

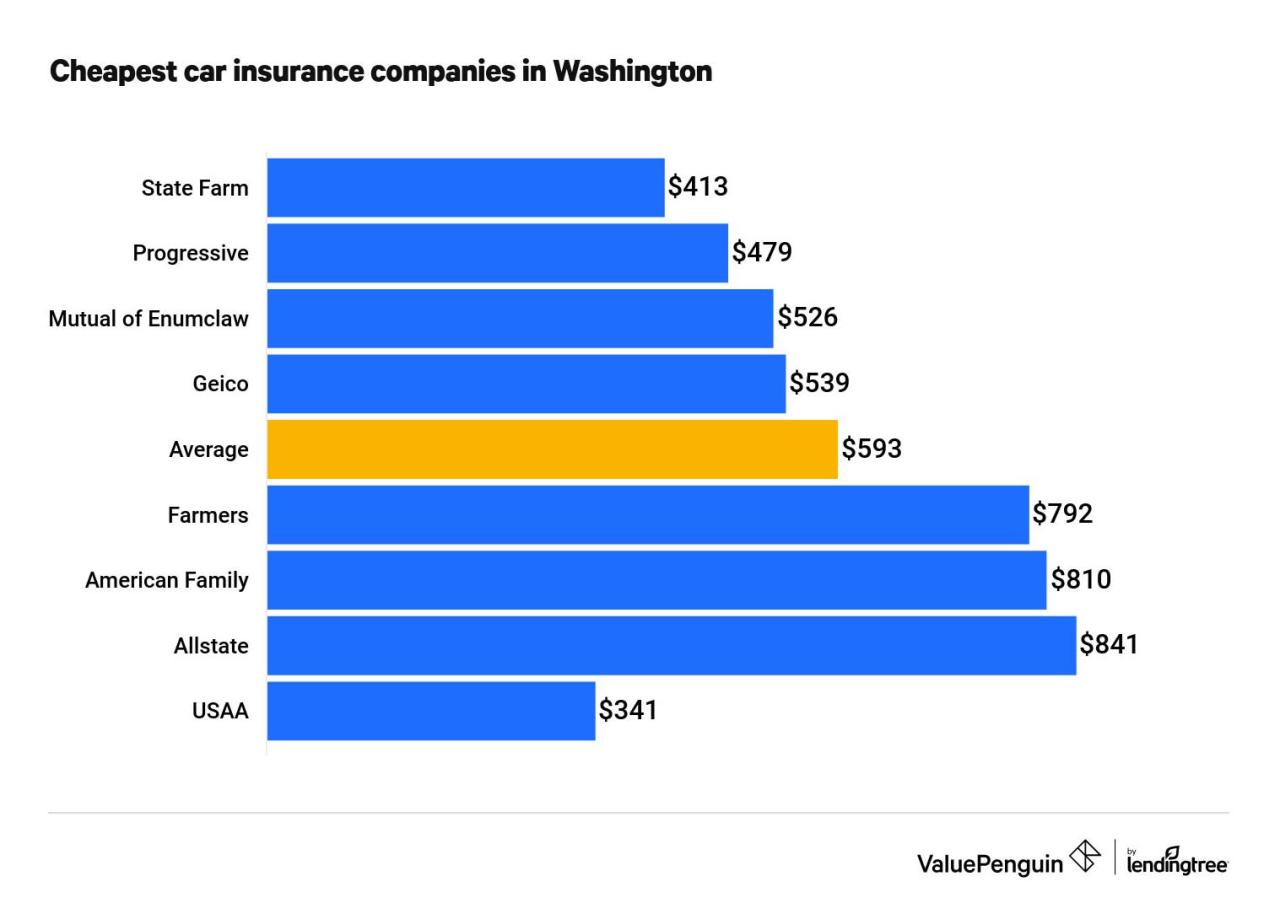

Finding the best car insurance in Washington involves comparing quotes from different providers and choosing the policy that best suits your needs and budget.

Comparing Car Insurance Quotes

To compare car insurance quotes, you can use online comparison websites or contact insurance companies directly. Online comparison websites allow you to enter your information once and receive quotes from multiple providers simultaneously, making it easy to compare prices and coverage. When contacting insurance companies directly, be sure to ask for quotes from multiple providers to ensure you are getting the best possible price.

- Gather your information: Before you start comparing quotes, gather all the necessary information, such as your driving history, vehicle information, and desired coverage. This will help you get accurate quotes and avoid delays.

- Use online comparison websites: Online comparison websites like Policygenius, The Zebra, and Insurance.com allow you to compare quotes from multiple providers simultaneously. These websites are convenient and save you time.

- Contact insurance companies directly: You can also contact insurance companies directly to get quotes. This gives you the opportunity to ask questions and discuss your specific needs with a representative.

- Compare quotes carefully: Once you have received quotes from multiple providers, compare them carefully. Consider factors such as price, coverage, and customer service. Remember that the cheapest option may not always be the best, and it’s essential to choose a policy that provides adequate coverage.

- Read the fine print: Before you commit to a policy, read the fine print carefully. Pay attention to deductibles, coverage limits, and any exclusions or limitations. Understanding the terms of your policy will help you avoid surprises later.

Key Features and Benefits of Different Insurance Companies

| Insurance Company | Key Features | Benefits |

|---|---|---|

| State Farm | Wide range of coverage options, strong customer service, discounts for bundling policies | Comprehensive coverage, reliable claims handling, competitive rates |

| Geico | Known for its affordable rates, convenient online tools, 24/7 customer service | Low premiums, easy policy management, quick claims processing |

| Progressive | Offers personalized coverage options, discounts for safe driving, innovative features like Name Your Price | Flexible coverage, competitive rates, advanced technology |

| USAA | Exclusively for military members and their families, known for its excellent customer service and financial stability | High-quality coverage, exceptional customer support, competitive rates |

| Liberty Mutual | Offers a variety of coverage options, discounts for good driving records, strong financial stability | Comprehensive coverage, competitive rates, reliable claims handling |

Tips for Negotiating Car Insurance Rates and Finding Discounts

- Shop around regularly: Car insurance rates can fluctuate, so it’s essential to shop around regularly to ensure you are getting the best possible price. You can compare quotes every six months or annually to see if there are any better deals available.

- Improve your credit score: In some states, including Washington, insurance companies use your credit score to determine your car insurance rates. Improving your credit score can potentially lower your premiums.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and earn you a discount on your insurance. These courses are often offered online or in person.

- Bundle your policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often earn you a significant discount. Ask your insurance provider about their bundling options.

- Consider a higher deductible: A higher deductible means you pay more out of pocket if you have an accident, but it can also lower your premium. Consider your financial situation and risk tolerance when deciding on your deductible.

- Ask about discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your car, and being a member of certain organizations. Ask your insurance provider about all available discounts to see if you qualify.

- Negotiate your rate: Don’t be afraid to negotiate your car insurance rate. If you find a lower rate from another provider, use it as leverage to try and get a better deal from your current insurer.

Understanding Car Insurance Claims in Washington: Car Insurance In Washington State

Navigating the car insurance claims process in Washington can seem daunting, but understanding the steps involved can make it more manageable. This section will guide you through the process of filing a claim, the role of the Washington State Department of Insurance, and the types of claims typically covered by car insurance.

Filing a Car Insurance Claim in Washington

When you’re involved in an accident, the first step is to ensure everyone is safe. If there are injuries, call 911 immediately. Once the situation is stabilized, follow these steps:

- Contact your insurance company: Inform them of the accident, providing details such as the date, time, location, and the nature of the incident. They will guide you through the next steps.

- File a police report: If the accident involves property damage exceeding $1,000 or injuries, you’re required to file a police report in Washington. The police report will be crucial for your insurance claim.

- Gather evidence: Collect any relevant information, including photos of the damage, witness contact details, and copies of medical bills if applicable.

- Submit a claim form: Your insurance company will provide you with a claim form to complete. Be sure to provide accurate and complete information.

- Cooperate with your insurance company: Respond to their requests promptly and provide any necessary documentation. This will help expedite the claims process.

Role of the Washington State Department of Insurance

The Washington State Department of Insurance (DOI) plays a vital role in regulating the insurance industry and ensuring fair treatment of policyholders. They handle complaints, investigate insurance fraud, and provide consumer education.

If you’re dissatisfied with your insurance company’s handling of a claim, you can file a complaint with the DOI. They will investigate the matter and attempt to resolve the issue.

Types of Claims Typically Covered by Car Insurance

Car insurance policies in Washington typically cover a range of claims, including:

- Liability coverage: This protects you financially if you cause an accident that results in damage to another person’s property or injuries. It covers the other driver’s medical expenses, property damage, and legal costs.

- Collision coverage: This covers damage to your vehicle resulting from a collision with another vehicle or object, regardless of who is at fault. However, you’ll need to pay a deductible before the insurance kicks in.

- Comprehensive coverage: This covers damage to your vehicle from non-collision events such as theft, vandalism, fire, or natural disasters. You’ll also need to pay a deductible for this coverage.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage. It helps cover your medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This covers your medical expenses and lost wages, regardless of who is at fault. It’s mandatory in Washington and is part of your car insurance policy.

Driving Safely in Washington

Driving safely is essential for everyone, but it’s particularly important in Washington state due to its diverse driving conditions, including heavy traffic, mountainous terrain, and varying weather patterns. Safe driving practices not only protect yourself and others but also help maintain a good driving record, which can positively impact your car insurance premiums.

Common Traffic Violations in Washington and Their Impact on Insurance Premiums

Traffic violations can significantly increase your car insurance premiums in Washington. These violations are recorded on your driving record and can lead to higher rates for several years. Here are some common violations and their potential impact:

- Speeding: Exceeding the speed limit is one of the most common traffic violations. Even exceeding the speed limit by a few miles per hour can result in a ticket and a point on your driving record. The more points you accumulate, the higher your insurance premiums will be.

- Reckless Driving: This serious offense involves driving with a willful or wanton disregard for the safety of others. It can lead to significant fines, license suspension, and a substantial increase in insurance premiums.

- Driving Under the Influence (DUI): Driving while intoxicated is a very serious offense in Washington. A DUI conviction can result in a long-term license suspension, fines, and a dramatic increase in car insurance rates. Insurance companies may even refuse to renew your policy after a DUI.

- Hit and Run: Leaving the scene of an accident without reporting it is a criminal offense. A hit-and-run conviction will significantly impact your insurance premiums, and you may face additional penalties, such as jail time and fines.

Tips for Safe Driving Practices in Washington State

Safe driving practices are essential for preventing accidents and keeping your insurance premiums low. Here are some tips for safe driving in Washington:

- Obey Traffic Laws: Always follow the posted speed limits, traffic signals, and road signs. This helps ensure the safety of all drivers and pedestrians.

- Be Aware of Weather Conditions: Washington is known for its unpredictable weather. Be prepared for rain, snow, fog, and ice. Adjust your speed and driving habits accordingly, and consider using your headlights even during the day when visibility is reduced.

- Maintain Your Vehicle: Regularly check your tire pressure, fluids, and lights to ensure your vehicle is in good working order. This helps prevent mechanical issues that could lead to accidents.

- Avoid Distractions: Distracted driving is a major cause of accidents. Put away your phone, avoid eating or drinking while driving, and refrain from engaging in other activities that could take your attention away from the road.

- Be Defensive: Anticipate the actions of other drivers and be prepared to react accordingly. This includes maintaining a safe following distance, checking your mirrors regularly, and being aware of your surroundings.

- Plan Your Route: Before you set out on a trip, plan your route and consider potential traffic delays. This will help you avoid unnecessary stress and ensure you arrive at your destination safely.

Resources for Driver Education and Training, Car insurance in washington state

If you want to improve your driving skills or learn more about safe driving practices, several resources are available in Washington state. These resources can help you become a safer driver and potentially reduce your insurance premiums.

- Washington State Department of Licensing (DOL): The DOL offers a variety of driver education programs, including defensive driving courses and driver’s education for teens. You can find information about these programs on the DOL website.

- AAA: The American Automobile Association (AAA) offers driver training courses and resources, including information on safe driving practices and traffic laws. You can find information about AAA’s driver education programs on their website or by contacting your local AAA office.

- Local Driving Schools: Many local driving schools offer driver education courses and training programs. You can search online or in your local community for driving schools that offer courses tailored to your needs.

Closure

Navigating the world of car insurance in Washington can be daunting, but with the right information and strategies, you can secure the coverage you need at a price that fits your budget. By understanding your state’s requirements, exploring your options, and prioritizing safe driving practices, you can confidently navigate the roads while being financially protected.

Key Questions Answered

What are the penalties for driving without car insurance in Washington state?

Driving without car insurance in Washington is illegal and can result in fines, license suspension, and even vehicle impoundment.

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or whenever there’s a significant life change, such as a new car, a change in your driving record, or a move to a new location.

Can I get car insurance discounts in Washington state?

Yes, many insurance companies offer discounts in Washington for factors like good driving records, safety features in your car, multiple policies, and membership in certain organizations.

What should I do if I’m in an accident in Washington?

If you’re involved in an accident, prioritize safety first. Call 911 if necessary. Then, exchange information with the other driver(s) involved, take pictures of the damage, and contact your insurance company to report the accident.