Car insurance in one state registered in another presents a unique situation for drivers who find themselves needing coverage in a state different from where their vehicle is registered. This scenario often arises when individuals move to a new state, work in a different state, or travel frequently between states. Navigating the complexities of state-specific regulations and insurance requirements can be challenging, but understanding the process is crucial for ensuring adequate coverage and avoiding potential legal complications.

This article will delve into the intricacies of car insurance when your vehicle is registered in one state but insured in another. We’ll explore the legal implications, compare state regulations, and analyze the impact on insurance premiums and claims. Additionally, we’ll discuss the potential benefits and drawbacks of this practice, providing practical tips and resources to help you make informed decisions.

Understanding the Concept

Registering a car in one state but insuring it in another is a practice that can arise due to various circumstances. This scenario involves the physical location of the vehicle being different from the state where the insurance policy is issued.

This situation can occur for several reasons. For example, someone might live in one state but work in another, requiring them to drive their car across state lines frequently. In another instance, an individual might relocate to a new state but still have their car registered in their previous state. These situations raise important legal implications that need to be considered.

Legal Implications

The legal implications of registering a car in one state and insuring it in another are multifaceted and depend on the specific laws of each state involved. It’s crucial to understand the legal framework surrounding car registration and insurance in both states.

- Insurance Coverage: The insurance policy should cover the car in the state where it’s registered. However, if the car is primarily driven in a different state, the insurer may need to be notified to ensure the policy is adequate and compliant with the laws of that state. Some insurers may require a change in the policy to reflect the primary location of the car.

- State Regulations: Each state has its own regulations regarding car registration and insurance requirements. The state where the car is registered will generally have primary jurisdiction over the registration process. The insurance policy, however, needs to comply with the laws of the state where the car is primarily driven.

- Financial Responsibility: In the event of an accident, the state where the accident occurred will have jurisdiction over any legal proceedings. The insurance policy needs to provide sufficient coverage to meet the financial responsibility requirements of that state.

State-Specific Regulations

The rules governing car registration and insurance can vary significantly from state to state. This means that registering a car in one state and insuring it in another can create complexities.

Registration Requirements

Different states have varying requirements for registering a vehicle. These requirements typically include:

- Proof of ownership

- Vehicle identification number (VIN) verification

- Emissions testing (in some states)

- Payment of registration fees

- Proof of insurance

Insurance Requirements

States also have different minimum insurance coverage requirements. These requirements usually include:

- Liability coverage (bodily injury and property damage)

- Uninsured/underinsured motorist coverage

- Personal injury protection (PIP) (in some states)

Challenges and Complications

Registering a car in one state and insuring it in another can lead to potential challenges and complications:

- Insurance Coverage Disputes: If an accident occurs in a state where your insurance is not valid, your insurance company may deny coverage or limit the amount of coverage provided.

- Non-Compliance with State Laws: Driving a vehicle that is not properly registered or insured in the state where you are driving can result in fines, penalties, or even suspension of your driver’s license.

- Difficulty in Obtaining Insurance: Some insurance companies may be reluctant to insure a vehicle registered in a different state. This is because they may have difficulty assessing the risk associated with insuring a vehicle in a state where they do not have a strong presence.

- Higher Insurance Premiums: Insurance premiums may be higher if you are insuring a vehicle in a state different from where it is registered. This is because insurance companies may consider it a higher risk to insure a vehicle in a state where they are not familiar with the driving environment.

Insurance Coverage and Premiums

When you register your car in one state but obtain insurance in another, the interplay between the two states’ regulations can significantly impact your insurance coverage and premiums. This is because both the state of registration and the state of insurance play a role in determining your coverage options and the cost of your premiums.

Premium Calculation

Car insurance premiums are calculated based on various factors, including the driver’s risk profile, the vehicle’s characteristics, and the coverage options chosen. However, the state of registration and the state of insurance can influence the calculation in specific ways:

* State of Registration: The state where your car is registered determines the minimum insurance coverage requirements you must meet. These requirements can vary significantly between states, impacting the coverage options you’re required to purchase. For example, some states require higher liability limits than others.

* State of Insurance: The state where you purchase your insurance determines the regulations that govern the insurance company’s operations, including how they calculate premiums. Some states have stricter regulations regarding pricing practices, which can influence the cost of insurance for residents.

Cost Comparison

Car insurance costs can vary considerably between states, primarily due to factors like:

* Traffic Density and Accident Rates: States with higher traffic density and accident rates typically have higher insurance premiums.

* Cost of Living: States with higher costs of living tend to have higher insurance premiums, as the cost of repairs and medical expenses is higher.

* State Regulations: State regulations on insurance pricing and coverage can influence premiums. Some states have more lenient regulations, which can result in lower premiums.

Factors Affecting Premiums

Several factors can influence your car insurance premiums, including:

* Driving History: Your driving record, including accidents, violations, and DUI convictions, significantly affects your premiums.

* Age and Gender: Younger drivers and males generally have higher premiums due to their higher risk profiles.

* Vehicle Type: The type of car you drive, including its make, model, and safety features, influences your premiums.

* Coverage Options: The level of coverage you choose, such as comprehensive and collision, affects the cost of your insurance.

* Credit Score: In some states, your credit score can be used to determine your insurance premiums.

Claims and Accidents

When you have car insurance in one state but your car is registered in another, it’s essential to understand how this affects claims and accidents. This scenario can bring about specific procedures and considerations, particularly when filing a claim or dealing with an accident.

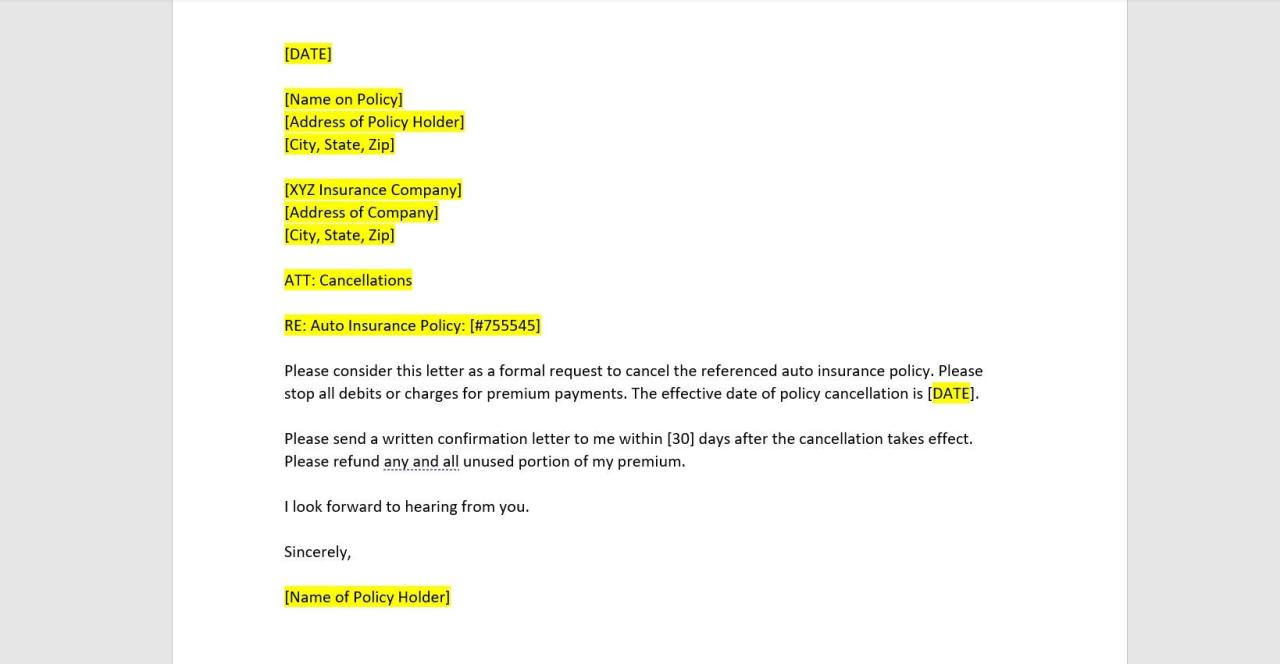

Filing a Claim

Filing a claim in this situation usually involves contacting your insurance company and providing them with the necessary information. This includes details about the accident, your car’s registration, and your insurance policy. The company will then assess the claim based on your policy’s coverage and the applicable state laws.

Potential Impact on Coverage and Claim Settlement

Here are some potential impacts on coverage and claim settlement:

* Coverage: Your insurance policy’s coverage may vary depending on the state where your car is registered. It’s crucial to ensure your policy covers you in both the state of registration and the state where you are insured.

* Claim Settlement: The claim settlement process can be influenced by the state where the accident occurred. The state’s laws regarding fault, liability, and coverage may affect how your claim is handled.

* Premiums: Your premiums may be affected by the state where your car is registered. Some states have higher insurance rates than others.

Handling Accidents

When you’re involved in an accident, here are some considerations:

* Reporting the Accident: Report the accident to the local authorities, such as the police, in the state where it occurred.

* Exchanging Information: Exchange contact and insurance information with the other parties involved.

* Documenting the Accident: Take photos or videos of the damage to your car, the accident scene, and any injuries.

* Contacting Your Insurance Company: Contact your insurance company immediately to report the accident and begin the claims process.

* Following Your State’s Laws: Be sure to follow the laws of the state where the accident occurred, as they may differ from the laws of the state where you are insured.

Benefits and Drawbacks

Registering a car in one state and insuring it in another can be a complex decision with both advantages and disadvantages. This practice can potentially save you money on insurance premiums, but it can also lead to complications in case of an accident or if you need to make a claim. It is important to carefully consider all the factors involved before making a decision.

Benefits of Registering a Car in One State and Insuring it in Another

- Lower Insurance Premiums: Insurance premiums can vary significantly from state to state. By registering your car in a state with lower insurance rates and insuring it in that state, you may be able to save money on your premiums. For example, if you live in a state with high insurance rates but work in a state with lower rates, you might consider registering your car in the state with lower rates.

- More Coverage Options: Some states offer more comprehensive insurance coverage options than others. If you need specific coverage that is not available in your home state, you may be able to obtain it by registering your car in a different state.

- More Favorable Laws: Some states have laws that are more favorable to drivers than others. For example, some states have lower penalties for traffic violations or offer more lenient insurance requirements. Registering your car in a state with more favorable laws can potentially benefit you.

Drawbacks of Registering a Car in One State and Insuring it in Another

- Increased Complexity: Registering your car in one state and insuring it in another can create administrative complexities. You will need to maintain separate registration and insurance documents, and you may need to provide additional documentation to both states.

- Potential Legal Issues: If you are involved in an accident in a state where your car is not registered, you may face legal issues. For example, you may be required to provide proof of insurance in the state where the accident occurred, even if your car is insured in a different state.

- Difficulties with Claims: Filing a claim with your insurance company can be more difficult if your car is registered in one state and insured in another. Your insurance company may require additional documentation or may take longer to process your claim.

Table of Benefits and Drawbacks

| Benefits | Drawbacks |

|---|---|

| Lower Insurance Premiums | Increased Complexity |

| More Coverage Options | Potential Legal Issues |

| More Favorable Laws | Difficulties with Claims |

Practical Considerations: Car Insurance In One State Registered In Another

This section delves into practical tips and considerations for individuals who plan to register their car in one state but insure it in another. It aims to provide a clear understanding of the steps involved, potential benefits, and potential challenges associated with this decision.

Registration and Insurance Requirements

Understanding the specific registration and insurance requirements of both the state where the car will be registered and the state where it will be insured is crucial. Each state has its own set of rules regarding vehicle registration, insurance coverage, and minimum requirements.

- Registration: The state where the car is registered will require you to obtain a license plate, title, and registration sticker. You may need to provide proof of insurance and pass a vehicle inspection.

- Insurance: The state where the car is insured will require you to purchase a minimum amount of insurance coverage, which may vary based on the type of vehicle and the specific coverage you need.

Finding the Right Insurance Provider

Finding an insurance provider that offers coverage in both states is essential. You should compare quotes from different providers to ensure you’re getting the best possible rates.

- Multi-State Coverage: Some insurance companies specialize in providing multi-state coverage, while others may only offer coverage in specific states.

- Coverage Options: Consider the coverage options available in both states. Some states may require specific types of coverage, such as uninsured motorist coverage or personal injury protection (PIP).

- Rate Comparisons: Compare quotes from multiple providers to find the best rates and coverage options that meet your needs.

Navigating the Process

The process of registering a car in one state and insuring it in another can be complex. It’s important to understand the specific requirements of each state and to follow the appropriate procedures.

- State Resources: Consult the websites of the Department of Motor Vehicles (DMV) in both states for detailed information on registration and insurance requirements.

- Insurance Company Guidance: Contact the insurance company to discuss your specific situation and ensure you understand the coverage options and any limitations.

- Professional Advice: Consider consulting with a licensed insurance agent or broker for personalized guidance and assistance with navigating the process.

Flowchart: Steps Involved

The following flowchart Artikels the general steps involved in registering a car in one state and insuring it in another:

- Step 1: Choose the State for Registration: Determine the state where you want to register your car.

- Step 2: Contact the DMV: Contact the DMV in the chosen state to obtain the necessary forms and requirements for registration.

- Step 3: Gather Required Documents: Gather all the required documents, such as proof of identification, proof of residency, vehicle title, and proof of insurance.

- Step 4: Complete Registration Process: Submit the required documents and pay any applicable fees to complete the registration process.

- Step 5: Choose an Insurance Provider: Select an insurance provider that offers coverage in both states.

- Step 6: Obtain Insurance Policy: Purchase an insurance policy that meets the minimum requirements of both states.

- Step 7: Provide Proof of Insurance: Provide proof of insurance to the DMV and your insurance provider.

Key Considerations, Car insurance in one state registered in another

It’s essential to consider the following factors before registering a car in one state and insuring it in another:

- Cost: Compare insurance rates in both states to determine the potential cost savings or increases.

- Coverage: Ensure the chosen insurance policy provides adequate coverage in both states.

- Convenience: Consider the convenience of having your car registered and insured in different states.

- Legal Compliance: Verify that you’re complying with the laws of both states regarding registration and insurance.

Resources and Information

Several resources can provide valuable information on registering a car in one state and insuring it in another:

- State Department of Motor Vehicles (DMV): Consult the websites of the DMV in both states for specific requirements and procedures.

- Insurance Companies: Contact insurance companies to discuss coverage options and rates for multi-state insurance.

- Insurance Agents and Brokers: Seek advice from licensed insurance agents or brokers who specialize in multi-state insurance.

Ending Remarks

In conclusion, registering your car in one state and insuring it in another can be a viable option for certain individuals, but it’s essential to carefully consider the implications. By understanding the legal requirements, insurance regulations, and potential challenges, you can make informed decisions and ensure you have the appropriate coverage. Remember to consult with your insurance provider and state authorities to clarify any uncertainties and ensure compliance with all applicable laws.

Question & Answer Hub

What are the potential benefits of registering a car in one state and insuring it in another?

Some potential benefits include lower insurance premiums in one state compared to another, easier access to specific insurance plans, or taking advantage of state-specific discounts.

What are the potential drawbacks of registering a car in one state and insuring it in another?

Potential drawbacks include increased complexity in handling claims, potential discrepancies in coverage, and possible legal complications if not properly documented.

How do I ensure my insurance policy covers me in both states?

Contact your insurance provider to confirm your policy’s coverage extends to the state where you’re registering your car. They can advise on any necessary endorsements or adjustments.

What happens if I get into an accident in a state where my car is not registered?

Your insurance provider should handle the claim, but it’s essential to notify them promptly and provide all necessary information. They will determine coverage based on your policy terms and state regulations.