Car insurance in New York State is a necessity, not a luxury. It protects you financially in the event of an accident, and it’s required by law. Understanding the intricacies of New York’s car insurance landscape is crucial for all drivers. This guide will equip you with the knowledge you need to navigate the system effectively, from understanding mandatory coverage to finding the best policy for your individual needs.

New York has a unique no-fault insurance system, which means that drivers are typically responsible for covering their own medical expenses after an accident, regardless of who is at fault. This system has both advantages and disadvantages, and it’s essential to understand how it works to ensure you’re protected. We’ll delve into the intricacies of the no-fault system, including how to file a claim and the limitations that apply.

Understanding New York State’s Car Insurance Requirements

Driving in New York State comes with certain legal responsibilities, and one of the most important is having the right car insurance coverage. To ensure you’re protected on the road and comply with the law, it’s crucial to understand the mandatory car insurance requirements.

Mandatory Car Insurance Coverage in New York State

New York State law mandates that all vehicle owners carry specific types of car insurance coverage to financially protect themselves and others in case of an accident. These mandatory coverages are designed to address various potential liabilities and damages that may arise from an accident.

- Liability Coverage: This coverage protects you financially if you’re at fault in an accident. It covers the other driver’s medical expenses, property damage, and other related costs.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other related costs, regardless of who’s at fault in an accident.

- Uninsured/Underinsured Motorist (UM/UIM): This coverage protects you if you’re hit by an uninsured or underinsured driver. It covers your medical expenses, lost wages, and other related costs.

Minimum Financial Responsibility Limits

New York State sets minimum financial responsibility limits for each mandatory coverage type. These limits represent the maximum amount your insurance company will pay out for covered claims.

- Liability Coverage: The minimum liability limit is $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

- Personal Injury Protection (PIP): The minimum PIP limit is $50,000 per person. This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault.

- Uninsured/Underinsured Motorist (UM/UIM): The minimum UM/UIM limit is $25,000 per person for bodily injury, $50,000 per accident for bodily injury, and $10,000 per accident for property damage.

Summary of Mandatory Car Insurance Coverages

The following table summarizes the mandatory coverages, their limits, and their purpose:

| Coverage Type | Minimum Limit | Purpose |

|---|---|---|

| Liability | $25,000 per person/$50,000 per accident/$10,000 per accident | Protects you financially if you’re at fault in an accident. |

| Personal Injury Protection (PIP) | $50,000 per person | Pays for your medical expenses, lost wages, and other related costs, regardless of who’s at fault. |

| Uninsured/Underinsured Motorist (UM/UIM) | $25,000 per person/$50,000 per accident/$10,000 per accident | Protects you if you’re hit by an uninsured or underinsured driver. |

Factors Influencing Car Insurance Premiums in New York

Your car insurance premium in New York is determined by a variety of factors. Understanding these factors can help you make informed decisions to potentially lower your costs.

Your Driving History

Your driving history is a major factor in determining your car insurance premium. This includes your driving record, which reflects any accidents, traffic violations, or DUI convictions. A clean driving record will generally result in lower premiums, while a history of accidents or violations will likely lead to higher premiums.

- Accidents: Accidents are a significant factor in premium calculations. The severity of the accident, such as whether it resulted in injuries or property damage, will influence the impact on your premium.

- Traffic Violations: Violations like speeding tickets, running red lights, or parking violations can increase your premium. The severity of the violation and the frequency of violations play a role in determining the increase.

- DUI Convictions: DUI convictions have a substantial impact on premiums. Insurance companies consider them a serious risk and will significantly increase premiums.

Your Vehicle

The type of vehicle you drive also plays a role in your insurance premium.

- Make and Model: Some car models are more expensive to repair or replace than others. This factor can influence your premium.

- Year: Newer vehicles generally have more advanced safety features, which can lead to lower premiums. Older vehicles, on the other hand, may have higher premiums due to their age and potential for increased repair costs.

- Safety Features: Vehicles equipped with safety features like anti-lock brakes, airbags, and electronic stability control can result in lower premiums. These features are designed to reduce the risk of accidents and injuries, making you a lower risk to insurers.

Your Personal Information

Your personal information, such as your age, gender, and credit score, can also influence your car insurance premium.

- Age: Younger drivers are statistically more likely to be involved in accidents, so they typically pay higher premiums. As drivers gain experience and age, their premiums usually decrease. However, older drivers, especially those over 70, may also see an increase in premiums due to factors such as health conditions and reduced driving abilities.

- Gender: Historically, insurance companies have considered gender a factor in premium calculations. However, this practice is being challenged in some states, including New York, as it is seen as discriminatory.

- Credit Score: In New York, credit score is not a factor in determining car insurance premiums.

Your Location

Where you live in New York can significantly affect your car insurance premium.

- Zip Code: Insurance companies use zip codes to assess the risk of accidents and claims in different areas. Areas with higher rates of accidents and claims typically have higher premiums.

- Traffic Density: Areas with heavy traffic can increase the risk of accidents, leading to higher premiums.

- Crime Rates: Areas with high crime rates may have higher premiums due to the increased risk of theft or vandalism.

Your Coverage

The amount and type of coverage you choose will directly impact your premium.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injuries or property damage to others. Higher liability limits generally result in higher premiums.

- Collision Coverage: This coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of who is at fault. Choosing a higher deductible can lower your premium, but you’ll pay more out of pocket if you need to file a claim.

- Comprehensive Coverage: This coverage protects you against damage to your vehicle from events like theft, vandalism, or natural disasters. Like collision coverage, a higher deductible can lower your premium.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages.

Other Factors

- Driving Habits: Your driving habits, such as the number of miles you drive and your driving style, can influence your premium.

- Discounts: Insurance companies offer various discounts, such as good student discounts, safe driver discounts, and multi-car discounts, which can lower your premium.

- Insurance Company: Different insurance companies have different pricing structures and risk assessments. It’s important to compare quotes from multiple companies to find the best rate.

Types of Car Insurance Coverage Available in New York: Car Insurance In New York State

Beyond the legally mandated coverage in New York, you have the option to purchase additional insurance policies that provide broader protection and financial security in the event of an accident or other unforeseen incidents. Understanding the different types of coverage and their implications is crucial for making informed decisions about your car insurance policy.

Liability Coverage

Liability coverage protects you financially if you are at fault in an accident that causes injury or damage to others. It covers the costs associated with the other driver’s medical bills, property damage, and legal expenses. In New York, the minimum liability coverage required is:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident

- Property Damage Liability: $10,000 per accident

However, it is advisable to consider higher liability limits to ensure adequate protection, especially considering the high costs of medical care and legal representation. Increasing your liability limits can significantly impact your premiums, but it can provide peace of mind knowing you are adequately protected in case of a major accident.

Collision Coverage

Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional in New York, but it is essential if you have a loan or lease on your vehicle, as the lender may require it.

- Benefits: Provides financial protection for your vehicle’s repair or replacement in case of an accident.

- Drawbacks: Can be expensive, especially for newer or high-value vehicles. You will likely have to pay a deductible before the insurance company covers the remaining costs.

Comprehensive Coverage

Comprehensive coverage protects your vehicle against damages caused by events other than collisions, such as theft, vandalism, fire, natural disasters, and falling objects. This coverage is also optional in New York, but it is recommended for older vehicles or those with high market value.

- Benefits: Provides protection against a wide range of risks that could damage your vehicle.

- Drawbacks: Can be expensive, and you will typically have to pay a deductible before the insurance company covers the remaining costs.

Uninsured/Underinsured Motorist Coverage

This coverage protects you and your passengers if you are involved in an accident with a driver who does not have adequate insurance or is uninsured.

- Benefits: Provides financial protection for your medical bills and property damage in case you are involved in an accident with an uninsured or underinsured driver.

- Drawbacks: Can be expensive, but it is essential considering the high number of uninsured drivers on the road.

Personal Injury Protection (PIP)

PIP coverage, also known as no-fault insurance, pays for your medical expenses and lost wages, regardless of who is at fault in an accident. It is mandatory in New York, and it covers:

- Medical expenses: Up to $50,000 per person

- Lost wages: Up to $2,000 per month

PIP coverage can be a valuable asset in case of an accident, but it is important to understand its limitations and the specific benefits it provides.

Other Optional Coverage

In addition to the core coverage types, you can consider other optional coverage options, such as:

- Rental Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after an accident.

- Roadside Assistance: Provides assistance with services such as towing, flat tire changes, and jump starts.

- Gap Insurance: Covers the difference between the actual cash value of your vehicle and the amount you owe on your loan or lease if your vehicle is totaled.

Table Comparing Different Coverage Options, Car insurance in new york state

| Coverage Type | Description | Typical Cost |

|---|---|---|

| Liability | Protects you against financial losses if you are at fault in an accident | Varies based on factors such as driving history, age, and vehicle type |

| Collision | Covers repairs or replacement of your vehicle if it is damaged in an accident | Varies based on factors such as vehicle value, driving history, and deductible amount |

| Comprehensive | Covers damages caused by events other than collisions, such as theft, vandalism, and natural disasters | Varies based on factors such as vehicle value, driving history, and deductible amount |

| Uninsured/Underinsured Motorist | Protects you if you are involved in an accident with an uninsured or underinsured driver | Varies based on factors such as driving history and coverage limits |

| Personal Injury Protection (PIP) | Covers your medical expenses and lost wages, regardless of who is at fault | Varies based on factors such as coverage limits and deductible amount |

Finding the Right Car Insurance Policy in New York

Finding the right car insurance policy in New York can seem overwhelming, but it’s a crucial step to ensure you’re adequately protected and paying a fair price. By following a systematic approach and considering your individual needs, you can navigate this process effectively and find the policy that best suits you.

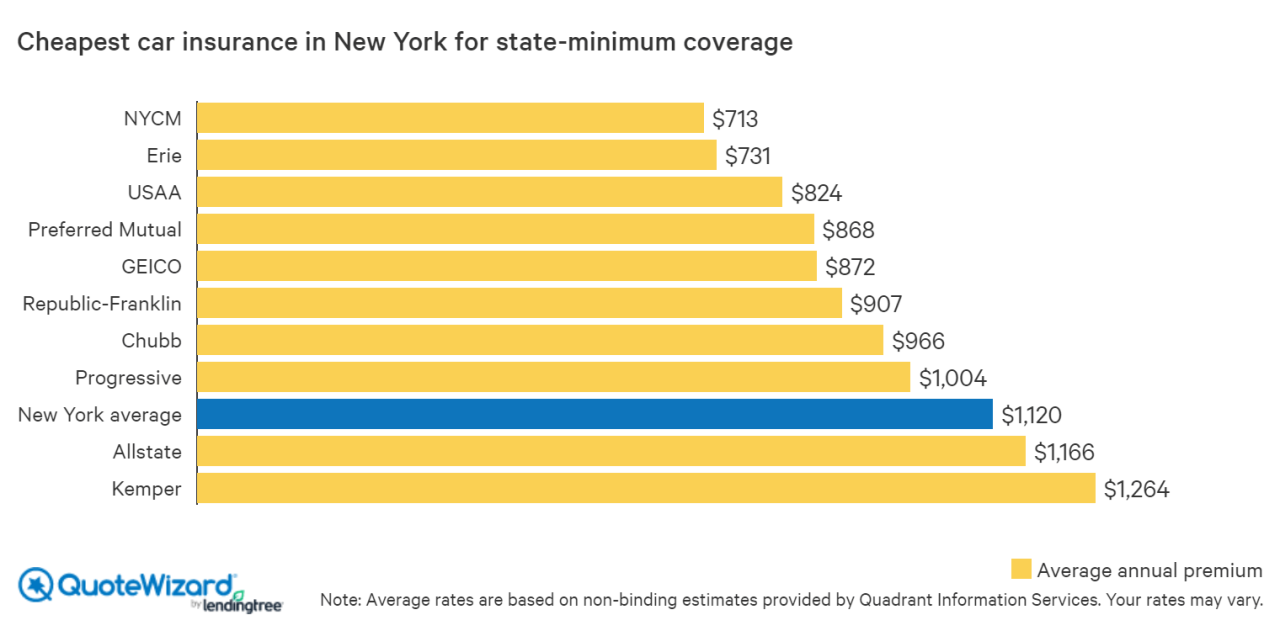

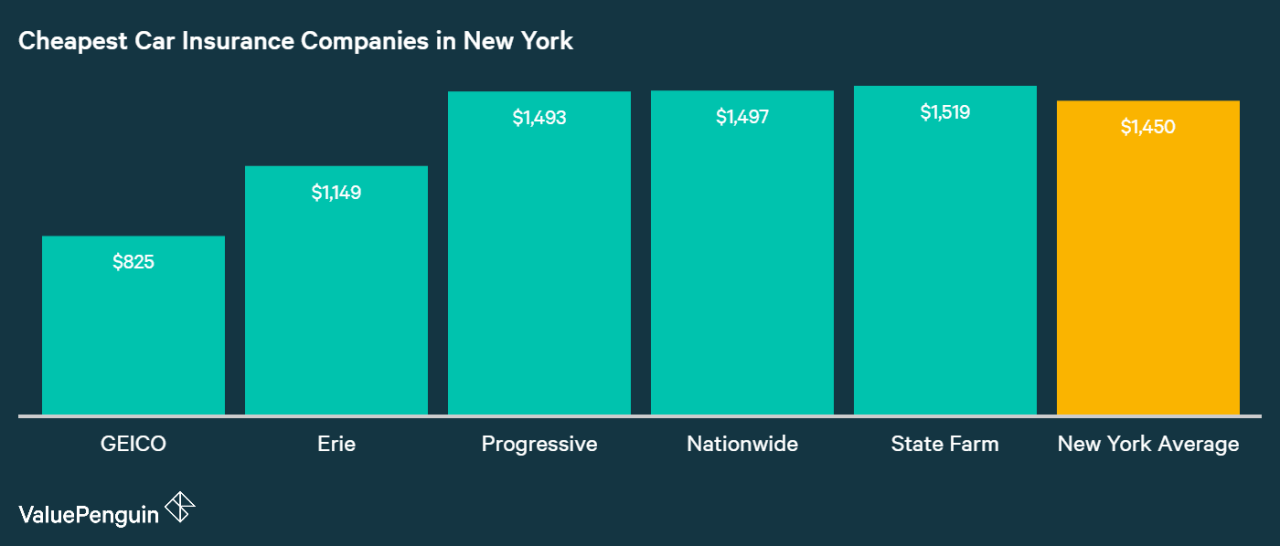

Comparing Quotes from Different Insurance Providers

To find the best car insurance policy for your needs, it’s essential to compare quotes from multiple insurance providers. This allows you to evaluate different coverage options, premiums, and discounts, helping you make an informed decision.

Here are some tips for comparing quotes effectively:

- Use online comparison tools: Many websites allow you to enter your information once and receive quotes from multiple insurance companies. This saves you time and effort.

- Contact insurance companies directly: While online tools are helpful, it’s also beneficial to contact insurance companies directly. This allows you to ask specific questions about their policies and get personalized quotes.

- Consider factors affecting your premium: Factors like your driving history, age, vehicle type, and location significantly influence your car insurance premium. By understanding these factors, you can adjust your search to focus on providers that cater to your specific needs.

- Compare coverage options: Insurance companies offer various coverage options, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Carefully evaluate your needs and select the coverage that provides adequate protection without exceeding your budget.

- Look for discounts: Many insurance companies offer discounts for various factors, such as good driving records, safety features in your vehicle, and bundling multiple insurance policies. Explore these discounts to potentially lower your premium.

Considering Individual Factors and Driving History

When selecting a car insurance policy, it’s crucial to consider your individual factors and driving history, as they significantly influence your premium.

- Driving history: Your driving record, including accidents, violations, and driving experience, plays a major role in determining your insurance premium. A clean driving record often results in lower premiums.

- Age and gender: Insurance companies generally consider younger drivers and male drivers to be higher risk, leading to higher premiums. However, this varies based on individual factors and the specific insurer.

- Vehicle type: The type of vehicle you drive, including its make, model, and safety features, affects your premium. Sports cars and luxury vehicles are typically more expensive to insure than basic models.

- Location: Your location, including the state, city, and neighborhood, impacts your premium. Areas with higher accident rates or theft rates often have higher insurance costs.

- Credit score: In some states, including New York, insurance companies may consider your credit score when determining your premium. A higher credit score generally translates to lower premiums.

Discounts and Savings on Car Insurance in New York

New York car insurance premiums can be costly, but you can reduce your costs with a variety of discounts. These discounts are offered by many insurance companies and can significantly impact your premium. By understanding the different types of discounts available and maximizing your eligibility, you can save money on your car insurance.

Types of Discounts Available

Here are some common discounts offered by car insurance providers in New York:

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, free of accidents or traffic violations. The longer your driving history without incidents, the larger the discount you can receive.

- Safe Driver Discount: This discount is often tied to the good driver discount, but it can also be earned by completing a defensive driving course. These courses teach safe driving techniques and can help you qualify for a discount even if you have had a minor accident or violation in the past.

- Multi-Car Discount: If you insure multiple vehicles with the same company, you can qualify for a multi-car discount. This discount applies to each vehicle, making it a significant savings opportunity for families or individuals with multiple cars.

- Multi-Policy Discount: Similar to the multi-car discount, you can get a multi-policy discount by bundling your car insurance with other types of insurance, such as home or renters insurance. This allows you to save money on both policies.

- Good Student Discount: This discount is available to students who maintain a certain GPA. Insurance companies recognize that good students are generally more responsible and cautious drivers.

- Anti-theft Device Discount: If you have anti-theft devices installed in your car, you may be eligible for a discount. These devices can deter theft and reduce the risk of your car being stolen, leading to lower insurance premiums.

- Loyalty Discount: Many insurance companies offer discounts to long-term customers who have maintained their policies for a certain period. This is a reward for your continued business and can help you save over time.

- Payment Discount: Some insurance companies offer discounts for paying your premium in full or for opting for automatic payments. These discounts are often small, but they can add up over time.

Maximizing Savings

To maximize your savings, it’s essential to understand the eligibility criteria for each discount and proactively take steps to qualify. Here are some tips:

- Maintain a Clean Driving Record: This is the most important factor in qualifying for many discounts, including the good driver and safe driver discounts. Avoid traffic violations and accidents, and consider taking a defensive driving course to further enhance your driving skills and potentially receive a discount.

- Bundle Your Policies: Combining your car insurance with other types of insurance, such as home or renters insurance, can lead to significant savings through multi-policy discounts.

- Shop Around: Compare quotes from different insurance companies to find the best rates and discounts. Don’t hesitate to ask about specific discounts you may be eligible for, such as those for good students, anti-theft devices, or loyalty.

- Review Your Policy Regularly: As your circumstances change, so may your eligibility for certain discounts. Review your policy periodically to ensure you are receiving all the discounts you qualify for.

Understanding New York’s No-Fault System

New York State operates under a no-fault insurance system, which means that, regardless of who is at fault in an accident, each driver’s own insurance company covers their medical expenses and lost wages up to a certain limit. This system aims to simplify the claims process and reduce litigation, but it also comes with specific rules and limitations.

The Process of Filing a No-Fault Claim

After an accident, you must notify your insurance company immediately and file a no-fault claim within 30 days. This claim will cover your medical expenses and lost wages up to the limits specified in your policy.

You will need to provide your insurance company with the following information:

- Your policy information

- Details of the accident, including the date, time, and location

- Information about the other driver(s) involved

- Medical bills and documentation of lost wages

Your insurance company will review your claim and approve or deny it based on the information provided. If your claim is approved, they will pay your medical expenses and lost wages directly to you or your healthcare providers.

Limitations and Exceptions of the No-Fault System

The no-fault system has limitations, including:

- Limited Coverage: Your no-fault benefits are limited to a specific amount, typically $50,000 for medical expenses and $2,000 per week for lost wages.

- Threshold for Suing: You can only sue the other driver for pain and suffering if your injuries meet a “serious injury” threshold. This threshold is defined by New York law and includes injuries like permanent disfigurement, significant limitation of use of a body function, or death.

- Specific Exclusions: Certain expenses, such as cosmetic surgery or treatment for conditions unrelated to the accident, are not covered by no-fault insurance.

It’s important to understand these limitations and exceptions to avoid any surprises during the claims process.

Navigating Car Accidents in New York

Car accidents can be stressful and confusing, especially in a state like New York with its unique legal system. Knowing how to handle a car accident in New York is crucial for protecting your rights and ensuring a smooth recovery process. This section will provide a step-by-step guide on how to navigate car accidents in New York, including reporting procedures, documentation tips, and the importance of contacting your insurance provider.

Reporting the Accident

Reporting a car accident to the authorities is essential for several reasons. It creates an official record of the accident, helps determine fault, and may be necessary to file insurance claims. Here’s how to report a car accident in New York:

- Call 911: If there are injuries, significant damage, or any immediate danger, call 911 immediately. The police will respond to the scene, investigate the accident, and file a report.

- Contact the New York State Department of Motor Vehicles (DMV): If the accident involves damage but no injuries, you can report it to the DMV online or by mail. You must file a report within 10 days of the accident.

- Exchange Information: Regardless of whether you call 911 or report the accident to the DMV, you should exchange information with the other driver(s) involved. This includes:

- Name and address

- Driver’s license number

- Insurance company and policy number

- License plate number

- Contact information

Documenting the Accident Scene

Documenting the accident scene is crucial for building your case and supporting your insurance claim. Here are some tips for documenting the accident:

- Take Pictures: Take pictures of the damage to your vehicle, the other vehicle(s) involved, and the accident scene. This includes any skid marks, traffic signs, or other relevant details.

- Create a Diagram: Sketch a simple diagram of the accident scene, showing the position of the vehicles, the direction of travel, and any other relevant details.

- Gather Witness Information: If there are any witnesses to the accident, get their names, addresses, and phone numbers.

- Note Down Details: Write down the date, time, and location of the accident. Include any details about the weather conditions, road conditions, and any other factors that may have contributed to the accident.

Contacting Your Insurance Provider

After an accident, it is crucial to contact your insurance provider as soon as possible. This is essential for several reasons:

- File a Claim: You will need to file a claim with your insurance company to receive coverage for damages and injuries.

- Get Guidance: Your insurance provider can provide guidance on how to proceed with the accident, including reporting procedures and claim filing.

- Legal Representation: If the accident involves serious injuries or legal disputes, your insurance provider may provide legal representation.

Understanding New York’s No-Fault System

New York State operates under a no-fault insurance system, which means that each driver is responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. However, there are exceptions to this rule. For example, if your injuries are severe, you may be able to sue the other driver for additional damages.

It is important to note that you should not discuss fault or liability with the other driver or their insurance company without consulting with your own insurance provider or an attorney.

Resources for Car Insurance in New York

Navigating the world of car insurance in New York can be overwhelming, but luckily, there are several resources available to help you make informed decisions and ensure you have the right coverage.

Government Agencies

Government agencies play a crucial role in regulating the insurance industry and protecting consumer rights. Here are some key agencies in New York:

- New York State Department of Financial Services (DFS): The DFS is the primary regulator of the insurance industry in New York. It oversees insurance companies, sets insurance rates, and investigates consumer complaints. You can contact the DFS to report insurance fraud, file a complaint against an insurance company, or get information about your rights as a policyholder.

- Website: https://dfs.ny.gov/

- Phone: (800) 342-3736

- New York State Insurance Department (NYID): The NYID is a division of the DFS that specifically focuses on insurance issues. It provides information and resources for consumers, including guides on car insurance, insurance fraud prevention, and consumer rights.

- Website: https://www.ny.gov/services/find-insurance-information-and-resources

- Phone: (800) 342-3736

Consumer Protection Organizations

Consumer protection organizations advocate for consumers’ rights and provide resources to help them navigate complex issues, including insurance. Here are some organizations that can assist you with car insurance in New York:

- Consumer Reports: Consumer Reports is a non-profit organization that conducts independent testing and research on various products and services, including car insurance. They provide ratings and recommendations for insurance companies based on their customer satisfaction, financial stability, and claims handling.

- Website: https://www.consumerreports.org/

- National Association of Insurance Commissioners (NAIC): The NAIC is a non-profit organization that represents insurance commissioners from all 50 states, the District of Columbia, and five U.S. territories. They develop model laws and regulations for the insurance industry, promote consumer protection, and provide resources for consumers.

- Website: https://www.naic.org/

Insurance Industry Associations

Insurance industry associations represent insurance companies and provide resources and information about the industry. Here are some key associations in New York:

- New York Insurance Association (NYIA): The NYIA is a trade association that represents insurance companies in New York. They provide information about the insurance industry, advocate for policies that support insurance companies, and offer resources for consumers.

- Website: https://www.nyia.org/

- Insurance Information Institute (III): The III is a non-profit organization that provides information about the insurance industry to consumers, the media, and the public. They offer resources on various insurance topics, including car insurance, and conduct research on insurance trends.

- Website: https://www.iii.org/

Table of Resources

| Resource | Website | Phone | Key Functions and Services |

|—|—|—|—|

| New York State Department of Financial Services (DFS) | https://dfs.ny.gov/ | (800) 342-3736 | Regulating the insurance industry, investigating consumer complaints, providing information about insurance rights |

| New York State Insurance Department (NYID) | https://www.ny.gov/services/find-insurance-information-and-resources | (800) 342-3736 | Providing information and resources for consumers, including guides on car insurance, insurance fraud prevention, and consumer rights |

| Consumer Reports | https://www.consumerreports.org/ | N/A | Conducting independent testing and research on various products and services, including car insurance, providing ratings and recommendations for insurance companies |

| National Association of Insurance Commissioners (NAIC) | https://www.naic.org/ | N/A | Developing model laws and regulations for the insurance industry, promoting consumer protection, providing resources for consumers |

| New York Insurance Association (NYIA) | https://www.nyia.org/ | N/A | Representing insurance companies in New York, providing information about the insurance industry, advocating for policies that support insurance companies |

| Insurance Information Institute (III) | https://www.iii.org/ | N/A | Providing information about the insurance industry to consumers, the media, and the public, offering resources on various insurance topics, conducting research on insurance trends |

Outcome Summary

Navigating the world of car insurance in New York can feel overwhelming, but it doesn’t have to be. With a thorough understanding of the state’s requirements, the factors influencing premiums, and the available coverage options, you can make informed decisions to ensure you’re adequately protected on the road. Remember to shop around, compare quotes, and take advantage of available discounts to find the best policy for your specific circumstances. By doing so, you can drive with confidence knowing you have the right insurance coverage in place.

User Queries

What are the minimum car insurance coverage requirements in New York?

New York State requires drivers to carry at least the following coverages: Bodily Injury Liability, Property Damage Liability, Personal Injury Protection (PIP), and No-Fault Coverage.

How can I get a discount on my car insurance?

There are many discounts available, such as good driver discounts, safe vehicle discounts, multi-car discounts, and discounts for completing defensive driving courses. Contact your insurance provider to inquire about available discounts.

What should I do if I get into a car accident in New York?

Stay calm, check for injuries, and exchange information with the other driver(s). Report the accident to the police and your insurance provider as soon as possible.

What is the difference between liability coverage and collision coverage?

Liability coverage protects you financially if you cause damage to another person’s property or injure someone in an accident. Collision coverage covers damage to your own vehicle, regardless of who is at fault.