Car insurance in different states is a complex topic, with regulations, costs, and coverage options varying widely. Understanding the nuances of car insurance in each state is crucial for drivers to ensure they have the right protection and avoid potential financial hardship in case of an accident.

This guide delves into the key aspects of car insurance across the United States, exploring state-specific regulations, average insurance costs, factors influencing premiums, and tips for finding the best coverage. We’ll also examine how to navigate insurance claims and disputes, and offer strategies for saving money on your car insurance premiums.

Car Insurance Basics

Car insurance is a vital financial safety net that protects you from potential financial losses arising from accidents, theft, or other unforeseen events involving your vehicle. It provides financial compensation to cover damages to your car, other vehicles involved, injuries sustained, and other related expenses. Understanding the fundamental principles and various types of coverage is essential to ensure you have the right protection for your needs.

Types of Car Insurance Coverage

Car insurance policies typically include various types of coverage to address different aspects of potential risks. Here’s a breakdown of common coverage options:

- Liability Coverage: This is the most basic type of car insurance, legally mandated in most states. It covers damages to other vehicles or property, as well as injuries to other individuals, caused by your negligence in an accident. Liability coverage is typically expressed as two limits: bodily injury liability per person and per accident, and property damage liability per accident.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in a collision, regardless of fault. Collision coverage helps you recover from accidents, even if you are at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damages caused by non-collision events, such as theft, vandalism, natural disasters, or falling objects. It helps you recover from losses not covered by collision coverage.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage. It helps you cover your medical expenses and vehicle repairs.

- Personal Injury Protection (PIP): This coverage, available in some states, covers medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault, after an accident. PIP helps mitigate financial burdens following an accident.

- Medical Payments Coverage (Med Pay): This coverage provides additional medical expense coverage for you and your passengers, regardless of fault, after an accident. Med Pay supplements your health insurance and covers medical expenses beyond PIP limits.

Factors Influencing Car Insurance Premiums

Several factors influence the cost of your car insurance premium. These factors are used by insurance companies to assess your risk profile and determine the premium you pay.

- Driving History: Your driving record, including accidents, violations, and DUI convictions, plays a significant role in determining your premium. A clean driving record typically leads to lower premiums.

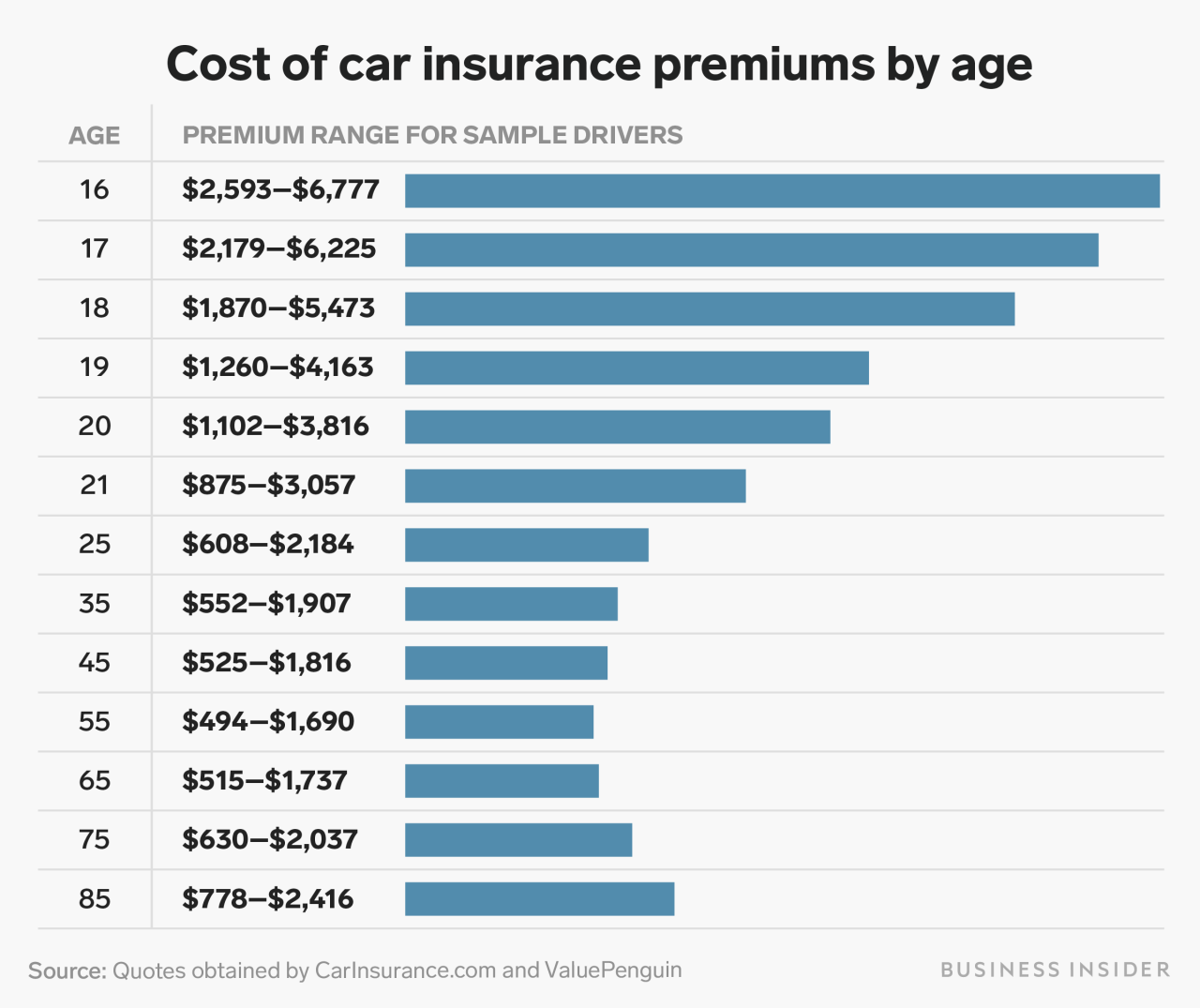

- Age and Gender: Younger and inexperienced drivers generally have higher premiums due to their higher risk of accidents. Gender also plays a role, with statistics suggesting that males tend to have higher accident rates.

- Vehicle Type and Value: The type and value of your vehicle significantly influence your premium. Sports cars and luxury vehicles are often more expensive to insure due to their higher repair costs and greater risk of theft.

- Location: Your location, including the state, city, and neighborhood, affects your premium. Areas with higher accident rates and theft statistics tend to have higher insurance costs.

- Credit History: In some states, insurance companies use your credit history as a factor in determining your premium. A good credit history can lead to lower premiums.

- Driving Habits: Your driving habits, such as mileage, commuting distance, and driving frequency, can impact your premium. Drivers who drive fewer miles or for shorter distances may qualify for lower premiums.

- Deductible: Your deductible is the amount you pay out of pocket before your insurance coverage kicks in. Choosing a higher deductible generally leads to lower premiums.

State-Specific Regulations

Each state in the U.S. has its own set of car insurance laws, which can vary significantly from one state to another. Understanding these regulations is crucial for drivers, as they determine the types of coverage they need to purchase and the minimum financial responsibility they must meet.

Mandatory Coverage Requirements

State laws dictate the minimum car insurance coverage that drivers must carry. These requirements typically include liability coverage, which protects drivers from financial losses if they are at fault in an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. It covers the other driver’s medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. Some states require PIP coverage, while others make it optional.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are involved in an accident with a driver who does not have insurance or does not have enough insurance to cover your losses. UM/UIM coverage can help pay for your medical expenses, lost wages, and property damage.

Key Differences in Insurance Regulations

Here are some key differences in insurance regulations that impact drivers:

- No-Fault Insurance: Some states have “no-fault” insurance systems, where drivers file claims with their own insurance company regardless of who is at fault in an accident. This can simplify the claims process and reduce litigation. However, it can also limit the amount of compensation you can receive.

- Minimum Coverage Limits: The minimum coverage limits required by law vary from state to state. Some states have higher minimum limits than others, which means drivers in those states may need to pay more for insurance.

- Financial Responsibility Laws: These laws require drivers to prove they can pay for damages caused in an accident. This can be done by carrying insurance or by posting a bond.

Average Car Insurance Costs

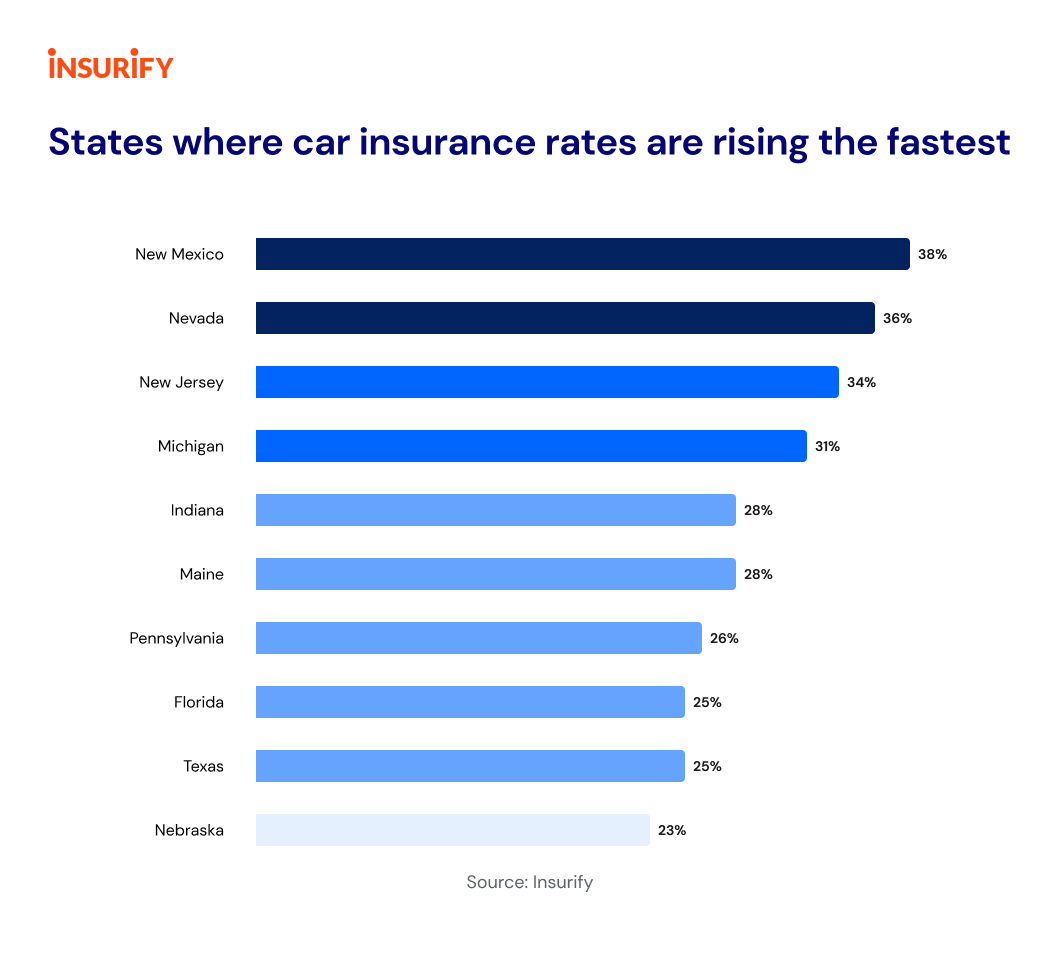

Car insurance premiums vary significantly across states, influenced by a multitude of factors. Understanding these cost variations is crucial for informed decision-making when purchasing insurance.

Average Premiums by State, Car insurance in different states

Average car insurance premiums differ significantly across states. This variation is due to several factors, including the density of population, traffic patterns, accident rates, and the cost of healthcare.

- States with high population density, such as New York and California, tend to have higher premiums due to increased traffic congestion and accident rates.

- States with a high cost of living, such as Hawaii and Alaska, often have higher premiums due to the higher cost of healthcare and repairs.

- States with lower population density and less traffic, such as Wyoming and North Dakota, generally have lower premiums.

Average Premiums by Car Type and Coverage Level

The cost of car insurance is also influenced by the type of vehicle and the level of coverage selected.

| Car Type | Coverage Level | Average Premium |

|---|---|---|

| Sedan | Liability Only | $500 – $700 |

| SUV | Liability Only | $600 – $800 |

| Sports Car | Liability Only | $700 – $900 |

| Sedan | Comprehensive and Collision | $1,000 – $1,500 |

| SUV | Comprehensive and Collision | $1,200 – $1,800 |

| Sports Car | Comprehensive and Collision | $1,500 – $2,200 |

Factors Contributing to Variations in Insurance Costs

Several factors contribute to variations in car insurance costs across states.

- State Laws and Regulations: State laws and regulations regarding insurance coverage requirements and minimum liability limits can significantly impact premiums. For instance, states with higher minimum liability limits generally have higher premiums.

- Cost of Living: The cost of living, particularly the cost of healthcare and auto repairs, can influence premiums. States with a higher cost of living tend to have higher insurance costs.

- Accident Rates: States with higher accident rates, often attributed to factors like traffic density and driving habits, generally have higher premiums.

- Traffic Density: States with high population density and congested traffic often have higher accident rates, leading to increased premiums.

- Insurance Company Competition: The level of competition among insurance companies in a state can also affect premiums. States with a more competitive insurance market may have lower premiums.

Factors Influencing Premiums

Your car insurance premium is not a fixed amount. It is calculated based on several factors that assess your risk as a driver. These factors can vary widely, leading to significant differences in premiums between individuals. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Demographics

Your personal characteristics play a significant role in determining your insurance premium. Insurance companies use demographic data to assess your risk profile.

- Age: Younger drivers, particularly those under 25, tend to have higher premiums due to their inexperience and higher risk of accidents. As drivers gain experience and age, their premiums typically decrease.

- Driving History: Your driving record is a crucial factor. A clean driving history with no accidents or traffic violations will result in lower premiums. Conversely, accidents, speeding tickets, and DUI convictions can significantly increase your rates.

- Gender: Historically, insurance companies have considered gender as a factor, with men generally paying higher premiums than women. However, this practice is becoming increasingly controversial and may vary depending on the state.

- Credit Score: In many states, insurance companies use credit scores as a proxy for risk. Individuals with good credit scores tend to have lower premiums, while those with poor credit may face higher rates.

Vehicle Characteristics

The type of car you drive also influences your insurance premiums.

- Make and Model: Certain car models are known to be more prone to accidents or theft. Luxury cars, sports cars, and vehicles with a history of safety issues often have higher premiums.

- Safety Features: Cars equipped with advanced safety features, such as anti-lock brakes, airbags, and stability control, can reduce your premiums. These features demonstrate a commitment to safety and can lower your risk of accidents.

- Vehicle Value: The value of your car directly impacts your premium. More expensive cars require higher insurance coverage, resulting in higher premiums.

Location and Driving Habits

Where you live and how you drive also affect your insurance costs.

- Location: Urban areas with higher traffic density and crime rates tend to have higher insurance premiums. Rural areas with lower population density and fewer accidents often have lower premiums.

- Driving Habits: Your driving habits are closely examined by insurance companies. Drivers who commute long distances, drive frequently, or drive in high-risk areas may face higher premiums.

- Annual Mileage: The more you drive, the higher your risk of accidents. Insurance companies consider your annual mileage when calculating your premiums.

Finding the Best Coverage

Finding the best car insurance coverage involves comparing quotes from different providers, understanding your specific needs, and negotiating for the best possible price. This section will guide you through the process of finding the right car insurance coverage for your situation.

Comparing Car Insurance Quotes

Comparing car insurance quotes from different providers is crucial for finding the best deal. This involves obtaining quotes from multiple insurance companies and then analyzing the coverage options, premiums, and discounts offered.

- Use online comparison websites: These websites allow you to enter your information once and receive quotes from various insurers. They simplify the comparison process and help you find competitive rates.

- Contact insurance companies directly: While online comparison websites are convenient, contacting insurance companies directly can provide more personalized quotes and allow you to ask specific questions about coverage options.

- Consider your driving history and vehicle details: Insurance companies base their quotes on factors like your driving history, vehicle make and model, and location. Providing accurate information ensures you receive the most accurate quotes.

- Review the coverage details: When comparing quotes, pay close attention to the coverage limits, deductibles, and any exclusions. Ensure the coverage aligns with your needs and budget.

Choosing the Right Coverage

Choosing the right car insurance coverage depends on your individual needs and circumstances. Factors like your financial situation, driving habits, and vehicle value should influence your decision.

- Liability coverage: This coverage protects you financially if you are responsible for an accident that causes injury or damage to others. It is usually required by law and covers medical expenses, property damage, and legal defense costs.

- Collision coverage: This coverage pays for repairs or replacement of your vehicle if you are involved in an accident, regardless of who is at fault. It is typically optional but can be valuable if your vehicle is relatively new or has a high market value.

- Comprehensive coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, or natural disasters. It is optional but can be beneficial if you live in an area prone to such incidents.

- Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It can cover your medical expenses and property damage.

- Personal injury protection (PIP): This coverage covers your medical expenses, lost wages, and other related costs, regardless of who is at fault in an accident. It is mandatory in some states and can provide valuable financial protection.

Negotiating Car Insurance Premiums

Once you have chosen the coverage that meets your needs, you can negotiate your premiums with the insurance company.

- Shop around: Comparing quotes from different insurers can help you leverage their competition to your advantage. Highlight the lower premiums you have found to encourage negotiation.

- Bundle your insurance: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts.

- Ask about discounts: Insurance companies offer various discounts, including safe driver discounts, good student discounts, and multi-car discounts. Make sure to inquire about all applicable discounts.

- Consider increasing your deductible: Raising your deductible can lower your premium, as you agree to pay more out of pocket in case of an accident. However, ensure you can afford the higher deductible before making this decision.

- Pay your premium in full: Paying your premium annually or semi-annually can often result in a lower overall cost compared to monthly payments.

Insurance Claims and Disputes

Car insurance claims are an essential part of the process when you experience an accident or damage to your vehicle. Knowing how to file a claim and what to expect during the process can help you navigate this complex situation smoothly.

Filing a Car Insurance Claim

Filing a claim after an accident involves several steps, and it’s important to understand the process to ensure a smooth and efficient experience.

- Contact Your Insurance Company: The first step is to contact your insurance company as soon as possible after the accident. They will guide you through the claim process and provide necessary information.

- Provide Details: You will need to provide your insurance company with details about the accident, including the date, time, location, and description of the damage. You may also need to provide information about the other driver(s) involved.

- File a Claim: Your insurance company will guide you through the claim filing process, which may involve completing forms or providing additional documentation.

- Investigate the Claim: Your insurance company will investigate the claim to verify the details you provided and assess the damage to your vehicle.

- Receive a Settlement: If your claim is approved, your insurance company will provide a settlement for the damages. This may involve paying for repairs, replacement parts, or medical expenses.

Common Disputes During Insurance Claims

Disputes can arise during the claims process for various reasons.

- Liability: Disputes about who is at fault for the accident can lead to delays in processing claims.

- Damage Assessment: Disagreements over the extent of damage to the vehicle or the cost of repairs can also cause delays.

- Coverage: Disputes can arise if there are questions about whether the policy covers the specific damage or expenses.

- Settlement Amount: The amount of the settlement offered by the insurance company may be disputed by the policyholder.

Resolving Insurance Claim Issues

If you encounter issues during the claims process, it’s important to know how to address them effectively.

- Document Everything: Keep detailed records of all communications, including dates, times, and names of individuals you speak with.

- Request a Review: If you disagree with the insurance company’s decision, you can request a review of your claim.

- Mediation: If a review doesn’t resolve the issue, consider mediation, which involves a neutral third party to facilitate a resolution.

- Legal Representation: In some cases, legal representation may be necessary to protect your rights and interests.

Tips for Saving Money: Car Insurance In Different States

Saving money on car insurance is a priority for many drivers. By implementing various strategies, you can potentially lower your premiums and keep more money in your pocket.

Discounts and Incentives

Insurance companies often offer discounts and incentives to attract and retain customers. These can significantly reduce your premium, making it crucial to explore all available options.

- Good Student Discount: This discount is typically offered to students who maintain a certain GPA. It acknowledges their responsible behavior and academic achievements, reflecting a lower risk profile for the insurance company.

- Safe Driver Discount: This discount rewards drivers with a clean driving record, demonstrating their responsible driving habits and reduced likelihood of accidents.

- Multi-Policy Discount: Insurance companies often provide discounts for bundling multiple policies, such as home, auto, and life insurance. This encourages customers to consolidate their insurance needs with one provider, simplifying management and potentially reducing costs.

- Anti-theft Device Discount: Installing anti-theft devices in your vehicle can deter theft and reduce the risk of claims. This makes your vehicle less appealing to thieves, resulting in lower premiums for you.

- Loyalty Discount: Insurance companies often reward long-term customers with loyalty discounts. This recognizes their continued business and fosters a sense of appreciation, incentivizing customer retention.

Safe Driving Practices

Maintaining a safe driving record is not only essential for your own safety but also for reducing your insurance premiums. Insurance companies consider safe driving practices a key indicator of risk, and rewarding responsible drivers with lower premiums.

- Defensive Driving Courses: Enrolling in a defensive driving course can help you acquire valuable skills and knowledge to avoid accidents and reduce your risk profile. This can lead to discounts on your insurance premiums as you demonstrate your commitment to safe driving.

- Maintaining a Clean Driving Record: Avoiding traffic violations, such as speeding tickets and reckless driving citations, can significantly impact your insurance premiums. Insurance companies view a clean driving record as a sign of responsible driving habits and lower risk.

- Avoiding Distracted Driving: Distracted driving, such as using your phone while driving, is a major cause of accidents. By minimizing distractions and focusing on the road, you can significantly reduce your risk of accidents and potentially lower your insurance premiums.

Summary

Navigating the world of car insurance can be challenging, especially when considering the differences between states. By understanding the basics of car insurance, state-specific regulations, and factors influencing premiums, you can make informed decisions about your coverage and ensure you have the right protection for your driving needs. Remember to compare quotes, choose the right coverage, and explore ways to save money on your premiums.

FAQ Overview

What are the minimum car insurance requirements in my state?

Minimum car insurance requirements vary by state. You can find this information on your state’s Department of Motor Vehicles website.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least annually, or whenever you experience a major life change, such as getting married, buying a new car, or having a child.

What are some ways to lower my car insurance premiums?

There are several ways to lower your car insurance premiums, such as taking a defensive driving course, maintaining a good driving record, bundling your insurance policies, and choosing a higher deductible.