Car insurance in different state than registration – Car insurance in a different state than registration can be a complex topic, especially when navigating the legal and regulatory landscape. While it may seem like a simple matter, there are various factors to consider, including coverage, costs, and claim processes. This exploration delves into the intricacies of obtaining car insurance in a state other than where your vehicle is registered, shedding light on the challenges and opportunities involved.

Understanding the legalities, coverage nuances, and potential cost variations is crucial for drivers who find themselves in this situation. Whether you’re relocating, traveling frequently, or simply seeking more affordable insurance options, this guide will equip you with the knowledge necessary to make informed decisions about your car insurance.

Legality and Requirements: Car Insurance In Different State Than Registration

Driving a car insured in a different state than where it’s registered can have legal implications. Understanding the specific requirements and regulations in each state is crucial to avoid penalties and ensure adequate coverage.

State-Specific Regulations

The regulations governing out-of-state car insurance vary significantly between states. Some states have strict policies, while others are more lenient. Here’s a breakdown of key aspects:

- Minimum Coverage Requirements: States often have minimum coverage requirements for car insurance, which can differ from state to state. For example, a state might require liability coverage of $25,000 per person and $50,000 per accident, while another state might have higher limits. When driving in a state other than where your car is registered, you must meet the minimum coverage requirements of that state, even if your home state’s requirements are lower.

- Financial Responsibility Laws: Many states have financial responsibility laws that require drivers to prove they can cover the costs of any accidents they cause. This can be done through car insurance or by posting a bond. If you’re driving in a state with financial responsibility laws and your insurance doesn’t meet the state’s requirements, you could face penalties, such as fines or license suspension.

- Non-Resident Insurance: Some states have specific insurance policies designed for non-residents, which may provide additional coverage or exemptions. These policies can help ensure you meet the legal requirements of the state you’re driving in.

Examples of State Policies

- Strict Policies: States like New York and California have strict policies regarding out-of-state car insurance. These states may require you to register your car in the state within a certain timeframe or obtain a non-resident insurance policy. They might also have strict penalties for driving without proper insurance.

- Lenient Policies: States like Texas and Florida tend to be more lenient. These states may allow you to drive on your home state’s insurance for a certain period, as long as it meets their minimum coverage requirements. However, it’s essential to check the specific regulations of each state to ensure compliance.

Coverage and Benefits

When you purchase car insurance in a state different from where your car is registered, it’s essential to understand how coverage might differ. Each state has its own set of regulations governing car insurance, which can impact the coverage you receive.

Understanding the nuances of coverage and benefits in different states is crucial to ensure you’re adequately protected.

Coverage Limits

Coverage limits define the maximum amount your insurance company will pay for covered losses. These limits can vary significantly between states. For example, the minimum liability coverage required in some states might be much lower than in others. It’s crucial to compare coverage limits offered by different insurance companies and ensure they meet your individual needs.

Deductibles

A deductible is the amount you pay out-of-pocket before your insurance kicks in. Higher deductibles typically result in lower premiums, while lower deductibles lead to higher premiums. Deductibles can also vary between states, so it’s important to compare them carefully.

Exclusions

Exclusions are specific events or circumstances not covered by your insurance policy. These exclusions can differ based on the state where you purchase the policy. Some common exclusions include:

* Damage caused by wear and tear.

* Damage resulting from driving under the influence of alcohol or drugs.

* Damage caused by intentional acts.

Benefits and Drawbacks

Benefits of Obtaining Insurance in a Different State

There are some potential benefits to obtaining car insurance in a state different from where your car is registered. For instance, if you live in a state with high insurance premiums, you might find more affordable rates in another state. However, it’s important to consider the potential drawbacks before making a decision.

Drawbacks of Obtaining Insurance in a Different State

The most significant drawback of obtaining car insurance in a different state is the potential for coverage gaps. If you’re involved in an accident in a state where your insurance isn’t valid, you might not be adequately covered. Additionally, you might face challenges filing claims and dealing with insurance companies in a different state.

Cost Considerations

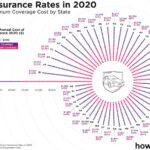

Obtaining car insurance in a state different from where your vehicle is registered can significantly impact your premiums. Several factors influence these costs, and understanding them can help you make informed decisions.

Factors Influencing Car Insurance Premiums, Car insurance in different state than registration

The cost of car insurance is influenced by a complex interplay of factors, including demographics, driving history, and the type of vehicle.

- Demographics: Your age, gender, marital status, and even your credit score can impact your insurance premiums. Younger drivers, for example, are statistically more likely to be involved in accidents, leading to higher premiums. Similarly, individuals with poor credit scores may be perceived as higher risk, resulting in increased insurance costs.

- Driving History: Your driving record, including accidents, traffic violations, and DUI convictions, plays a crucial role in determining your insurance rates. A clean driving record typically translates to lower premiums, while a history of accidents or violations can lead to higher rates.

- Vehicle Type: The make, model, and year of your vehicle are significant factors. Sports cars and luxury vehicles are often associated with higher repair costs and are therefore more expensive to insure. Additionally, newer vehicles with advanced safety features may qualify for discounts, reducing your premium.

- State Laws and Regulations: Each state has its own regulations and requirements for car insurance, including minimum coverage limits. These regulations can impact the overall cost of insurance, as different states may have varying levels of coverage mandates.

- Local Risk Factors: The location where you live and drive can influence your insurance premiums. Areas with high crime rates, traffic congestion, or a history of accidents may have higher insurance rates compared to safer, less congested areas.

Cost Savings or Increases

Obtaining car insurance in a different state from your vehicle registration may result in either cost savings or increases, depending on the specific factors involved.

- Potential Cost Savings: In some cases, you might find lower premiums in a different state, especially if the state has more competitive insurance markets or lower average insurance rates. For example, if you move from a state with high insurance costs to a state with lower costs, you may benefit from lower premiums.

- Potential Cost Increases: Conversely, insurance costs may be higher in certain states, especially if they have stricter insurance regulations, higher average claims, or a higher concentration of high-risk drivers. For example, if you move from a state with low insurance costs to a state with higher costs, you may experience an increase in your premiums.

Scenarios with Varying Insurance Costs

Here are some real-life scenarios where insurance costs can vary significantly based on the state of coverage:

- Scenario 1: A young driver with a clean driving record living in a state with high insurance costs may find it advantageous to obtain insurance in a state with lower insurance costs, potentially saving hundreds of dollars annually.

- Scenario 2: An individual driving a high-performance sports car in a state with a high concentration of accidents may face higher insurance premiums compared to someone driving a standard sedan in a state with lower accident rates.

- Scenario 3: A driver with a history of traffic violations or accidents may find it challenging to obtain affordable insurance in certain states with strict insurance regulations, potentially leading to significantly higher premiums.

Claims and Accidents

If you’re insured in a different state than where your car is registered, filing a claim after an accident can be more complex than usual. This is because your insurance company might need to navigate different state laws and regulations.

Claim Filing Process

The process of filing a claim for an accident when insured in a different state than the car’s registration generally involves these steps:

- Report the accident: You should always report the accident to the police and your insurance company as soon as possible, regardless of the state where the accident occurred.

- Provide details: Your insurance company will need detailed information about the accident, including the date, time, location, and any witnesses.

- Submit claim documents: You’ll need to submit the necessary claim documents, such as a police report, medical records, and photos of the damage.

- Negotiate settlement: Your insurance company will work with you to assess the damage and negotiate a settlement for your claim.

State of Coverage and Claim Handling

The state where your insurance policy is issued (your state of coverage) can influence how your claim is handled, especially if the accident occurs in a different state.

- State laws and regulations: Each state has its own set of laws and regulations regarding car insurance and accident claims. These can vary significantly, so it’s important to understand the laws of both the state where your policy is issued and the state where the accident occurred.

- Dispute resolution: If you and your insurance company can’t agree on a settlement, the state’s dispute resolution process might come into play. This could involve mediation, arbitration, or even a lawsuit.

- Legal proceedings: In some cases, a lawsuit may be necessary to resolve a claim dispute. The laws and procedures governing lawsuits can vary significantly from state to state.

Potential Challenges and Complications

There are several potential challenges and complications that can arise when filing a claim in a different state than your car’s registration:

- Coverage limitations: Your insurance policy might have specific limitations or exclusions that apply to accidents occurring outside your state of coverage. For example, your policy might not cover certain types of damages or have lower coverage limits for accidents in other states.

- State-specific requirements: Some states have specific requirements for filing accident claims, such as the need to file a police report or submit certain documents. You might need to familiarize yourself with these requirements if you’re filing a claim in a different state.

- Communication challenges: There can be communication challenges between your insurance company and the other parties involved in the accident, especially if they are located in different states. This could lead to delays in processing your claim.

- Legal complexities: The legal complexities involved in navigating different state laws and regulations can be significant, especially if you’re dealing with a complex claim or a dispute with your insurance company.

Tips for Choosing Insurance

Choosing the right car insurance when you’re living in a different state than where your car is registered can be a bit tricky. You need to consider various factors to ensure you get the best coverage at a reasonable price. This section provides tips for making informed decisions and finding the most suitable and affordable coverage options.

Factors to Consider When Choosing Insurance

This section Artikels key factors to consider when selecting car insurance in a different state than your car’s registration.

- State Minimum Requirements: Each state has its own minimum insurance requirements. You must meet these requirements, even if you’re driving a car registered in another state. For example, some states may require higher liability limits than others. It’s essential to check the minimum requirements of the state you’re living in to ensure you have adequate coverage.

- Your Driving History: Your driving history, including any accidents or traffic violations, plays a significant role in determining your insurance premiums. A clean driving record can lead to lower premiums. However, if you have a history of accidents or violations, you may face higher rates, especially in a new state where your driving history isn’t readily available.

- Your Car’s Value: The value of your car can also affect your insurance premiums. If you have a more expensive car, you’ll likely pay higher premiums for comprehensive and collision coverage. It’s crucial to factor in the value of your car when choosing your insurance policy.

- Your Coverage Needs: Consider your individual needs and circumstances when choosing coverage. For example, if you live in an area with a high risk of theft, you might want to consider adding comprehensive coverage to your policy. If you frequently drive long distances, you may want to consider increasing your liability limits.

- Your Budget: It’s essential to consider your budget when choosing car insurance. There are various factors that can affect your premiums, such as your age, driving history, and the type of coverage you choose. Comparing quotes from multiple insurers can help you find the most affordable option that meets your needs.

Tips for Finding the Most Suitable and Affordable Coverage Options

This section provides tips for finding the best car insurance options when you’re living in a different state than your car’s registration.

- Compare Quotes from Multiple Insurers: Getting quotes from several insurers is crucial to finding the best deal. Online comparison websites can help you compare quotes quickly and easily. You can also contact insurers directly to get personalized quotes.

- Consider Bundling Policies: Bundling your car insurance with other policies, such as homeowners or renters insurance, can often result in discounts. Many insurers offer discounts for bundling multiple policies.

- Look for Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your car, and being a member of certain organizations. Ask about available discounts when getting quotes.

- Negotiate Your Premium: Don’t be afraid to negotiate your premium with insurers. If you have a good driving record and are willing to bundle policies, you may be able to get a better rate.

- Review Your Policy Regularly: It’s essential to review your policy regularly to ensure you have the right coverage and that your premium is still competitive. You may need to adjust your coverage or switch insurers if your needs change or if you find a better deal.

Obtaining Out-of-State Car Insurance

This section provides a step-by-step guide for obtaining out-of-state car insurance.

- Gather Necessary Information: Before contacting insurers, gather all the necessary information, such as your driver’s license, vehicle registration, and proof of previous insurance. Having this information readily available will streamline the quoting process.

- Contact Insurers: Once you’ve gathered the necessary information, contact several insurers to get quotes. You can use online comparison websites or contact insurers directly. Provide them with all the required details, including your new address and the state where you’ll be living.

- Compare Quotes and Choose a Policy: After receiving quotes from multiple insurers, compare them carefully, considering factors such as coverage, premium, and customer service. Choose the policy that best meets your needs and budget.

- Provide Proof of Insurance: Once you’ve chosen a policy, the insurer will provide you with proof of insurance. You’ll need to keep this proof readily available in your car, as you may be required to show it to law enforcement officers if stopped.

- Notify Your Previous Insurer: Inform your previous insurer that you’re cancelling your policy. Make sure you understand the cancellation process and any potential penalties.

Case Studies

To better understand the implications of obtaining car insurance in a different state than your vehicle’s registration, let’s explore some real-world scenarios.

Scenarios for Obtaining Car Insurance in a Different State

The following table showcases different situations where obtaining car insurance in a different state could be advantageous or disadvantageous, highlighting the potential outcomes based on the car’s registration state and the driver’s location:

| Scenario | Car Registration State | Driver’s Location | Potential Outcomes |

|---|---|---|---|

| Scenario 1: College Student | Texas | California | A college student living in California for their studies while their car is registered in Texas might find it more convenient to obtain car insurance in California, potentially benefiting from lower premiums due to California’s more competitive insurance market. However, they might face higher deductibles or stricter coverage requirements in California compared to Texas. |

| Scenario 2: Seasonal Residence | Florida | New York | A person who owns a car registered in Florida and spends several months each year in New York might benefit from obtaining car insurance in New York during their stay. This could provide them with more comprehensive coverage tailored to the specific needs of driving in New York, potentially including coverage for winter driving conditions or higher liability limits. However, they might need to maintain two insurance policies, one in Florida and one in New York, which could increase their overall costs. |

| Scenario 3: Military Relocation | Virginia | Washington | A military service member relocating from Virginia to Washington with their registered car might find it advantageous to obtain car insurance in Washington. This could ensure they have the necessary coverage for driving in Washington, potentially including coverage for specific road conditions or traffic laws. However, they might face higher premiums in Washington due to the state’s higher average insurance costs. |

| Scenario 4: Work-Related Travel | Illinois | Michigan | A person working in Michigan but living in Illinois with a car registered in Illinois might find it advantageous to obtain car insurance in Michigan. This could provide them with coverage for their daily commute and work-related driving activities, potentially including coverage for specific risks associated with driving in Michigan. However, they might need to ensure their Illinois insurance policy covers their occasional trips to Michigan to avoid any coverage gaps. |

Conclusion

Obtaining car insurance in a different state than your car’s registration can be a complex decision with both advantages and disadvantages. While it might seem like a simple solution, it’s essential to weigh the pros and cons carefully before making a decision.

This guide has provided you with a comprehensive understanding of the legal aspects, coverage options, cost considerations, claims processes, and tips for choosing insurance when your car is registered in one state but you’re seeking coverage in another.

Key Takeaways and Recommendations

The decision of obtaining car insurance in a different state than your car’s registration should be based on a thorough assessment of your individual needs and circumstances. Here are some key takeaways and recommendations:

- Understand the legal requirements and regulations in both your car’s registration state and the state where you’re seeking insurance. Ensure you comply with all legal obligations and avoid potential penalties.

- Compare insurance quotes from multiple insurers in both states to identify the best coverage options and prices. Consider factors such as your driving history, vehicle type, and coverage needs.

- Consider the potential impact on your premiums. Insurers may adjust premiums based on the state where your car is primarily driven, so be prepared for potential increases or decreases.

- Review the coverage options and benefits offered in each state to ensure you have adequate protection for your needs. Consider factors like liability limits, comprehensive and collision coverage, and uninsured motorist coverage.

- Understand the claims process in both states, including reporting procedures, documentation requirements, and dispute resolution mechanisms.

- Seek professional advice from a licensed insurance agent or broker who can provide guidance and help you navigate the complexities of interstate insurance.

Concluding Remarks

Navigating car insurance in a different state than registration requires careful consideration of legal requirements, coverage options, and potential cost implications. By understanding the intricacies of this process, drivers can ensure they have adequate protection while minimizing potential complications. Whether you’re a frequent traveler or considering a move, this guide provides valuable insights to help you make informed decisions and secure the right insurance for your needs.

General Inquiries

What happens if I get into an accident while insured in a different state than my car’s registration?

The state where the accident occurred will typically govern the claim process, regardless of where your insurance is from. It’s important to contact your insurance company immediately to report the accident and follow their instructions for filing a claim.

Can I get car insurance in a different state if I’m only visiting for a short period?

You may be able to get temporary insurance in the state you’re visiting, but it’s best to check with your current insurance company to see if they offer coverage for out-of-state trips. Some insurers may have coverage limitations or require additional premiums for temporary out-of-state coverage.

Is it always cheaper to get car insurance in a different state?

Not necessarily. Insurance premiums are influenced by various factors, including your driving history, vehicle type, and the state’s regulations. While you may find lower rates in some states, it’s essential to compare quotes from multiple insurers in both your home state and the state where you’re considering getting insurance.