Car insurance for Washington state is a vital aspect of responsible driving, ensuring financial protection in case of accidents. Washington state mandates specific minimum liability coverage levels, protecting drivers and their passengers from financial hardship due to unforeseen events. This guide delves into the intricacies of car insurance in Washington, exploring the factors influencing costs, the different types of coverage available, and tips for finding affordable options. It also highlights common discounts and provides a step-by-step guide for filing claims.

Understanding car insurance requirements and navigating the complexities of coverage options can be overwhelming. However, this guide aims to simplify the process, providing you with the knowledge needed to make informed decisions about your car insurance. From understanding minimum coverage requirements to exploring various discount opportunities, this guide equips you with the tools to find the best car insurance plan tailored to your specific needs and budget.

Washington State Car Insurance Requirements

Driving a car in Washington State comes with certain responsibilities, and one of the most important is having the right car insurance. The state has specific requirements for car insurance coverage, ensuring that drivers are financially protected in case of an accident.

Minimum Liability Coverage Amounts

Washington State requires all drivers to carry a minimum amount of liability insurance. This coverage protects other drivers and their property if you cause an accident. The minimum liability coverage amounts required by law are:

- Bodily Injury Liability: $25,000 per person, $50,000 per accident. This coverage pays for medical expenses, lost wages, and other damages to people injured in an accident caused by you.

- Property Damage Liability: $10,000 per accident. This coverage pays for damage to another person’s property, such as their vehicle or other possessions, if you cause an accident.

Penalties for Driving Without Insurance

Driving without valid car insurance in Washington State is a serious offense. The penalties for driving without insurance can be significant and include:

- Fines: You could face fines of up to $1,000 for driving without insurance.

- License Suspension: Your driver’s license may be suspended for up to 90 days if you are caught driving without insurance.

- Vehicle Impoundment: Your vehicle may be impounded until you provide proof of insurance.

- Court Costs: You may be required to pay court costs if you are found guilty of driving without insurance.

Factors Influencing Car Insurance Costs in Washington

Several factors determine car insurance premiums in Washington State. These factors are used by insurance companies to assess your risk as a driver and to determine how much they should charge you for coverage.

Driving History

Your driving history is one of the most significant factors affecting your car insurance premiums. A clean driving record with no accidents or violations will result in lower premiums. However, if you have a history of accidents, speeding tickets, or DUI convictions, your premiums will likely be higher. Insurance companies use this information to assess your risk of being involved in an accident.

Age

Your age is also a significant factor in determining your car insurance premiums. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. Therefore, insurance companies often charge higher premiums to younger drivers. As you get older and gain more driving experience, your premiums typically decrease.

Vehicle Type

The type of vehicle you drive can significantly impact your car insurance premiums. Some vehicles are considered more expensive to repair or replace, such as luxury cars or high-performance vehicles. Additionally, vehicles with safety features like airbags and anti-lock brakes can qualify for lower premiums.

Location

Your location in Washington State can also influence your car insurance premiums. Insurance companies consider the crime rate, traffic density, and number of accidents in your area when determining your rates. Areas with higher crime rates or more accidents tend to have higher insurance premiums.

Types of Car Insurance Coverage in Washington: Car Insurance For Washington State

Understanding the different types of car insurance coverage available in Washington is crucial for making informed decisions about your insurance policy. Each type of coverage offers distinct benefits and drawbacks, so it’s essential to carefully consider your needs and budget when selecting the right coverage for you.

Liability Coverage

Liability coverage is a crucial component of car insurance in Washington, as it protects you financially if you are responsible for an accident that causes injury or damage to another person or property. This coverage helps cover the costs of:

* Medical Expenses: If you cause an accident that injures another person, liability coverage will help pay for their medical bills, including hospital stays, surgery, and rehabilitation.

* Property Damage: If you damage someone else’s vehicle or property, liability coverage will help cover the cost of repairs or replacement.

Liability coverage is typically expressed as a limit, such as 25/50/10, which means:

* $25,000: The maximum amount the policy will pay for injuries to a single person in an accident.

* $50,000: The maximum amount the policy will pay for injuries to multiple people in a single accident.

* $10,000: The maximum amount the policy will pay for property damage in a single accident.

Note: Washington state law requires all drivers to carry liability insurance with minimum limits of 25/50/10.

Collision Coverage

Collision coverage protects you financially if your vehicle is damaged in an accident, regardless of who is at fault. This coverage will help pay for repairs or replacement of your vehicle, minus your deductible.

| Coverage Type | Description | Benefits |

|---|---|---|

| Collision | Covers damage to your vehicle in an accident, regardless of fault. | Pays for repairs or replacement of your vehicle, minus your deductible. Provides financial protection in case of an accident, even if you are at fault. |

Note: Collision coverage is optional in Washington, but it is often recommended for newer vehicles or vehicles with high loan balances.

Comprehensive Coverage

Comprehensive coverage protects your vehicle from damage caused by events other than accidents, such as:

* Theft

* Vandalism

* Fire

* Hail

* Windstorms

* Floods

* Animal collisions

This coverage will help pay for repairs or replacement of your vehicle, minus your deductible.

| Coverage Type | Description | Benefits |

|---|---|---|

| Comprehensive | Covers damage to your vehicle from events other than accidents. | Pays for repairs or replacement of your vehicle, minus your deductible. Provides financial protection against unexpected events that can damage your vehicle. |

Note: Comprehensive coverage is optional in Washington, but it is often recommended for newer vehicles or vehicles with high loan balances.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you financially if you are involved in an accident with a driver who is uninsured or underinsured. This coverage will help pay for your medical expenses, lost wages, and property damage, up to the limits of your policy.

| Coverage Type | Description | Benefits |

|---|---|---|

| Uninsured/Underinsured Motorist (UM/UIM) | Covers your losses if you are involved in an accident with an uninsured or underinsured driver. | Provides financial protection in case of an accident with a driver who does not have sufficient insurance. Helps cover medical expenses, lost wages, and property damage. |

Note: UM/UIM coverage is optional in Washington, but it is strongly recommended to ensure adequate protection in case of an accident with an uninsured or underinsured driver.

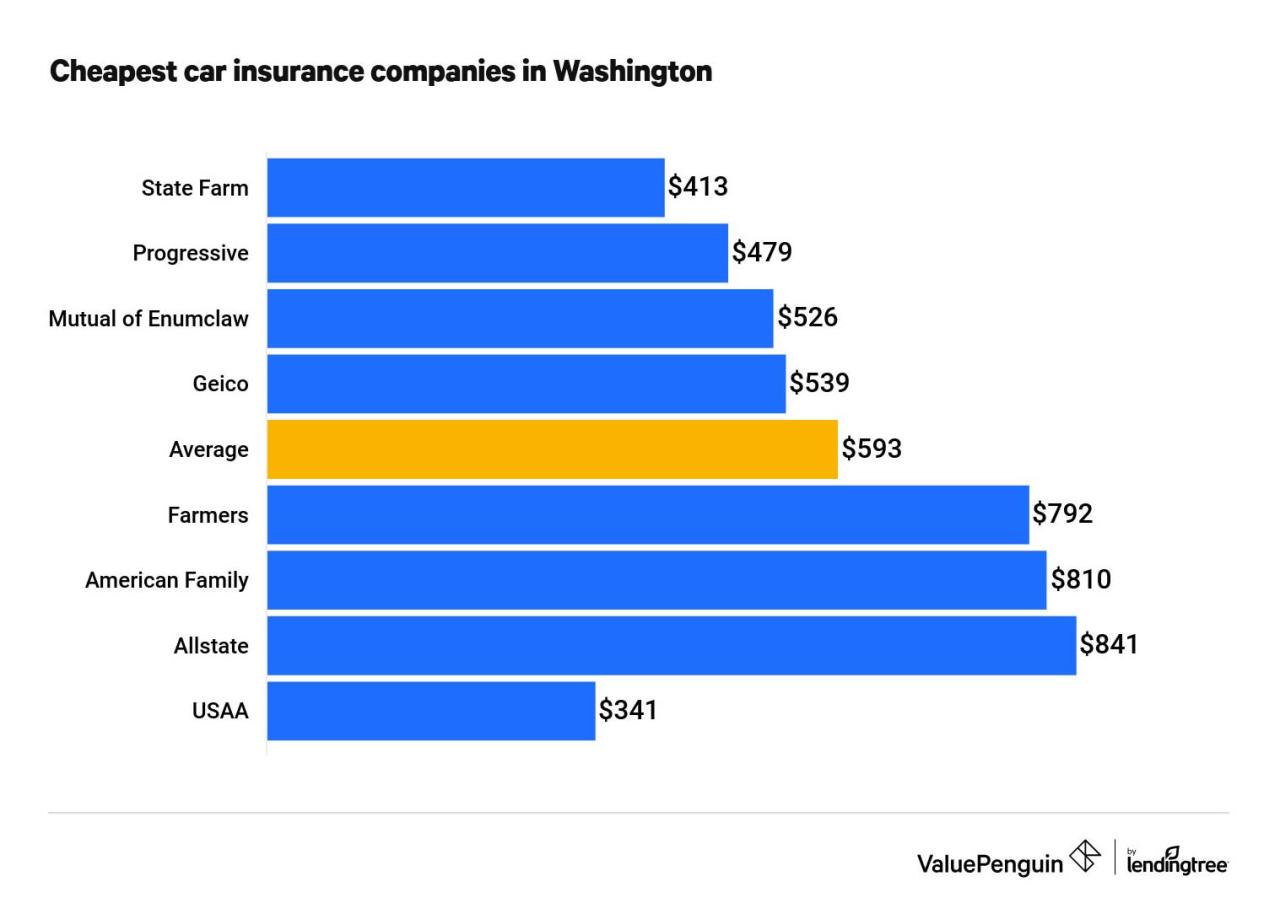

Finding Affordable Car Insurance in Washington

Finding affordable car insurance in Washington can be a challenge, but with some research and effort, you can secure a policy that fits your budget.

Tips for Finding Affordable Car Insurance

Finding affordable car insurance in Washington requires careful planning and comparison. Here are some tips to help you get the best rates:

- Shop around and compare quotes: Get quotes from multiple insurance companies to compare prices and coverage options. Online comparison tools can simplify this process.

- Consider your driving history: A clean driving record with no accidents or violations can significantly lower your premiums. Maintaining a safe driving record is crucial for affordability.

- Bundle your policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can often lead to discounts. Consider bundling your policies for potential savings.

- Increase your deductible: A higher deductible means you pay more out of pocket in case of an accident but can lead to lower premiums. Carefully assess your risk tolerance and financial situation before deciding on a deductible.

- Ask about discounts: Insurance companies offer various discounts, such as good student, safe driver, or multi-car discounts. Inquire about available discounts and ensure you qualify for them.

- Maintain a good credit score: Your credit score can influence your car insurance rates in Washington. A good credit score generally leads to lower premiums. Work on improving your credit score if needed.

- Consider your car’s safety features: Vehicles equipped with safety features, such as anti-theft systems or airbags, may qualify for discounts. These features reduce the risk of accidents and can impact your premiums.

Strategies for Comparing Quotes

When comparing quotes, it’s essential to consider various factors and use a systematic approach:

- Use online comparison tools: These tools allow you to enter your information once and receive quotes from multiple insurers. This saves time and effort compared to contacting each company individually.

- Focus on coverage: Compare quotes based on the same coverage levels to ensure a fair comparison. Don’t solely rely on the lowest price without considering the coverage provided.

- Read the fine print: Carefully review the policy details, including deductibles, coverage limits, and exclusions. Understand the terms and conditions before making a decision.

- Consider customer service: While price is important, also consider the insurer’s reputation for customer service and claims handling. Look for companies known for their responsiveness and fairness in handling claims.

Step-by-Step Guide to Obtaining Car Insurance in Washington

Securing car insurance in Washington involves a straightforward process:

- Gather necessary information: Prepare your driver’s license, vehicle registration, and any relevant details about your driving history and vehicle.

- Contact insurance companies: Get quotes from multiple insurers, either online or by phone.

- Compare quotes and coverage: Analyze the quotes, focusing on coverage levels, premiums, and customer service.

- Choose a policy: Select the policy that best meets your needs and budget.

- Pay your premium: Make the initial payment and ensure you receive your insurance card.

Car Insurance Discounts in Washington

Saving money on your car insurance is always a good thing, and Washington State offers a variety of discounts to help you do just that. These discounts can be significant, so it’s worth taking the time to see which ones you qualify for.

Common Car Insurance Discounts

Discounts are a great way to lower your insurance premiums. Here are some of the most common discounts available in Washington:

- Good Driver Discount: This is one of the most common discounts, and it’s available to drivers with a clean driving record. This discount is typically offered to drivers who have not had any accidents or traffic violations in a certain period, usually 3 to 5 years. The discount can range from 5% to 25% or more, depending on the insurer and your driving history.

- Safe Driver Discount: Similar to the good driver discount, the safe driver discount rewards drivers who have a history of safe driving. This discount can be based on factors such as driving record, accident history, and traffic violations. The discount can vary depending on the insurer and your driving history.

- Defensive Driving Course Discount: Taking a defensive driving course can help you learn safe driving techniques and reduce your risk of accidents. Many insurers offer discounts to drivers who complete an approved defensive driving course. The discount can range from 5% to 15% or more, depending on the insurer and the course you take.

- Multi-Car Discount: If you insure multiple vehicles with the same insurer, you may be eligible for a multi-car discount. This discount can save you a significant amount of money, especially if you have several cars. The discount can vary depending on the insurer and the number of vehicles you insure.

- Good Student Discount: This discount is available to students who maintain a certain GPA. The discount can vary depending on the insurer and the student’s GPA. Some insurers may offer discounts for students who are involved in extracurricular activities or volunteer work.

- Anti-theft Device Discount: Installing anti-theft devices in your car can help deter theft and reduce your insurance premiums. Many insurers offer discounts to drivers who have anti-theft devices installed in their cars. The discount can vary depending on the insurer and the type of anti-theft device installed. Some common anti-theft devices include alarms, immobilizers, and GPS tracking systems.

- Low Mileage Discount: If you drive less than a certain number of miles per year, you may be eligible for a low mileage discount. This discount is typically offered to drivers who commute short distances or work from home. The discount can vary depending on the insurer and the number of miles you drive per year.

- Bundling Discount: You can often save money by bundling your car insurance with other types of insurance, such as homeowners, renters, or life insurance. Many insurers offer discounts to customers who bundle their policies. The discount can vary depending on the insurer and the types of policies you bundle.

- Loyalty Discount: Some insurers offer discounts to customers who have been with them for a certain period of time. The discount can vary depending on the insurer and the length of time you have been a customer.

Qualifying for Discounts

To qualify for discounts, you’ll need to meet certain criteria. Here are some of the factors that insurers consider when determining your eligibility for discounts:

- Driving Record: As mentioned above, a clean driving record is essential for qualifying for many discounts. This includes factors such as accidents, traffic violations, and DUI convictions. If you have a history of accidents or violations, you may have to wait a certain period of time before you are eligible for a discount.

- Vehicle Safety Features: Cars with safety features, such as airbags, anti-lock brakes, and electronic stability control, are generally considered safer to drive. Many insurers offer discounts to drivers who own vehicles with these features.

- Credit History: In some states, including Washington, insurers may use your credit history to determine your insurance rates. A good credit history can qualify you for discounts. However, it’s important to note that this practice is controversial, and some people believe it’s unfair.

- Age and Gender: Younger drivers and drivers of certain genders may be eligible for discounts. This is because these groups are statistically less likely to be involved in accidents. However, it’s important to note that this practice is also controversial, and some people believe it’s discriminatory.

- Occupation: Some occupations may be eligible for discounts. For example, some insurers offer discounts to teachers, firefighters, and police officers.

- Location: Your location can also affect your eligibility for discounts. For example, some insurers offer discounts to drivers who live in areas with lower crime rates.

- Policy Bundling: As mentioned above, bundling your car insurance with other types of insurance can qualify you for discounts. This is because insurers can often offer lower rates when they insure multiple types of coverage for a single customer.

Filing a Car Insurance Claim in Washington

In the unfortunate event of an accident, knowing how to file a car insurance claim in Washington is crucial. This guide will walk you through the process, explaining the necessary steps, required documentation, and the rights and responsibilities of insured individuals.

Reporting an Accident

It is essential to report an accident to your insurance company promptly. This ensures that the claims process is initiated promptly, and you can receive the necessary assistance.

- Contact your insurance company: The first step is to contact your insurance company and report the accident. You will need to provide them with details such as the date, time, location, and circumstances of the accident. Additionally, you should include information about any injuries or damage sustained. You can typically report an accident by phone, online, or through their mobile app.

- Report to the police: In Washington, you are legally required to report an accident to the police if there are injuries, fatalities, or property damage exceeding $1,000. The police will file a report documenting the details of the accident, which is valuable evidence in the claims process.

- Exchange information: Regardless of whether you are required to report to the police, it is essential to exchange information with the other parties involved in the accident. This includes their name, address, insurance company, and policy number. You should also obtain the names and contact information of any witnesses to the accident.

Submitting Documentation, Car insurance for washington state

Once you have reported the accident, your insurance company will guide you on the next steps. This may involve submitting documentation to support your claim.

- Accident report: If you have filed a police report, you will need to provide a copy to your insurance company. This document provides an official account of the accident and can help determine liability.

- Photographs: Take detailed photographs of the damage to your vehicle, the other vehicle(s), and the accident scene. These photographs serve as visual evidence of the extent of the damage and can be helpful in the claims process.

- Medical records: If you have sustained injuries, you will need to provide your insurance company with medical records from your doctor or other healthcare providers. These records document the nature and extent of your injuries, which is essential for determining the appropriate compensation.

- Repair estimates: Obtain repair estimates from reputable auto body shops for the damage to your vehicle. These estimates will help determine the cost of repairs and can be used to support your claim.

Rights and Responsibilities of Insured Individuals

As an insured individual in Washington, you have certain rights and responsibilities when filing a car insurance claim.

- Right to fair treatment: You have the right to be treated fairly and with respect by your insurance company throughout the claims process. This includes receiving prompt and accurate information about your claim, and having your claim processed in a timely manner.

- Right to appeal: If you disagree with your insurance company’s decision regarding your claim, you have the right to appeal the decision. The appeal process provides an opportunity to present additional evidence and argue your case.

- Responsibility to cooperate: You are responsible for cooperating with your insurance company throughout the claims process. This includes providing accurate and complete information, submitting required documentation, and attending any necessary appointments or inspections. Failure to cooperate can jeopardize your claim.

- Responsibility to be honest: You are responsible for being honest and truthful with your insurance company about the accident and any related circumstances. Providing false information can result in the denial of your claim and potentially legal consequences.

Final Summary

Navigating the world of car insurance in Washington state can be a daunting task. However, with the right knowledge and guidance, finding affordable and comprehensive coverage is achievable. By understanding the factors that influence premiums, exploring various coverage options, and taking advantage of available discounts, drivers can secure a policy that meets their specific needs and budget. This guide has provided a comprehensive overview of car insurance in Washington, equipping you with the information and tools to make informed decisions about your coverage. Remember to compare quotes from different insurance providers, explore discounts, and ensure your policy meets your individual requirements.

FAQ Guide

What are the minimum car insurance requirements in Washington State?

Washington State requires drivers to carry a minimum amount of liability coverage, including $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $10,000 for property damage.

How do I find the cheapest car insurance in Washington?

To find the cheapest car insurance, compare quotes from multiple insurance providers, explore discounts, and consider factors like your driving history, vehicle type, and location.

What happens if I drive without car insurance in Washington?

Driving without car insurance in Washington is illegal and can result in fines, license suspension, and even vehicle impoundment.

What are some common car insurance discounts available in Washington?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, and bundling discounts for combining car insurance with other types of insurance.