Car insurance for state employees presents a unique opportunity to secure affordable and comprehensive coverage tailored to their specific needs. State-sponsored plans often offer exclusive benefits, competitive premiums, and dedicated customer service resources. This article delves into the details of these programs, exploring eligibility, enrollment processes, and the advantages they provide compared to private insurance options.

Navigating the world of car insurance can be overwhelming, but understanding the benefits available to state employees can empower them to make informed decisions and find the best coverage for their individual circumstances. This guide will provide a clear and concise overview of the options available, helping state employees navigate the process with confidence.

State Employee Car Insurance Benefits

As a state employee, you may be eligible for a variety of car insurance benefits. These benefits can help you save money on your car insurance premiums and provide you with peace of mind knowing that you have adequate coverage in case of an accident.

Coverage Options

State employee car insurance plans typically offer a range of coverage options, including:

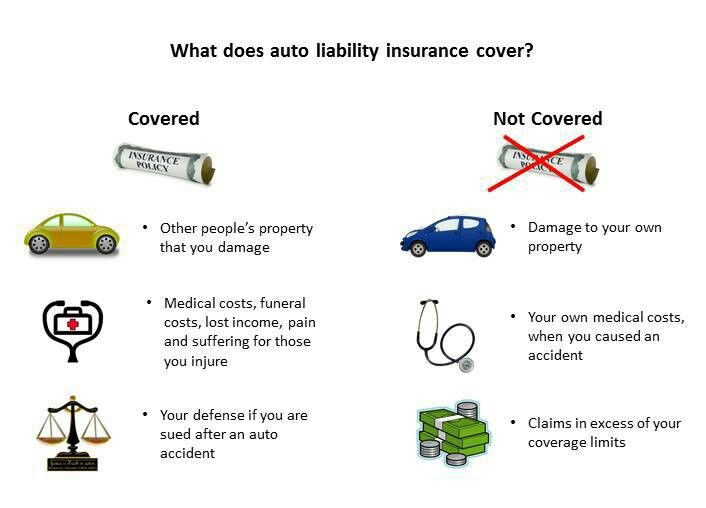

- Liability Coverage: This coverage protects you financially if you are at fault in an accident that causes injury or damage to another person or their property. It covers medical expenses, property damage, and legal defense costs.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: This coverage pays for repairs or replacement of your vehicle if it is damaged by something other than a collision, such as theft, vandalism, or a natural disaster.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured. It covers your medical expenses, property damage, and lost wages.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other expenses if you are injured in an accident, regardless of who is at fault.

Benefits Compared to Standard Plans

State employee car insurance plans often offer benefits that are not available in standard car insurance plans. These benefits may include:

- Lower Premiums: State employees may be eligible for discounted premiums due to the group purchasing power of their employer.

- Additional Coverage Options: State employee plans may offer additional coverage options, such as rental car reimbursement or roadside assistance.

- Specialized Coverage: Some state employee plans offer specialized coverage options that are tailored to the specific needs of state employees, such as coverage for vehicles used for work-related travel.

Example of State Employee Car Insurance Benefits

For instance, a state employee in California might be eligible for a car insurance plan that offers a 10% discount on premiums, free roadside assistance, and coverage for vehicles used for work-related travel. This plan could also offer higher liability limits than standard car insurance plans, providing greater financial protection in the event of an accident.

Eligibility and Enrollment: Car Insurance For State Employees

This section Artikels the eligibility criteria for state employees to access these insurance plans and provides a comprehensive guide to the enrollment process.

Eligibility Criteria

To be eligible for state employee car insurance plans, you must meet the following criteria:

- Be a full-time or part-time state employee.

- Be actively employed by the state government.

- Have a valid driver’s license.

- Meet the minimum driving experience requirements.

Enrollment Process

The enrollment process for state employee car insurance is straightforward. Here’s a step-by-step guide:

- Review Plan Options: Carefully evaluate the available insurance plans and their coverage options to choose the plan that best suits your needs and budget.

- Complete Application: Fill out the online application form or contact the insurance provider directly to request a paper application. Provide accurate and complete information.

- Submit Documents: Submit any required supporting documents, such as your driver’s license, proof of residency, and vehicle registration.

- Receive Confirmation: Once your application is processed, you will receive confirmation of your enrollment and policy details.

Enrollment Deadlines

There are specific enrollment deadlines for state employee car insurance. These deadlines may vary depending on the insurance provider and plan. To avoid missing the enrollment window, it is crucial to:

- Contact the insurance provider directly to inquire about enrollment deadlines.

- Review your employee benefits materials for specific enrollment information.

- Mark important deadlines on your calendar to ensure timely enrollment.

Enrollment Options

State employees have multiple convenient enrollment options available:

- Online Enrollment: Many insurance providers offer online enrollment portals for easy and efficient access.

- Phone Enrollment: Contact the insurance provider’s customer service hotline to enroll over the phone.

- In-Person Enrollment: Visit the insurance provider’s office or designated enrollment center to complete the enrollment process in person.

Cost and Premiums

Understanding the cost of your car insurance is crucial. State employee car insurance premiums are calculated based on several factors, and the rates are designed to be competitive with other insurance providers. This section delves into the factors influencing premium calculations and highlights potential savings available to state employees.

Premium Calculation Factors

The premium you pay for your car insurance is determined by various factors, including:

- Your driving history: A clean driving record with no accidents or violations will generally result in lower premiums.

- Your vehicle: The make, model, year, and safety features of your car can impact your premium.

- Your location: Where you live can influence your premium due to factors like traffic density, crime rates, and weather conditions.

- Your coverage options: The level of coverage you choose, such as liability, collision, and comprehensive, will affect your premium.

- Your age and gender: In some states, these factors can play a role in premium calculations.

Comparison with Other Insurance Providers

State employee car insurance aims to be competitive with other insurance providers. While rates can vary based on individual circumstances, you can expect to find comparable coverage options at competitive prices.

To ensure you’re getting the best value, it’s always recommended to compare quotes from multiple insurance providers.

Discounts and Savings

State employee car insurance often offers a variety of discounts that can help reduce your premium. Some common discounts include:

- Good driver discounts: These discounts reward drivers with clean driving records.

- Safe vehicle discounts: Vehicles with advanced safety features like anti-lock brakes and airbags may qualify for discounts.

- Multi-policy discounts: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can lead to significant savings.

- State employee discounts: As a state employee, you may be eligible for exclusive discounts on your car insurance.

Claims and Customer Service

Filing a claim for car insurance is a common process that most people will encounter at some point. State employees have access to a dedicated claims process designed for their specific needs. This section will Artikel the claims process and the customer service resources available to state employees.

Claims Process

The claims process for state employee car insurance is straightforward and designed to provide a smooth and efficient experience. Here are the steps involved:

- Report the Accident: Contact the insurance company immediately after the accident. This can be done by phone, online, or through the mobile app. Provide the necessary details of the accident, including the date, time, location, and involved parties.

- File a Claim: Once you have reported the accident, you will need to file a formal claim. This can be done online or by mail. You will need to provide supporting documentation, such as a police report, photographs of the damage, and medical records if applicable.

- Claim Review and Processing: The insurance company will review your claim and gather any additional information needed. This process may involve an inspection of the vehicle or contacting witnesses. Once the review is complete, the company will process your claim and determine the amount of coverage available.

- Claim Payment: If your claim is approved, the insurance company will issue payment for the covered damages. This may be in the form of a check, direct deposit, or payment to the repair shop.

Customer Service Resources

State employee car insurance provides a comprehensive suite of customer service resources to ensure a positive experience for policyholders.

- 24/7 Phone Support: Access to a dedicated customer service line available 24 hours a day, 7 days a week for immediate assistance with claims, policy inquiries, and general support.

- Online Portal: A user-friendly online portal for managing policies, filing claims, and accessing account information. This portal allows for convenient and secure access to insurance information from any location with internet access.

- Mobile App: A mobile app that provides similar features to the online portal, allowing for on-the-go access to policy details, claim status, and other resources.

- Dedicated Customer Service Representatives: A team of knowledgeable and experienced customer service representatives available to assist with any questions or concerns. These representatives are trained to provide personalized support and guidance.

Customer Feedback and Reviews

While there is no publicly available data on customer satisfaction with the state employee car insurance claims process, feedback from state employees suggests a generally positive experience. Many state employees appreciate the dedicated claims process, the availability of customer service resources, and the promptness of claim processing.

“The claims process was very easy and straightforward. I was able to file my claim online and received updates throughout the process. The customer service representatives were very helpful and answered all of my questions.” – State Employee, California

Comparison with Private Insurance Options

Choosing the right car insurance is a significant decision, and understanding the advantages and disadvantages of state employee car insurance compared to private insurance providers is crucial. This section will guide you through the key differences, allowing you to make an informed choice based on your individual needs and circumstances.

Key Features, Costs, and Benefits

To make a well-informed decision, it’s important to compare the key features, costs, and benefits of state employee car insurance with private insurance options. The following table provides a concise overview of the main considerations:

| Feature | State Employee Car Insurance | Private Insurance |

|---|---|---|

| Coverage Options | Typically offers standard coverage options like liability, collision, comprehensive, and uninsured/underinsured motorist. | Offers a wide range of coverage options, including specialized coverage for specific needs, like rental car reimbursement, gap insurance, or roadside assistance. |

| Premiums | Generally offers lower premiums due to group discounts and lower administrative costs. | Premiums vary based on individual risk factors, driving history, and other factors, potentially resulting in higher premiums. |

| Discounts | Provides discounts for safe driving, good credit history, and other factors specific to state employees. | Offers a variety of discounts, including safe driver, good student, multi-car, and bundling discounts. |

| Customer Service | Dedicated customer service representatives specifically for state employees. | Customer service may vary depending on the private insurer, with some offering 24/7 support. |

| Claims Process | Streamlined claims process tailored for state employees. | Claims process can vary depending on the private insurer, with some offering online claim filing and 24/7 claims support. |

Making an Informed Decision

Consider these factors when comparing state employee car insurance with private insurance options:

- Your individual risk profile: Factors like your driving history, age, and location can significantly impact your premiums. If you have a clean driving record and live in a low-risk area, you might find private insurance more competitive.

- Your coverage needs: If you require specialized coverage or additional benefits, private insurance might offer more options. However, if you are satisfied with standard coverage, state employee insurance might suffice.

- Your budget: State employee insurance often offers lower premiums due to group discounts and lower administrative costs. However, if you are looking for the lowest possible premium, it’s essential to compare quotes from multiple private insurers.

- Your customer service preferences: Consider your preferred communication channels and the level of customer support you expect. State employee insurance typically provides dedicated customer service for state employees, while private insurers may offer different levels of support.

Tips for Saving on Car Insurance

Saving money on your car insurance is a smart move, especially as a state employee. There are many ways to reduce your premiums without compromising coverage. Here are some practical tips and strategies to help you save.

Factors Influencing Premiums

Your driving history, vehicle type, and location all play a significant role in determining your insurance rates. Understanding how these factors impact your premiums can help you make informed decisions that save you money.

- Driving History: A clean driving record with no accidents or violations is a major factor in lower premiums. Maintaining a safe driving record is crucial for minimizing your insurance costs.

- Vehicle Type: The type of vehicle you drive influences your insurance rates. High-performance cars or luxury vehicles are generally more expensive to insure due to their higher repair costs and potential for theft.

- Location: Where you live significantly affects your insurance premiums. Areas with high crime rates or frequent accidents tend to have higher insurance rates.

Discounts and Programs

Insurance companies offer various discounts and programs to reward safe driving practices and encourage responsible behavior. These programs can significantly reduce your premiums.

- Safe Driver Discounts: Many insurers offer discounts to drivers with clean driving records, demonstrating their commitment to safety.

- Good Student Discounts: These discounts are available to students with high grades, recognizing their responsible nature and reduced risk.

- Defensive Driving Courses: Completing a defensive driving course can often qualify you for discounts, as it demonstrates your commitment to safe driving practices.

- Multi-Policy Discounts: Bundling your car insurance with other policies like homeowners or renters insurance can often result in significant savings.

Additional Savings Tips, Car insurance for state employees

Here are additional strategies to help you save on your car insurance:

- Compare Quotes: Regularly compare quotes from different insurers to ensure you’re getting the best rates. This competitive comparison can often lead to significant savings.

- Increase Your Deductible: Raising your deductible can lower your premiums. However, make sure you can afford the higher out-of-pocket expense in case of an accident.

- Maintain a Good Credit Score: Your credit score can influence your insurance premiums. A good credit score often translates to lower rates.

- Avoid Claims: Making claims can lead to higher premiums. If possible, try to resolve minor incidents without filing claims, especially if the cost is relatively low.

Final Wrap-Up

Ultimately, choosing the right car insurance plan is a personal decision based on individual needs and priorities. State employees have the unique advantage of accessing plans specifically designed to meet their needs, offering potential savings and comprehensive coverage. By carefully considering the options and utilizing the tips provided, state employees can make informed decisions that ensure they are adequately protected on the road.

Popular Questions

What are the common discounts available for state employee car insurance?

State employee car insurance plans often offer discounts for safe driving records, multi-car policies, and other factors. Specific discounts may vary depending on the insurer and the state.

Can I switch to state employee car insurance if I already have private coverage?

Yes, you can usually switch to state employee car insurance if you meet the eligibility requirements. However, there may be enrollment deadlines or waiting periods to consider.

What if I have a driving violation?

Driving violations can impact your insurance premiums, regardless of whether you have state employee or private insurance. It’s essential to maintain a clean driving record to keep your rates low.