Car insurance discounts for state employees set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. State employees, often dedicated public servants, are eligible for various car insurance discounts, potentially saving them a significant amount of money on their premiums. These discounts are a recognition of their service and a way for insurance companies to reward them for their commitment to the community.

From safe driving records to bundling policies, numerous factors can contribute to lower car insurance premiums for state employees. This article will delve into the specifics of these discounts, outlining eligibility requirements, available programs, and tips for maximizing savings. Join us as we explore the world of car insurance discounts and discover how state employees can benefit from these valuable perks.

Overview of Car Insurance Discounts

Car insurance discounts are reductions in your premium that insurance companies offer to policyholders who meet certain criteria. These discounts are designed to reward safe driving habits, responsible vehicle ownership, and other factors that reduce the risk of accidents.

Common Car Insurance Discounts

Insurance companies offer a wide variety of discounts to make their policies more affordable. Here are some common examples:

- Good Driver Discount: This is one of the most common discounts and is typically offered to drivers with a clean driving record, meaning no accidents or traffic violations for a specified period. This discount is often a significant reduction in your premium, as it demonstrates your responsible driving behavior.

- Safe Driver Discount: Similar to the good driver discount, this discount rewards drivers who have not been involved in any accidents or traffic violations for a certain period. This discount can be a significant savings on your premium, as it reflects your safe driving practices.

- Multi-Car Discount: This discount is offered to policyholders who insure multiple vehicles with the same insurance company. The more cars you insure, the greater the discount you receive, reflecting the reduced administrative costs and the higher likelihood of policy renewal for the insurance company.

- Multi-Policy Discount: This discount applies when you insure multiple types of insurance, such as car insurance, homeowners insurance, or renters insurance, with the same company. This bundle of policies offers the insurance company a higher level of business, resulting in cost savings that are passed on to you as a discount.

- Anti-theft Device Discount: Installing anti-theft devices on your car, such as alarms or tracking systems, can significantly reduce the risk of theft, making your vehicle less appealing to criminals. This reduced risk is reflected in a discount on your car insurance premium.

- Good Student Discount: This discount is often offered to young drivers who maintain a high GPA or excellent academic standing. This discount reflects the positive correlation between academic achievement and responsible driving habits, leading to a lower risk profile for the insurance company.

- Defensive Driving Course Discount: Completing a defensive driving course demonstrates your commitment to safe driving practices. This course equips you with valuable knowledge and skills to navigate challenging driving situations, reducing your risk of accidents and making you a more responsible driver, resulting in a discount on your insurance premium.

- Loyalty Discount: This discount is offered to long-term customers who have maintained their car insurance policy with the same company for an extended period. This loyalty demonstrates your satisfaction with the company’s services and your consistent risk profile, leading to a discount as a reward for your continued business.

- Low Mileage Discount: If you drive less than the average driver, you are less likely to be involved in an accident. This reduced risk is reflected in a discount on your car insurance premium.

- Vehicle Safety Features Discount: Modern cars are equipped with advanced safety features, such as anti-lock brakes, electronic stability control, and airbags, that significantly reduce the severity of accidents. These safety features are reflected in a discount on your insurance premium, as they minimize the potential financial burden on the insurance company.

Purpose of Car Insurance Discounts for Insurance Companies

Car insurance discounts serve a crucial purpose for insurance companies. They help to:

- Attract and Retain Customers: Discounts make insurance policies more attractive to potential customers, increasing the likelihood of them choosing a particular company. Existing customers are also more likely to stay with a company that offers them discounts, leading to higher customer retention rates.

- Reward Safe Driving: By offering discounts for safe driving habits, insurance companies encourage responsible driving behavior, which ultimately leads to fewer accidents and lower claims costs. This approach promotes a safer driving environment for everyone on the road.

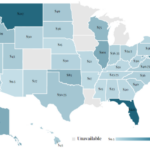

- Reduce Risk: Discounts are often tailored to specific risk factors, such as driving history, vehicle features, and location. By offering discounts to policyholders who meet these criteria, insurance companies can reduce their overall risk exposure and ensure that they are charging premiums that accurately reflect the risk associated with each policy.

- Improve Profitability: By attracting and retaining customers with attractive discounts, insurance companies can increase their customer base and policy premiums. This leads to higher revenue and improved profitability, enabling them to continue offering competitive policies and services.

State Employee Car Insurance Discounts: Car Insurance Discounts For State Employees

State employees often qualify for car insurance discounts, which can significantly reduce their insurance premiums. These discounts are offered by various insurance companies as a way to attract and retain state employees, recognizing their potential for loyalty and long-term business.

Types of Car Insurance Discounts for State Employees

State employees may be eligible for a variety of car insurance discounts, depending on the insurance company and the specific state’s policies. Here are some common types of discounts:

- State Employee Discount: This is a general discount offered to individuals employed by a state government. The discount amount may vary depending on the insurance company and the state.

- Group Discount: Some insurance companies offer discounts to members of specific groups, including state employees. These group discounts are often negotiated by the state government or employee organizations.

- Good Driver Discount: This discount is awarded to drivers with a clean driving record, demonstrating safe driving habits. State employees, often with a lower risk profile, may qualify for this discount.

- Multi-Policy Discount: If a state employee bundles their car insurance with other insurance policies, such as homeowners or renters insurance, they may receive a multi-policy discount. This is a common practice across insurance companies.

- Safety Features Discount: Some insurance companies offer discounts for vehicles equipped with safety features like anti-theft devices, airbags, or anti-lock brakes. This discount recognizes the reduced risk associated with safer vehicles.

Rationale for Offering Discounts, Car insurance discounts for state employees

Offering discounts to state employees is a strategic move by insurance companies, driven by the following reasons:

- Attracting and Retaining Customers: By offering discounts, insurance companies can attract and retain state employees as customers, creating a loyal base. This is especially relevant in competitive insurance markets.

- Building Positive Relationships: Providing discounts demonstrates the company’s appreciation for state employees and fosters a positive relationship. This can lead to increased customer satisfaction and loyalty.

- Leveraging Group Dynamics: Targeting state employees as a group allows insurance companies to capitalize on the potential for collective benefits. This can lead to increased policy sales and reduced administrative costs.

- Lower Risk Profile: State employees often have a lower risk profile compared to the general population, as they may have safer driving habits and fewer claims. This makes them attractive customers for insurance companies.

Potential Benefits for State Employees

Car insurance discounts can provide significant financial benefits to state employees, leading to savings on their insurance premiums. These savings can be used for other expenses, such as:

- Reducing Monthly Expenses: Discounts directly lower the cost of car insurance, reducing monthly expenses and freeing up more disposable income.

- Financial Stability: Lower insurance premiums contribute to financial stability, providing peace of mind and a greater sense of security. This is especially important for individuals with limited financial resources.

- Investing in Other Priorities: The savings from insurance discounts can be allocated towards other priorities, such as retirement savings, education, or home improvements.

- Improving Overall Well-being: Reduced financial stress due to lower insurance premiums can positively impact overall well-being, leading to a greater sense of satisfaction and peace of mind.

Last Word

In conclusion, car insurance discounts for state employees offer a tangible benefit for those who serve their communities. By understanding the eligibility criteria, exploring available programs, and implementing strategies for maximizing savings, state employees can significantly reduce their car insurance premiums. The financial advantages of these discounts are undeniable, and they serve as a testament to the value placed on the contributions of state employees. Whether you’re a seasoned veteran or a recent addition to the public sector, taking advantage of these discounts can make a real difference in your financial well-being.

FAQs

What if I’m a part-time state employee?

Eligibility criteria for car insurance discounts vary by provider. Some may require full-time employment, while others may accept part-time employees. It’s essential to contact individual insurance companies to confirm their specific requirements.

Can I get a discount if I’m a retired state employee?

Some insurance providers may offer discounts to retired state employees. However, this is not always the case. It’s recommended to contact insurance companies directly to inquire about their policies regarding retired state employees.

How often are these discounts reviewed?

The frequency of discount reviews can vary by insurance company. It’s a good practice to check with your insurer periodically to ensure you’re still eligible for the maximum discounts.