Car insurance different state registered is a complex topic that often leads to confusion. Understanding the regulations and requirements in different states is crucial for drivers who relocate or have vehicles registered in multiple states. This article explores the impact of state registration on car insurance, providing insights into coverage options, rates, and the best strategies for securing affordable insurance.

The state where your vehicle is registered plays a significant role in determining your car insurance premiums. Each state has its own set of regulations, including minimum coverage requirements, insurance rates, and factors considered when calculating premiums. For instance, states with higher population densities and more traffic congestion may have higher insurance rates due to a greater risk of accidents. Understanding these state-specific regulations is essential for making informed decisions about your car insurance.

Understanding State-Specific Car Insurance Regulations

Car insurance rates vary significantly across different states. This variation is due to a complex interplay of factors, including state-specific regulations, the prevalence of accidents, and the cost of healthcare. Understanding these regulations is crucial for drivers, as they directly impact the cost of car insurance.

Factors Influencing Car Insurance Rates

Several factors contribute to the differences in car insurance rates across states. These factors are not independent and often interact with each other, creating a complex picture of rate determination.

- Cost of Healthcare: States with higher healthcare costs generally have higher car insurance rates. This is because insurance companies must factor in the potential costs of medical expenses in case of an accident. For example, states with higher average healthcare costs like New York and California tend to have higher car insurance rates compared to states with lower healthcare costs like Mississippi and Arkansas.

- Traffic Density and Accident Rates: States with higher traffic density and more accidents tend to have higher car insurance rates. This is because insurance companies face a higher risk of having to pay claims in these states. For instance, states like California and Florida have a high number of accidents and congested roads, leading to higher car insurance premiums.

- State-Specific Regulations: State governments have the authority to regulate the car insurance market within their jurisdictions. These regulations can significantly impact car insurance rates by influencing factors such as minimum coverage requirements, pricing practices, and the availability of discounts.

State-Specific Regulations Impacting Insurance Costs

State regulations play a significant role in shaping the car insurance landscape. These regulations can impact rates by influencing the minimum coverage requirements, pricing practices, and the availability of discounts.

- Minimum Coverage Requirements: States have different minimum coverage requirements for car insurance, which can influence the cost of insurance. States with higher minimum coverage requirements generally have higher car insurance rates. For instance, New York has higher minimum coverage requirements than Florida, which contributes to higher car insurance rates in New York.

- Pricing Practices: Some states regulate how insurance companies can price their policies. For example, some states prohibit the use of certain factors, such as credit scores, when setting rates. This can lead to higher or lower rates depending on the specific regulation.

- Availability of Discounts: State regulations can impact the availability of discounts offered by insurance companies. For example, some states require insurance companies to offer discounts for certain types of drivers, such as those who have completed a defensive driving course.

State-Mandated Insurance Coverage Requirements

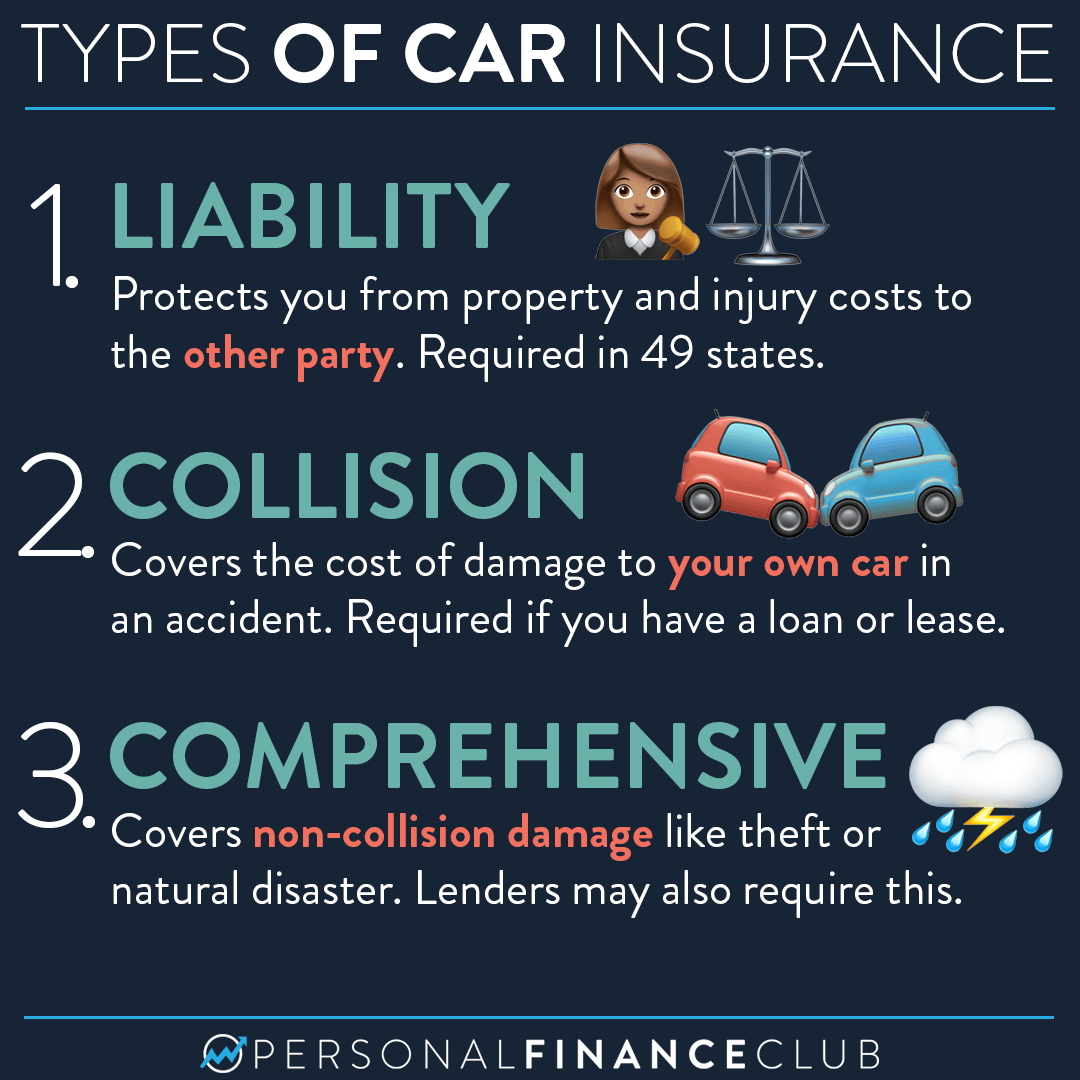

States mandate certain types of insurance coverage to protect drivers and passengers in case of an accident. These coverage requirements can vary significantly from state to state.

- Liability Coverage: This coverage protects you if you cause an accident that injures someone or damages their property. It covers the other party’s medical expenses, lost wages, and property damage.

- Personal Injury Protection (PIP): This coverage pays for your medical expenses, lost wages, and other expenses if you are injured in an accident, regardless of fault. It is often required in no-fault states, where you can file a claim with your own insurance company, regardless of who caused the accident.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects you if you are injured in an accident caused by an uninsured or underinsured driver. It pays for your medical expenses, lost wages, and other expenses that are not covered by the at-fault driver’s insurance.

The Impact of Vehicle Registration on Car Insurance: Car Insurance Different State Registered

The state where your vehicle is registered plays a crucial role in determining your car insurance premiums. Insurance companies consider various factors related to the state of registration, including the risk of accidents, the cost of repairs, and the state’s specific insurance regulations.

State-Specific Insurance Rates

The cost of car insurance can vary significantly depending on the state where your vehicle is registered. For example, a car registered in a state with a high number of accidents and a high cost of living may have higher insurance premiums compared to a car registered in a state with a lower accident rate and a lower cost of living.

Key Differences in Car Insurance Requirements, Car insurance different state registered

The table below highlights some key differences in car insurance requirements across several states:

| State | Minimum Liability Coverage | Uninsured Motorist Coverage | Other Requirements |

|---|---|---|---|

| California | 15/30/5 | 15/30/5 | Financial Responsibility Law |

| Florida | 10/20/10 | 10/20/10 | No-Fault Insurance |

| New York | 25/50/10 | 25/50/10 | Mandatory Insurance |

| Texas | 30/60/25 | 30/60/25 | Financial Responsibility Law |

It is important to note that these are just a few examples, and the specific requirements may vary within each state. It is recommended to consult with an insurance agent to determine the exact coverage requirements for your vehicle and your specific situation.

Navigating Insurance Coverage When Moving Between States

Moving to a new state can be exciting, but it also involves updating your car insurance policy. While you might think that simply notifying your current insurer about your move is enough, it’s essential to understand the complexities of transferring your coverage. This is crucial because car insurance regulations differ significantly between states, and failing to comply with the new state’s requirements could leave you vulnerable in case of an accident.

Transferring Car Insurance Coverage When Relocating

When you move to a new state, your current car insurance policy might not be valid. You need to inform your insurance company about your move and ensure your coverage meets the requirements of your new state. The process typically involves these steps:

- Notify Your Insurance Company: Inform your insurer about your move, including your new address and the date of your move. This is usually done by phone or online, but it’s a good idea to follow up with written confirmation.

- Review Your Policy: Once you inform your insurer, they will review your policy and determine if it meets the requirements of your new state. You may need to update your coverage to comply with the new state’s minimum coverage limits.

- Update Your Vehicle Registration: Register your vehicle in your new state. This involves obtaining a new license plate and registering your vehicle with the Department of Motor Vehicles (DMV).

- Obtain New Proof of Insurance: Once your coverage is updated and your vehicle is registered in the new state, you’ll receive new proof of insurance. Keep this documentation readily available in your vehicle.

Essential Information To Gather When Switching States

To ensure a smooth transition and avoid any surprises, gather the following information when relocating:

- Your Current Policy Details: This includes your policy number, coverage details, and any deductibles.

- Your Driving Record: Obtain a copy of your driving record, which shows your history of traffic violations and accidents.

- Your Vehicle Information: Gather information about your vehicle, such as its make, model, year, and VIN (Vehicle Identification Number).

- Your New State’s Insurance Requirements: Research the minimum car insurance requirements in your new state. This information is usually available on the state’s DMV website.

Challenges and Considerations for Individuals Who Drive Across State Lines Regularly

Driving across state lines regularly can introduce additional complexities to your car insurance coverage. Here are some key challenges and considerations:

- Varying Insurance Requirements: Each state has its own minimum insurance requirements, and you need to ensure your coverage meets the requirements of every state you drive in.

- Potential for Coverage Gaps: If you’re involved in an accident in a state where your coverage doesn’t meet the minimum requirements, you could face significant financial consequences.

- Non-Resident Insurance: Some states offer non-resident insurance options for individuals who live in one state but drive frequently in another. This type of coverage can help address the challenges of varying insurance requirements.

- Reciprocity Agreements: Some states have reciprocity agreements with other states, meaning your insurance coverage from your home state may be valid in those states. However, it’s essential to verify this information with your insurer.

Car Insurance Options for Drivers with Multiple State Registrations

Navigating car insurance when you have vehicles registered in multiple states can be a bit tricky. You need to consider how often you drive in each state, the specific insurance requirements of each state, and your personal risk tolerance. Let’s explore the different insurance options available to drivers with multiple state registrations.

Multi-State Policies

A multi-state policy is a single insurance policy that provides coverage in multiple states. This can be a convenient option for drivers who frequently travel between states or who have vehicles registered in multiple states.

- Pros:

- Simplified coverage: You only need to manage one policy and one insurance company.

- Potential cost savings: Some insurance companies offer discounts for multi-state policies.

- Cons:

- Limited coverage: The coverage provided by a multi-state policy may not meet the minimum requirements of all states, especially if you drive in states with higher minimum coverage requirements.

- Higher premiums: Multi-state policies can be more expensive than separate policies, especially if you have a high-risk profile or drive in states with high insurance costs.

Separate Policies for Each State

This approach involves obtaining a separate insurance policy for each state in which you have a vehicle registered. This can be a good option if you drive frequently in one state but only occasionally in another.

- Pros:

- Tailored coverage: You can customize each policy to meet the specific requirements of each state.

- Potential cost savings: If you have a low-risk profile and drive mainly in states with low insurance costs, separate policies could be more affordable.

- Cons:

- Multiple policies to manage: You’ll need to manage multiple policies and insurance companies.

- Potential for gaps in coverage: If you forget to renew a policy or if your coverage lapses, you could face a gap in coverage.

Choosing the Right Option

When choosing the right car insurance plan for multiple state registrations, consider the following:

- Driving frequency in each state: If you drive primarily in one state, a separate policy for that state might be more cost-effective. However, if you frequently travel between states, a multi-state policy could be more convenient.

- Insurance requirements of each state: Make sure your chosen policy meets the minimum coverage requirements of all states where you drive.

- Personal risk tolerance: If you have a high-risk profile, a multi-state policy may be more expensive. You might consider separate policies to tailor coverage and potentially save on premiums.

- Budget: Compare the cost of multi-state policies and separate policies to find the most affordable option for your needs.

Tips for Obtaining the Best Car Insurance Rates

Finding affordable car insurance when your vehicle is registered in a different state can be challenging. However, with the right strategies, you can secure competitive rates and protect your financial interests.

Comparing Quotes from Multiple Insurers

It is crucial to compare quotes from several insurers to find the best rates. Each insurer uses its own pricing algorithms, which can result in significant variations in premiums.

- Use online comparison tools: Websites like Policygenius, Insurance.com, and NerdWallet allow you to compare quotes from multiple insurers simultaneously. This saves you time and effort.

- Contact insurers directly: Reach out to insurance companies directly to obtain quotes. Some insurers may offer discounts or special promotions that are not advertised online.

- Consider niche insurers: Explore niche insurers that specialize in specific types of drivers, such as those with good driving records or those who own particular car models. These insurers may offer competitive rates for your specific circumstances.

Negotiating Insurance Premiums

Once you have received quotes from multiple insurers, you can negotiate premiums to secure the best possible rates.

- Highlight your good driving record: If you have a clean driving history, emphasize this fact to insurers. This demonstrates your low risk profile and can potentially lead to lower premiums.

- Bundle your policies: Consider bundling your car insurance with other insurance policies, such as home or renter’s insurance. Many insurers offer discounts for bundling multiple policies.

- Explore discounts: Ask about available discounts, such as those for good student discounts, safe driver discounts, or discounts for installing anti-theft devices.

Securing Discounts

There are several ways to secure discounts on your car insurance premiums.

- Pay your premiums in full: Some insurers offer discounts for paying your premium in full upfront rather than in monthly installments.

- Take a defensive driving course: Completing a defensive driving course can demonstrate your commitment to safe driving and may qualify you for a discount.

- Install safety features: Consider installing safety features such as anti-theft devices or rearview cameras. These features can reduce your risk of accidents and may qualify you for discounts.

Ultimate Conclusion

Navigating car insurance when you have a vehicle registered in a different state can be challenging, but with careful planning and research, you can find affordable and comprehensive coverage. By understanding the factors that influence car insurance rates, comparing quotes from multiple insurers, and exploring available coverage options, you can ensure that you are adequately protected while minimizing your insurance costs.

Commonly Asked Questions

What happens if I move to a new state and don’t update my car insurance?

Driving without the required insurance coverage in your new state can result in fines, penalties, and even license suspension. It is crucial to update your insurance policy to reflect your new address and state of residence.

Can I get car insurance in one state for a vehicle registered in another state?

Yes, you can generally get car insurance in one state for a vehicle registered in another. However, you may need to provide proof of residency in the state where you are obtaining insurance. Some insurers may also require you to register your vehicle in the state where you are insured.

What are the benefits of having a multi-state car insurance policy?

A multi-state policy can provide comprehensive coverage for drivers who frequently travel across state lines. It eliminates the need to maintain separate policies for each state and can offer potential cost savings.

How can I find the best car insurance rates for my situation?

To find the best rates, it’s essential to compare quotes from multiple insurers. Use online comparison tools or contact insurance agents directly to obtain quotes. Be sure to provide accurate information about your vehicle, driving history, and coverage needs.