Car insurance coverage out of state sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the complexities of car insurance when venturing beyond your home state can be a daunting task, but understanding the key concepts can empower you to make informed decisions and ensure you’re adequately protected on the road.

From the fundamental principles of coverage to the intricacies of reciprocity and non-reciprocity, this guide will equip you with the knowledge necessary to navigate the world of out-of-state car insurance. We’ll delve into the various types of coverage, explore the factors that influence premiums, and provide practical tips for staying safe while driving in another state.

Understanding Out-of-State Car Insurance Coverage: Car Insurance Coverage Out Of State

When you drive your car in a state other than your home state, it’s essential to understand how your car insurance coverage might change. While your primary insurance policy typically provides some level of protection, there are nuances and potential gaps that you should be aware of.

Out-of-State Coverage Basics

Your car insurance policy generally provides some level of coverage when you drive in other states. However, the extent of coverage can vary depending on the specific state laws and the terms of your policy.

Most states require drivers to carry a minimum level of liability insurance, covering injuries or property damage you cause to others in an accident.

This means that if you’re involved in an accident in another state, your insurance policy will generally cover your liability obligations, but only up to the minimum limits required by that state. It’s important to note that the minimum liability limits can vary significantly from state to state.

Potential Implications of Inadequate Coverage

Driving in another state with inadequate coverage can lead to serious financial consequences. For instance:

- Higher Out-of-Pocket Costs: If you cause an accident and your coverage limits are lower than the minimum required by the state where the accident occurred, you may be personally liable for the difference in costs. This can lead to significant financial strain.

- License Suspension: Some states may suspend your driver’s license if you are found to be driving without the minimum required insurance coverage. This can be a major inconvenience and could lead to legal trouble.

- Legal Action: In some cases, you may face legal action from the other party involved in the accident if your coverage is inadequate to cover their damages. This could result in a judgment against you, further increasing your financial burden.

Scenarios Where Out-of-State Coverage Might Be Necessary, Car insurance coverage out of state

There are several scenarios where having additional coverage for out-of-state driving might be necessary:

- Long-Distance Road Trips: When planning a cross-country road trip or driving through multiple states, it’s wise to ensure your policy provides sufficient coverage in all states you plan to visit. This includes checking the minimum liability limits in each state and potentially considering additional coverage options like uninsured/underinsured motorist (UM/UIM) coverage.

- Relocation: If you’re moving to a new state, you’ll need to update your car insurance policy to comply with the new state’s requirements. This typically involves changing your policy to reflect the new state’s minimum liability limits and other relevant coverage requirements.

- Frequent Business Travel: If you frequently drive for work across state lines, it’s important to review your coverage and consider whether additional protection is necessary. This might include higher liability limits or coverage for rental cars if you’re using them for business purposes.

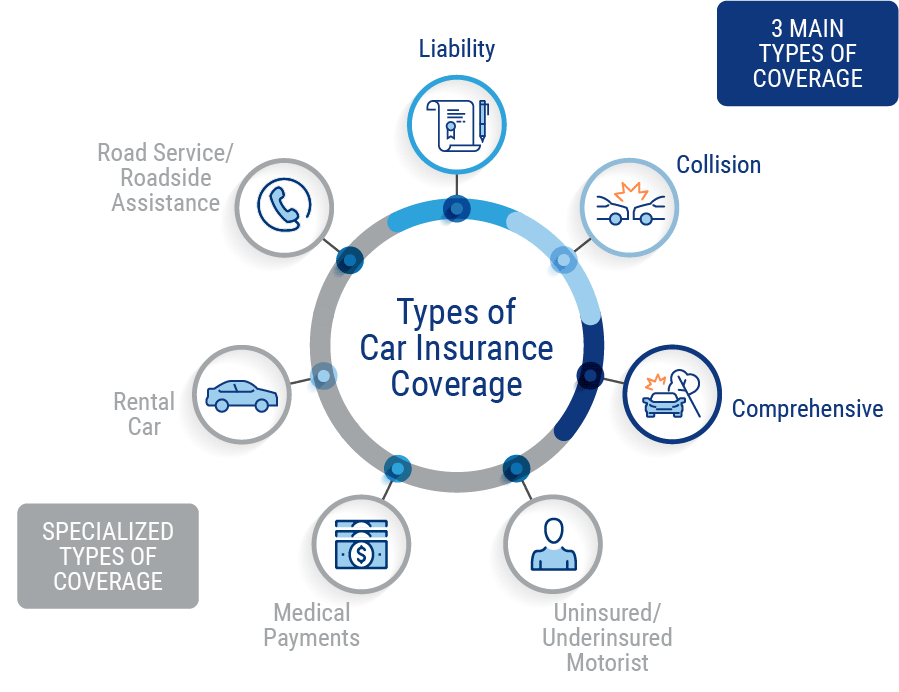

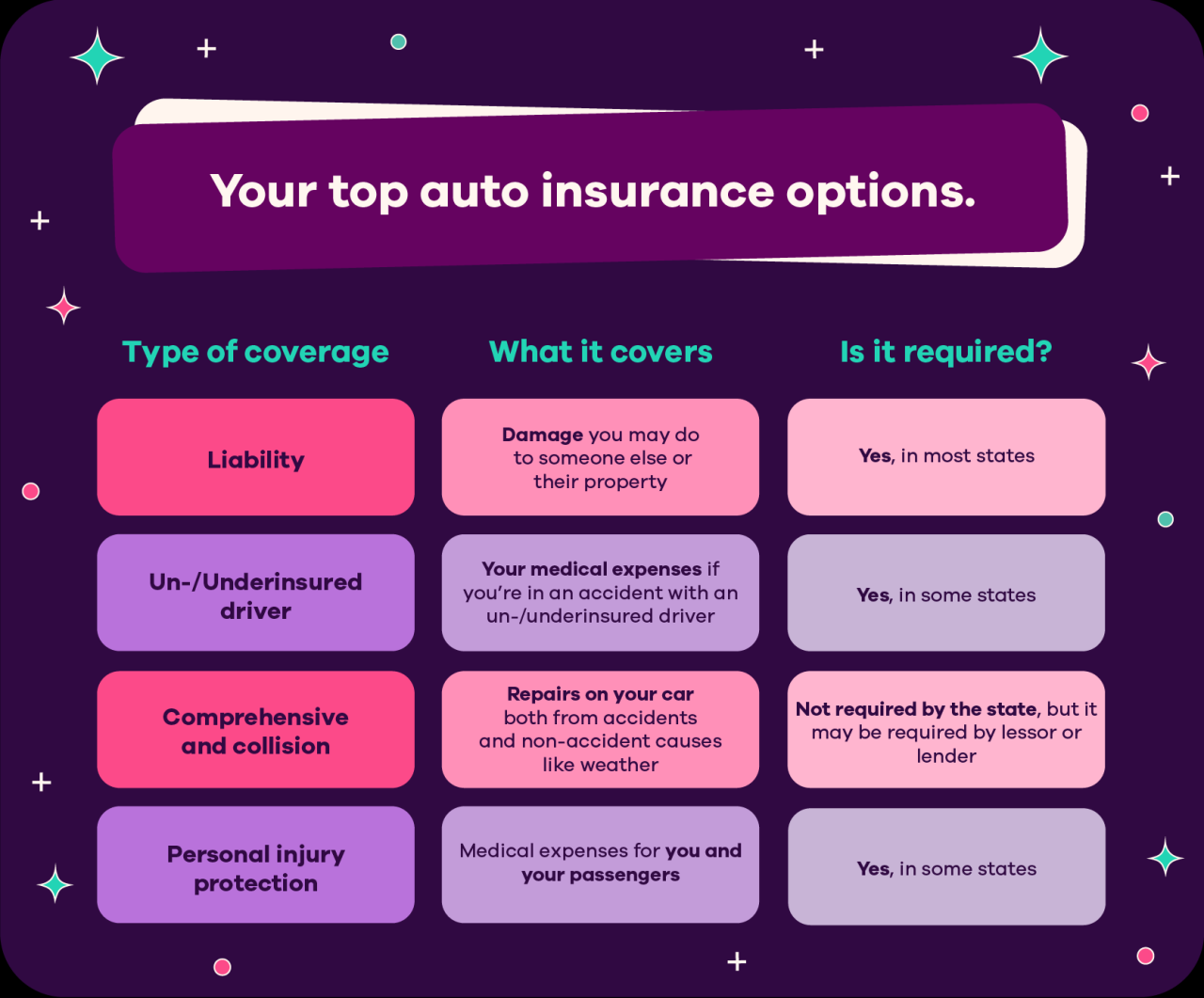

Types of Coverage

When driving out of state, it’s important to understand how your car insurance coverage might change. Different states have different minimum insurance requirements, and some types of coverage may not be as comprehensive as you’re used to.

Liability Coverage

Liability coverage is the most common type of car insurance and is usually required by law. This coverage protects you financially if you’re at fault in an accident and cause injury or damage to another person or their property. Liability coverage typically includes:

- Bodily Injury Liability: This covers medical expenses, lost wages, and pain and suffering for the other driver and passengers involved in an accident if you are at fault.

- Property Damage Liability: This covers repairs or replacement costs for the other driver’s vehicle and any other property damaged in an accident if you are at fault.

Liability coverage limits are usually expressed as a set of three numbers, such as 25/50/25. This means your policy will cover up to $25,000 per person for bodily injury, up to $50,000 total for bodily injury per accident, and up to $25,000 for property damage per accident.

The minimum liability coverage requirements vary significantly from state to state. For example, the minimum liability coverage requirements in California are 15/30/5, while in Florida, they are 10/20/10.

Collision Coverage

Collision coverage protects you from financial loss if your car is damaged in an accident, regardless of who is at fault. This coverage will pay for repairs or replacement costs for your vehicle, minus your deductible.

If you drive out of state, your collision coverage may not be as comprehensive as it is in your home state. For example, some states have a “no-fault” insurance system, where your own insurance company will cover your damages regardless of who is at fault. In these states, collision coverage may not be as necessary.

Comprehensive Coverage

Comprehensive coverage protects you from financial loss if your car is damaged due to events other than an accident, such as theft, vandalism, fire, or natural disasters. This coverage will pay for repairs or replacement costs for your vehicle, minus your deductible.

Similar to collision coverage, comprehensive coverage may not be as comprehensive in other states. For example, some states may exclude certain types of events from coverage, such as hail damage.

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist coverage (UM/UIM) protects you from financial loss if you are injured in an accident caused by a driver who is uninsured or underinsured. This coverage will pay for your medical expenses, lost wages, and pain and suffering, even if the other driver is at fault.

UM/UIM coverage is often required by law in many states. However, the amount of coverage available may vary depending on the state. Some states may have a lower minimum coverage requirement than others.

Minimum Insurance Requirements

The minimum insurance requirements for each state are determined by state law. These requirements typically include liability coverage and sometimes other coverage types, such as uninsured/underinsured motorist coverage. It is important to check the minimum insurance requirements for each state you plan to drive in.

For example, in California, the minimum liability coverage requirements are 15/30/5, while in Florida, they are 10/20/10.

Reciprocity and Non-Reciprocity

Insurance reciprocity is a crucial aspect of out-of-state car insurance coverage. Understanding this concept helps drivers navigate the complexities of insurance requirements when traveling or relocating to another state.

Reciprocity Agreements

Reciprocity agreements exist between states, meaning that drivers from one state are typically recognized and covered by the other state’s insurance laws, as if they were residents of that state. These agreements streamline the process of obtaining coverage and ensure that drivers are protected in case of an accident.

States with Reciprocity Agreements

A significant number of states have reciprocity agreements. These agreements generally apply to minimum liability coverage, ensuring that drivers are protected against financial losses in case of an accident.

- Example 1: If you are a resident of California and drive to Nevada, your California car insurance policy will likely be recognized as valid in Nevada, provided you meet Nevada’s minimum liability coverage requirements.

- Example 2: Similarly, if you are a resident of Texas and drive to Oklahoma, your Texas car insurance policy will likely be accepted in Oklahoma, as long as it meets Oklahoma’s minimum liability coverage requirements.

States Without Reciprocity Agreements

While many states have reciprocity agreements, some states do not. This means that your home state’s insurance policy may not be recognized in these states.

- Example 1: If you are a resident of New York and drive to Massachusetts, your New York car insurance policy may not be recognized in Massachusetts, even if it meets New York’s minimum liability coverage requirements.

- Example 2: Similarly, if you are a resident of Florida and drive to New Jersey, your Florida car insurance policy may not be accepted in New Jersey, even if it meets Florida’s minimum liability coverage requirements.

Implications of Driving in a Non-Reciprocal State

Driving in a non-reciprocal state without proper coverage can have serious consequences. Your insurance policy may not cover you in case of an accident, leaving you financially responsible for any damages or injuries.

- Example 1: If you are involved in an accident in a non-reciprocal state and your insurance policy is not recognized, you may be held personally liable for all damages and injuries, even if you were not at fault. This can lead to significant financial hardship, including medical expenses, legal fees, and property repairs.

- Example 2: You may also face legal penalties, such as fines, license suspension, or even imprisonment, if you are caught driving in a non-reciprocal state without proper coverage.

Purchasing Out-of-State Coverage

You might need out-of-state car insurance if you’re moving, traveling frequently, or even taking a road trip. Obtaining this coverage is generally straightforward. Here’s a breakdown of the process.

Obtaining Out-of-State Car Insurance

To get out-of-state car insurance, you’ll need to contact an insurance company licensed in the state where you’ll be driving. This process is similar to getting insurance in your home state.

- Gather your information: You’ll need basic details like your driver’s license number, vehicle information, and driving history.

- Contact insurance companies: You can either contact companies directly or use an online comparison tool to get quotes.

- Provide necessary details: You’ll need to provide information about your driving history, vehicle, and the state you’ll be driving in.

- Compare quotes: Once you have quotes from multiple companies, compare coverage options and prices.

- Choose a policy: Select the policy that best meets your needs and budget.

- Pay your premium: You can usually pay your premium online, by phone, or by mail.

Factors Affecting Premiums

Several factors can affect your insurance premiums when driving in another state. These factors can be similar to those that affect premiums in your home state, but some differences might exist:

- State-Specific Laws: Each state has its own laws regarding minimum coverage requirements and insurance rates. Some states may have higher minimum coverage requirements, which could impact your premiums. Additionally, states have varying regulations on insurance companies, which can influence pricing.

- Driving History: Your driving history, including any accidents or traffic violations, can affect your premium in any state.

- Vehicle Type: The type of vehicle you drive, including its make, model, and safety features, can influence your premium. This factor remains consistent across states.

- Coverage Levels: The level of coverage you choose, such as liability limits and comprehensive or collision coverage, will directly impact your premium. You’ll need to weigh the level of protection you need against the cost of coverage.

- Driving Habits: Factors like your driving habits, such as commuting distance or driving frequency, can influence your premium in some states.

Choosing the Right Coverage

Choosing the right level of coverage is crucial, especially when driving in another state. Here are some factors to consider:

- State Requirements: Be aware of the minimum coverage requirements in the state where you’ll be driving. You must meet these requirements to drive legally.

- Your Risk Tolerance: Consider your risk tolerance and how much coverage you’re comfortable with. If you’re a cautious driver with a clean driving record, you might opt for lower coverage levels. However, if you have a history of accidents or are a frequent driver, you might prefer higher coverage levels.

- Your Financial Situation: Evaluate your financial situation and how much you can afford to pay for insurance. You should also consider the potential costs of an accident and how much coverage you’d need to protect yourself financially.

- The Value of Your Vehicle: If you have a newer or more expensive vehicle, you might want to consider comprehensive and collision coverage. These coverages help protect you from financial losses if your vehicle is damaged or stolen.

Driving with Existing Coverage

You might think that your current car insurance policy covers you while driving out of state. While this is often true, there are some important things to consider.

Your existing car insurance policy likely provides some level of coverage while you drive in other states. However, the extent of this coverage can vary depending on your insurer and the specific state you are driving in. It’s crucial to understand the potential limitations of relying solely on your existing coverage and to consider whether you need additional protection.

Limitations of Existing Coverage

The amount of coverage your existing policy provides while you drive in another state can be limited. For example, your policy may not cover you for certain types of accidents, such as those involving uninsured or underinsured drivers. Additionally, the minimum liability coverage required in some states may exceed the coverage limits provided by your current policy.

Determining the Need for Additional Coverage

Here are some factors to consider when determining whether you need additional coverage:

- The length of your trip: If you’re only driving out of state for a short period, your existing coverage may be sufficient. However, if you’re planning a longer trip, you may want to consider purchasing additional coverage.

- The states you’re driving through: Some states have higher minimum liability coverage requirements than others. If you’re driving through a state with higher requirements, you may need to purchase additional coverage to ensure you’re adequately protected.

- The value of your vehicle: If you’re driving a high-value vehicle, you may want to consider purchasing additional coverage to protect your investment in case of an accident.

- Your personal risk tolerance: Some people are more comfortable with a higher level of risk than others. If you’re concerned about the potential financial consequences of an accident, you may want to purchase additional coverage.

Tips for Safe Out-of-State Driving

Hitting the road for an out-of-state adventure can be exciting, but it’s crucial to prioritize safety. Whether you’re driving for a vacation, a business trip, or a family visit, understanding the unique challenges of unfamiliar roads and traffic patterns is essential. Here are some tips to help you navigate safely and confidently.

Following Local Traffic Laws and Regulations

Familiarizing yourself with the traffic laws and regulations of the state you’re driving in is crucial. Every state has its own unique rules, which can differ significantly from what you’re accustomed to. For example, speed limits, lane usage, and rules for turning and passing can vary widely.

- Check the state’s official website: Most state websites have a dedicated section on driving laws and regulations, including information on speed limits, seatbelt requirements, cell phone usage, and other important details.

- Look for signs and markings: Pay close attention to signs and road markings, as they can provide vital information about speed limits, lane restrictions, and other regulations.

- Be aware of local customs: Even if a specific law is not explicitly written, there might be unwritten customs or practices in certain areas. For instance, some regions might have different rules about yielding to pedestrians or merging onto highways.

Defensive Driving Techniques and Awareness

Defensive driving is an essential skill for all drivers, but it’s particularly important when driving in unfamiliar territory. Being aware of your surroundings, anticipating potential hazards, and reacting appropriately can help you avoid accidents.

- Maintain a safe following distance: This allows you more time to react if the car in front of you brakes suddenly.

- Avoid distractions: Distracted driving is a major cause of accidents, so it’s essential to minimize distractions while driving. Put your phone away, avoid eating or drinking while driving, and resist the temptation to talk to passengers or adjust the radio.

- Be aware of blind spots: Check your mirrors and blind spots regularly to ensure that you’re aware of all vehicles around you.

- Stay alert and rested: Fatigue can significantly impair your driving abilities. If you’re feeling tired, pull over and take a break.

Additional Tips for Safe Out-of-State Driving

Here are some additional tips to enhance your safety on the road:

- Plan your route in advance: Familiarize yourself with the route you’ll be taking, including major highways, rest stops, and potential traffic bottlenecks. Using a GPS navigation system can be helpful, but it’s also wise to have a printed map as a backup.

- Check your vehicle before you go: Ensure your vehicle is in good working condition, including tires, brakes, lights, and fluids.

- Pack an emergency kit: This should include items like a flashlight, jumper cables, a first-aid kit, and a blanket.

- Inform someone about your travel plans: Let a friend or family member know your itinerary and expected arrival time.

Addressing Accidents and Claims

Accidents can happen anywhere, including while driving out of state. Understanding how to file a claim and navigate the process with an out-of-state insurer is crucial.

Filing a Claim

In case of an accident while driving out of state, the first step is to ensure everyone is safe and contact the local authorities. Once the situation is under control, follow these steps:

- Contact your insurance company: Inform them about the accident, providing details like date, time, location, and involved parties.

- Gather information: Collect details of the other driver(s), including their insurance information, contact information, and license plate number. Also, take pictures of the damage to your vehicle and the accident scene.

- File a police report: Report the accident to the local police department and obtain a copy of the report.

- Seek medical attention: If you or any passenger is injured, seek medical attention immediately and keep records of all medical expenses.

Potential Complications

Handling out-of-state claims can be more complex due to:

- Different state laws: Each state has its own set of traffic laws and insurance regulations. For example, some states have no-fault insurance systems, while others have traditional fault-based systems.

- Out-of-state adjusters: Your insurance company may assign an adjuster who is not familiar with the local laws and procedures. This can lead to delays and complications in the claims process.

- Language barriers: If you are in a state where English is not the primary language, communication with local authorities and insurance companies can be challenging.

Navigating the Claims Process

To navigate the claims process smoothly:

- Understand your policy: Review your insurance policy carefully to understand your coverage limits, deductibles, and any specific provisions related to out-of-state accidents.

- Keep records: Maintain detailed records of all communication with your insurance company, including dates, times, and names of individuals you spoke with.

- Be patient: The claims process can take longer when dealing with an out-of-state accident. Be patient and communicate clearly with your insurance company.

- Consider legal advice: If you are facing difficulties with the claims process, it is advisable to consult with a lawyer specializing in insurance law.

Ultimate Conclusion

In conclusion, understanding car insurance coverage out of state is crucial for every driver who plans to venture beyond their home state. By familiarizing yourself with the essential principles, types of coverage, and legal requirements, you can navigate the complexities of out-of-state driving with confidence. Remember to carefully consider your individual needs, explore available options, and prioritize safety to ensure a smooth and worry-free journey.

Essential Questionnaire

What if I have an accident while driving out of state?

If you have an accident while driving out of state, your insurance company will handle the claim, but there may be additional complexities involved. You should contact your insurer immediately to report the accident and follow their instructions for filing a claim.

Do I need to buy separate insurance for each state I drive in?

Generally, you don’t need to buy separate insurance for each state. Your existing car insurance policy will likely provide some coverage out of state, but it’s essential to check the specific terms and conditions of your policy.

What happens if I’m in an accident with an uninsured driver out of state?

If you’re involved in an accident with an uninsured driver out of state, your uninsured/underinsured motorist coverage will come into play. This coverage protects you from financial losses if the other driver is uninsured or underinsured.