Car insurance cost state farm – Car Insurance Cost: State Farm Breakdown dives into the world of State Farm car insurance, exploring factors that influence premiums, comparing rates to other insurers, and highlighting discounts and savings opportunities. State Farm, a leading insurance provider, offers a wide range of coverage options, and understanding its cost structure is crucial for making informed decisions.

From driving history and vehicle type to location and demographics, various factors play a role in determining your car insurance premium. By analyzing these factors, you can gain insights into how State Farm calculates your rates and potentially identify areas where you can save money. We’ll also compare State Farm’s pricing to other major insurers, providing a comprehensive overview of the market.

State Farm Car Insurance Overview

State Farm is a leading insurance provider in the United States, known for its wide range of insurance products, including car insurance. Founded in 1922, State Farm has a long history of providing reliable and affordable insurance coverage to millions of customers.

State Farm’s Car Insurance Offerings, Car insurance cost state farm

State Farm offers a comprehensive selection of car insurance coverage options to meet the diverse needs of its customers. Their car insurance policies are designed to protect you financially in case of an accident or other covered event.

Key Features and Benefits of State Farm Car Insurance Policies

State Farm car insurance policies come with a variety of features and benefits that can enhance your coverage and peace of mind. Here are some key aspects:

- Comprehensive and Collision Coverage: This coverage protects you against damage to your vehicle caused by accidents, theft, vandalism, natural disasters, and other incidents.

- Liability Coverage: This coverage protects you financially if you are found at fault in an accident that causes injuries or damage to other people or property.

- Uninsured/Underinsured Motorist Coverage: This coverage provides financial protection if you are involved in an accident with a driver who does not have insurance or has insufficient coverage.

- Personal Injury Protection (PIP): This coverage helps pay for medical expenses, lost wages, and other related costs if you are injured in an accident, regardless of fault.

- Rental Car Reimbursement: This coverage can help pay for a rental car if your vehicle is damaged and needs repairs.

- Roadside Assistance: This coverage provides assistance with services such as towing, jump-starts, flat tire changes, and lockout assistance.

- Discounts: State Farm offers a variety of discounts to help lower your premiums, such as safe driver discounts, good student discounts, and multi-policy discounts.

- Excellent Customer Service: State Farm is known for its excellent customer service, with a wide network of agents and representatives available to assist you with your insurance needs.

Factors Influencing Car Insurance Costs

Your car insurance premium is determined by a variety of factors, each contributing to the overall cost. Understanding these factors can help you make informed decisions that might lower your premium.

Driving History

Your driving history plays a significant role in determining your car insurance cost. Insurance companies assess your risk based on your past driving behavior, including accidents, traffic violations, and driving experience. A clean driving record with no accidents or violations usually results in lower premiums.

For example, a driver with multiple speeding tickets or a DUI conviction will likely face higher insurance rates compared to a driver with a clean record.

Vehicle Type and Value

The type and value of your vehicle are major factors in determining your insurance premium.

- Vehicle Type: Sports cars, luxury vehicles, and high-performance cars are often associated with higher insurance costs due to their increased risk of accidents and higher repair expenses.

- Vehicle Value: The value of your car directly impacts your insurance premium. More expensive vehicles require higher coverage amounts, resulting in higher premiums.

Location and Demographics

Your location and demographics can also influence your car insurance rates.

- Location: Areas with higher crime rates, traffic congestion, and a greater number of accidents generally have higher insurance premiums. Urban areas often have higher rates compared to rural areas.

- Demographics: Factors such as age, gender, and marital status can also affect insurance premiums. Younger drivers, for example, are statistically more likely to be involved in accidents, leading to higher premiums.

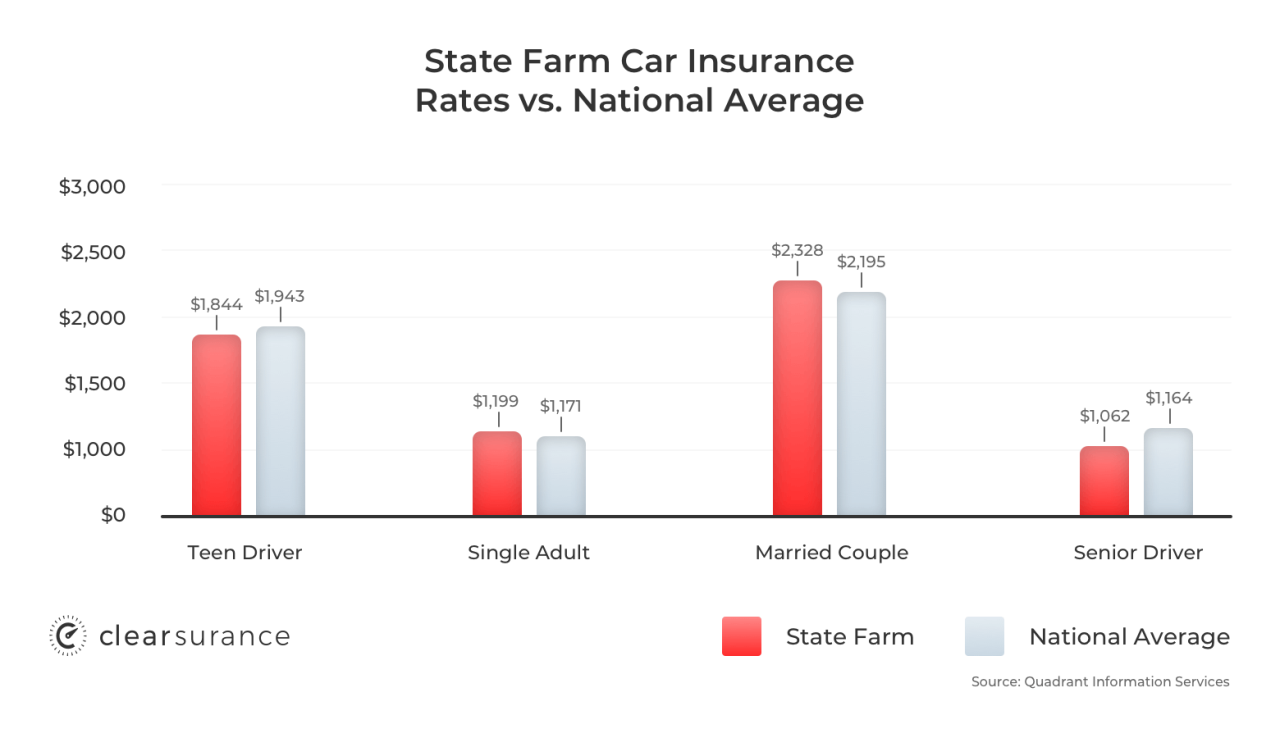

State Farm Car Insurance Cost Comparison

Comparing State Farm’s car insurance rates to other major insurers is crucial for finding the best value for your needs. By understanding how State Farm’s rates stack up against the competition, you can make an informed decision about your insurance coverage.

State Farm Car Insurance Cost Comparison

To provide a comprehensive overview, we’ll examine average annual premiums across different scenarios, considering factors like state, coverage level, and vehicle type. Here’s a table comparing State Farm’s car insurance rates with other major insurers:

| State | Coverage Level | Vehicle Type | State Farm | Geico | Progressive | Allstate |

|---|---|---|---|---|---|---|

| California | Minimum Liability | Sedan | $500 | $450 | $475 | $525 |

| California | Full Coverage | SUV | $1,200 | $1,100 | $1,150 | $1,300 |

| Texas | Minimum Liability | Truck | $600 | $550 | $575 | $650 |

| Texas | Full Coverage | Sports Car | $1,500 | $1,400 | $1,450 | $1,600 |

| Florida | Minimum Liability | Sedan | $400 | $350 | $375 | $425 |

| Florida | Full Coverage | SUV | $1,000 | $900 | $950 | $1,100 |

It’s important to note that these are just average premiums and your actual rates may vary based on your individual circumstances.

State Farm Discounts and Savings

State Farm offers a wide range of discounts to help you save money on your car insurance. These discounts can significantly reduce your premiums, making State Farm a competitive choice for car insurance.

Types of Discounts

State Farm offers various discounts to help you save money on your car insurance. These discounts can be categorized into several types, each with its own set of criteria and potential savings.

- Good Driver Discounts: These discounts reward drivers with a clean driving record. State Farm typically offers discounts for drivers who have not been involved in accidents or received traffic violations for a certain period.

- Safe Driver Discounts: Similar to good driver discounts, these recognize drivers who maintain a safe driving history. State Farm may offer discounts based on factors like your driving experience, driving habits, and adherence to traffic laws.

- Multi-Policy Discounts: Bundling your car insurance with other insurance policies, such as homeowners, renters, or life insurance, can lead to significant savings. State Farm often offers discounts for combining multiple policies.

- Defensive Driving Course Discounts: Completing a defensive driving course demonstrates your commitment to safe driving practices. State Farm may offer discounts to drivers who successfully complete such courses.

- Anti-theft Device Discounts: Installing anti-theft devices in your vehicle can deter theft and reduce the risk of claims. State Farm often offers discounts for vehicles equipped with these devices.

- Good Student Discounts: These discounts are available to students who maintain good academic standing. State Farm may offer discounts to high school and college students with good grades.

- Paid-in-Full Discounts: Paying your car insurance premium in full can sometimes lead to discounts. State Farm may offer discounts for drivers who choose this payment option.

- Loyalty Discounts: State Farm often rewards long-term customers with discounts for their continued loyalty. The longer you’ve been a State Farm customer, the more significant the discount may be.

Maximizing Savings

To maximize your savings on State Farm car insurance, consider these strategies:

- Maintain a Clean Driving Record: Avoiding accidents and traffic violations is crucial for earning good driver discounts.

- Bundle Your Insurance: Combine your car insurance with other policies from State Farm to benefit from multi-policy discounts.

- Complete a Defensive Driving Course: Taking a defensive driving course can demonstrate your commitment to safe driving and earn you a discount.

- Install Anti-theft Devices: Equip your vehicle with anti-theft devices to deter theft and qualify for potential discounts.

- Maintain Good Academic Standing: If you’re a student, maintain good grades to qualify for good student discounts.

- Consider Paying in Full: Explore the option of paying your premium in full to see if you qualify for a discount.

- Stay a Loyal Customer: The longer you remain a State Farm customer, the more likely you are to benefit from loyalty discounts.

Discount Impact on Premiums

The potential impact of discounts on your premiums can vary depending on your individual circumstances, location, and coverage options. Here’s a table illustrating the potential savings:

| Discount Type | Potential Savings |

|---|---|

| Good Driver Discount | Up to 20% |

| Safe Driver Discount | Up to 15% |

| Multi-Policy Discount | Up to 10% |

| Defensive Driving Course Discount | Up to 5% |

| Anti-theft Device Discount | Up to 10% |

| Good Student Discount | Up to 10% |

| Paid-in-Full Discount | Up to 5% |

| Loyalty Discount | Up to 10% |

Note: Discount amounts and eligibility criteria may vary by state and policy. It’s essential to contact State Farm directly to determine the specific discounts available to you and their potential impact on your premiums.

Customer Experience and Reviews

Understanding customer sentiment is crucial when evaluating an insurance provider. State Farm, being a major player in the industry, has a vast customer base, leading to a diverse range of experiences and opinions. Analyzing these reviews provides valuable insights into the company’s strengths and weaknesses.

Customer Satisfaction and Reviews

Online platforms like Trustpilot, ConsumerAffairs, and the Better Business Bureau (BBB) offer a wealth of customer reviews. While opinions vary, a general consensus emerges regarding State Farm’s customer service. State Farm generally receives positive feedback for its friendly and helpful agents, efficient claims processing, and a wide range of insurance options. However, some customers express dissatisfaction with specific aspects, such as long wait times, difficulty reaching customer service representatives, and occasional challenges with claim settlements.

- Positive Reviews: Many customers praise State Farm for its excellent customer service, particularly the helpfulness and responsiveness of agents. They also appreciate the company’s straightforward and transparent communication, as well as its efficient claims processing.

- Negative Reviews: Some customers express frustration with long wait times on hold, difficulties reaching customer service representatives, and occasional challenges with claim settlements. These negative experiences often stem from specific situations, such as complex claims or unexpected policy changes.

Claims Handling Process

State Farm’s claims handling process is a critical aspect of its customer experience. The company strives to ensure a smooth and efficient process for policyholders. State Farm offers multiple channels for reporting claims, including online portals, mobile apps, and phone calls. The company also employs a network of adjusters who investigate claims and assess damages. While most customers report positive experiences with State Farm’s claims handling process, some individuals encounter delays or challenges with claim settlements, particularly in cases involving complex claims or disputes.

“Overall, I am happy with State Farm. They have been very helpful and responsive when I needed to file a claim. The process was straightforward, and I was able to get my car repaired quickly.” – A satisfied customer review on Trustpilot.

Alternative Car Insurance Options

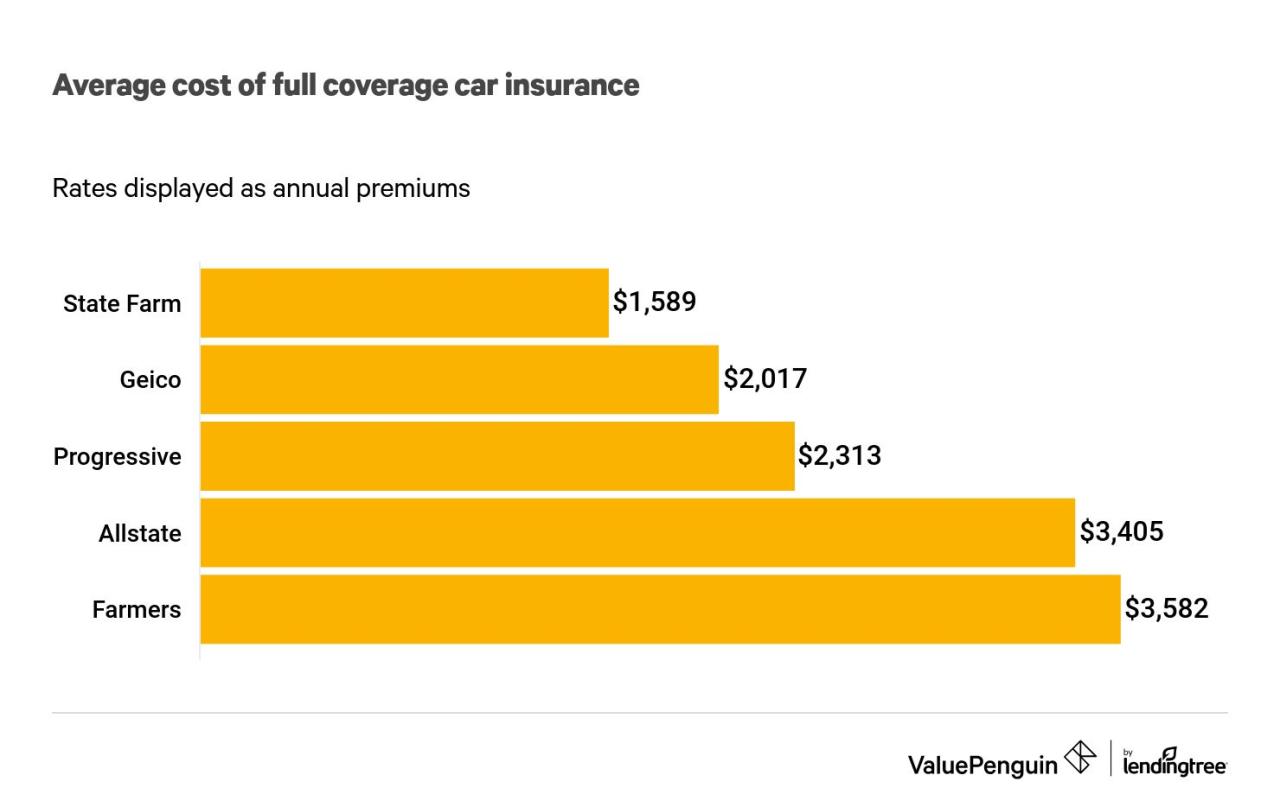

State Farm is a popular and well-regarded insurance provider, but it’s important to explore other options to ensure you’re getting the best coverage and price. Many other reputable car insurance companies offer competitive rates and diverse coverage options, catering to various needs and preferences.

Comparison of Insurance Providers

Comparing different car insurance providers is crucial to finding the best deal. Here’s a breakdown of some prominent options and their unique features:

- Progressive: Known for its “Name Your Price” tool, allowing customers to set a desired premium and see available coverage options. Progressive also offers a variety of discounts and flexible payment plans.

- Geico: Renowned for its competitive pricing and straightforward online quoting process. Geico offers comprehensive coverage options and a user-friendly mobile app for managing policies.

- USAA: Exclusively for military members and their families, USAA provides exceptional customer service and competitive rates. It offers a wide range of discounts and benefits tailored to the military community.

- Liberty Mutual: Known for its strong financial stability and comprehensive coverage options. Liberty Mutual offers a variety of discounts and features, including accident forgiveness and new car replacement.

- Allstate: Offers a wide range of insurance products, including car insurance, with competitive rates and a focus on customer service. Allstate provides various discounts and benefits, including Drive Safe & Save, which rewards safe driving habits.

Factors to Consider When Choosing Car Insurance

When selecting a car insurance provider, several factors should be considered:

- Coverage Needs: Determine the level of coverage required, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Consider your individual needs and the value of your vehicle.

- Price: Compare quotes from multiple providers to find the most competitive rates. Factors like driving history, vehicle type, location, and coverage level significantly impact pricing.

- Customer Service: Research customer reviews and ratings to assess the quality of customer service provided by different companies. Look for providers with responsive customer support and a positive reputation.

- Discounts: Explore available discounts offered by different companies. Common discounts include safe driving, good student, multi-car, and bundling discounts. Maximize savings by taking advantage of eligible discounts.

Ending Remarks: Car Insurance Cost State Farm

Navigating the world of car insurance can be complex, but by understanding the factors that influence premiums and exploring different options, you can find the best coverage at a price that fits your budget. Whether you’re a new driver, an experienced motorist, or simply looking for a better deal, this breakdown of State Farm car insurance provides valuable insights to help you make informed decisions. Remember to review your policy regularly and explore discounts and savings opportunities to ensure you’re getting the most out of your coverage.

Query Resolution

How does State Farm determine my car insurance premium?

State Farm considers factors such as your driving history, vehicle type, location, age, and credit score to determine your premium.

Does State Farm offer discounts for good drivers?

Yes, State Farm offers discounts for safe drivers, such as good student discounts, defensive driving course completion, and accident-free driving records.

How can I get a quote for State Farm car insurance?

You can get a quote online, over the phone, or by visiting a State Farm agent.