Car insurance comparison washington state – Navigating the world of car insurance in Washington State can be overwhelming, but it doesn’t have to be. “Car Insurance Comparison: Washington State Guide” is your comprehensive resource for understanding the state’s insurance requirements, factors that influence your rates, and strategies for finding the best policy for your needs. Whether you’re a new driver, a seasoned motorist, or simply looking to save money on your premiums, this guide will equip you with the knowledge and tools to make informed decisions.

From mandatory coverage requirements and discounts to tips for filing claims, we cover everything you need to know about car insurance in Washington. We’ll break down the key factors that affect your rates, such as your driving history, age, vehicle type, and location, and explain how to leverage these factors to your advantage. We’ll also delve into the different types of coverage available, helping you understand the benefits and drawbacks of each option.

Understanding Washington State Car Insurance Requirements

Driving in Washington State requires you to have car insurance. This ensures that you can cover costs related to accidents and injuries. The state mandates specific coverage amounts to protect both yourself and others on the road.

Minimum Car Insurance Coverage Requirements

Washington State requires all drivers to carry minimum liability insurance, personal injury protection (PIP), and uninsured/underinsured motorist (UM/UIM) coverage. These coverages are essential to protect you financially in case of an accident.

- Liability Coverage: This coverage protects you financially if you cause an accident that injures someone or damages their property. Washington State requires a minimum of $25,000 per person and $50,000 per accident for bodily injury liability and $10,000 for property damage liability. This means you’re responsible for covering up to $25,000 in medical expenses for each person injured in an accident you caused and up to $50,000 for all injuries in a single accident. Additionally, you’re required to cover up to $10,000 in property damage caused by the accident.

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault. Washington State requires a minimum of $10,000 in PIP coverage. This means your insurance company will pay up to $10,000 for your medical expenses and lost wages following an accident.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. Washington State requires a minimum of $25,000 per person and $50,000 per accident for UM/UIM coverage. This means your insurance company will cover your medical expenses and lost wages up to $25,000 per person and $50,000 per accident if the other driver doesn’t have enough insurance or no insurance at all.

Penalties for Driving Without Car Insurance

Driving without valid car insurance in Washington State can lead to serious consequences. If you’re caught driving without insurance, you could face:

- Fines: You may have to pay a fine of up to $1,000. The exact amount of the fine depends on the circumstances and the number of offenses.

- License Suspension: Your driver’s license could be suspended for up to 90 days. This means you won’t be able to drive legally until your license is reinstated.

- Vehicle Impoundment: Your vehicle could be impounded until you provide proof of insurance. This can be a significant inconvenience and expense, as you’ll have to pay storage fees for your vehicle.

- Higher Insurance Premiums: Even if you get insurance after being caught driving without it, your insurance premiums may be significantly higher in the future.

Factors Affecting Car Insurance Rates in Washington

Several factors influence car insurance premiums in Washington, impacting how much you pay for coverage. Understanding these factors can help you make informed decisions about your insurance policy and potentially save money.

Driving History

Your driving history is a major factor determining your car insurance rates. Insurance companies assess your driving record to determine your risk level. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

Age

Age is another important factor in car insurance rates. Younger drivers, particularly those under 25, are statistically more likely to be involved in accidents. As a result, insurance companies typically charge higher premiums for young drivers. As you age and gain more driving experience, your rates tend to decrease.

Vehicle Type

The type of vehicle you drive also plays a significant role in your insurance premiums. High-performance vehicles, luxury cars, and SUVs often have higher insurance rates due to their higher repair costs and greater potential for damage in accidents. Conversely, smaller, less expensive cars tend to have lower premiums.

Location, Car insurance comparison washington state

Your location in Washington can also affect your car insurance rates. Areas with higher rates of accidents or theft tend to have higher insurance premiums. For example, drivers in urban areas with heavy traffic may pay more than those in rural areas with lower accident rates.

Credit Score

In Washington, insurance companies can use your credit score as a factor in determining your car insurance premiums. This practice is based on the belief that individuals with good credit scores are more financially responsible and therefore less likely to file claims. While not all insurance companies use credit scores, it is a factor worth considering, especially if you have a lower credit score.

Types of Car Insurance Coverage Available: Car Insurance Comparison Washington State

In Washington state, you have a variety of car insurance coverage options to choose from, each designed to protect you and your vehicle in different situations. Understanding the different types of coverage and their benefits is crucial for making informed decisions about your insurance policy.

Types of Car Insurance Coverage

| Coverage Type | Purpose | Benefits | Cost Implications |

|---|---|---|---|

| Liability Coverage | Protects you financially if you cause an accident that injures someone or damages their property. | Covers medical expenses, lost wages, and property damage costs for the other party. | Required by law in Washington state, with minimum limits. Higher limits offer greater protection but can increase premiums. |

| Collision Coverage | Covers damage to your vehicle if you’re involved in an accident, regardless of fault. | Pays for repairs or replacement of your car after a collision. | Optional coverage, but often required by lenders if you have a car loan. Higher deductibles can lower premiums. |

| Comprehensive Coverage | Protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. | Covers repairs or replacement of your car due to non-collision incidents. | Optional coverage, often bundled with collision coverage. Higher deductibles can lower premiums. |

| Uninsured/Underinsured Motorist Coverage (UM/UIM) | Protects you if you’re involved in an accident with a driver who has no insurance or insufficient coverage. | Covers medical expenses, lost wages, and property damage costs for you and your passengers. | Optional coverage, but highly recommended for financial protection. |

| Personal Injury Protection (PIP) | Covers medical expenses, lost wages, and other expenses for you and your passengers, regardless of fault. | Provides financial support for medical treatment and lost income after an accident. | Required in Washington state. |

| Rental Car Coverage | Provides you with a rental car while your vehicle is being repaired after an accident. | Offers convenient transportation while your car is unavailable. | Optional coverage, can be added to your policy. |

| Roadside Assistance | Provides help with unexpected situations like flat tires, dead batteries, and lockouts. | Offers peace of mind and assistance in emergencies. | Optional coverage, can be added to your policy. |

Examples of Coverage Benefits

- Liability Coverage: If you cause an accident that results in $50,000 in damages to the other driver’s car and $100,000 in medical expenses for the other driver’s injuries, your liability coverage will pay for these costs, up to your policy limits.

- Collision Coverage: If you hit a parked car and damage your own vehicle, your collision coverage will pay for repairs or replacement of your car, minus your deductible.

- Comprehensive Coverage: If your car is stolen or damaged by a hailstorm, your comprehensive coverage will pay for repairs or replacement of your car, minus your deductible.

- UM/UIM Coverage: If you’re hit by an uninsured driver who causes $20,000 in damage to your car and $50,000 in medical expenses for you and your passengers, your UM/UIM coverage will pay for these costs, up to your policy limits.

- Rental Car Coverage: If your car is damaged in an accident and needs to be repaired for two weeks, your rental car coverage will pay for a rental car for that period.

- Roadside Assistance: If you have a flat tire in the middle of the night, your roadside assistance coverage will send a tow truck to help you.

Choosing the Right Car Insurance Policy

Finding the right car insurance policy in Washington can feel like navigating a maze, but it doesn’t have to be overwhelming. By understanding your needs, comparing quotes, and carefully considering your options, you can find a policy that provides the protection you need at a price that fits your budget.

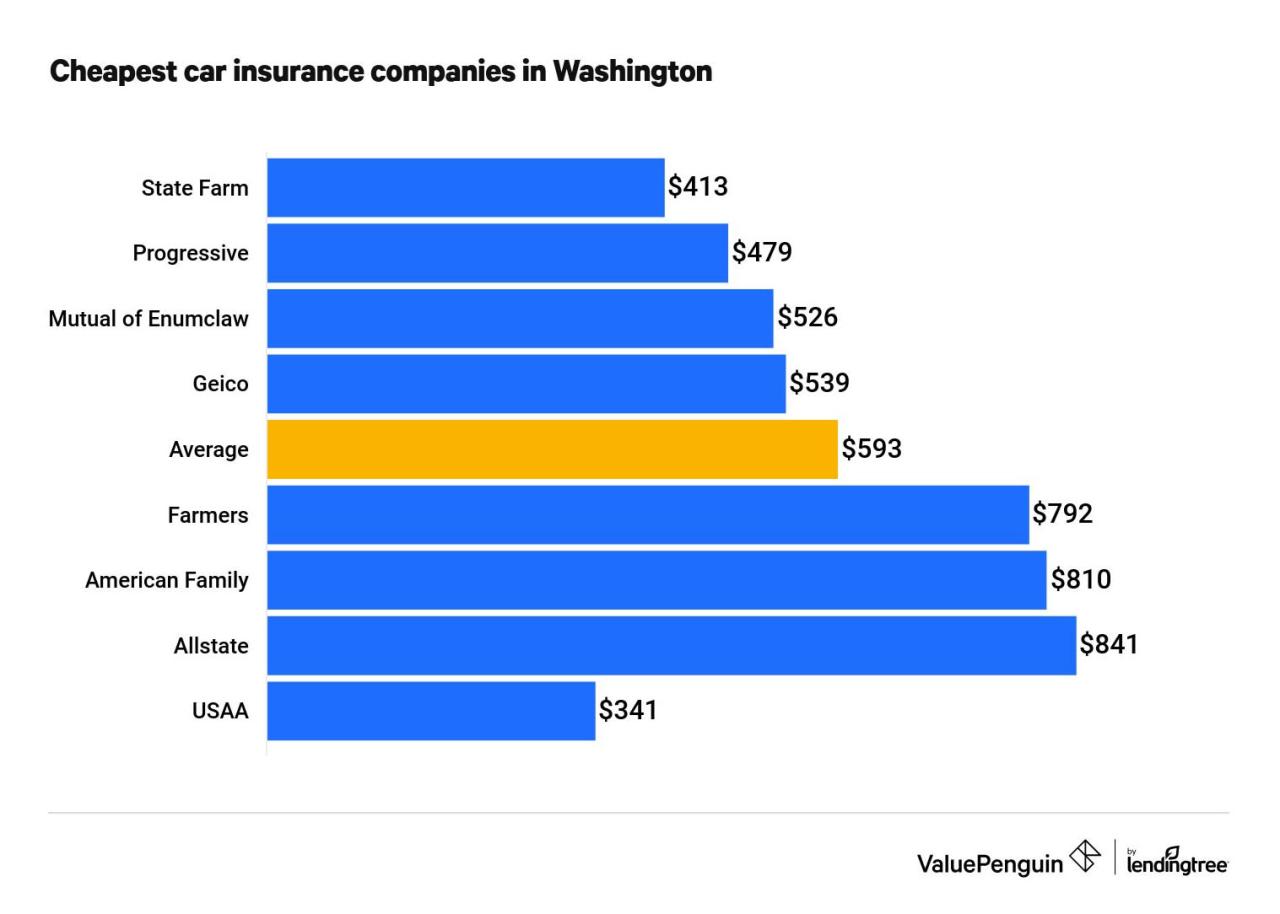

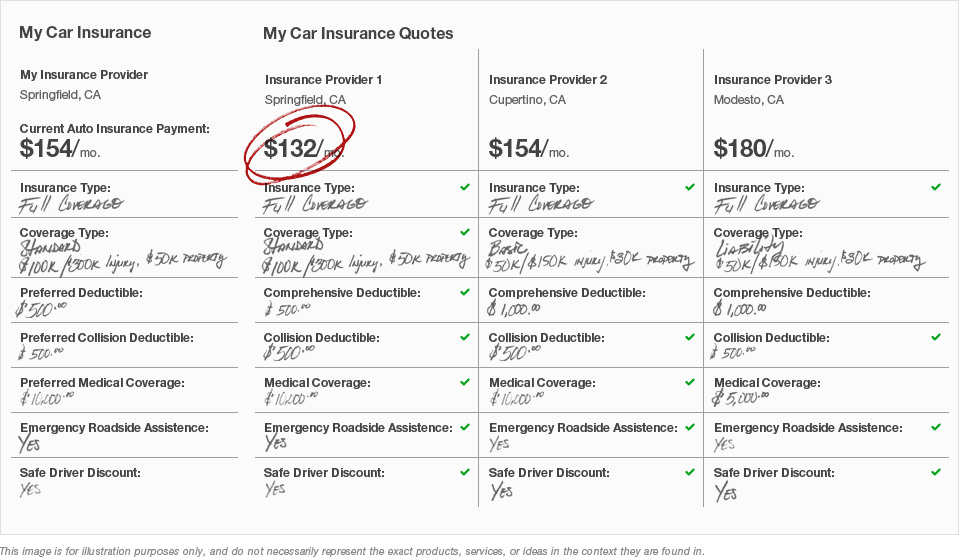

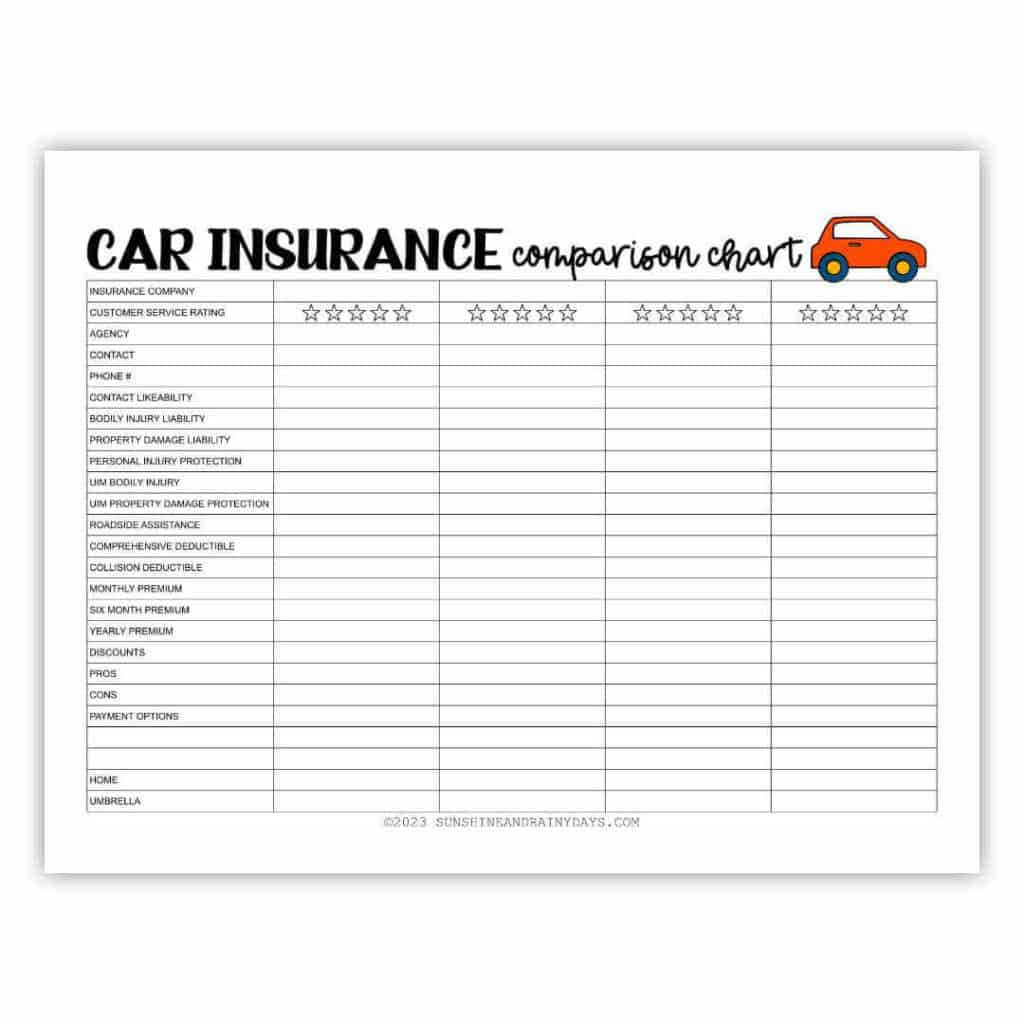

Comparing Quotes and Finding the Best Policy

Before you commit to any policy, it’s crucial to shop around and compare quotes from multiple insurance providers. This allows you to see a wide range of options and find the best value for your money. Here are some tips for comparing quotes effectively:

- Use online comparison tools: Several websites allow you to enter your information once and receive quotes from multiple insurers, making the process quick and convenient.

- Contact insurers directly: While online tools are helpful, don’t hesitate to contact insurance companies directly to discuss your specific needs and get personalized quotes.

- Be transparent about your driving history: Providing accurate information about your driving record, including any accidents or violations, will ensure you receive accurate quotes.

- Consider your coverage needs: Carefully evaluate the different types of coverage available and choose the levels that best suit your situation. For example, if you have a new car, you might consider comprehensive and collision coverage to protect your investment.

Understanding Coverage Levels, Deductibles, and Discounts

Once you’ve gathered quotes, it’s time to analyze the details of each policy and compare factors like coverage levels, deductibles, and discounts.

- Coverage Levels: Different policies offer varying levels of coverage, from basic liability insurance to comprehensive and collision coverage. The higher the coverage level, the more protection you have, but the higher the premium.

- Deductibles: Your deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible typically means a lower premium, but you’ll pay more if you need to file a claim. Consider your risk tolerance and financial situation when choosing a deductible.

- Discounts: Many insurers offer discounts for various factors, such as good driving records, safety features in your car, and bundling multiple insurance policies. Ask about available discounts and see if you qualify.

The Importance of Shopping Around

The value of shopping around cannot be overstated. By comparing quotes from multiple insurers, you can often find significant savings on your car insurance premiums. Don’t be afraid to negotiate with insurers to see if you can get a better rate. Remember, the best policy for you is the one that provides the right level of protection at a price you can afford.

Car Insurance Discounts in Washington

Car insurance discounts are a great way to save money on your premiums. By taking advantage of these discounts, you can significantly reduce your insurance costs and keep more money in your pocket.

Common Car Insurance Discounts in Washington

Several car insurance discounts are available in Washington State. Understanding these discounts and their eligibility requirements can help you save on your insurance premiums.

Good Driver Discounts

Good driver discounts are offered to drivers with a clean driving record. This discount is typically given to drivers who have not been involved in any accidents or received any traffic violations within a specific timeframe, usually three to five years.

Safe Driving Courses

Taking a defensive driving course can demonstrate your commitment to safe driving practices. These courses teach you about safe driving techniques, traffic laws, and accident avoidance strategies. Completing these courses can qualify you for a safe driver discount.

Multi-Car Discounts

If you have multiple vehicles insured with the same insurance company, you may be eligible for a multi-car discount. This discount is usually a percentage off the total premium for all insured vehicles.

Other Discounts

Other common car insurance discounts in Washington include:

- Loyalty Discount: This discount is offered to customers who have been with the same insurance company for a long time.

- Anti-theft Device Discount: If you have anti-theft devices installed in your vehicle, you may qualify for a discount.

- Bundling Discount: You may receive a discount if you bundle your car insurance with other types of insurance, such as homeowners or renters insurance.

- Student Discount: Good students with high GPAs may be eligible for a discount.

- Military Discount: Active military personnel and veterans may receive a discount on their car insurance premiums.

- Good Credit Discount: Some insurance companies offer discounts to drivers with good credit scores.

Importance of Utilizing Discounts

Understanding and utilizing available discounts is crucial for minimizing your insurance costs.

Filing a Car Insurance Claim in Washington

Filing a car insurance claim in Washington can be a stressful experience, but understanding the process can help you navigate it more smoothly. Whether you’ve been in an accident, your car has been damaged, or you need to file a claim for another reason, knowing what to do and what to expect can make a big difference.

Reporting the Accident

After an accident, it’s crucial to report it to your insurance company as soon as possible. This is typically done by phone, online, or through their mobile app. Be prepared to provide details about the accident, including the date, time, location, and any injuries involved. You should also gather information from the other driver(s) involved, such as their name, address, insurance information, and driver’s license number.

Gathering Necessary Documentation

To support your claim, you’ll need to gather several documents. This includes:

- A copy of the police report, if one was filed.

- Photos or videos of the damage to your vehicle.

- Estimates from repair shops for the cost of repairs.

- Medical bills and records, if you were injured in the accident.

- Any other relevant documentation, such as witness statements.

Contacting the Insurance Company

Once you’ve gathered the necessary documentation, you can contact your insurance company to file your claim. They will guide you through the process and may request additional information. It’s important to be patient and cooperative with your insurance company throughout the process.

Types of Claims

In Washington, you can file different types of car insurance claims, depending on the situation. These include:

- Collision Claims: These claims are filed when your vehicle is damaged in an accident, regardless of who is at fault. You can file a collision claim to cover the cost of repairs or replacement of your vehicle.

- Comprehensive Claims: These claims cover damage to your vehicle caused by events other than accidents, such as theft, vandalism, fire, or natural disasters. For example, if your car is damaged by a hailstorm, you can file a comprehensive claim to cover the repairs.

- Liability Claims: These claims are filed when you are at fault for an accident that causes damage to another person’s property or injuries. Your liability coverage will help pay for the other driver’s medical expenses, vehicle repairs, and other related costs.

Tips for Navigating the Claims Process

- Be Prompt: The sooner you report the accident and file your claim, the better. This can help prevent delays in the process and ensure that you receive the coverage you need.

- Be Detailed: When providing information to your insurance company, be as detailed as possible. This includes providing accurate descriptions of the accident, the damage to your vehicle, and any injuries sustained.

- Keep Records: Keep a record of all communication with your insurance company, including dates, times, and the names of the people you spoke with. This can help you track the progress of your claim and address any issues that may arise.

- Be Patient: The claims process can take time, so be patient and understanding. It may take several weeks or even months for your claim to be processed and settled.

- Get Legal Advice: If you have any questions or concerns about your claim, it’s a good idea to seek legal advice from an experienced car insurance attorney. They can help you understand your rights and ensure that you receive the compensation you deserve.

Car Insurance Resources in Washington

Navigating the world of car insurance can be overwhelming, especially in a state like Washington with its unique requirements and regulations. Fortunately, various resources are available to help you find the right coverage and ensure you’re well-informed throughout the process.

Washington State Office of the Insurance Commissioner

The Washington State Office of the Insurance Commissioner (OIC) is your primary resource for information and assistance regarding car insurance in the state. The OIC is responsible for regulating the insurance industry, protecting consumers, and ensuring fair and competitive practices.

- Website: The OIC website provides comprehensive information on car insurance requirements, consumer rights, and resources for filing complaints. You can find guidance on choosing the right coverage, understanding your policy, and resolving disputes with insurance companies.

- Contact Information:

- Phone: (800) 562-6900

- Email: insurance.commissioner@insurance.wa.gov

- Address: PO Box 40250, Olympia, WA 98504-0250

Consumer Protection Agencies

Consumer protection agencies play a crucial role in safeguarding your rights and interests when it comes to car insurance. These agencies offer valuable resources, guidance, and assistance in resolving disputes with insurance companies.

- Washington State Attorney General’s Office: The Attorney General’s Office investigates consumer complaints against insurance companies and works to protect consumers from unfair or deceptive practices.

- Website: www.atg.wa.gov

- Phone: (800) 551-4663

- Better Business Bureau (BBB): The BBB provides ratings and reviews of insurance companies, helping consumers make informed decisions. They also offer resources for resolving complaints and disputes.

- Website: www.bbb.org

- Phone: (206) 628-0044

Independent Insurance Agents

Independent insurance agents act as your advocate, helping you navigate the complexities of car insurance and find the best policy for your needs. They represent multiple insurance companies, allowing them to offer a wide range of options and compare rates to find the most suitable coverage for you.

- Role of Insurance Agents: Independent agents are experts in the insurance industry and can provide personalized guidance based on your specific situation. They can help you understand the different types of coverage available, explain the terms and conditions of your policy, and recommend the best discounts and options for you.

- Finding an Agent: You can find independent insurance agents through online directories, recommendations from friends and family, or by contacting the OIC for a list of licensed agents in your area.

Last Word

With a clear understanding of Washington State’s car insurance landscape, you’ll be empowered to shop around, compare quotes, and choose a policy that provides the right coverage at a price you can afford. Don’t settle for just any insurance policy – take control of your car insurance and find the best protection for yourself and your vehicle. Remember, a little research and comparison can go a long way in ensuring you have the right coverage at the best possible price.

Commonly Asked Questions

What are the penalties for driving without car insurance in Washington State?

Driving without valid car insurance in Washington State can result in fines, license suspension, and even vehicle impoundment. The penalties can vary depending on the circumstances, but they can be substantial.

How often should I review my car insurance policy?

It’s a good idea to review your car insurance policy at least once a year, or even more frequently if your circumstances change, such as getting a new car, moving to a new location, or changing your driving habits.

Can I get car insurance if I have a poor driving record?

Yes, you can still get car insurance even if you have a poor driving record. However, your rates will likely be higher than those with a clean record. It’s important to shop around and compare quotes from different insurance providers to find the best possible rates.