Car insurance by state is a complex topic, influenced by a multitude of factors that can significantly impact your premiums. Understanding these variations is crucial for finding the best coverage at the most affordable price. This guide explores the key factors that determine car insurance rates, including state-specific regulations, driving conditions, and individual risk profiles.

From comparing average premiums across the nation to identifying the states with the highest and lowest costs, we delve into the reasons behind these disparities. We also examine how factors like driving history, age, vehicle type, and location influence individual insurance rates. This comprehensive analysis provides valuable insights for navigating the complexities of car insurance and making informed decisions about your coverage.

Car Insurance Rates by State

Car insurance rates vary significantly across the United States, influenced by a multitude of factors. Understanding these variations can help you make informed decisions about your car insurance coverage and potentially save money.

Average Car Insurance Premiums by State

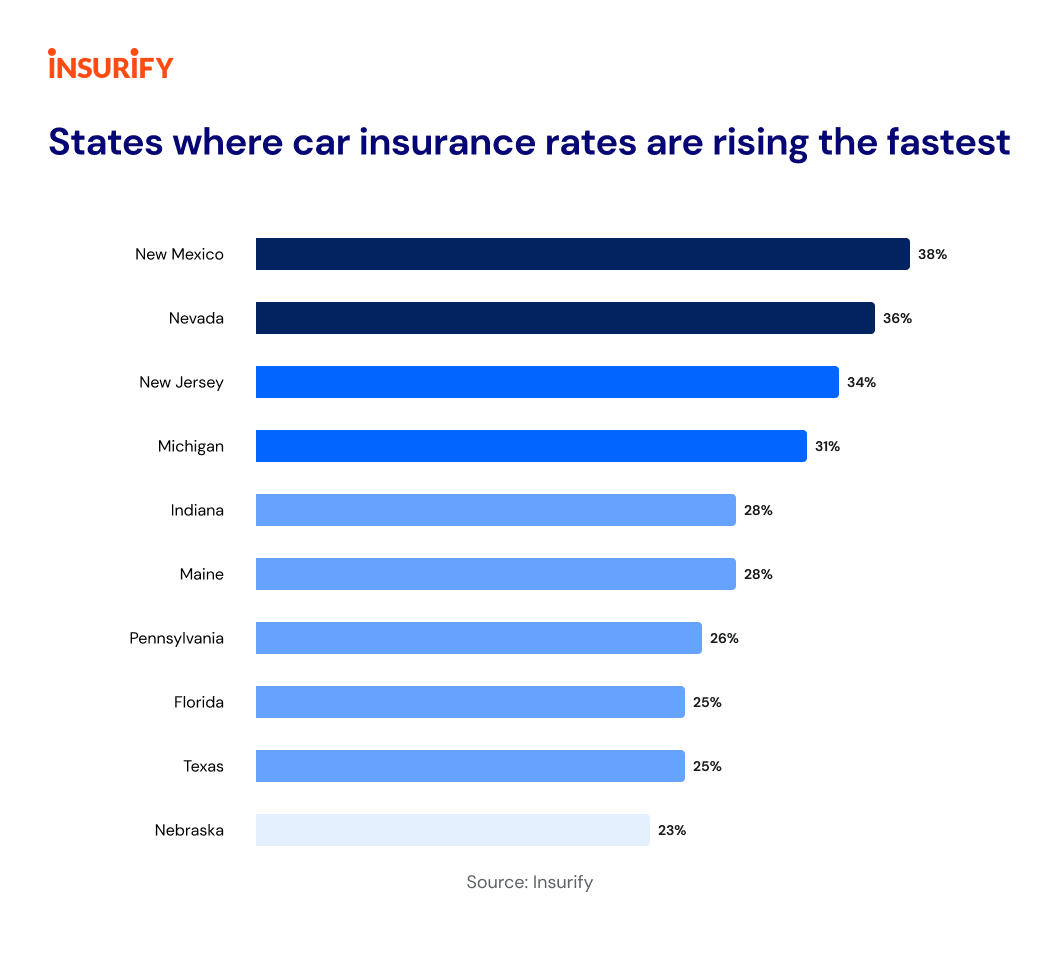

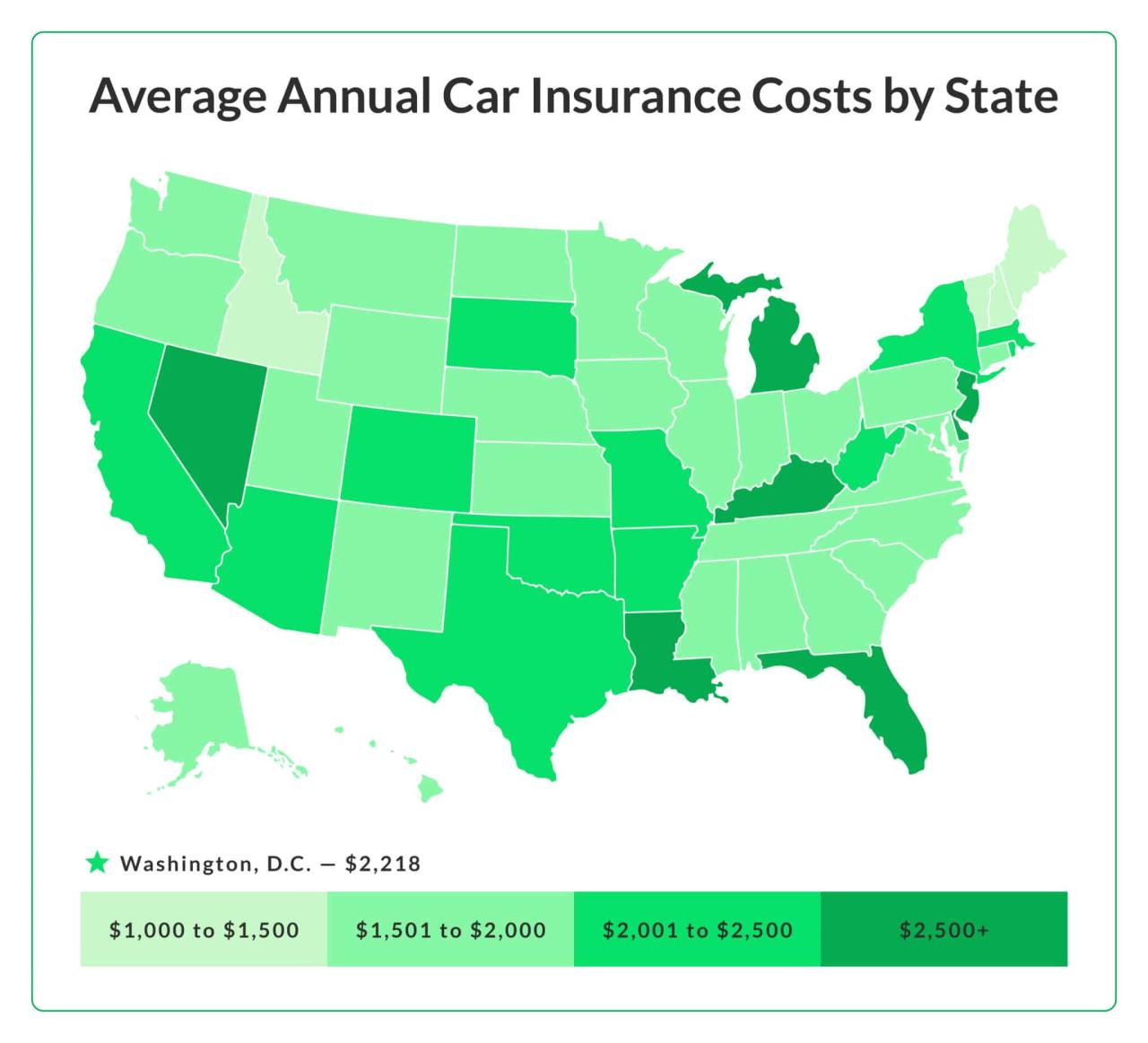

The average annual car insurance premium in the United States is $1,771. However, premiums can range widely depending on the state you reside in.

Top 5 States with the Highest Average Premiums

- Michigan: $2,634

- Louisiana: $2,425

- Florida: $2,372

- New Jersey: $2,348

- Pennsylvania: $2,276

Top 5 States with the Lowest Average Premiums

- Maine: $1,133

- Idaho: $1,159

- North Dakota: $1,203

- Utah: $1,206

- Iowa: $1,225

Factors Influencing Car Insurance Rates

Several factors contribute to the significant variations in car insurance rates across states:

Demographics

- Population density: States with higher population density often have more traffic congestion and accidents, leading to higher insurance premiums.

- Age distribution: Younger drivers are statistically more likely to be involved in accidents, resulting in higher premiums in states with a larger proportion of young drivers.

Driving History

- Accident frequency: States with higher accident rates tend to have higher insurance premiums as insurers need to cover more claims.

- Driving violations: Drivers with a history of traffic violations, such as speeding tickets or DUI convictions, face higher premiums due to their increased risk.

Vehicle Type

- Vehicle value: More expensive vehicles, such as luxury cars or sports cars, are more costly to repair or replace, leading to higher insurance premiums.

- Safety features: Vehicles with advanced safety features, such as anti-lock brakes and airbags, are often associated with lower insurance premiums.

State Regulations

- Minimum coverage requirements: States with higher minimum coverage requirements, such as higher liability limits, generally have higher insurance premiums.

- Tort laws: States with “no-fault” insurance laws, where drivers are compensated by their own insurance regardless of fault, tend to have lower premiums than states with “fault” laws.

Factors Influencing Car Insurance Rates

Car insurance premiums are calculated based on a variety of factors, with each company using its own proprietary algorithms to determine rates. These factors are designed to assess the risk associated with insuring a particular driver and vehicle. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Driving History

Your driving history is one of the most significant factors influencing your car insurance rates. A clean driving record with no accidents or violations will generally result in lower premiums. Insurance companies view drivers with a history of accidents, speeding tickets, or other violations as higher risks.

For example, a driver with two speeding tickets and a DUI conviction may face significantly higher premiums compared to a driver with a clean record.

Age

Age is another significant factor, as younger and older drivers are statistically more likely to be involved in accidents.

- Younger drivers, particularly those under 25, often lack experience and are more likely to take risks, leading to higher premiums.

- Older drivers, especially those over 65, may have declining eyesight or reflexes, which can also increase their risk of accidents.

However, drivers in their mid-30s to mid-50s generally enjoy lower premiums due to their experience and reduced risk.

Gender

While gender-based pricing is becoming less common due to regulations in some areas, it still plays a role in determining car insurance rates in some states.

- Historically, men have been statistically more likely to be involved in accidents, which has led to higher premiums for male drivers.

- However, this gap is narrowing, and some insurance companies are now offering gender-neutral pricing.

Credit Score

Surprisingly, your credit score can impact your car insurance premiums.

- Insurance companies believe that drivers with good credit scores are more financially responsible and less likely to file claims.

- This correlation is not universally accepted, and some states prohibit using credit scores for insurance pricing.

It is important to note that this practice is controversial, and some states have banned the use of credit scores for insurance pricing.

Vehicle Type

The type of vehicle you drive also influences your insurance premiums.

- Sports cars, luxury vehicles, and high-performance cars are generally more expensive to repair and replace, resulting in higher insurance costs.

- Older vehicles, especially those with safety features that are outdated, may also carry higher premiums.

Location

Where you live can significantly impact your car insurance rates.

- Urban areas with higher population density and traffic congestion often have higher accident rates, leading to higher premiums.

- Areas with a high incidence of theft or vandalism may also result in higher insurance costs.

State-Specific Regulations and Laws

Each state in the US has its own set of regulations and laws governing car insurance. These regulations significantly influence insurance premiums, coverage options, and the overall cost of car insurance for individuals.

Minimum Coverage Requirements

State laws mandate minimum coverage levels for car insurance, known as “financial responsibility laws.” These requirements ensure that drivers have adequate financial resources to cover damages and injuries caused by accidents. The minimum coverage requirements vary considerably across states. For example, some states require only liability coverage, while others mandate comprehensive and collision coverage.

- Liability Coverage: This coverage protects drivers against claims for bodily injury and property damage to others caused by their negligence. It typically includes limits for bodily injury per person, bodily injury per accident, and property damage per accident.

- Collision Coverage: This coverage protects drivers against damage to their own vehicle in an accident, regardless of fault. It typically covers the cost of repairs or replacement, minus the deductible.

- Comprehensive Coverage: This coverage protects drivers against damage to their vehicle from events other than collisions, such as theft, vandalism, or natural disasters. It typically covers the cost of repairs or replacement, minus the deductible.

- Uninsured/Underinsured Motorist Coverage (UM/UIM): This coverage protects drivers against damages caused by uninsured or underinsured drivers. It typically covers medical expenses, lost wages, and property damage.

Fault vs. No-Fault Systems

States are classified into two systems: fault-based and no-fault systems.

- Fault-Based Systems: In fault-based systems, the driver at fault for an accident is responsible for covering the damages. This system often involves lengthy legal proceedings to determine fault and negotiate settlements.

- No-Fault Systems: In no-fault systems, drivers file claims with their own insurance companies, regardless of who is at fault. This system aims to simplify the claims process and reduce legal costs.

Restrictions on Coverage Options

Some states impose restrictions on coverage options, such as limits on the amount of coverage available or restrictions on certain types of coverage. These restrictions can impact the cost of car insurance and the level of protection available to drivers.

- Coverage Limits: Some states impose limits on the maximum amount of coverage available for specific types of coverage, such as liability coverage or uninsured/underinsured motorist coverage. These limits can impact the amount of financial protection available to drivers in the event of a serious accident.

- Restrictions on Certain Types of Coverage: Some states may restrict or prohibit certain types of coverage, such as coverage for rental cars or coverage for personal belongings in a vehicle. These restrictions can limit the overall protection available to drivers.

State-Specific Examples

- Texas: Texas has a fault-based system and requires drivers to carry liability coverage, but does not require comprehensive or collision coverage. This can result in lower minimum insurance requirements and potentially lower premiums for drivers.

- Michigan: Michigan has a no-fault system, which means drivers file claims with their own insurance companies, regardless of who is at fault. This system typically results in higher premiums but simplifies the claims process.

- California: California requires drivers to carry liability coverage, collision coverage, and comprehensive coverage. This can result in higher minimum insurance requirements and potentially higher premiums.

Impact of Driving Conditions and Risks

Car insurance rates are significantly influenced by the driving conditions and risks prevalent in a particular state. Insurers meticulously analyze these factors to determine the likelihood of accidents and, consequently, adjust premiums accordingly.

Traffic Density and Congestion

Traffic density and congestion are significant contributors to accident risk. States with high population density and heavy traffic often experience more accidents due to increased vehicle interactions, potential for driver distractions, and heightened stress levels.

For example, cities like New York City and Los Angeles have a high concentration of vehicles on the road, leading to increased traffic congestion and a higher likelihood of accidents. This, in turn, translates to higher car insurance premiums in these areas.

Road Infrastructure and Quality

The quality and condition of roads significantly impact driving safety. States with well-maintained roads, proper signage, and adequate lighting tend to have lower accident rates. Conversely, areas with poorly maintained roads, inadequate infrastructure, and limited visibility are prone to accidents.

For instance, states with extensive highway networks, regular road maintenance, and efficient traffic management systems generally have lower accident rates, resulting in lower insurance premiums.

Weather Patterns and Conditions

Weather conditions can dramatically affect driving safety. States with harsh weather patterns, such as heavy snowfall, frequent rain, and extreme temperatures, often have higher accident rates.

For example, states with frequent snowfall, such as Alaska and New York, experience more accidents due to slippery roads, reduced visibility, and potential for hazardous driving conditions. These factors contribute to higher car insurance premiums in these regions.

Natural Disasters and Climate Events

States prone to natural disasters, such as hurricanes, earthquakes, and floods, face increased risks of vehicle damage.

For example, states along the Gulf Coast, such as Florida and Louisiana, are susceptible to hurricanes, which can cause widespread damage to vehicles. This increased risk of damage is reflected in higher car insurance premiums in these areas.

Choosing the Right Insurance Policy

Finding the right car insurance policy can seem overwhelming, but it’s crucial for protecting yourself financially in case of an accident. The right policy depends on your individual needs and circumstances. Consider these factors: your driving history, the type of car you drive, where you live, and your budget.

Types of Car Insurance Coverage

Understanding the different types of coverage available will help you make informed decisions. Each type offers protection for specific situations.

- Liability Coverage: This is the most basic type of car insurance and is required in most states. It covers damages to other people’s property or injuries caused by you in an accident. Liability coverage is typically divided into two parts: bodily injury liability and property damage liability.

- Collision Coverage: This covers damages to your car if you are involved in an accident, regardless of who is at fault. Collision coverage is optional but can be beneficial if you have a newer car or if you are financing your vehicle.

- Comprehensive Coverage: This covers damages to your car from events other than accidents, such as theft, vandalism, fire, or natural disasters. Comprehensive coverage is optional but can be helpful if your car is valuable or if you live in an area prone to natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or has insufficient coverage. It can help cover your medical expenses and property damage.

Benefits of Different Coverage Types

Each type of coverage offers unique benefits to protect you financially. The following table summarizes key features and benefits:

Coverage Type

Key Features

Benefits

Liability Coverage

Covers damages to others’ property or injuries caused by you in an accident.

Protects you from financial ruin in case of an accident involving another party.

Collision Coverage

Covers damages to your car in an accident, regardless of fault.

Provides financial protection for repairs or replacement of your car after an accident.

Comprehensive Coverage

Covers damages to your car from events other than accidents, such as theft or natural disasters.

Protects your car from damage caused by events beyond your control.

Uninsured/Underinsured Motorist Coverage

Covers damages if you are hit by a driver without or with insufficient insurance.

Provides financial protection in situations where the other driver cannot fully cover your losses.

Saving Money on Car Insurance

Car insurance is a necessity for most car owners, but it can also be a significant expense. Luckily, there are several strategies you can employ to reduce your car insurance premiums.

Discounts, Car insurance by state

Insurance companies offer various discounts to lower premiums. These discounts can be significant, so it’s worth exploring what you might qualify for.

- Good Driver Discounts: These are often offered to drivers with clean driving records, meaning no accidents or traffic violations.

- Safe Driver Discounts: Some insurance companies offer discounts to drivers who complete defensive driving courses. These courses teach safe driving techniques and can help reduce your risk of accidents.

- Multi-Car Discounts: If you insure multiple cars with the same company, you can often receive a discount on your premiums.

- Multi-Policy Discounts: Bundling your car insurance with other types of insurance, like home or renters insurance, can also lead to significant savings.

- Loyalty Discounts: Some companies reward long-term customers with discounts for staying with them for a certain period.

- Payment Discounts: Paying your premium in full or setting up automatic payments can sometimes qualify you for a discount.

- Anti-theft Device Discounts: Installing anti-theft devices, such as alarms or tracking systems, can reduce your risk of theft and earn you a discount.

- Good Student Discounts: These discounts are often available to students with good grades.

Improving Your Driving History

A clean driving record is a significant factor in determining your car insurance premiums. Avoiding accidents and traffic violations can lead to lower premiums over time.

Shopping Around for the Best Rates

Getting quotes from multiple insurance companies is essential to ensure you’re getting the best rate. You can use online comparison tools or contact insurance companies directly to get quotes.

Final Thoughts

By understanding the factors that shape car insurance rates and utilizing strategies for saving money, you can secure the right coverage without breaking the bank. Remember to regularly review your insurance needs, shop around for the best rates, and take advantage of discounts to ensure you’re getting the most value for your premiums. With careful planning and a proactive approach, you can navigate the world of car insurance with confidence and find a policy that meets your individual needs and budget.

Commonly Asked Questions: Car Insurance By State

How often should I review my car insurance policy?

It’s recommended to review your car insurance policy at least annually, or even more frequently if you experience significant life changes, such as a new car purchase, a change in your driving record, or a move to a new state.

What are the common types of car insurance discounts?

Common discounts include good driver discounts, safe driver discounts, multi-car discounts, bundling discounts, and discounts for safety features in your vehicle.

How can I improve my driving record to get lower insurance rates?

Maintain a clean driving record by avoiding traffic violations, accidents, and speeding tickets. Consider taking a defensive driving course to enhance your driving skills and potentially earn a discount.