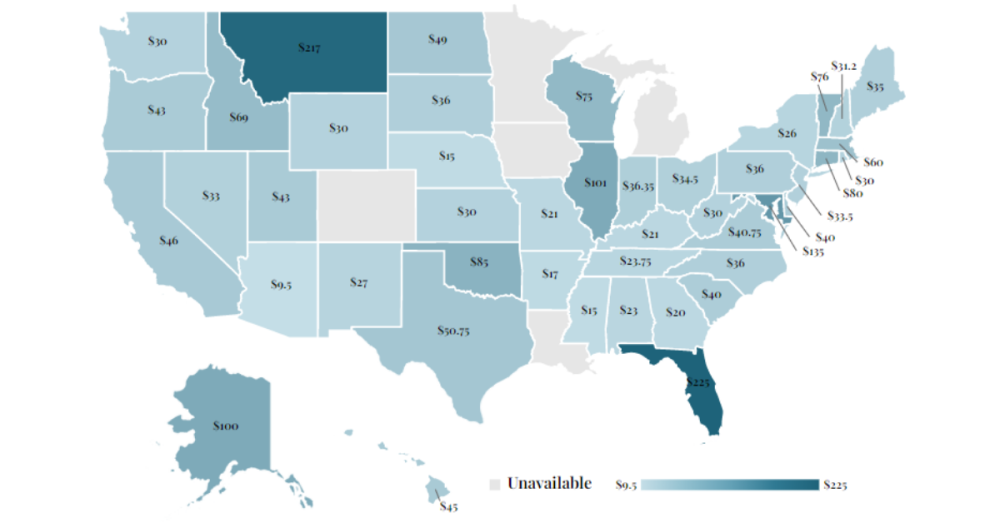

Car insurance and registration in different states are not one-size-fits-all. Navigating the complex world of car insurance and registration requirements across the United States can be a daunting task. Each state has its own unique set of laws and regulations that govern how you insure and register your vehicle. This guide aims to provide a comprehensive overview of the key aspects of car insurance and registration in different states, helping you understand the requirements, procedures, and costs involved.

From mandatory coverage levels and registration fees to the impact of state laws on your insurance premiums, we will explore the intricacies of this vital topic. We will also delve into the factors that influence car insurance rates, such as your age, driving history, and vehicle type. Understanding these differences is crucial for ensuring you are adequately covered and compliant with the law.

Car Insurance Requirements Across States

Navigating the world of car insurance can be a complex endeavor, especially when considering the varying regulations across different states. Each state has its own unique set of car insurance requirements, dictating the minimum coverage levels drivers must maintain. Understanding these requirements is crucial for ensuring you are adequately protected and compliant with the law.

Minimum Liability Coverage Levels Across States

States mandate minimum liability coverage levels to safeguard drivers and their property in case of accidents. These levels vary significantly across the country, reflecting different risk profiles and legislative priorities.

- Bodily Injury Liability: This coverage protects you financially if you injure someone in an accident. States typically set minimum limits for bodily injury liability per person and per accident. For instance, a state might require a minimum of $25,000 per person and $50,000 per accident.

- Property Damage Liability: This coverage covers damages to another person’s property, such as their vehicle, in an accident. Similar to bodily injury liability, states set minimum limits for property damage liability. For example, a state might require a minimum of $25,000 for property damage.

Optional Car Insurance Coverages Available in Different States

Beyond the mandatory liability coverage, states offer various optional car insurance coverages that provide additional protection. These coverages cater to specific needs and circumstances, offering financial security in various scenarios.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of fault. This is particularly useful for newer or more expensive vehicles.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by non-accident events, such as theft, vandalism, or natural disasters. It can be beneficial for vehicles with high replacement costs.

- Uninsured/Underinsured Motorist Coverage: This coverage provides protection if you are involved in an accident with an uninsured or underinsured driver. It helps cover your medical expenses and property damage in such situations.

- Personal Injury Protection (PIP): This coverage covers your medical expenses and lost wages, regardless of fault, in case of an accident. It is often required in states with no-fault insurance systems.

Factors That Influence Car Insurance Premiums in Different States

Car insurance premiums are influenced by various factors, including state regulations, demographics, and risk assessments. Understanding these factors can help you make informed decisions about your car insurance needs.

- State Regulations: Each state has its own set of regulations governing car insurance, including minimum coverage requirements and pricing guidelines. These regulations can significantly impact premium costs.

- Demographics: Factors such as population density, driving habits, and accident rates can influence insurance premiums. States with higher accident rates or congested urban areas may have higher premiums.

- Risk Assessments: Insurance companies use sophisticated algorithms to assess individual risk profiles based on factors like age, driving history, vehicle type, and credit score. These assessments influence premium calculations.

Examples of How Car Insurance Rates Vary Based on Factors Like Age, Driving History, and Vehicle Type

Car insurance rates are highly personalized, reflecting individual risk profiles and factors such as age, driving history, and vehicle type.

- Age: Younger drivers, particularly those under 25, tend to have higher premiums due to their higher risk of accidents. As drivers gain experience and age, their premiums typically decrease.

- Driving History: Drivers with a history of accidents, speeding tickets, or other violations face higher premiums. A clean driving record generally translates to lower rates.

- Vehicle Type: The type of vehicle you drive significantly impacts your insurance rates. Sports cars, luxury vehicles, and high-performance cars are often associated with higher risks and therefore higher premiums.

Impact of State Laws on Car Insurance and Registration: Car Insurance And Registration In Different States

State laws play a significant role in shaping car insurance and registration requirements, influencing everything from coverage options to vehicle inspection procedures. Understanding these laws is crucial for drivers to ensure they meet legal obligations and obtain the appropriate insurance protection.

Impact of No-Fault Insurance Laws

No-fault insurance laws dictate how insurance claims are handled after an accident. In states with no-fault systems, drivers are primarily responsible for covering their own medical expenses and lost wages, regardless of who caused the accident. These laws aim to simplify the claims process and reduce litigation.

- Personal Injury Protection (PIP): No-fault states typically require drivers to purchase PIP coverage, which covers medical expenses and lost wages for the insured and their passengers, regardless of fault. PIP coverage limits vary by state.

- Limited Tort: Some states offer limited tort options, allowing drivers to sue for pain and suffering only in cases of serious injury or death. This limits lawsuits and potentially reduces insurance premiums.

- Choice No-Fault: Some states allow drivers to choose between a no-fault system and a traditional tort system. This provides drivers with more flexibility in selecting the insurance coverage that best suits their needs.

Impact of Uninsured Motorist Coverage Laws, Car insurance and registration in different states

Uninsured motorist (UM) coverage protects drivers and passengers in the event of an accident caused by an uninsured or underinsured driver. State laws determine the minimum UM coverage requirements and whether drivers can opt out of this coverage.

- Minimum UM Coverage: States set minimum UM coverage limits, which vary depending on the state. Drivers are required to carry at least this minimum amount of coverage.

- Optional UM Coverage: Drivers can choose to purchase additional UM coverage beyond the minimum requirement, providing greater financial protection in the event of an accident with an uninsured driver.

- Opting Out of UM Coverage: Some states allow drivers to opt out of UM coverage if they can provide proof of alternative insurance, such as a self-insurance certificate or surety bond.

Impact of Vehicle Inspection Requirements

Vehicle inspection requirements vary significantly across states. Some states mandate annual or biennial inspections to ensure vehicles meet safety standards, while others have no inspection requirements.

- Safety Inspections: States with inspection requirements typically conduct safety checks on vehicle components like brakes, lights, tires, and emissions systems.

- Registration Renewal: Vehicle inspections are often tied to vehicle registration renewal. Drivers must pass a safety inspection to renew their registration.

- Environmental Regulations: Some states conduct emissions inspections to ensure vehicles meet environmental standards and reduce air pollution.

Examples of State Laws Influencing Car Insurance and Registration

- California: California requires drivers to carry minimum liability insurance limits and offers a choice no-fault system. It also mandates annual vehicle inspections for certain vehicle types.

- Florida: Florida has a no-fault insurance system with mandatory PIP coverage. It also requires drivers to carry minimum liability insurance limits and offers a choice no-fault option.

- Texas: Texas has a traditional tort system and requires drivers to carry minimum liability insurance limits. It does not have mandatory vehicle inspections.

Closing Summary

Understanding car insurance and registration requirements in different states is essential for every driver. By being aware of the regulations and procedures specific to your state, you can ensure you are adequately covered, legally compliant, and financially protected on the road. This guide has provided a comprehensive overview of key aspects, from mandatory coverages to registration procedures and the impact of state laws. Remember to consult official state resources and seek professional advice for personalized guidance and to make informed decisions about your car insurance and registration needs.

Top FAQs

What are the penalties for driving without car insurance?

Penalties for driving without car insurance vary by state but can include fines, suspension of your driver’s license, and even jail time.

How do I transfer my car registration to a new state?

You’ll need to contact the DMV in your new state and provide the necessary documentation, including your current registration, proof of insurance, and a vehicle inspection if required.

What is the difference between liability and collision coverage?

Liability coverage protects you from financial responsibility if you cause an accident, while collision coverage covers damage to your own vehicle in an accident, regardless of fault.

Can I get a discount on my car insurance if I have a good driving record?

Yes, most insurance companies offer discounts for drivers with clean driving records.

What are the best resources for finding affordable car insurance?

You can compare quotes from multiple insurance companies online, contact independent insurance brokers, or consult with a financial advisor.