Can you register a car with out of state insurance – Can you register a car with out-of-state insurance? This question often arises when individuals relocate or spend significant time in a different state. While it’s possible, the process involves understanding specific state laws, insurance requirements, and potential challenges. This guide will provide a comprehensive overview of the steps, considerations, and potential issues associated with registering a vehicle with out-of-state insurance.

Every state has its own set of rules regarding car insurance and registration. Some states may require immediate transfer of your insurance upon registration, while others might allow a grace period. It’s crucial to research the specific laws of the state where you’re registering your vehicle to ensure compliance and avoid any legal complications.

State Laws and Regulations: Can You Register A Car With Out Of State Insurance

When registering a vehicle in a new state, you must comply with the state’s insurance requirements. These regulations typically mandate that all vehicles registered within the state must have active insurance coverage.

State-Specific Insurance Requirements

The specific insurance requirements vary across states. Some states may accept out-of-state insurance coverage for a limited period, while others require you to transfer your insurance to a local provider immediately upon registration.

- States that Require Immediate Insurance Transfer: Several states, including California, Florida, and New York, mandate that you obtain insurance from a licensed provider within the state before registering your vehicle. These states often have a grace period, typically ranging from a few days to a week, to allow you to secure local insurance.

- States with Grace Periods: Other states, such as Texas and Illinois, allow you to maintain your out-of-state insurance for a specific period, usually 30 to 60 days, after registering your vehicle. However, it’s essential to confirm the specific grace period with the state’s Department of Motor Vehicles (DMV).

- Exceptions: Certain exceptions may apply, such as for military personnel stationed in a different state. These exceptions are often Artikeld in the state’s insurance regulations.

Grace Periods and Exceptions

States often offer grace periods for transitioning insurance coverage. These periods provide individuals with sufficient time to obtain local insurance. For instance, California allows a 20-day grace period for out-of-state insurance coverage after registering a vehicle.

“The grace period allows individuals to transition their insurance coverage to a local provider without facing penalties or delays in vehicle registration.”

Exceptions to the insurance requirements may exist for specific situations. For example, military personnel stationed in a different state may be exempt from the state’s insurance requirements. These exceptions are often Artikeld in the state’s insurance regulations.

Insurance Transfer and Coverage

Transferring your car insurance to a new state is usually a straightforward process, but it’s essential to understand the potential changes in coverage and premium rates. You’ll need to notify your current insurance provider of your move and they will handle the transfer, but there are some things to be aware of.

Coverage Changes When Switching States

When you move to a new state, your car insurance policy may need adjustments to comply with the new state’s regulations. Here are some key areas where coverage might change:

- Minimum Coverage Requirements: Each state mandates specific minimum liability coverage levels, such as bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. These minimums can vary significantly from state to state. You may need to increase your coverage to meet the new state’s requirements.

- Personal Injury Protection (PIP): Some states require PIP coverage, which covers medical expenses for you and your passengers, regardless of fault. Other states do not have this requirement. If you move to a state that mandates PIP, your policy will need to be updated accordingly.

- Uninsured/Underinsured Motorist (UM/UIM): This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. The amount of coverage required can vary between states. You may need to increase your UM/UIM coverage to ensure adequate protection.

- No-Fault Insurance: Some states operate under a no-fault system, where you file a claim with your own insurer regardless of who caused the accident. If you move to a no-fault state, your policy may need to be adjusted to reflect this system.

Premium Rate Changes When Switching States

Your insurance premiums can fluctuate when you move to a new state due to various factors, including:

- State-Specific Risk Factors: Insurance premiums are influenced by the frequency and severity of accidents, the cost of medical care, and other state-specific factors. States with higher accident rates or higher healthcare costs tend to have higher insurance premiums.

- Driving Record: Your driving record, including any accidents or traffic violations, will affect your premium rates in both your current and new state. A clean driving record can lead to lower premiums, while a history of accidents or violations can result in higher premiums.

- Vehicle Type and Value: The type of vehicle you drive and its value can influence your insurance premiums. For example, sports cars or luxury vehicles may have higher premiums than more affordable vehicles.

- Credit History: In some states, your credit history can be a factor in determining your insurance premiums. A good credit history can lead to lower premiums, while a poor credit history can result in higher premiums.

Coverage Options and Limitations

The following table illustrates some common coverage options and limitations between states:

| Coverage | State A | State B |

|---|---|---|

| Minimum Liability Coverage | $25,000/$50,000/$10,000 | $50,000/$100,000/$25,000 |

| Personal Injury Protection (PIP) | Required, $10,000 per person | Optional, up to $50,000 per person |

| Uninsured/Underinsured Motorist (UM/UIM) | Required, equal to liability limits | Optional, up to $100,000 per person |

| No-Fault Insurance | No-Fault System | Tort System |

Potential Challenges and Solutions

Registering a car with out-of-state insurance can present a few hurdles. While most states recognize insurance from other states, there are specific regulations and potential issues that drivers need to be aware of. Understanding these challenges and having solutions in place can ensure a smooth transition and prevent complications.

Consequences of Driving Without Proper Insurance, Can you register a car with out of state insurance

Driving without proper insurance in a new state can have serious consequences. Most states have mandatory insurance requirements, and failing to comply can lead to:

- Fines and Penalties: You may face hefty fines for driving without insurance, which can vary significantly depending on the state and the number of violations.

- License Suspension: If you continue to drive without insurance, your driver’s license could be suspended, making it impossible to legally operate a vehicle.

- Impounded Vehicle: Your car could be impounded if you’re caught driving without insurance, leading to additional costs for storage and towing.

- Financial Responsibility: In the event of an accident, you’ll be held fully responsible for any damages or injuries, potentially leading to significant financial burdens.

Addressing Common Issues

Many challenges arise when registering a car with out-of-state insurance. Here are some common issues and practical solutions:

Insurance Gaps

- Limited Coverage: Some states have specific coverage requirements that may not be fully met by your out-of-state insurance policy. For instance, your policy might not cover certain types of accidents or injuries.

- Coverage Limitations: Your current insurance policy might have limitations on coverage amounts or specific types of coverage that are not accepted in the new state.

- Solution: To address these gaps, you can consider obtaining additional coverage from a local insurance provider in the new state. This could involve purchasing a supplemental policy that bridges the gap between your existing coverage and the state’s requirements.

Coverage Limitations

- Out-of-State Coverage Restrictions: Your out-of-state insurance provider may have restrictions on coverage for accidents or incidents that occur outside your home state.

- State-Specific Requirements: Some states have unique coverage requirements, such as mandatory uninsured motorist coverage, that may not be included in your out-of-state policy.

- Solution: It’s essential to review your insurance policy carefully and contact your insurer to understand any limitations or exclusions related to out-of-state coverage. You may need to adjust your policy or obtain additional coverage to comply with the new state’s regulations.

Alternative Insurance Options

For temporary situations or short-term stays, alternative insurance options can provide coverage:

- Temporary Insurance: Many insurance providers offer temporary insurance policies, typically for periods ranging from a few days to a few months, that can bridge the gap while you establish permanent residency and obtain a new policy.

- Short-Term Coverage: If you’re planning a short-term move or stay in a new state, you can purchase short-term insurance that provides coverage for a specific period.

- Non-Owner Coverage: If you’re not the owner of the vehicle but need coverage for driving in a new state, non-owner insurance can provide liability protection.

Financial Implications

Registering a car with out-of-state insurance can have significant financial implications, particularly concerning insurance premiums. Understanding the potential cost differences between states and the factors influencing insurance rates is crucial for making informed decisions.

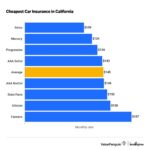

Insurance Premium Differences

Insurance premiums can vary significantly across states due to factors like:

- State-specific regulations: Different states have different regulations governing insurance rates, coverage requirements, and minimum liability limits.

- Cost of living: States with higher costs of living generally have higher insurance premiums, reflecting the increased cost of repairs and medical expenses.

- Risk profiles: States with higher accident rates or a greater prevalence of certain types of claims may have higher premiums to offset the increased risk.

- Competition: The level of competition among insurance companies in a state can influence premium rates. More competition can lead to lower premiums as companies strive to attract customers.

Factors Influencing Insurance Costs

Beyond state-specific regulations, several factors influence individual insurance premiums, including:

- Driving history: Drivers with a history of accidents, traffic violations, or DUI convictions generally face higher premiums due to their increased risk profile.

- Vehicle type: The type of vehicle, its value, and its safety features can significantly impact insurance costs. High-performance cars, luxury vehicles, and older cars with lower safety ratings typically have higher premiums.

- Coverage levels: The level of coverage chosen, including liability limits, collision and comprehensive coverage, and uninsured motorist coverage, affects insurance costs. Higher coverage levels generally result in higher premiums.

- Age and gender: Younger drivers and males generally pay higher premiums due to their statistically higher risk of accidents.

- Location: Where you live can affect insurance premiums, as areas with higher crime rates or traffic congestion may have higher premiums.

Insurance Premium Comparison

The following table compares hypothetical insurance premiums for a 30-year-old driver with a clean driving record, driving a 2020 Honda Civic, with minimum liability coverage, in different states:

| State | Annual Premium |

|---|---|

| California | $1,500 |

| Florida | $1,200 |

| Texas | $1,000 |

| New York | $1,800 |

It is important to note that these are hypothetical examples and actual premiums may vary based on individual circumstances and insurance company policies.

Summary

Navigating the process of registering a car with out-of-state insurance can be complex, but with proper research and understanding of state regulations, it’s achievable. Remember to consult with your insurance provider and the relevant state authorities to ensure you meet all requirements. By following these steps, you can successfully register your car and enjoy peace of mind knowing you’re compliant with the law.

Quick FAQs

What if I’m only visiting a state for a short period?

If you’re visiting a state for a short period, you may not need to register your vehicle or change your insurance. However, it’s essential to check the state’s laws regarding temporary vehicle registration and insurance requirements.

Can I use my current insurance policy for a different state?

While you can use your current insurance policy for a different state, it’s essential to confirm if it provides adequate coverage in the new state. Some states may require specific types of coverage or additional endorsements.

What happens if I get into an accident with out-of-state insurance?

If you get into an accident with out-of-state insurance, your insurance provider will handle the claim according to your policy’s terms and conditions. However, it’s essential to notify your insurer immediately and follow their instructions.

Is there a grace period for transferring insurance?

Some states allow a grace period for transferring insurance after registering a vehicle. However, the duration of the grace period varies, so it’s important to check the specific regulations of the state you’re registering in.