Can you insure a car in a different state? This is a question that many people ask when they move or travel to a new state. The answer is not always simple, as insurance regulations vary significantly from state to state. This guide explores the intricacies of insuring a car in a different state, covering everything from understanding state-specific requirements to securing affordable insurance options.

It’s important to understand that each state has its own set of rules regarding car insurance. These rules can cover minimum coverage levels, mandatory coverage types, and specific exclusions. For instance, some states require drivers to carry uninsured motorist coverage, while others do not. It’s crucial to be aware of the regulations in the state where you’ll be driving to ensure you have adequate coverage.

Understanding State-Specific Insurance Requirements

Each state in the US has its own set of regulations regarding car insurance, and these requirements can vary significantly. It’s crucial to understand the specific rules of the state where you’ll be driving to ensure you’re properly covered.

Minimum Coverage Levels

States establish minimum coverage levels that all drivers must maintain. These levels define the minimum amount of financial protection required to cover potential damages or injuries in an accident. The minimum coverage levels vary from state to state, and they typically include:

- Liability Coverage: This protects you financially if you cause an accident that results in injuries or property damage to others. It typically covers bodily injury liability and property damage liability.

- Uninsured/Underinsured Motorist Coverage: This protects you if you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough coverage. It can help cover your medical expenses, lost wages, and property damage.

Mandatory Coverage Types

Besides minimum coverage levels, certain states mandate specific coverage types. These requirements may include:

- Personal Injury Protection (PIP): This coverage helps pay for your medical expenses and lost wages if you’re injured in an accident, regardless of who is at fault.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects your vehicle against damages caused by events other than accidents, such as theft, vandalism, or natural disasters.

Specific Exclusions

States may also have specific exclusions in their insurance regulations. These exclusions define situations or circumstances where insurance coverage may not apply. Some common exclusions include:

- Driving without a valid license: If you’re driving without a valid license, your insurance may not cover you in an accident.

- Driving under the influence of alcohol or drugs: Insurance coverage may be voided if you’re driving under the influence.

- Using your vehicle for commercial purposes: If you’re using your personal vehicle for business purposes, your insurance may not cover you.

Consequences of Driving Without Proper Insurance

Driving a car in a different state without proper insurance can have serious consequences. You may face:

- Fines and penalties: States impose fines and penalties on drivers caught driving without the required insurance.

- License suspension or revocation: Your driving privileges may be suspended or revoked if you’re caught driving without insurance.

- Imprisonment: In some states, driving without insurance can lead to imprisonment.

- Financial responsibility: If you cause an accident without proper insurance, you’ll be held financially responsible for all damages and injuries.

Options for Insuring a Car in a Different State

Moving to a new state often involves updating your car insurance. You have a few options when it comes to insuring your car in a different state.

You can either transfer your existing policy to the new state or obtain new insurance coverage.

Transferring an Existing Policy

Transferring your existing policy is often the easiest option, especially if you have a good driving record and your insurer operates in the new state. This process typically involves contacting your current insurer and informing them of your move. They will then update your policy with the new state’s requirements and adjust your premium accordingly.

Obtaining New Insurance Coverage

If your current insurer doesn’t operate in the new state, you’ll need to obtain new insurance coverage. This involves getting quotes from different insurers and comparing their rates and coverage options. You can use online comparison tools or contact insurers directly to get quotes.

Factors Influencing Insurance Premiums

Several factors influence car insurance premiums in different states. Some of these factors include:

- Driving history: Your driving record, including accidents, violations, and claims history, significantly impacts your premiums. A clean driving record generally results in lower premiums.

- Vehicle type: The type of car you drive also plays a role in determining your premium. High-performance vehicles, luxury cars, and vehicles with safety features are typically more expensive to insure.

- Location: The state you live in and the specific location within the state can influence your premium. Areas with higher crime rates, traffic congestion, and accident rates tend to have higher insurance premiums.

- Age and gender: Younger drivers and males typically have higher premiums due to higher risk factors. However, this varies depending on the state’s regulations.

- Credit score: In some states, insurers use credit score as a factor in determining premiums. A good credit score can lead to lower premiums.

Factors to Consider When Insuring a Car in a Different State

Insuring your car in a different state can offer several advantages, but it’s crucial to carefully consider the factors involved to make an informed decision. These factors can significantly impact your insurance costs, coverage, and overall experience.

Benefits and Drawbacks of Insuring a Car in a Different State, Can you insure a car in a different state

Insuring your car in a different state can offer advantages and drawbacks depending on your specific circumstances.

- Lower Insurance Premiums: Some states have lower average insurance premiums than others due to factors like lower accident rates, stricter regulations, or a more competitive insurance market. You might find that insuring your car in a state with lower premiums could save you money.

- More Comprehensive Coverage Options: Certain states offer more comprehensive insurance coverage options, including additional benefits or higher limits. This can be beneficial if you want broader protection for your vehicle and yourself in case of an accident or other incidents.

- State-Specific Regulations: Each state has its own set of regulations regarding car insurance. Understanding these regulations is crucial, as they can influence your coverage, requirements, and even the cost of your insurance.

- Potential for Higher Premiums: Conversely, you might find that insurance premiums are higher in some states. This could be due to factors like higher accident rates, stricter regulations, or a less competitive insurance market.

- Limited Coverage in Other States: While your insurance policy will be valid in the state where you purchase it, you might face limitations or exclusions when driving in other states. This could affect your coverage in case of an accident or other incidents.

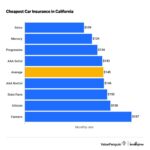

Comparison of Insurance Costs Between States

The cost of car insurance varies significantly from state to state due to factors like accident rates, traffic density, cost of living, and insurance regulations.

- Average Premiums: According to the National Association of Insurance Commissioners (NAIC), the average annual car insurance premium in the United States was $1,771 in 2022. However, this average can vary greatly depending on the state. For instance, Michigan has the highest average annual premium at $2,732, while Maine has the lowest at $988.

- Factors Influencing Costs: Several factors can influence insurance costs in different states, including:

- Accident Rates: States with higher accident rates generally have higher insurance premiums.

- Traffic Density: States with higher traffic density often have higher insurance premiums due to increased risk of accidents.

- Cost of Living: States with a higher cost of living often have higher insurance premiums, as the cost of repairs and medical expenses tends to be higher.

- Insurance Regulations: States with stricter insurance regulations, such as mandatory coverage requirements or stricter penalties for uninsured drivers, can influence insurance costs.

Impact of State-Specific Regulations on Insurance Coverage

Each state has its own set of regulations governing car insurance. These regulations can significantly impact the coverage you receive, the requirements you must meet, and the overall cost of your insurance.

- Mandatory Coverage: All states require drivers to carry a minimum level of liability insurance, which covers damages to other vehicles and injuries to other people in case of an accident. However, the specific coverage requirements can vary from state to state. For example, some states require higher liability limits than others.

- No-Fault Insurance: Some states have “no-fault” insurance systems, where drivers are required to file claims with their own insurance company regardless of who is at fault in an accident. This can simplify the claims process and reduce lawsuits, but it can also limit the amount of compensation you can receive.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you in case you are involved in an accident with a driver who is uninsured or underinsured. Some states require this coverage, while others make it optional.

Tips for Securing Affordable Insurance in a Different State

Insuring your car in a new state can be a significant expense, but with careful planning and negotiation, you can find affordable options. This section provides practical strategies for finding affordable insurance, negotiating premiums, and comparing quotes from different providers.

Finding Affordable Insurance Options

Finding affordable insurance options in a new state involves exploring different insurers, comparing coverage options, and taking advantage of available discounts.

- Compare quotes from multiple insurers: Obtain quotes from at least three different insurers to compare prices and coverage options. Online comparison tools can help streamline this process.

- Consider regional insurers: Local or regional insurers often offer competitive rates compared to national providers. They may have a better understanding of the specific risks in your new state and can offer tailored coverage options.

- Explore different coverage levels: While comprehensive and collision coverage is essential for new cars, you might consider opting for a higher deductible for older vehicles. This can significantly lower your premium, as you are essentially taking on more financial responsibility in case of an accident.

- Bundle your insurance policies: Combining your car insurance with other policies, such as homeowners or renters insurance, can lead to significant discounts.

- Ask about available discounts: Most insurers offer various discounts, such as safe driver discounts, good student discounts, and multi-car discounts. Make sure to inquire about these discounts during your initial quote request.

Negotiating Insurance Premiums

Once you have received quotes from multiple insurers, you can leverage your research to negotiate better rates.

- Highlight your good driving record: A clean driving record is a significant factor in determining your premium. Emphasize your driving history and the absence of accidents or violations.

- Inquire about discounts: As mentioned earlier, inquire about available discounts and document any eligible factors, such as safety features in your car or your membership in specific organizations.

- Shop around for better rates: Don’t hesitate to contact multiple insurers to compare rates and negotiate better premiums.

- Be prepared to switch insurers: Having multiple quotes and understanding the market can give you leverage to negotiate lower premiums. If you are not satisfied with the initial offer, be prepared to switch insurers to secure a more favorable deal.

Comparing Insurance Quotes

Comparing quotes from different providers is crucial to finding the best value for your money.

- Use online comparison tools: Many websites and apps allow you to enter your information once and receive quotes from multiple insurers simultaneously. This saves you time and effort.

- Compare coverage details: Don’t just focus on the premium; carefully review the coverage details of each quote. Pay attention to deductibles, limits, and exclusions to ensure you understand the protection offered by each policy.

- Read the fine print: Before making a decision, take the time to read the policy documents carefully. Pay attention to any specific conditions, limitations, or exclusions that might affect your coverage.

- Ask for clarification: If you have any questions or concerns about the quotes or coverage details, don’t hesitate to contact the insurer directly for clarification.

Additional Considerations for Insuring a Car in a Different State

It’s crucial to be aware of additional factors that can influence your car insurance in a new state. While you’ve already covered the basics, understanding the finer points of your policy and navigating state-specific regulations is vital.

Understanding Your Insurance Policy’s Terms and Conditions

Thoroughly review your insurance policy’s terms and conditions, paying particular attention to the following aspects:

- Coverage Limits: Ensure your policy provides adequate coverage for liability, collision, comprehensive, and uninsured motorist protection. Consider adjusting these limits based on the new state’s regulations and your individual needs.

- Exclusions: Identify any specific exclusions in your policy, such as coverage limitations for certain types of vehicles, driving activities, or geographical areas. This will help you avoid unexpected surprises.

- Deductibles: Review your deductibles and consider adjusting them if necessary. Higher deductibles typically result in lower premiums, but you’ll have to pay more out-of-pocket in case of an accident.

- Premium Payment Options: Check if your insurance company offers different payment options, such as monthly, quarterly, or annual installments. This can help you manage your insurance costs effectively.

Updating Your Insurance Information with Authorities

Once you’ve established residency in the new state, it’s important to update your insurance information with the relevant authorities:

- Department of Motor Vehicles (DMV): Contact your new state’s DMV to register your vehicle and obtain a new driver’s license. Provide your insurance details to ensure your vehicle is properly registered.

- Insurance Company: Notify your insurance company about your change of address and any other relevant information, such as the new state of residence and the date of your move. This will help them update your policy and ensure you receive the correct coverage.

Maintaining Adequate Insurance Coverage While Traveling to Other States

When traveling to other states, it’s important to ensure you have adequate insurance coverage:

- Check State Minimum Requirements: Each state has its own minimum insurance requirements. Before traveling, check the minimum liability coverage limits in the states you plan to visit. If your policy’s coverage falls below the minimum requirements, you may be at risk of facing fines or penalties.

- Consider Supplemental Coverage: Depending on your travel plans and risk tolerance, you may consider obtaining supplemental coverage, such as:

- Rental Car Insurance: If you plan to rent a car, you may want to consider purchasing additional rental car insurance to protect yourself from potential liabilities.

- Roadside Assistance: Roadside assistance can provide valuable support in case of breakdowns or accidents while traveling. This can include services such as towing, jump starts, and tire changes.

Conclusive Thoughts

Insuring a car in a different state can seem daunting, but it doesn’t have to be. By understanding the nuances of state-specific insurance regulations, exploring your options, and taking proactive steps to secure affordable coverage, you can confidently navigate the process. Remember to compare quotes from different providers, negotiate for discounts, and stay informed about the terms and conditions of your insurance policy. With careful planning and preparation, you can ensure you’re adequately protected on the road, no matter where you drive.

FAQ Summary: Can You Insure A Car In A Different State

What happens if I get into an accident in another state without proper insurance?

You could face serious consequences, including fines, license suspension, and even jail time. You may also be held personally liable for any damages caused.

Can I use my current insurance policy in a different state?

It depends on the specific policy and the state you’re driving in. Some insurers offer coverage in multiple states, but you may need to make adjustments to your policy. It’s best to contact your insurance company to confirm.

How do I find the best insurance rates in a different state?

Compare quotes from multiple insurance providers, consider discounts for good driving records and safety features, and shop around for the best rates.

What are the common factors that influence insurance premiums in different states?

Factors like driving history, vehicle type, location, and the cost of living in a particular state can all influence insurance premiums.