Can you have out of state car insurance in florida – Can you have out-of-state car insurance in Florida? This question arises frequently for individuals who are relocating to the Sunshine State or who spend significant time there. Florida has specific insurance laws and regulations that govern car insurance, and navigating them can be tricky, especially if you’re used to the rules in another state. This article will break down the key aspects of out-of-state car insurance in Florida, including the potential benefits and drawbacks, factors affecting eligibility, and how to transition to Florida insurance.

Understanding Florida’s insurance requirements is crucial for drivers. Failing to meet these requirements can lead to hefty fines, penalties, and even the suspension of your driving privileges. Whether you’re a new resident or a frequent visitor, knowing your options and understanding the implications of choosing out-of-state insurance is essential for safe and legal driving in Florida.

Florida’s Insurance Laws and Regulations

Florida has specific laws regarding car insurance and residency requirements. These laws ensure that all drivers have adequate financial protection in case of an accident and that insurance companies are held accountable for providing coverage.

Florida’s Minimum Car Insurance Requirements

Florida law requires all drivers to carry a minimum amount of car insurance, known as the “Financial Responsibility Law.” These minimum requirements ensure that drivers have financial resources to cover damages and injuries caused by accidents.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. The minimum PIP coverage required is $10,000.

- Property Damage Liability (PDL): This coverage pays for damages to another person’s property, such as their vehicle, if you are at fault in an accident. The minimum PDL coverage required is $10,000.

- Bodily Injury Liability (BIL): This coverage pays for medical expenses, lost wages, and other related costs for injuries to other people if you are at fault in an accident. The minimum BIL coverage required is $10,000 per person and $20,000 per accident.

Florida’s Residency Requirements for Car Insurance

Florida’s insurance laws require that all drivers have insurance that meets the state’s minimum requirements and that they are residents of Florida.

- Proof of Residency: When applying for car insurance in Florida, you will need to provide proof of residency, such as a driver’s license, utility bills, or lease agreement.

- Out-of-State Insurance: If you are a resident of another state but are driving in Florida, you must have car insurance that meets Florida’s minimum requirements. However, your out-of-state insurance policy may not be valid in Florida if it does not meet the state’s requirements. You can check with your insurance company to ensure that your policy complies with Florida law.

Florida Department of Motor Vehicles (DMV) and Out-of-State Insurance

The Florida Department of Motor Vehicles (DMV) is responsible for enforcing Florida’s insurance laws. The DMV may require you to provide proof of insurance when you register your vehicle in Florida. They also have access to a database that allows them to verify your insurance coverage.

Consequences of Driving in Florida with Insufficient Insurance

Driving in Florida without the required minimum car insurance or with out-of-state insurance that doesn’t meet Florida’s minimum requirements can result in serious consequences.

- Fines and Penalties: You may face fines and penalties, including suspension of your driver’s license, if you are caught driving without the required insurance.

- Legal Liability: If you are involved in an accident without the required insurance, you could be held personally liable for all damages and injuries, even if you were not at fault.

- Financial Burden: You could face significant financial hardship if you have to pay for damages and injuries out of pocket.

Benefits and Drawbacks of Out-of-State Insurance in Florida

Maintaining out-of-state car insurance while living in Florida can present both advantages and disadvantages. It’s essential to carefully weigh these factors before making a decision.

Potential Benefits of Out-of-State Insurance in Florida, Can you have out of state car insurance in florida

Out-of-state car insurance may offer certain benefits, depending on your individual circumstances.

- Lower Premiums: In some cases, out-of-state insurers may offer lower premiums compared to Florida-based insurers, especially if you have a good driving record and live in a lower-risk area. For example, if you previously resided in a state with lower insurance rates and have a clean driving history, your out-of-state insurer may continue to offer you a more favorable rate even after moving to Florida.

- More Coverage Options: Some out-of-state insurers might provide broader coverage options or unique features not readily available in Florida. This could include specialized coverage for specific vehicle types, such as classic cars or motorcycles, or higher coverage limits for certain types of accidents.

- Existing Relationships: If you have a long-standing relationship with an out-of-state insurer and are satisfied with their service, you may prefer to continue with them even after moving to Florida. Maintaining an existing relationship can provide continuity and familiarity, especially if you’ve had positive experiences with your insurer in the past.

Potential Drawbacks of Out-of-State Insurance in Florida

While out-of-state insurance may offer some benefits, it’s crucial to consider the potential drawbacks as well.

- Limited Coverage: Florida has specific insurance requirements that may not be fully met by out-of-state policies. For example, Florida’s no-fault insurance law mandates Personal Injury Protection (PIP) coverage, which may not be included in some out-of-state policies. If your out-of-state policy doesn’t comply with Florida’s requirements, you could face legal consequences in the event of an accident.

- Difficulty Filing Claims: Filing claims with an out-of-state insurer can be more complex and time-consuming, especially if you’re involved in an accident in Florida. You may have to deal with unfamiliar procedures, adjusters, and legal requirements. Additionally, if you need roadside assistance or other emergency services, it might be challenging to access them quickly from an out-of-state insurer.

- Higher Costs in the Long Run: While you might initially benefit from lower premiums, out-of-state insurance could become more expensive over time. This is because Florida insurers are required to offer certain minimum coverages and may adjust their rates based on local risk factors. If your out-of-state insurer doesn’t account for these factors, your premiums might increase significantly compared to Florida-based insurers.

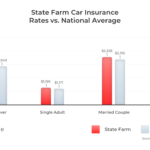

Cost Differences Between In-State and Out-of-State Insurance

The cost of car insurance can vary significantly depending on various factors, including your driving record, vehicle type, location, and the specific coverage you choose. In general, Florida’s insurance market is known for its higher premiums due to factors like high accident rates and litigation costs.

Out-of-state insurers may initially offer lower premiums due to their lower overhead costs or different risk assessment models. However, Florida’s insurance regulations and the unique factors affecting the state’s market can lead to higher costs for out-of-state policies in the long run.

It’s essential to compare quotes from both in-state and out-of-state insurers to determine the most cost-effective option. Consider the total cost of insurance, including premiums, deductibles, and any potential surcharges or penalties that may apply.

Factors Affecting Insurance Eligibility and Coverage: Can You Have Out Of State Car Insurance In Florida

Several factors determine whether your out-of-state car insurance is valid in Florida. These factors can impact your eligibility for coverage and the extent of protection you receive.

Driving History

Your driving history is a crucial factor that insurance companies consider when assessing your risk. A clean driving record with no accidents or violations will generally lead to lower premiums and greater eligibility for coverage. Conversely, a history of accidents, traffic violations, or DUI convictions can significantly impact your insurance rates and even make you ineligible for coverage with some insurers.

Vehicle Type

The type of vehicle you drive plays a significant role in determining your insurance premium and coverage options. High-performance vehicles, luxury cars, and vehicles with a higher risk of theft or accidents generally have higher insurance premiums.

Coverage Levels

The amount of coverage you choose will also affect your insurance eligibility. Florida requires all drivers to have a minimum amount of liability insurance, but you can choose to purchase additional coverage like collision, comprehensive, or uninsured motorist coverage. The more coverage you choose, the higher your premium will be, but you’ll also have greater protection in case of an accident.

Table of Factors and Their Impact on Insurance Coverage

| Factor | Impact on Insurance Coverage |

|---|---|

| Driving History | A clean driving record can lead to lower premiums and greater eligibility for coverage. A history of accidents or violations can increase premiums or make you ineligible for coverage. |

| Vehicle Type | Higher-risk vehicles (luxury cars, high-performance cars) generally have higher insurance premiums. |

| Coverage Levels | Higher coverage levels (collision, comprehensive, uninsured motorist) provide greater protection but also increase premiums. |

| Age and Gender | Younger drivers and males often have higher premiums due to higher risk factors. |

| Credit Score | A good credit score can lead to lower premiums, while a poor credit score can increase premiums. |

| Location | Areas with higher accident rates or crime rates may have higher insurance premiums. |

Navigating the Transition to Florida Insurance

Moving to Florida and transitioning your car insurance can be a smooth process if you plan ahead and understand the requirements. This section provides a step-by-step guide to ensure a seamless transition and avoid any potential gaps in coverage.

Obtaining Quotes from Florida Insurance Providers

Once you’ve decided to switch to Florida car insurance, you’ll need to get quotes from various insurance providers. This allows you to compare prices, coverage options, and find the best deal that meets your needs.

- Start by gathering information: Before contacting insurance companies, gather information about your vehicle, driving history, and any relevant details like your age, occupation, and credit score. These factors can influence your insurance premiums.

- Use online comparison tools: Many websites allow you to compare quotes from multiple insurance companies simultaneously. This can save you time and effort in researching individual providers.

- Contact insurance companies directly: Reach out to insurance companies in Florida directly, either through their websites or by phone. Be prepared to provide the information you gathered in the first step to receive accurate quotes.

Ensuring a Smooth Transition and Avoiding Coverage Gaps

It’s crucial to ensure a smooth transition to Florida car insurance to avoid any gaps in coverage.

- Inform your current insurer: Notify your current insurance company about your move to Florida and your intention to cancel your policy. They can help you determine the cancellation date and any applicable refunds.

- Obtain proof of insurance: Before driving in Florida, ensure you have proof of insurance from your new provider. This could be in the form of a paper certificate or an electronic copy.

- Maintain continuous coverage: It’s vital to maintain continuous coverage throughout the transition process. This means ensuring your current policy remains active until your new Florida insurance policy takes effect.

Understanding the Process of Changing Insurance Providers

The process of changing car insurance providers in Florida is relatively straightforward.

- Select your new insurer: Choose the insurance provider that offers the best coverage and price based on your quotes and needs.

- Provide necessary information: Provide your new insurer with the required information, such as your driving history, vehicle details, and contact information.

- Pay your premium: Pay the initial premium for your new Florida car insurance policy. This will activate your coverage.

- Receive your policy documents: Your new insurance company will send you policy documents, including your insurance card, which you’ll need to keep in your vehicle.

Common Misconceptions about Out-of-State Insurance in Florida

Many people believe that they can simply keep their out-of-state car insurance when they move to Florida. However, this is not always the case, and there are several misconceptions surrounding out-of-state insurance in Florida. It’s important to understand the facts to avoid potential problems and ensure you have adequate coverage.

Understanding the Legality of Out-of-State Insurance in Florida

It’s crucial to know that driving with out-of-state insurance in Florida is not illegal. However, it’s essential to understand that your current policy might not fully comply with Florida’s specific requirements. While your out-of-state insurance might cover some aspects, it might not be sufficient for Florida’s minimum coverage requirements.

Common Misconceptions and Correct Information

Here are some common misconceptions about out-of-state insurance in Florida and the correct information:

| Misconception | Correct Information |

|---|---|

| My out-of-state insurance is automatically valid in Florida. | While your out-of-state insurance might be valid, it may not meet Florida’s minimum coverage requirements. |

| I can continue with my out-of-state insurance indefinitely. | Florida requires you to obtain a Florida driver’s license and register your vehicle within 30 days of moving to the state. This usually necessitates switching to Florida insurance. |

| My out-of-state insurance will cover me in Florida. | Your out-of-state insurance might cover some aspects, but it may not be sufficient for Florida’s minimum coverage requirements. |

| I can save money by keeping my out-of-state insurance. | While you might initially save money, you could face significant penalties if you don’t comply with Florida’s insurance requirements. |

Summary

In conclusion, having out-of-state car insurance in Florida can be a complex issue with potential advantages and disadvantages. While it might seem like a cost-saving option, it’s crucial to ensure that your policy meets Florida’s minimum requirements. If you’re considering using out-of-state insurance, thoroughly research the specific regulations and consult with an insurance professional to determine the best course of action. By carefully weighing your options and making informed decisions, you can navigate the intricacies of Florida’s insurance laws and enjoy peace of mind while driving in the Sunshine State.

Question & Answer Hub

What are the minimum car insurance requirements in Florida?

Florida requires drivers to carry a minimum of $10,000 in Personal Injury Protection (PIP) coverage, $10,000 in Property Damage Liability (PDL) coverage, and $10,000 in Bodily Injury Liability (BI) coverage per person and $20,000 per accident.

Can I use my out-of-state insurance for a short trip to Florida?

Yes, you can generally use your out-of-state insurance for short trips to Florida. However, make sure your policy meets Florida’s minimum requirements and that your insurance company covers you in Florida.

What happens if my out-of-state insurance doesn’t meet Florida’s requirements?

You could face fines, penalties, and even the suspension of your driving privileges. It’s crucial to ensure your out-of-state insurance meets Florida’s minimum requirements.

How do I transition to Florida car insurance?

Contact Florida insurance providers, get quotes, and choose a policy that meets your needs. Make sure to cancel your out-of-state policy once you’ve secured Florida insurance.