Can you have auto insurance from another state sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the world of auto insurance can be a complex process, especially when you’re considering insurance from a different state. This guide will delve into the nuances of residency requirements, legal considerations, and practical aspects of obtaining out-of-state insurance.

From understanding the intricacies of residency laws to exploring the potential benefits and challenges of out-of-state coverage, this exploration will provide valuable insights for individuals seeking to navigate this often-confusing territory. Whether you’re a frequent traveler, a recent transplant, or simply curious about the possibilities, this guide will equip you with the knowledge to make informed decisions about your auto insurance.

Understanding Residency Requirements

Residency is a crucial factor that insurance companies consider when determining your eligibility for auto insurance. It essentially refers to where you primarily live and spend most of your time. This concept is not just about your physical address, but rather your intention to make a particular location your permanent home.

Factors Considered for Residency

Insurance companies carefully analyze several factors to determine your residency for auto insurance purposes. These factors are crucial in establishing whether you are a resident of the state where you are seeking insurance.

- Your Primary Residence: This is your main home, where you spend most of your time and keep your belongings. Insurance companies often ask for proof of residency, such as utility bills, voter registration, or a lease agreement.

- Your Driver’s License: The state where your driver’s license is issued is often considered a strong indicator of your residency. If your driver’s license is from a different state than where you’re seeking insurance, it can raise questions about your residency.

- Your Vehicle Registration: The state where your vehicle is registered is also a significant factor. If your vehicle is registered in a different state than where you claim residency, it could be a red flag for insurance companies.

- Your Employment: The location of your primary employment can be another indicator of residency. If you work in a different state than where you claim residency, you might need to provide additional evidence to support your residency claim.

- Your Mail: The address where you receive your mail is often considered a good indicator of residency. If your mail is forwarded to a different address, it could raise questions about your residency.

Examples of Residency Questions

There are several situations that can raise questions about residency, which can complicate your insurance application.

- College Students: Students attending college in a different state than their permanent residence may face challenges proving residency for insurance purposes. They might need to provide additional documentation, such as a lease agreement for their college housing, to demonstrate their residency in that state.

- Military Personnel: Military personnel who are stationed in a different state than their permanent residence may also need to provide additional documentation to prove their residency. They may need to show their military orders, a lease agreement for their base housing, or other evidence to support their residency claim.

- Seasonal Residents: Individuals who spend a significant portion of the year in a different state than their permanent residence may need to provide additional documentation to demonstrate their residency in both states. For example, a person who owns a vacation home in a different state may need to show proof of residency in both states, depending on the length of time they spend at each location.

Legal and Regulatory Considerations: Can You Have Auto Insurance From Another State

While it might seem convenient to keep your auto insurance from your previous state, there are legal and regulatory aspects to consider. Driving with insurance from another state could have consequences that you might not anticipate.

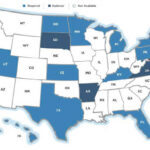

State Laws and Regulations

Each state has its own laws and regulations regarding auto insurance. These regulations often dictate the minimum coverage requirements, the types of insurance available, and the penalties for driving without proper coverage.

- Minimum Coverage Requirements: Every state has a minimum amount of liability coverage that drivers must carry. These requirements can vary significantly from state to state. For example, some states require higher liability limits for uninsured/underinsured motorist coverage than others. If you’re driving in a state with higher minimum coverage requirements than your home state, you could be in violation of the law.

- Insurance Company Licensing: Insurance companies must be licensed to operate in each state. This means that your home state insurance company might not be licensed to sell insurance in the state you’re driving in. If your insurer isn’t licensed in the state you’re driving in, your policy might not be valid, leaving you without coverage in the event of an accident.

- State-Specific Insurance Requirements: Some states have additional insurance requirements, such as personal injury protection (PIP) or no-fault insurance. If your home state insurance policy doesn’t meet these specific requirements, you could be in violation of the law.

Legal Implications of Driving with Out-of-State Insurance

Driving with out-of-state insurance can lead to several legal consequences, including:

- Fines and Penalties: If you’re caught driving without the minimum required insurance coverage in a state, you could face fines and penalties, including suspension of your driver’s license.

- Invalidation of Insurance Coverage: Your insurance company might refuse to cover you in the event of an accident if your policy isn’t valid in the state where the accident occurred.

- Difficulty in Filing Claims: If you need to file a claim, the insurance company might have difficulty processing it if your policy isn’t valid in the state where the accident occurred.

- Legal Liability: If you’re involved in an accident, you could be held personally liable for damages if your insurance coverage isn’t valid.

Practical Considerations for Obtaining Out-of-State Insurance

Obtaining auto insurance from another state can present both challenges and benefits. It’s crucial to weigh these factors carefully before making a decision.

This section will explore the practical considerations involved in obtaining out-of-state insurance, including the process, potential costs, and coverage differences.

Process of Obtaining Out-of-State Insurance

Securing auto insurance from another state generally involves a straightforward process, but it’s essential to understand the specific requirements and procedures.

The process typically involves the following steps:

- Contacting insurance companies in the desired state. You can do this online, over the phone, or by visiting their offices.

- Providing your personal information, including your driver’s license, vehicle registration, and driving history.

- Providing information about your vehicle, such as its make, model, year, and value.

- Receiving quotes from multiple insurance companies to compare prices and coverage options.

- Choosing the policy that best meets your needs and budget.

- Paying your premium and receiving your insurance card.

Cost and Coverage Differences

Out-of-state insurance policies may offer different coverage options and pricing compared to in-state policies.

Here’s a comparison of potential cost and coverage differences:

- Cost: Out-of-state insurance premiums may be higher or lower than in-state premiums, depending on factors such as the state’s insurance regulations, the insurer’s risk assessment, and the driver’s driving history. For example, a driver with a clean driving record might find lower premiums in a state with fewer accidents and lower insurance costs overall.

- Coverage: The specific coverage options available and their limits may vary between states. For instance, some states require higher minimum liability coverage than others. Additionally, certain coverage options, such as uninsured/underinsured motorist coverage, may be more comprehensive or limited in certain states.

Scenarios and Examples

Understanding when and why you might need out-of-state insurance is crucial. Let’s explore scenarios where obtaining out-of-state insurance could be advantageous or even necessary.

Situations Where Out-of-State Insurance Might Be Advantageous

This section explores situations where obtaining out-of-state insurance might be a beneficial decision.

- Lower Premiums: Insurance rates vary significantly across states due to factors like competition, regulations, and risk profiles. You might find more affordable rates in another state, even if you’re living in a different one. For example, if you live in a state with high insurance costs, you might find better rates in a neighboring state with a more competitive market.

- Specialized Coverage: Some states offer unique or specialized insurance coverages that might not be available in your current state. For instance, if you’re a high-risk driver, you might find a state that offers more lenient insurance requirements or specialized coverage options.

- Limited Coverage in Your State: If your state has limited coverage options, you might need to look elsewhere. For example, if you own a classic car or a high-value vehicle, you might find more comprehensive coverage in a state with a broader range of insurance providers.

Scenarios Where Obtaining Out-of-State Insurance Might Be Necessary

This section explores scenarios where obtaining out-of-state insurance might be a necessity.

- Relocation: If you’re relocating to another state, you’ll need to obtain insurance in that state. Even if you’re only temporarily living in another state, you might need to obtain out-of-state insurance, depending on the duration of your stay and your state’s regulations.

- Military Deployment: Military personnel often have to obtain out-of-state insurance when they’re deployed to a different state.

- Travel: If you’re driving a vehicle in another state for an extended period, you might need to obtain out-of-state insurance. For example, if you’re traveling across state lines for a long road trip, you might need to obtain temporary insurance in the states you’re driving through.

Insurance Requirements Based on Specific Circumstances, Can you have auto insurance from another state

This section highlights how insurance requirements can vary based on individual circumstances.

- Driving Record: Your driving record can significantly impact your insurance rates, and different states have different regulations regarding driving offenses. For example, a state with a high tolerance for minor traffic violations might offer lower rates to drivers with a few offenses, compared to a state with stricter penalties for similar offenses.

- Vehicle Type: The type of vehicle you own can influence your insurance rates. For instance, states with high rates of vehicle theft might charge higher premiums for luxury vehicles, while states with lower theft rates might offer more affordable rates.

- Age and Gender: Insurance rates can vary based on age and gender. For example, young drivers often face higher premiums due to their higher risk profile, while older drivers might qualify for discounts.

Best Practices and Recommendations

Navigating the process of obtaining auto insurance from another state can seem complicated, but with the right approach, it can be a smooth transition. Understanding the nuances of residency requirements, legal and regulatory considerations, and practical factors involved is crucial for a successful outcome. Here are some best practices and recommendations to guide you through this process.

Factors to Consider Before Obtaining Out-of-State Insurance

It’s essential to carefully evaluate your circumstances before pursuing out-of-state insurance. Several factors can influence your decision and impact the process. Here’s a list of key considerations:

- Your residency status: Define your primary residence and determine if you meet the residency requirements of the state where you intend to obtain insurance. This often involves factors like your driver’s license, voter registration, and length of stay.

- Your driving history: Consider your driving record and its impact on insurance rates in both your current and the potential new state. A clean driving record may lead to more favorable rates, while a history of violations could result in higher premiums.

- Your vehicle: The type, age, and value of your vehicle can influence insurance costs in different states. Consider factors like make, model, and safety features, as they may affect your premiums.

- Your insurance needs: Evaluate your coverage requirements based on your individual circumstances, including your commute, driving habits, and potential risks. This may involve comparing coverage options and limits offered in both your current and the potential new state.

- The cost of insurance: Obtain quotes from multiple insurance companies in both your current and the potential new state to compare premiums and coverage options. Consider factors like discounts, coverage limits, and deductible amounts.

- The availability of insurance: Check if the insurance company you’re interested in offers coverage in the state you’re planning to move to. Not all companies operate in every state, so research is crucial.

Checklist of Documents and Information

To successfully obtain out-of-state insurance, gather the necessary documents and information. This checklist can help you stay organized:

- Proof of residency: Provide documents like a driver’s license, voter registration card, utility bills, or lease agreement to demonstrate your residency in the new state.

- Driving history: Obtain a copy of your driving record from your current state’s Department of Motor Vehicles. This document will include details of any violations, accidents, or other incidents.

- Vehicle information: Gather information about your vehicle, including its make, model, year, VIN, and current mileage. This information will be used to determine coverage and premiums.

- Current insurance policy details: Provide details of your current insurance policy, including your coverage limits, deductible amounts, and policy number. This will help the new insurer understand your current coverage and potentially transfer any applicable discounts.

- Personal information: Provide your full name, address, phone number, date of birth, and Social Security number for identification and policy setup.

Final Conclusion

The decision to obtain auto insurance from another state is a multifaceted one, requiring careful consideration of legal, practical, and personal factors. While it may seem like a straightforward process, understanding the intricacies of residency requirements, state regulations, and potential coverage differences is crucial. By navigating these considerations with diligence and seeking professional guidance when needed, you can ensure that your auto insurance provides adequate protection and meets your specific needs.

Popular Questions

Can I get a lower rate on car insurance if I get it from another state?

It’s possible, but not guaranteed. Rates vary based on factors like your driving record, vehicle type, and the state’s insurance market. You’ll need to compare quotes from multiple insurers in both your current state and the state you’re considering.

What if I’m only in another state for a short period?

Most states have temporary insurance options for visitors, such as non-resident insurance or short-term coverage. Check with your current insurer or a local agent to see what’s available.

What if I move to a new state but keep my car registered in the old state?

This could be problematic. Most states require you to register your vehicle in the state you reside in. Check your state’s DMV for specific regulations.

Can I use my out-of-state insurance if I get into an accident in a different state?

Generally, yes. However, it’s important to understand the coverage limits and any specific state laws that might apply. It’s always best to be aware of your policy details and contact your insurer in case of an accident.