Can you get car insurance in a different state sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Moving to a new state can be an exciting adventure, but it also comes with practical considerations, including car insurance. While you might think that your current insurance policy will follow you wherever you go, the reality is that car insurance is primarily regulated at the state level. This means that you’ll need to understand the specific requirements and regulations of your new state to ensure you have the right coverage.

Navigating the complexities of car insurance in a different state can feel like driving through an unfamiliar city without a map. This guide will provide you with the necessary information to navigate this process smoothly. We’ll explore the key factors that determine your eligibility for insurance, the different coverage options available, and the steps you need to take to secure a policy. Whether you’re a student relocating for college, a remote worker seeking new horizons, or simply moving for a fresh start, this comprehensive guide will equip you with the knowledge you need to make informed decisions about your car insurance.

Understanding State Residency Requirements

Before you can get car insurance in a new state, you need to establish residency. This is crucial because your car insurance premiums are often based on the state’s risk factors, such as accident rates and the cost of healthcare.

Residency requirements vary by state, but generally, you need to prove that you live in the state and intend to stay there for an extended period.

Determining Residency

The following factors are typically considered when determining residency:

- Driver’s License: Having a driver’s license issued by the state you claim residency in is a strong indicator of your residency status.

- Address: Your primary residence address should be in the state where you’re seeking insurance. This could be your home, apartment, or even a dorm if you’re a student.

- Length of Stay: You’ll likely need to demonstrate that you’ve lived in the state for a certain period. This could be a few months or even a year, depending on the state’s regulations.

Residency Ambiguity

Residency can be ambiguous in certain situations, for example:

- Students Attending College Out of State: Students attending college out of state may have difficulty establishing residency in the state where they are attending school. They may still be considered residents of their home state if they maintain a permanent address there and intend to return after graduation.

- Individuals Working Remotely in a Different State: Individuals who work remotely may find themselves in a situation where they are living in one state but working in another. In such cases, it’s important to consult with an insurance agent to determine which state’s residency requirements apply.

Insurance Requirements in Different States

Each state in the United States has its own set of regulations regarding mandatory car insurance coverage. These requirements are designed to protect drivers and their passengers in case of accidents, ensuring that financial responsibility is taken care of.

Minimum Liability Limits

The minimum liability limits represent the minimum amount of coverage required by law in each state. These limits specify the maximum amount an insurance company will pay for damages caused by a policyholder in an accident.

The table below shows the minimum liability limits for bodily injury and property damage in various states.

| State | Bodily Injury per Person | Bodily Injury per Accident | Property Damage |

|---|---|---|---|

| California | $15,000 | $30,000 | $5,000 |

| Texas | $30,000 | $60,000 | $25,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| Illinois | $20,000 | $40,000 | $15,000 |

Uninsured/Underinsured Motorist Coverage

Uninsured/underinsured motorist (UM/UIM) coverage protects you in case you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages. This coverage pays for your medical expenses, lost wages, and property damage.

Many states require a minimum amount of UM/UIM coverage, but the specific requirements vary. For example, in California, drivers are required to have at least $15,000 in UM/UIM coverage per person and $30,000 per accident. However, other states, like Texas, allow drivers to opt out of UM/UIM coverage altogether.

Other Mandatory Coverages

In addition to liability and UM/UIM coverage, some states require other types of car insurance coverage, such as:

- Personal Injury Protection (PIP): PIP coverage covers medical expenses, lost wages, and other expenses for you and your passengers, regardless of who is at fault in an accident. This type of coverage is mandatory in states like Florida and Michigan.

- Collision Coverage: Collision coverage pays for repairs or replacement of your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional in most states, but it is usually required if you have a car loan.

- Comprehensive Coverage: Comprehensive coverage pays for repairs or replacement of your vehicle if it is damaged by something other than an accident, such as theft, vandalism, or natural disasters. This coverage is also optional in most states, but it is usually required if you have a car loan.

Consequences of Driving Without Required Insurance

Driving without the required car insurance in a specific state can result in serious consequences, including:

- Fines and Penalties: You may face hefty fines and penalties, which can vary depending on the state and the severity of the violation. In some cases, these fines can reach hundreds or even thousands of dollars.

- License Suspension or Revocation: Your driver’s license may be suspended or revoked if you are caught driving without insurance. This can make it difficult or impossible to drive legally, and you may have to pay reinstatement fees to get your license back.

- Impounded Vehicle: Your vehicle may be impounded if you are caught driving without insurance. You will have to pay towing and storage fees to get your vehicle back.

- Jail Time: In some states, driving without insurance can even lead to jail time, especially if you are involved in an accident that results in injuries or death.

- Financial Responsibility: If you are involved in an accident without insurance, you will be personally liable for all damages and injuries caused. This can result in significant financial losses, including medical bills, property damage, and legal fees.

It is crucial to understand the specific car insurance requirements in your state to avoid legal and financial consequences. Contact your insurance agent or the Department of Motor Vehicles (DMV) in your state for more information.

Obtaining Car Insurance in a Different State: Can You Get Car Insurance In A Different State

Moving to a new state can be exciting, but it also comes with the responsibility of securing car insurance that meets the requirements of your new residence. Navigating the process of obtaining car insurance in a different state can seem daunting, but with proper planning and understanding of the steps involved, it can be a smooth transition.

Securing Car Insurance in a New State

Once you have established residency in a new state, you’ll need to obtain car insurance that complies with the state’s regulations. Here’s a step-by-step guide to ensure a seamless transition:

- Notify Your Current Insurer: Inform your current insurance provider about your move and the date you will be changing your residency. This is crucial to avoid any lapse in coverage and to ensure a smooth transition to your new policy.

- Gather Necessary Information: Before contacting new insurance providers, gather essential information, including your driver’s license, vehicle registration, and proof of residency in the new state. This will streamline the quote process and ensure accurate coverage.

- Compare Quotes from Multiple Insurers: Research and compare quotes from different insurance companies operating in your new state. Online comparison tools can be helpful in finding the best rates and coverage options.

- Consider Factors Affecting Rates: Keep in mind that factors like your driving history, vehicle type, and the state’s insurance regulations can significantly impact your rates.

- Choose a Policy and Pay Your Premium: Once you’ve selected the policy that best suits your needs, provide the necessary information to finalize your coverage and pay your premium.

- Receive Your Policy Documents: Your new insurer will send you the policy documents, including your insurance card, which you’ll need to carry while driving.

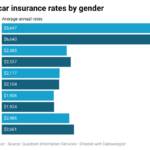

Factors Affecting Insurance Rates in Different States

Car insurance premiums can vary significantly from state to state due to a multitude of factors. Understanding these factors can help you make informed decisions about your insurance needs and potentially save money.

Factors Influencing Car Insurance Premiums

A range of factors can impact the cost of car insurance in different states. Some of the key factors include:

- Driving History: Your driving record is a major determinant of your insurance premium. A clean driving record with no accidents or violations will typically result in lower premiums. Conversely, having a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Vehicle Type: The type of car you drive plays a crucial role in determining your insurance costs. Luxury cars, sports cars, and vehicles with high repair costs tend to have higher insurance premiums. On the other hand, smaller, less expensive cars often have lower premiums.

- Age: Insurance companies generally consider younger drivers to be riskier than older drivers. Young drivers, particularly those under 25, often pay higher premiums due to their lack of experience and higher risk of accidents. As drivers age and gain experience, their premiums typically decrease.

- Location: The state and specific location where you live can significantly influence your car insurance rates. States with higher population density, traffic congestion, and higher rates of accidents tend to have higher insurance premiums. Urban areas, for example, often have higher premiums compared to rural areas.

- Credit Score: In some states, insurance companies may use your credit score as a factor in determining your premium. Individuals with good credit scores may qualify for lower premiums, while those with poor credit may face higher rates.

- Coverage Levels: The amount of coverage you choose will impact your insurance premium. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will generally result in higher premiums.

- State Regulations: State laws and regulations can influence insurance rates. Some states have stricter regulations regarding coverage requirements or minimum liability limits, which can impact insurance premiums.

State-Specific Insurance Rate Comparisons

Here is a table comparing average car insurance rates in different states based on various demographics:

| State | Average Annual Premium (All Drivers) | Average Annual Premium (Young Drivers) | Average Annual Premium (Drivers with Accidents) |

|---|---|---|---|

| California | $2,100 | $3,500 | $2,800 |

| Florida | $2,300 | $4,000 | $3,200 |

| Texas | $1,800 | $3,000 | $2,500 |

| New York | $2,500 | $4,200 | $3,500 |

| Pennsylvania | $1,900 | $3,200 | $2,600 |

Note: These are average premiums and actual rates may vary based on individual factors.

Potential Challenges of Obtaining Insurance in a Different State

Moving to a new state and obtaining car insurance can sometimes be a challenging experience, especially if you have a less-than-perfect driving history or limited driving experience. Factors like prior claims history, state-specific regulations, and the insurance market dynamics in your new state can significantly impact the availability and cost of your car insurance.

Impact of Prior Claims History

Your prior claims history plays a significant role in determining your insurance rates. If you have a history of accidents or claims, insurers in your new state may perceive you as a higher risk and charge you higher premiums. This is because insurers use your past driving behavior to predict your future risk of filing a claim.

State-Specific Regulations and Insurance Market Dynamics, Can you get car insurance in a different state

State-specific regulations and insurance market dynamics can also impact your insurance rates. Each state has its own set of regulations governing car insurance, including minimum coverage requirements, insurance rates, and coverage options. For example, some states have a more competitive insurance market with lower rates, while others have fewer insurance companies and higher rates. Additionally, the availability of certain coverage options, such as uninsured motorist coverage, may vary from state to state.

Strategies for Overcoming Challenges

Here are some strategies you can use to overcome these challenges and secure affordable car insurance in your new state:

- Shop around and compare quotes from multiple insurers: It’s important to shop around and compare quotes from multiple insurers to find the best rates. You can use online comparison websites or contact insurers directly to get quotes.

- Maintain a clean driving record: Avoid accidents and traffic violations to maintain a clean driving record. A clean driving record will help you qualify for lower insurance rates.

- Consider increasing your deductible: Increasing your deductible can help lower your premiums. However, be sure you can afford to pay the deductible if you need to file a claim.

- Bundle your insurance policies: Bundling your car insurance with other insurance policies, such as homeowners or renters insurance, can help you save money on your premiums.

- Ask about discounts: Many insurers offer discounts for good students, safe drivers, and other factors. Be sure to ask about any discounts that may apply to you.

Last Recap

Obtaining car insurance in a new state can be a straightforward process if you understand the requirements and regulations. By taking the time to research the insurance landscape of your new state, comparing quotes from multiple insurers, and ensuring you meet the necessary residency criteria, you can secure affordable and comprehensive coverage. Remember, your insurance is your safety net on the road, so prioritize finding the right policy that protects you and your vehicle.

Question Bank

What if I’m only living in a different state temporarily?

If you’re only living in a different state temporarily, you may be able to keep your current insurance policy. However, you should contact your insurance company to confirm if your policy is valid in the new state. You may need to purchase additional coverage or adjust your policy to meet the requirements of the new state.

What if I have a poor driving record?

If you have a poor driving record, you may find it more challenging to obtain car insurance in a new state. Insurance companies will review your driving history, including accidents, tickets, and violations, when determining your eligibility and rates. It’s important to be honest about your driving record and provide any necessary documentation to support your claims.

Can I get car insurance in a different state if I’m not a resident?

It may be possible to get car insurance in a different state if you’re not a resident, but it will depend on the specific requirements of the insurer. Some insurers may require you to have a driver’s license in the state where you’re seeking insurance, while others may have different criteria. It’s best to contact insurers directly to inquire about their policies.