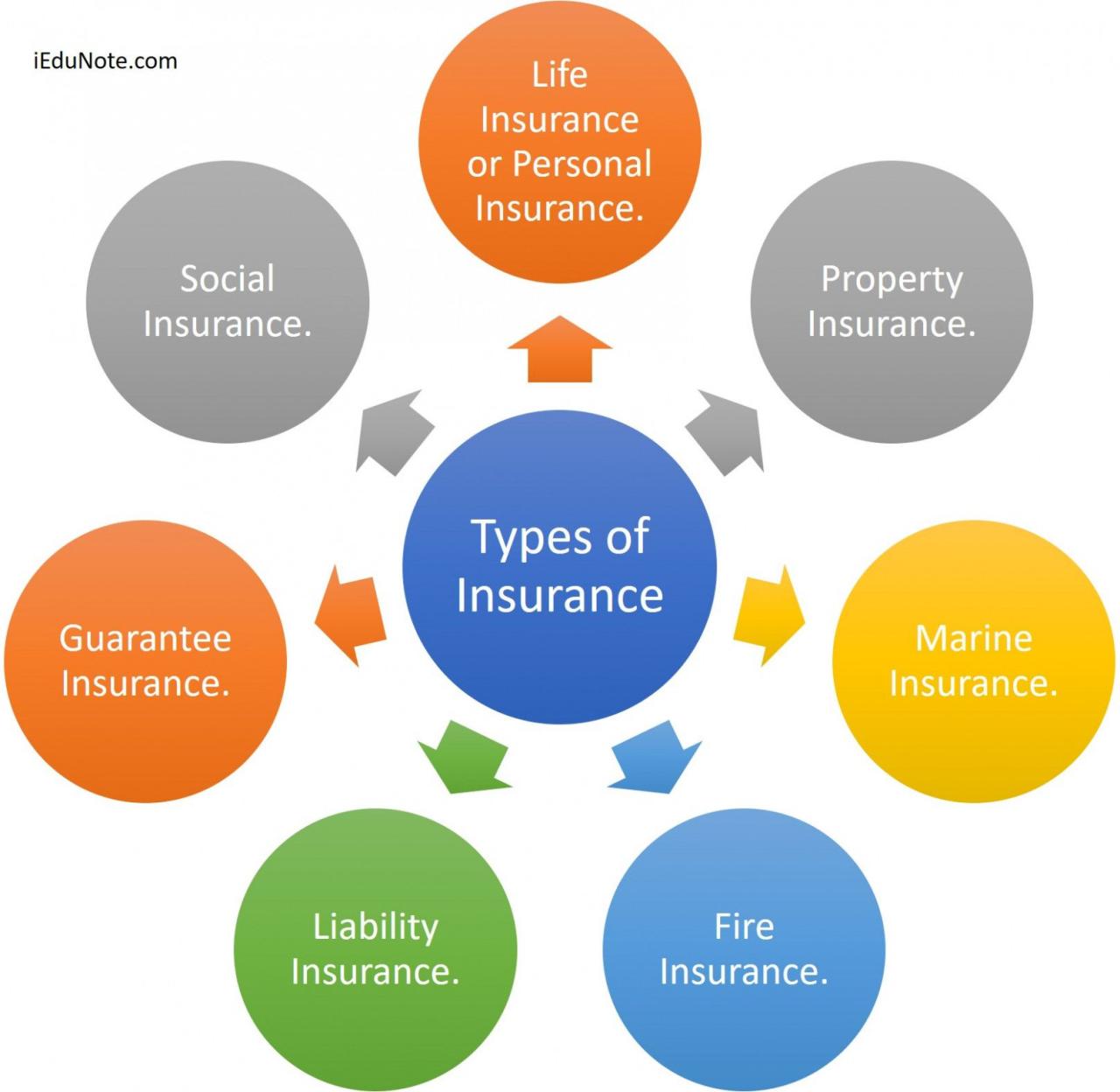

Can I use insurance from another state? This question arises frequently, particularly for those who travel, relocate, or conduct business across state lines. The answer isn’t always straightforward, as insurance regulations vary significantly between states, influencing the coverage and validity of policies. This article delves into the complexities of using insurance from another state, exploring the legal frameworks, residency requirements, and potential consequences.

Understanding the differences in state insurance laws is crucial. Each state has its own set of regulations governing insurance companies, policy requirements, and coverage limitations. This means that a policy issued in one state may not be fully recognized or enforceable in another. For instance, a car insurance policy purchased in California may not provide adequate coverage for an accident in Texas, where minimum liability limits are higher. This highlights the importance of carefully considering the specific needs and requirements of each state when using insurance across state borders.

Understanding State Insurance Regulations

Insurance regulations vary significantly from state to state, impacting how insurance companies operate and the policies they offer. Understanding these differences is crucial for consumers seeking coverage, as it influences factors like premiums, coverage limits, and available benefits.

State Insurance Licensing and Regulation

Each state has its own insurance department responsible for licensing insurance companies and regulating their operations. These departments ensure that companies meet specific financial solvency requirements and adhere to consumer protection regulations.

- Licensing Requirements: Insurance companies must obtain a license from each state where they intend to sell policies. This process involves meeting specific financial and operational standards, such as maintaining adequate capital reserves and demonstrating a sound business model.

- Regulatory Oversight: State insurance departments monitor licensed companies to ensure they comply with regulations, including those related to pricing, underwriting, and claims handling. They conduct regular audits and investigations to prevent unfair practices and protect policyholders’ interests.

- Consumer Protection Laws: State insurance laws also include provisions designed to protect consumers, such as requirements for clear and concise policy language, fair claims handling procedures, and dispute resolution mechanisms.

Examples of State-Specific Insurance Policy Variations

State laws can influence various aspects of insurance policies, leading to differences in coverage, benefits, and pricing. Here are some examples:

- Auto Insurance: States may have different minimum coverage requirements for liability, collision, and comprehensive insurance. Some states also have unique provisions, such as no-fault insurance systems, which dictate how claims are handled after an accident.

- Health Insurance: State regulations can impact the availability of health insurance plans, including the types of coverage offered, premium costs, and benefit structures. For example, some states have mandated coverage for specific conditions or services, while others have restrictions on pre-existing condition exclusions.

- Homeowners Insurance: State laws can influence coverage for natural disasters, such as earthquakes or hurricanes. Some states may have specific requirements for flood insurance, while others offer additional coverage for specific perils not typically included in standard policies.

Using Insurance from Another State While Traveling

When traveling outside of your home state, it’s essential to understand how your insurance policy will cover you in case of an accident or emergency. Your auto, health, and homeowners insurance policies may provide varying levels of coverage while you’re away.

Coverage Provided by Insurance Policies While Traveling

Your insurance policy’s coverage while traveling outside your home state depends on the specific terms of your policy. Most insurance policies provide at least some coverage outside of your home state, but the extent of that coverage can vary significantly.

- Auto Insurance: Your auto insurance policy generally covers you for accidents and injuries in other states. However, the specific coverage you have may differ from state to state. For example, some states have mandatory minimum coverage requirements that are higher than others.

- Health Insurance: Your health insurance policy will typically cover you for medical expenses incurred while traveling outside of your home state. However, you may need to file a claim with your insurer and provide documentation of your travel.

- Homeowners Insurance: Your homeowners insurance policy may provide some coverage for your belongings while you’re traveling. However, this coverage is often limited and may not cover everything.

Limitations of Using Out-of-State Insurance

While your insurance policy may provide some coverage while traveling outside your home state, there are several potential limitations to consider:

- Coverage Limits: Your insurance policy may have specific coverage limits for accidents or emergencies that occur outside of your home state. These limits may be lower than the coverage you have in your home state.

- State-Specific Laws: Each state has its own set of laws regarding insurance coverage. Your policy may not be fully compliant with the laws of the state you are traveling to, which could limit your coverage.

- Claims Process: Filing a claim with your insurance company while traveling outside of your home state can be more complex. You may need to provide additional documentation, such as proof of travel or identification.

- Availability of Providers: Your insurance company may not have a network of providers in the state you are traveling to. This could make it difficult to find a doctor or hospital that accepts your insurance.

Examples of Scenarios Where Out-of-State Insurance May Be Sufficient or Insufficient

- Sufficient Coverage: If you are traveling to a state with similar insurance laws to your home state, and your policy has adequate coverage limits, you may be adequately covered by your out-of-state insurance. For example, if you are driving your own car in a neighboring state with similar auto insurance laws, your policy should provide sufficient coverage.

- Insufficient Coverage: If you are traveling to a state with very different insurance laws or your policy has low coverage limits, you may not be adequately covered by your out-of-state insurance. For example, if you are involved in a serious accident in a state with higher mandatory minimum coverage requirements, your policy may not provide enough coverage to meet the legal requirements.

Residency and Insurance Eligibility: Can I Use Insurance From Another State

Residency is a crucial factor in determining your insurance eligibility and rates. It’s not just about where you live; it’s about establishing a permanent home in a specific state. Insurance companies carefully evaluate residency to ensure they’re covering individuals who are actually living and paying taxes in the state where they’re seeking coverage.

Determining Residency

Residency is determined by a combination of factors. Insurance companies typically consider the following:

- Primary Residence: The state where you own or rent your primary residence is usually the primary indicator of your residency.

- Voter Registration: Registering to vote in a state is a strong indication of residency, as it signifies your intent to participate in the political process of that state.

- Driver’s License: Having a driver’s license issued by a specific state also points towards residency, as it’s required for driving legally in that state.

- Employment: Your place of employment can be a significant factor in determining residency, especially if you work full-time in a particular state.

- Tax Returns: Filing state income taxes in a specific state is another clear indicator of residency, as it demonstrates your financial ties to that state.

- Bank Accounts: Having bank accounts and financial institutions primarily located in a state can also be considered evidence of residency.

- Other Factors: Other factors that can be considered include your mail address, utility bills, and memberships in local organizations.

Establishing Residency in a New State

To establish residency in a new state, you typically need to demonstrate that you’ve moved there with the intention of staying permanently. This usually involves:

- Changing your address: This includes updating your driver’s license, voter registration, and other important documents.

- Finding a permanent residence: This could be renting or buying a home, and establishing it as your primary residence.

- Obtaining a driver’s license: Getting a driver’s license in your new state is a key step in establishing residency.

- Registering to vote: Registering to vote in your new state demonstrates your intent to be a part of the community.

- Paying taxes: Filing state income taxes in your new state is a crucial step in establishing residency.

Residency and Insurance Eligibility, Can i use insurance from another state

Residency plays a significant role in insurance eligibility and rates. Insurance companies typically only offer coverage to individuals who reside in the state where they’re seeking insurance. For instance, you might not be eligible for car insurance in California if you don’t reside there.

Residency and Insurance Rates

Residency also affects insurance rates. Insurance premiums are often based on factors like the cost of living, risk factors, and the frequency of claims in a particular state. For example, car insurance rates in a state with a high number of accidents and a higher cost of car repairs might be higher than in a state with lower accident rates and lower repair costs.

Moving to a New State and Changing Insurance

Moving to a new state often necessitates changes to your insurance coverage. State insurance regulations vary, and your existing policies may not be valid or sufficient in your new location. Understanding the process of transferring insurance coverage, potential policy updates, and how to ensure a smooth transition is crucial for maintaining adequate protection.

Transferring Insurance Coverage

When moving to a new state, you’ll need to inform your insurance providers about your change of address. This allows them to assess your new location’s risk factors and determine if your current policies need adjustments. You might need to update your policies to comply with the new state’s regulations, or you might need to purchase new coverage altogether.

Updating Policies or Purchasing New Coverage

Your existing insurance policies may not be valid in your new state. This is especially true for auto insurance, as state regulations regarding minimum coverage requirements and liability limits differ significantly. For example, your existing auto insurance policy might not cover you adequately in a new state with stricter liability requirements.

Tips for a Smooth Transition

- Contact your insurance providers as soon as possible. Inform them about your move and the date you’ll be relocating. This allows them to start the process of evaluating your new location and determining any necessary policy changes.

- Gather all relevant documentation. This includes your driver’s license, vehicle registration, proof of residency, and any other documents that might be required by your insurance providers.

- Review your current policies. Compare your existing coverage with the minimum requirements in your new state. If you find any gaps in coverage, consider purchasing additional policies or adjusting your existing ones.

- Shop around for new insurance. Don’t assume your current provider offers the best rates in your new state. Get quotes from multiple insurers to ensure you’re getting the most competitive rates and coverage options.

Reciprocity Agreements and Insurance Coverage

Reciprocity agreements are a crucial aspect of insurance coverage, particularly when dealing with policies across state lines. These agreements allow individuals to maintain their insurance coverage while traveling or moving to a new state.

Reciprocity agreements essentially create a network of mutual recognition between states. These agreements ensure that insurance policies issued in one state are honored in another, preventing individuals from having to purchase new policies or face gaps in coverage.

Types of Reciprocity Agreements

Reciprocity agreements can vary significantly based on the type of insurance involved. Common types of agreements include:

- Motor Vehicle Insurance: These agreements are perhaps the most common and ensure that your auto insurance policy will be recognized in another state, allowing you to drive legally and have coverage in case of an accident.

- Workers’ Compensation Insurance: These agreements are important for employers who operate in multiple states. They ensure that employees are covered under the workers’ compensation laws of the state where they are injured, regardless of where the employer is headquartered.

- Commercial Insurance: Reciprocity agreements for commercial insurance can vary greatly depending on the specific type of business and the state in question. Some agreements may cover liability insurance, while others may cover property insurance or other specific types of coverage.

Consequences of Using Unlicensed Insurance

Driving or operating a business with insurance that is not authorized in your state can have serious legal and financial consequences. You may face fines, penalties, and even the denial of your claims.

Potential Legal and Financial Consequences

Using unlicensed insurance can result in a variety of legal and financial consequences. These include:

- Fines and Penalties: Most states impose fines on individuals and businesses operating with unlicensed insurance. The amount of the fine can vary depending on the state and the specific violation.

- Denial of Claims: If you are involved in an accident and your insurance is not licensed in the state where the accident occurred, your claim may be denied. This means you will be responsible for all costs associated with the accident, including repairs, medical bills, and legal fees.

- Suspension of License: In some cases, driving with unlicensed insurance can lead to the suspension of your driver’s license.

- Criminal Charges: In some states, using unlicensed insurance may be considered a criminal offense, leading to fines, jail time, or both.

Risks Associated with Unlicensed Insurance

Using unlicensed insurance can put you at significant risk, especially if you are involved in an accident.

- Lack of Coverage: Unlicensed insurance may not provide the coverage you need in the event of an accident. This could leave you financially responsible for significant expenses, such as medical bills, property damage, and legal fees.

- Limited Legal Representation: If you are involved in a legal dispute, your unlicensed insurance provider may not provide you with adequate legal representation. This can make it difficult to protect your rights and interests.

- Financial Instability: Unlicensed insurance providers may be financially unstable, increasing the risk that they will not be able to pay claims.

Examples of Situations Where Unlicensed Insurance Could Lead to Penalties

Here are some examples of situations where using unlicensed insurance could lead to penalties or claim denial:

- Car Accident: If you are involved in a car accident in a state where your insurance is not licensed, your claim may be denied. You could be held responsible for all damages and injuries, even if you were not at fault.

- Business Liability: If you operate a business with unlicensed insurance, you may be held liable for any damages or injuries that occur on your property.

- Workers’ Compensation: If you are injured at work and your employer has unlicensed workers’ compensation insurance, you may not be able to receive benefits.

Conclusive Thoughts

Navigating the intricacies of using insurance from another state requires a comprehensive understanding of state regulations, residency requirements, and potential legal implications. While insurance reciprocity agreements can offer some relief, it’s essential to consult with insurance professionals and state authorities to ensure compliance and adequate coverage. By understanding the nuances of this complex topic, individuals can make informed decisions to protect themselves and their assets when traveling, relocating, or conducting business across state lines.

FAQ Overview

Can I use my current insurance policy if I’m just visiting another state for a short trip?

Generally, yes, your current insurance policy will likely provide some coverage while you’re traveling in another state. However, it’s important to review your policy’s terms and conditions to understand any limitations or exclusions that may apply. For example, some policies may have specific coverage restrictions for certain types of accidents or emergencies.

What happens if I have an accident in another state and my insurance is from a different state?

If you have an accident in another state and your insurance is from a different state, your insurer will still be obligated to handle your claim. However, they may need to work with the insurance commissioner or other authorities in the state where the accident occurred to ensure compliance with local regulations. It’s also important to be aware that your insurance policy may have specific provisions related to out-of-state accidents, such as coverage limits or deductible requirements.