Can I insure my car in a different state? This question arises frequently for individuals relocating or planning to drive their car in a new state. Navigating the intricacies of car insurance across state lines can seem daunting, but understanding the process and key considerations can make the transition smooth.

The answer to this question hinges on several factors, including your current insurance policy, the state you are moving to, and the type of coverage you need. State insurance regulations vary widely, affecting the cost and availability of coverage, as well as the minimum requirements for drivers.

Understanding State-Specific Insurance Requirements

Car insurance is a necessity for vehicle owners, but the specific requirements and costs can vary significantly depending on the state you reside in. Understanding the factors that influence car insurance rates and the key differences in coverage requirements across states is crucial for making informed decisions about your insurance needs.

Factors Influencing Car Insurance Rates

The cost of car insurance is determined by a complex interplay of factors, with some being more influential than others. Here’s a breakdown of the key elements:

- Driving Record: Your driving history is a major factor in determining your insurance rates. A clean record with no accidents or traffic violations will result in lower premiums, while a history of accidents or violations will lead to higher rates.

- Vehicle Type: The type of vehicle you drive plays a significant role in insurance costs. High-performance cars, luxury vehicles, and expensive vehicles are generally more expensive to insure due to their higher repair costs and greater risk of theft.

- Age and Gender: Younger drivers, especially those under 25, are statistically more likely to be involved in accidents. Insurance companies typically charge higher premiums for younger drivers due to this increased risk. Similarly, gender can also be a factor, with some insurers charging higher rates for young men.

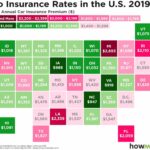

- Location: Where you live can significantly impact your insurance rates. States with high traffic congestion, high crime rates, and more frequent accidents generally have higher insurance premiums. Urban areas often have higher insurance rates compared to rural areas.

- Credit Score: In many states, your credit score can be used to determine your insurance rates. A good credit score is generally associated with responsible financial behavior, which insurance companies view as a positive indicator.

- Coverage Levels: The amount of coverage you choose can significantly affect your premiums. Higher coverage limits, such as higher liability limits or comprehensive and collision coverage, will typically result in higher premiums.

- Discounts: Insurance companies offer various discounts that can reduce your premiums. These discounts may be available for safe driving, good student records, multi-car policies, and other factors.

State-Specific Coverage Requirements

While the core elements of car insurance are generally the same across states, there are key differences in the specific coverage requirements and regulations.

- Liability Coverage: All states require liability coverage, which protects you financially if you cause an accident that injures another person or damages their property. The minimum liability limits vary by state, with some states requiring higher limits than others.

- Personal Injury Protection (PIP): PIP coverage, also known as no-fault insurance, covers your own medical expenses and lost wages in case of an accident, regardless of who is at fault. Some states require PIP coverage, while others make it optional.

- Uninsured Motorist Coverage: This coverage protects you if you are involved in an accident with an uninsured or underinsured driver. It covers your medical expenses and property damage. While most states require uninsured motorist coverage, the specific requirements and limits can vary.

- Collision Coverage: Collision coverage pays for repairs to your vehicle if it is damaged in an accident, regardless of who is at fault. This coverage is optional in most states.

- Comprehensive Coverage: Comprehensive coverage protects your vehicle against damage caused by events other than collisions, such as theft, vandalism, or natural disasters. This coverage is also optional in most states.

Moving to a New State with Your Car

Congratulations on your move! It’s exciting to embark on a new chapter in a different state. But before you hit the road, you’ll need to consider how your car insurance will be affected by your relocation.

Notifying Your Current Insurer

It’s essential to inform your current insurer about your move as soon as possible. This ensures your coverage remains active and you avoid any potential issues with your policy. You can typically do this by:

- Calling your insurance company directly and providing your new address and the date of your move.

- Logging into your online account and updating your contact information.

- Sending a written notification via mail or email.

Transferring Your Existing Policy

In some cases, you might be able to transfer your existing car insurance policy to your new state. This depends on the specific insurance company and the regulations of your new state. However, even if your insurer operates in both states, there are a few factors to consider:

- State-Specific Requirements: Each state has its own unique car insurance requirements. Your current policy might not fully comply with the new state’s regulations. For example, your current coverage might not meet the minimum liability limits required in your new state.

- Coverage Rates: Insurance premiums are influenced by a range of factors, including the state you reside in. Your current insurer might adjust your rates based on the new state’s risk profile and driving conditions.

- Policy Availability: Some insurance companies might not offer all of their policies in every state. If your desired coverage isn’t available in your new state, you might need to explore alternative options.

Obtaining New Insurance

If your current insurance policy cannot be transferred or doesn’t meet the requirements of your new state, you’ll need to obtain new car insurance. This process involves:

- Researching Insurers: Start by comparing quotes from different insurance companies in your new state. Consider factors like coverage options, rates, customer service, and financial stability.

- Providing Information: You’ll need to provide your new address, driving history, and details about your vehicle to get an accurate quote. Be prepared to share your Social Security number and proof of residency.

- Choosing a Policy: Review the quotes carefully and choose the policy that best meets your needs and budget. Ensure the coverage you select meets the minimum requirements of your new state.

Obtaining Insurance in a New State

Once you’ve established residency in your new state, you’ll need to obtain car insurance. This is a crucial step, as driving without valid insurance is illegal in all states.

Steps Involved in Obtaining Car Insurance

Obtaining car insurance in a new state involves a straightforward process. Here’s a breakdown of the steps:

- Contact Your Current Insurance Provider: Start by contacting your existing insurance provider. They may be able to offer coverage in your new state. This can save you time and potentially offer you a seamless transition.

- Gather Necessary Information: Before contacting insurance providers, gather essential information, including your driver’s license, vehicle registration, proof of residency, and driving history.

- Obtain Quotes from Multiple Providers: Contact several insurance companies in your new state to get quotes. Compare rates, coverage options, and customer service before making a decision.

- Choose a Provider and Purchase Coverage: Once you’ve compared quotes and chosen a provider, complete the application process and purchase your insurance policy.

- Update Your Vehicle Registration: In some states, you may need to update your vehicle registration to reflect your new address and insurance policy.

Finding Competitive Insurance Quotes

To find competitive insurance quotes, consider these tips:

- Use Online Comparison Tools: Several online comparison websites allow you to enter your information and receive quotes from multiple insurance companies simultaneously.

- Contact Insurance Agents Directly: Reach out to insurance agents in your new state to discuss your needs and obtain personalized quotes.

- Check for Discounts: Inquire about available discounts, such as good driver discounts, multi-car discounts, or safe driver discounts.

- Negotiate Rates: Don’t be afraid to negotiate with insurance companies. They may be willing to lower their rates if you can demonstrate a good driving record and a commitment to safety.

Factors to Consider When Selecting a New Insurance Provider

When choosing a new insurance provider, it’s essential to consider various factors:

- Coverage Options: Ensure the provider offers the coverage options you need, such as liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Customer Service: Look for a provider with a strong reputation for customer service. Read reviews and testimonials to get an idea of their responsiveness and helpfulness.

- Financial Stability: Choose a financially stable insurance company that is unlikely to go bankrupt.

- Claims Process: Understand the claims process and how the provider handles claims.

Maintaining Coverage Continuity

Maintaining continuous car insurance coverage is crucial, even when you’re moving to a new state. Gaps in coverage can lead to serious consequences, including hefty fines, legal troubles, and even difficulty obtaining insurance in the future.

Consequences of Gaps in Coverage

A lapse in insurance coverage can result in significant financial and legal repercussions. These consequences are not limited to the period of the gap; they can extend beyond it, impacting your future insurance rates and even your driving privileges.

- Fines and Penalties: Most states have laws requiring drivers to maintain continuous car insurance coverage. If you’re caught driving without insurance, you could face hefty fines, which can vary by state and the severity of the offense.

- Legal Issues: In the event of an accident, being uninsured can have severe legal consequences. You could be held personally liable for any damages or injuries caused, potentially facing lawsuits and significant financial burdens.

- Difficulty Obtaining Future Insurance: Insurance companies often view gaps in coverage as a risk factor. A history of lapsed coverage can lead to higher premiums, difficulty finding coverage, or even denial of insurance altogether.

Ensuring a Smooth Transition of Coverage, Can i insure my car in a different state

To avoid the risks associated with gaps in coverage, it’s essential to plan ahead and ensure a smooth transition of your insurance coverage during your move.

- Contact Your Current Insurer: Inform your current insurer about your move well in advance of your departure date. They can guide you through the process of transferring your coverage to the new state.

- Obtain a Certificate of Insurance: Request a certificate of insurance from your current insurer. This document verifies that you have active coverage and can be helpful when registering your car in the new state.

- Research New State Insurance Requirements: Before you move, familiarize yourself with the insurance requirements in your new state. Some states have different coverage minimums or specific requirements that may not be covered by your current policy.

- Consider Shopping for New Insurance: Once you’ve moved, it’s a good idea to compare insurance rates from different companies in your new state. You may find better rates or coverage options than your current insurer offers.

Additional Considerations

While transitioning your car insurance to a new state generally involves straightforward steps, certain complexities can arise. Understanding state-specific regulations and insurance laws is crucial to ensure a smooth transition and maintain adequate coverage.

State-Specific Regulations and Insurance Laws

Each state has its own unique set of regulations and laws governing car insurance. These regulations can impact various aspects of your policy, including coverage requirements, premium rates, and claim processes.

For example, some states mandate specific coverage types, such as personal injury protection (PIP) or uninsured motorist coverage (UM), while others have different minimum coverage requirements. Understanding these differences is essential to ensure you meet the legal requirements of your new state.

Potential Challenges

Several potential challenges can arise when insuring your car in a different state. These include:

- Coverage Gaps: Your current insurance policy might not fully cover you in your new state due to differences in coverage requirements or exclusions. It’s crucial to review your policy carefully and discuss any potential gaps with your insurer.

- Higher Premiums: Premiums can vary significantly between states based on factors such as traffic density, accident rates, and the cost of living. You might experience higher premiums in your new state, particularly if it has a higher risk profile.

- Limited Coverage Options: Some insurance companies may not operate in all states, limiting your choices for insurers in your new location. It’s essential to research available options and compare quotes from multiple insurers to find the best coverage at a reasonable price.

- Claim Processing Delays: Switching insurers or states can sometimes lead to delays in claim processing as your new insurer may need to verify your information and assess your coverage. It’s advisable to notify your insurer of your move as early as possible to minimize potential delays.

Resources and Information

For further guidance and information on insuring your car in a different state, consider the following resources:

- Your Current Insurance Company: Your existing insurer can provide valuable information about transferring your policy and navigating the process in your new state.

- State Department of Insurance: Each state has a Department of Insurance that regulates insurance companies and provides resources for consumers. You can find contact information and helpful guides on their websites.

- Independent Insurance Agents: Independent insurance agents can help you compare quotes from multiple insurers and find the best coverage for your needs.

- Consumer Reports: Consumer Reports provides comprehensive reviews and ratings of car insurance companies, helping you make informed decisions.

Outcome Summary: Can I Insure My Car In A Different State

Moving with your car to a new state involves more than just updating your address. Understanding how insurance requirements and regulations differ is crucial. By proactively contacting your current insurer, exploring options for transferring your policy, and researching new providers in the new state, you can ensure continuous and adequate coverage for your vehicle. Remember, maintaining continuous insurance is essential, and gaps in coverage can lead to penalties and financial burdens. With proper planning and research, you can navigate the complexities of insuring your car in a different state seamlessly.

Top FAQs

Can I drive my car in another state with my current insurance?

Generally, your current insurance policy will cover you in other states for a certain period. However, it’s best to contact your insurer to confirm coverage details and any limitations.

Do I need to get a new insurance policy if I move to another state?

You might need a new policy, depending on your insurer’s policies and the state’s requirements. Some insurers offer nationwide coverage, while others might require you to switch to a local provider in the new state.

What are the consequences of driving without insurance in a new state?

Driving without insurance in any state is illegal and can result in fines, license suspension, and even jail time. You could also face significant financial penalties if you are involved in an accident.

How can I find affordable insurance in a new state?

Use online comparison tools, contact multiple insurance providers, and shop around for quotes. Be sure to compare coverage options and prices carefully before making a decision.