Can I insure a car in a different state sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Moving to a new state often means navigating a whole new set of rules, and car insurance is no exception. Each state has its own unique requirements for car insurance, meaning you can’t simply transfer your old policy to your new address. Understanding the nuances of state-specific regulations is crucial to ensure you’re properly covered and avoid any legal complications.

This guide will explore the process of obtaining car insurance in a different state, outlining the key factors to consider, the steps involved, and the potential challenges you might encounter. We’ll delve into residency requirements, insurance eligibility, and the factors that influence insurance premiums in a new state. Whether you’re a recent transplant or planning a cross-country move, this comprehensive guide will provide you with the information you need to make informed decisions about your car insurance.

Understanding State-Specific Insurance Requirements

Car insurance regulations vary significantly from state to state. This means that the coverage you need and the cost of your insurance can change depending on where you live. Understanding these differences is crucial when insuring a car in a different state.

Mandatory Coverages, Can i insure a car in a different state

State laws mandate specific types of car insurance coverage to protect drivers and others involved in accidents. These mandatory coverages, also known as minimum coverage requirements, can vary significantly across states.

Here are some examples of mandatory coverages that differ by state:

- Bodily Injury Liability Coverage: This coverage pays for medical expenses and other damages incurred by others if you are at fault in an accident. States have varying minimum limits for this coverage, ranging from $10,000 to $50,000 per person and $20,000 to $100,000 per accident.

- Property Damage Liability Coverage: This coverage pays for damages to another person’s vehicle or property if you are at fault in an accident. Similar to bodily injury liability, state minimum limits for this coverage vary significantly, typically ranging from $5,000 to $25,000.

- Personal Injury Protection (PIP): This coverage pays for medical expenses, lost wages, and other related costs for you and your passengers, regardless of fault. Some states require PIP coverage, while others offer it as an optional coverage.

- Uninsured Motorist Coverage: This coverage protects you and your passengers if you are involved in an accident with an uninsured or underinsured driver. States have different requirements for this coverage, with some mandating it and others offering it as an option.

State Laws and Insurance Premiums

State laws significantly influence insurance premiums and coverage options.

For example, states with higher minimum coverage requirements generally have higher insurance premiums.

States with mandatory PIP coverage tend to have higher premiums than states without it, but they also offer greater protection in the event of an accident.

Additionally, states with stricter laws regarding fault in accidents, such as no-fault states, may have higher premiums.

States with lower rates of accidents and crime generally have lower insurance premiums.

Ultimately, the cost of your car insurance will be determined by several factors, including your driving record, the type of car you drive, your age, and your location.

Residency and Insurance Eligibility

Car insurance companies require proof of residency to determine your eligibility for coverage. This is because insurance premiums are calculated based on factors like the location where you drive, the likelihood of accidents, and the cost of repairs in that specific area.

Residency Requirements for Obtaining Car Insurance

Each state has its own set of residency requirements for obtaining car insurance. These requirements typically include:

- A valid driver’s license issued by the state where you reside.

- Proof of address, such as utility bills, bank statements, or voter registration cards.

- A permanent address, meaning you intend to live there for an extended period of time.

It’s important to note that simply having a mailing address in a state does not necessarily establish residency. You must demonstrate that you have a permanent residence in the state where you’re seeking insurance.

Driving in a Different State with a Primary Residence in Another

If you have a primary residence in one state but drive regularly in another, you’ll need to consider the following:

- Maintaining insurance in your home state: Your primary residence state’s insurance policy may cover you in other states, but it’s essential to check the policy’s coverage limits and exclusions.

- Purchasing additional insurance in the other state: If your home state’s policy doesn’t provide adequate coverage in the other state, you may need to purchase a separate insurance policy in the state where you’re driving. This is particularly important if you spend a significant amount of time driving in the other state.

- Notifying your insurer: Regardless of whether you need additional insurance, you should always inform your insurer about your driving habits and any changes to your residency status. This ensures you’re receiving the correct coverage and avoiding any potential issues with your policy.

Insurance Company Verification of Residency

Insurance companies typically use various methods to verify your residency, including:

- Checking your driver’s license: Your driver’s license should match the address you provided on your insurance application.

- Requesting utility bills or bank statements: These documents should display your name and address, confirming your residency.

- Conducting a credit check: Your credit history may include information about your address, which can help insurance companies verify your residency.

- Contacting you by phone or mail: Insurance companies may contact you at the address you provided to confirm your residency.

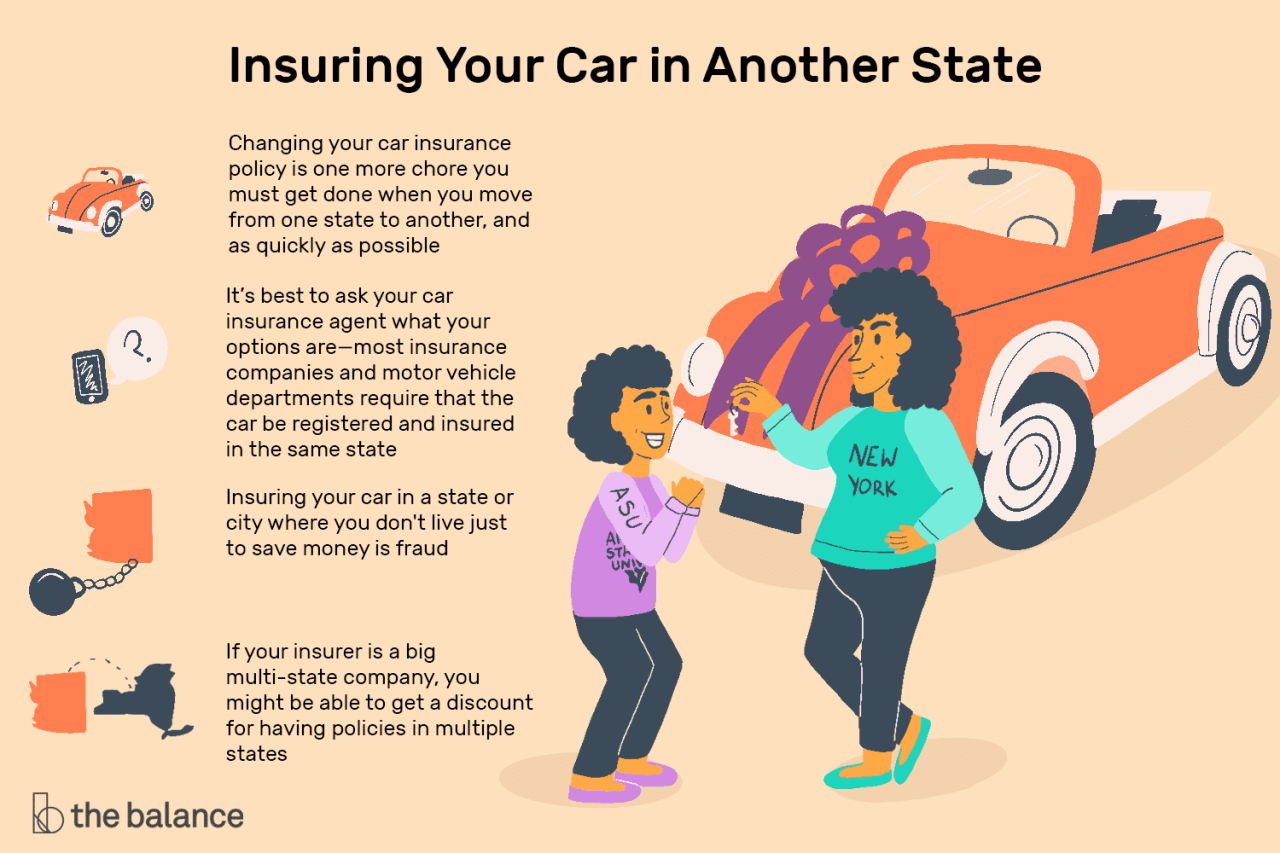

Consequences of Providing False Information

Providing false information about your residency to an insurance company can have serious consequences, including:

- Policy cancellation: Your insurance policy may be canceled if the company discovers that you provided false information.

- Denial of claims: If you’re involved in an accident and your insurance company finds out you lied about your residency, they may deny your claim.

- Legal penalties: In some cases, providing false information to an insurance company may be considered fraud, which can result in fines or even jail time.

It’s crucial to be honest and accurate when applying for car insurance. This ensures you receive the correct coverage and avoid potential legal issues.

The Process of Insuring a Car in a Different State

You’ve decided to make a move, and your car is coming along for the ride. But what about your car insurance? Switching states means you’ll need to navigate a new set of rules and regulations. Fortunately, the process of transferring your car insurance is generally straightforward, but it’s essential to understand the steps involved.

Steps to Insure Your Car in a New State

To ensure a smooth transition, follow these steps:

- Contact your current insurance provider: Inform them of your upcoming move and the new state you’ll be residing in. They can guide you on the process of transferring your policy or advise you on available options in the new state.

- Research insurance providers in your new state: You can find information online, through recommendations, or by contacting insurance agencies directly.

- Gather necessary documentation: Prepare documents such as your driver’s license, vehicle registration, proof of address, and your current insurance policy details. These documents will be required for the new insurance provider to process your application.

- Obtain quotes from multiple insurance companies: Comparing quotes from different providers can help you find the most competitive rates and coverage options.

- Finalize your policy: Once you’ve selected a provider, you’ll need to complete the application process, review the policy details, and pay the premium.

Finding Affordable Car Insurance in a Different State

Here are some strategies to help you find affordable car insurance in your new state:

- Shop around: Don’t settle for the first quote you receive. Compare prices and coverage options from multiple insurance providers.

- Consider bundling: If you have other insurance policies, like homeowners or renters insurance, ask about bundling discounts.

- Improve your driving record: Maintaining a clean driving record is crucial for securing lower insurance premiums.

- Increase your deductible: A higher deductible can lower your monthly premium, but it means you’ll pay more out of pocket if you need to file a claim.

- Explore discounts: Many insurance companies offer discounts for safe driving, good student status, anti-theft devices, and more. Ask about available discounts when you get quotes.

Importance of Comparing Quotes from Multiple Insurance Companies

Comparing quotes is essential to ensure you’re getting the best possible deal. Here’s why:

- Different companies have different rates: Each insurance company has its own pricing structure based on factors like your driving record, age, location, and vehicle type.

- Coverage options vary: Insurance companies offer a range of coverage options, and it’s crucial to find one that meets your needs.

- You can save money: By comparing quotes, you can identify potential savings and choose the most affordable option.

Factors Influencing Insurance Rates in a New State

Moving to a new state can significantly impact your car insurance premiums. Various factors play a role in determining your rates, and understanding these factors can help you minimize your insurance costs.

Factors Affecting Insurance Premiums

Insurance companies consider a multitude of factors when calculating your car insurance premiums. These factors can vary from state to state and can influence your overall cost.

- Vehicle Type: The type of car you drive significantly impacts your insurance rates. Luxury cars, sports cars, and high-performance vehicles are often associated with higher risks and, therefore, higher premiums. Conversely, smaller, less powerful vehicles typically have lower premiums.

- Driving History: Your driving record is a major factor in determining your insurance rates. A clean driving record with no accidents or traffic violations will generally result in lower premiums. Conversely, a history of accidents, speeding tickets, or DUI convictions can significantly increase your rates.

- Age: Age plays a role in insurance rates, with younger drivers often paying higher premiums. Younger drivers are statistically more likely to be involved in accidents. As drivers age and gain experience, their premiums typically decrease.

- Credit Score: In many states, insurance companies use your credit score as a factor in determining your insurance rates. A good credit score can indicate financial responsibility, which can lead to lower premiums. Conversely, a poor credit score may lead to higher premiums.

- Location: Your location, including the state, city, and even neighborhood, can significantly impact your insurance rates. Areas with higher crime rates, traffic congestion, or a higher frequency of accidents tend to have higher insurance premiums.

- Coverage Levels: The level of coverage you choose for your car insurance also influences your premiums. Comprehensive and collision coverage, which protect you from damage to your car, will generally cost more than liability coverage, which only covers damage to other vehicles or property.

Maintaining Coverage During a Move: Can I Insure A Car In A Different State

Moving to a new state can be a hectic process, but it’s crucial to ensure your car insurance coverage remains uninterrupted. This involves notifying your current insurance company about your relocation and potentially updating your policy to reflect the new state’s requirements. Failing to do so can have serious consequences, including driving without insurance, which could result in hefty fines and penalties.

Updating Your Policy

It’s essential to notify your current insurance company about your move as soon as possible. This ensures that your policy remains active and that you have the necessary coverage in your new state. You can typically update your policy by contacting your insurance company directly through phone, email, or online portal. When informing your insurer about your relocation, you’ll need to provide them with the following information:

- Your new address

- Your new state of residence

- The date you’re moving

Once you’ve informed your insurance company, they will review your policy and make any necessary adjustments to ensure you have the appropriate coverage in your new state. This may include updating your coverage limits, adding or removing optional coverages, or adjusting your premium based on the new state’s insurance regulations.

Driving Without Insurance

Driving without insurance in any state is illegal and can result in severe consequences. In the event of an accident, you could be held personally liable for all damages, including medical expenses, property damage, and legal fees. Furthermore, driving without insurance can lead to:

- Fines and penalties: These can vary depending on the state, but they can be significant. In some states, driving without insurance can result in a suspension of your driver’s license or vehicle registration.

- Increased insurance premiums: If you’re caught driving without insurance, your insurance company may increase your premiums significantly in the future, even after you obtain insurance.

- Difficulty obtaining insurance: If you have a history of driving without insurance, you may find it challenging to obtain insurance in the future, especially at reasonable rates.

It’s crucial to remember that even if you’re in the process of moving and haven’t yet finalized your insurance in your new state, you still need to maintain coverage. Your current insurance company may be able to provide you with temporary coverage while you transition to a new policy.

Potential Challenges and Considerations

While insuring a car in a different state offers the convenience of maintaining coverage, it’s essential to be aware of potential challenges that could impact your insurance costs and coverage. Understanding these factors allows you to make informed decisions and ensure a smooth transition.

Higher Premiums

Moving to a new state often results in higher insurance premiums due to factors such as:

- Cost of Living: States with higher costs of living typically have higher insurance premiums due to increased repair costs and medical expenses.

- Traffic Density and Accident Rates: States with congested traffic and high accident rates generally have higher premiums to cover increased claims.

- State Regulations: Each state has its own insurance regulations, which can affect premium rates. Some states may have mandatory coverages or higher minimum liability limits.

Limited Coverage Options

While most major insurance providers operate nationwide, the specific coverage options available may vary by state. Some states may offer unique coverage options, while others may have limitations on certain types of coverage.

Thorough Research

Before choosing an insurance provider in a new state, it’s crucial to conduct thorough research to compare rates and coverage options. Factors to consider include:

- Reputation and Financial Stability: Look for providers with a strong reputation and solid financial standing.

- Customer Service: Check customer reviews and ratings to assess the provider’s responsiveness and customer satisfaction.

- Coverage Options: Compare the types of coverage offered by different providers, including liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Discounts: Explore available discounts, such as good driver discounts, safe vehicle discounts, and multi-policy discounts.

Addressing Issues

If you encounter any issues during the insurance process, such as unexpected rate increases or coverage limitations, it’s important to:

- Contact Your Insurance Provider: Reach out to your insurance provider to discuss your concerns and seek clarification.

- Review Your Policy: Carefully review your policy documents to understand the terms and conditions.

- Explore Other Options: If you’re dissatisfied with your current provider, consider exploring other insurance options.

Wrap-Up

Navigating the complexities of car insurance in a new state can feel overwhelming, but with a clear understanding of the process and the factors that influence premiums, you can make informed decisions to ensure you’re properly protected. Remember to research different insurance providers, compare quotes, and carefully review policy details to find the best coverage for your needs and budget. By taking a proactive approach and understanding the nuances of state-specific insurance regulations, you can seamlessly transition your car insurance and enjoy peace of mind on the road.

FAQ Summary

Do I need to inform my current insurance company about my move?

Yes, it’s crucial to inform your current insurance company about your move as soon as possible. Failing to do so could result in your policy being canceled or invalidated, leaving you without coverage.

Can I keep my current car insurance policy after moving?

In some cases, you might be able to keep your current car insurance policy after moving, but it’s not always possible. Your insurance company might require you to switch to a policy that meets the requirements of your new state.

What documents do I need to provide when applying for car insurance in a new state?

The specific documents required will vary depending on the insurance company, but generally include your driver’s license, proof of residency, vehicle registration, and proof of insurance history.