Can i have out of-state car insurance in texas – Can I Have Out-of-State Car Insurance in Texas? This question often arises for individuals who are new to the state or who frequently travel between states. While it’s possible to have out-of-state car insurance in Texas, it’s crucial to understand the specific requirements and potential implications. Texas has its own set of regulations regarding car insurance, and failing to comply with these regulations can result in legal consequences.

Texas requires all drivers to have liability insurance, and the minimum coverage amounts are Artikeld by the state. If you’re driving in Texas with out-of-state insurance, it must meet or exceed these minimum requirements. You should also be aware that some out-of-state insurance policies may not cover all the risks you face while driving in Texas. For instance, your policy might not cover certain types of accidents or damage, or it might have different coverage limits for specific situations.

Texas Residency Requirements

To obtain car insurance in Texas, you must be a resident of the state. This means you must have a permanent address in Texas and intend to live there indefinitely. Texas law requires that you have a physical address in the state where you can receive mail and other communications.

Proof of Residency, Can i have out of-state car insurance in texas

To prove your residency, you must provide acceptable documentation to your insurance company. This documentation should show your name and address, and it should be current.

Here are some examples of acceptable documentation:

- Texas driver’s license or identification card

- Voter registration card

- Utility bill (gas, electric, water, or phone)

- Bank statement

- Lease or mortgage agreement

- Tax return

Consequences of Providing False Residency Information

Providing false residency information to obtain car insurance in Texas is a serious offense. You could face fines, penalties, and even criminal charges. Additionally, your insurance company may cancel your policy, leaving you without coverage.

Out-of-State Insurance Coverage

Driving in Texas with an out-of-state car insurance policy can present some unique considerations. It’s essential to understand the coverage options available, how they compare to Texas resident requirements, and potential coverage gaps that might arise.

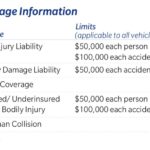

Coverage Options for Out-of-State Drivers

Out-of-state drivers in Texas have several coverage options available to them. These options ensure they meet the state’s minimum insurance requirements while also providing additional protection.

- Liability Coverage: This coverage protects you financially if you cause an accident that results in injury or damage to another person or their property. Texas law requires all drivers to carry at least $30,000 in liability coverage per person, $60,000 per accident, and $25,000 for property damage.

- Collision Coverage: This coverage pays for repairs or replacement of your vehicle if it’s damaged in an accident, regardless of who’s at fault.

- Comprehensive Coverage: This coverage protects your vehicle from damage caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re involved in an accident with a driver who doesn’t have insurance or has insufficient coverage.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who’s at fault in an accident.

Coverage Requirements for Texas Residents vs. Out-of-State Drivers

Texas residents and out-of-state drivers are subject to the same minimum insurance requirements. Both must carry at least $30,000 in liability coverage per person, $60,000 per accident, and $25,000 for property damage. However, there are some differences in coverage requirements depending on your residency status.

- Financial Responsibility Laws: Texas residents are subject to stricter financial responsibility laws than out-of-state drivers. For instance, if you’re a Texas resident and your insurance lapses, you may face fines and suspension of your driver’s license. Out-of-state drivers are generally subject to the laws of their home state regarding insurance lapses.

- Coverage Options: Texas residents may have access to a wider range of coverage options than out-of-state drivers. For example, some insurance companies may offer discounts or specialized coverage options for Texas residents.

Potential Coverage Gaps for Out-of-State Drivers

While out-of-state drivers must meet the minimum insurance requirements in Texas, there are potential coverage gaps that could leave them vulnerable.

- Reciprocity: While many states have reciprocity agreements, meaning they recognize insurance policies issued in other states, there might be some coverage differences or limitations. For example, your out-of-state policy might not cover certain types of accidents or situations that are covered under Texas law.

- State-Specific Coverage: Some states offer unique coverage options or requirements that may not be available in other states. For instance, Texas has a specific coverage requirement for uninsured motorist coverage, which may not be the same in your home state.

- Coverage Limits: Even if your out-of-state policy meets Texas’s minimum requirements, the coverage limits might be lower than what’s recommended or available to Texas residents.

Legal Implications

Driving in Texas without valid car insurance can lead to serious legal consequences. It’s crucial to understand the implications of driving with out-of-state insurance that doesn’t meet Texas requirements.

Penalties for Driving Without Insurance

Driving without insurance in Texas is a serious offense. If you’re caught driving without insurance, you could face a variety of penalties, including:

- Fines: You could be fined up to $1,000 for a first offense. Subsequent offenses can result in even higher fines.

- License Suspension: Your driver’s license could be suspended until you provide proof of insurance.

- Vehicle Impoundment: Your vehicle could be impounded until you provide proof of insurance.

- Jail Time: In some cases, you could even face jail time for driving without insurance.

Penalties for Driving with Out-of-State Insurance That Doesn’t Meet Texas Requirements

If you’re driving in Texas with out-of-state insurance that doesn’t meet Texas requirements, you could face similar penalties as those for driving without insurance. This is because Texas law requires all drivers to carry a minimum amount of liability insurance, regardless of where they are from.

- Fines: You could be fined up to $1,000 for a first offense. Subsequent offenses can result in even higher fines.

- License Suspension: Your driver’s license could be suspended until you provide proof of insurance that meets Texas requirements.

- Vehicle Impoundment: Your vehicle could be impounded until you provide proof of insurance that meets Texas requirements.

Obtaining a Texas Driver’s License for Out-of-State Residents

To obtain a Texas driver’s license, out-of-state residents must meet certain requirements, including:

- Proof of Identity: You must provide proof of your identity, such as a passport or birth certificate.

- Proof of Residency: You must provide proof of residency in Texas, such as a utility bill or lease agreement.

- Social Security Number: You must provide your Social Security number.

- Proof of Insurance: You must provide proof of insurance that meets Texas requirements.

- Passing a Vision Test: You must pass a vision test.

- Passing a Written Test: You may be required to pass a written test, depending on your driving history.

- Passing a Driving Test: You may be required to pass a driving test, depending on your driving history.

Insurance Options for Out-of-State Residents

If you’re a resident of another state but driving in Texas, you’ll need to understand the different insurance options available to you. While you can choose to keep your current out-of-state insurance, you may find that Texas-specific coverage is more beneficial in certain situations.

Types of Car Insurance Policies for Out-of-State Residents

Out-of-state residents in Texas have access to the same types of car insurance policies as Texas residents, with the main difference being the possibility of needing to purchase additional coverage depending on your current policy’s coverage limits. Here’s a breakdown of the common types of insurance:

- Liability Insurance: This is the most basic type of insurance and is required by law in Texas. It covers damages to other people’s property and injuries caused by you in an accident.

- Collision Coverage: This coverage pays for repairs to your vehicle if you’re involved in an accident, regardless of who is at fault.

- Comprehensive Coverage: This coverage protects you from damages to your vehicle caused by events other than accidents, such as theft, vandalism, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you’re hit by a driver who doesn’t have insurance or has insufficient coverage.

- Medical Payments Coverage: This coverage pays for medical expenses for you and your passengers, regardless of who is at fault.

Factors Influencing Insurance Premiums for Out-of-State Drivers

Several factors can influence the cost of car insurance for out-of-state drivers in Texas. These include:

- Driving History: Your driving record, including accidents, tickets, and violations, plays a significant role in determining your premium.

- Vehicle Type: The type of vehicle you drive, including its make, model, and year, affects your premium due to factors like safety ratings and repair costs.

- Age and Gender: Your age and gender can impact your premium, as younger drivers and males generally have higher risk profiles.

- Credit Score: In some states, including Texas, insurers may consider your credit score as a factor in determining your premium.

- Location: Your location in Texas can influence your premium, as areas with higher accident rates or crime rates may have higher premiums.

- Coverage Levels: The amount of coverage you choose can impact your premium. Higher coverage limits generally result in higher premiums.

Comparing Insurance Providers for Out-of-State Residents

When choosing an insurance provider, it’s important to compare different options and consider the following:

| Provider | Advantages | Disadvantages |

|---|---|---|

| State Farm | Wide network of agents, good customer service, various discounts | May not be the cheapest option, can have limited coverage options |

| Geico | Generally lower premiums, easy online quoting and claims process | Limited customer service options, may not have as many discounts |

| Progressive | Offers personalized coverage options, known for innovative features | Can be more expensive than other providers, customer service can vary |

| USAA | Excellent customer service, discounts for military members and families | Only available to military members and their families |

Tips for Out-of-State Drivers

Navigating the world of car insurance as an out-of-state driver in Texas can feel overwhelming. However, with some planning and a strategic approach, you can secure the best possible coverage for your needs. Here are some tips to help you through the process.

Understanding Texas Insurance Requirements

Texas requires all drivers to carry liability insurance. This means that you must have insurance that covers damages to other people and their property if you are involved in an accident. The minimum liability coverage required in Texas is:

* $30,000 for bodily injury per person

* $60,000 for bodily injury per accident

* $25,000 for property damage per accident

You can choose to purchase higher limits of liability coverage, which can provide greater protection in case of an accident.

Obtaining Quotes from Multiple Insurance Providers

The key to getting the best possible rate is to compare quotes from multiple insurance providers. You can do this online, by phone, or by visiting insurance agents in person. When comparing quotes, be sure to consider the following factors:

* Coverage limits: Make sure the coverage limits are adequate for your needs.

* Deductibles: A higher deductible will generally result in a lower premium, but you will have to pay more out of pocket if you have to file a claim.

* Discounts: Ask about available discounts, such as those for good driving records, safety features, and multiple policies.

* Customer service: Choose a company with a good reputation for customer service.

Negotiating Insurance Premiums

Once you have received quotes from multiple providers, you can start negotiating your premium. Here are some tips for negotiating:

* Shop around: Get quotes from at least three different providers.

* Be prepared to walk away: If you’re not happy with the price, don’t be afraid to walk away.

* Consider bundling: If you have multiple policies, such as auto and home insurance, you can often get a discount by bundling them together.

* Negotiate your deductible: A higher deductible will generally result in a lower premium.

* Ask about discounts: See if you qualify for any discounts, such as those for good driving records, safety features, and multiple policies.

Ensuring Proper Coverage

It’s important to ensure that your insurance policy provides adequate coverage for your needs. Here are some things to consider:

* Liability coverage: This coverage protects you from financial responsibility if you are found liable for an accident.

* Collision coverage: This coverage pays for repairs to your vehicle if you are involved in an accident, regardless of who is at fault.

* Comprehensive coverage: This coverage pays for repairs to your vehicle if it is damaged in an accident that is not your fault, such as a fire, theft, or vandalism.

* Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who is uninsured or underinsured.

Tips for Obtaining Quotes

Here are some additional tips for obtaining quotes from insurance providers:

* Use online comparison tools: Many websites allow you to compare quotes from multiple insurance providers at once.

* Contact insurance agents directly: You can also contact insurance agents directly to get quotes.

* Be prepared to provide information: When you contact an insurance provider, be prepared to provide information about your driving history, vehicle, and coverage needs.

Important Considerations for Out-of-State Drivers

* State-specific requirements: Be aware of any specific requirements for out-of-state drivers in Texas.

* Insurance transfer: Understand the process of transferring your insurance from your previous state to Texas.

* Coverage adjustments: Be prepared to adjust your coverage levels to meet Texas requirements.

Wrap-Up

Navigating the world of car insurance, especially when crossing state lines, can feel overwhelming. However, understanding the Texas regulations and your insurance options is key to staying safe and compliant on the road. By carefully considering your coverage needs and exploring available options, you can ensure you have the appropriate protection while driving in Texas.

Detailed FAQs: Can I Have Out Of-state Car Insurance In Texas

Can I drive in Texas with out-of-state insurance?

Yes, you can drive in Texas with out-of-state insurance, but it must meet Texas’ minimum coverage requirements.

What are the minimum coverage requirements for car insurance in Texas?

Texas requires drivers to have liability insurance with a minimum of $30,000 for bodily injury per person, $60,000 for bodily injury per accident, and $25,000 for property damage.

What if my out-of-state insurance doesn’t meet Texas requirements?

If your out-of-state insurance doesn’t meet Texas requirements, you could face penalties, including fines and license suspension.

How do I get a Texas driver’s license if I’m an out-of-state resident?

To get a Texas driver’s license, you’ll need to provide proof of residency, pass a vision test, and possibly a written and driving test.